Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Replying to a comment saying it is not related I don't quite understand what that means, but this is the entirety of the question and

Replying to a comment saying "it is not related" I don't quite understand what that means, but this is the entirety of the question and everything is related.

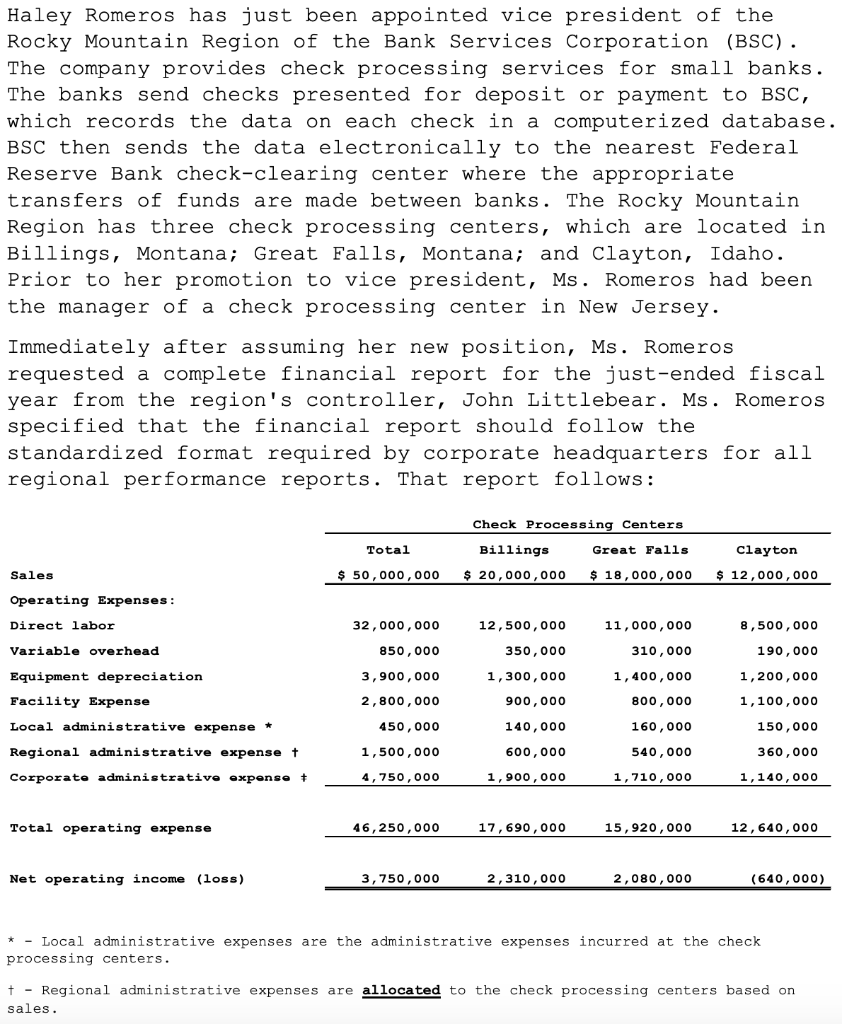

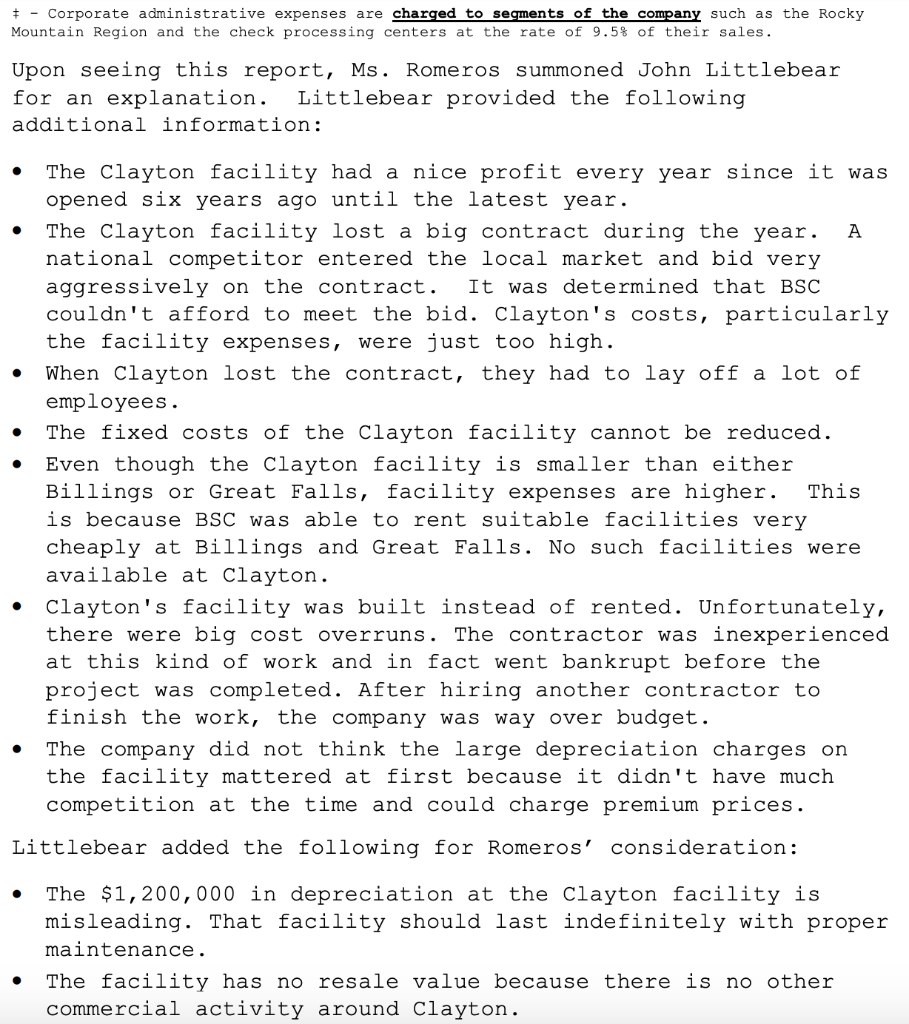

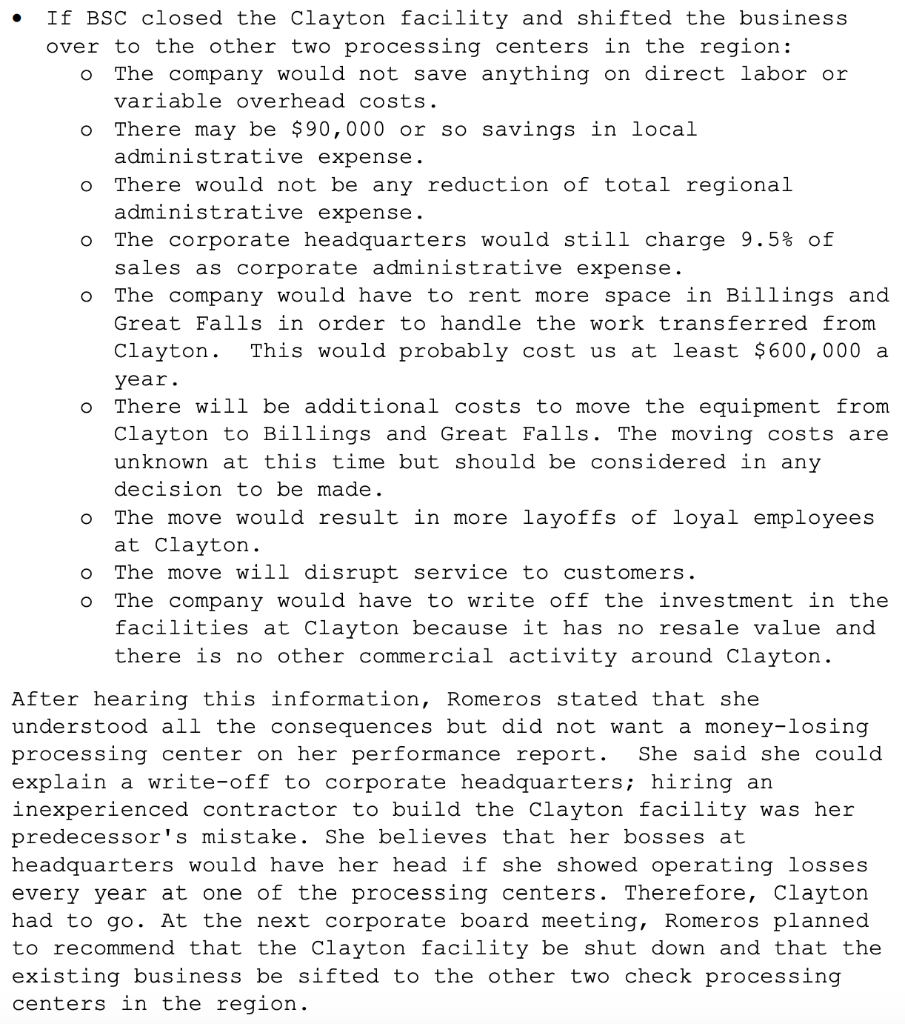

Haley Romeros has just been appointed vice president of the Rocky Mountain Region of the Bank Services Corporation (BSC). The company provides check processing services for small banks. The banks send checks presented for deposit or payment to BSC, which records the data on each check in a computerized database. BSC then sends the data electronically to the nearest Federal Reserve Bank check-clearing center where the appropriate transfers of funds are made between banks. The Rocky Mountain Region has three check processing centers, which are located in Billings, Montana; Great Falls, Montana; and Clayton, Idaho. Prior to her promotion to vice president, Ms. Romeros had been the manager of a check processing center in New Jersey. Immediately after assuming her new position, Ms. Romeros requested a complete financial report for the just-ended fiscal year from the region's controller, John Littlebear. Ms. Romeros specified that the financial report should follow the standardized format required by corporate headquarters for all regional performance reports. That report follows: Check Processing Centers Total Billings Great Falls clayton $ 50,000,000 $ 12,000,000 Sales 20,000,000 18,000,000 Operating Expenses 12,500,000 Direct 1abor 32,000,000 11,000,000 8,500,000 Variable overhead 850,000 310,000 350,000 190,000 3,900,000 Equipment depreciation 1,300,000 1,400,000 1,200,000 Facility Expense 900,000 800,000 2,800,000 1,100,000 Local administrative excpense * 450,000 140,000 160,000 150,000 Reqional administrative expense t 1,500,000 360,000 600,000 540,000 4,750,000 1,900,000 1,710,000 1,140,000 Corporate administrative expense t 12,640,000 Total operating expense 46,250,000 15,920,000 17,690,000 Net operating income (loss) 3,750,000 2,310,000 2,080,000 (640,000) Local administrative expenses are the administrative expenses incurred at the check processing centers t Regional administrative expenses are allocated to the check processing centers based on sales Corporate administrative expenses are charged to segments of the company such as the Rocky Mountain Reqion and the check processing centers at the rate of 9.5% of their sales. Upon seeing this report, Ms. Romeros summoned John Littlebear Littlebear provided the following for an explanation. additional information: The Clayton facility had a nice profit every year since it was opened six years ago until the latest year. The Clayton facility lost a big contract during the year. national competitor entered the local market and bid very A aggressively on the contract. couldn't afford to meet the bid. Clayton's costs, particularly the facility expenses, It was determined that BSC were just too high. When Clayton lost the contract, they had to lay off a lot of employees. The fixed costs of the Clayton facility cannot be reduced. Even though the Clayton facility is smaller than either Billings or Great Falls, facility expenses are higher. is because BSC was able to rent suitable facilities very This cheaply at Billings and Great Falls. No such facilities were available at Clayton. Clayton's facility was built instead of rented. Unfortunately, there were big cost overruns. The contractor was inexperienced at this kind of work and in fact went bankrupt before the project was completed. After hiring another contractor to finish the work, the company was way over budget. The company did not think the large depreciation charges on the facility mattered at first because it didn't have much competition at the time and could charge premium prices. Littlebear added the following for Romeros' consideration: The $1,200,000 in depreciation at the Clayton facility is misleading. That facility should last indefinitely with proper maintenance. The facility has no resale value because there is no other commerciall activity around Clayton. If BSC closed the clayton facility and shifted the business over to the other two processing centers in the region: The company would not save anything on direct labor or variable overhead costs. There may be $90,000 or administrative expense. so savings in local C There would not be any reduction of total regional administrative expense. O The corporate headquarters would still charge 9.5% of O sales as corporate administrative expense. The company would have to rent more space in Billings and Great Falls in order to handle the work transferred from This would probably cost us at least $600,000 a Clayton year. There will be additional costs to move the equipment from Clayton to Billings and Great Falls. The moving costs are C this time but should be considered in any unknown decision to be made. The move would result in more layoffs of loyal employees at Clayton. The move will disrupt service to customers. O The company would have to write off the investment in the facilities at Clayton because it has no resale value and C there is no other commercial activity around Clayton. After hearing this information, Romeros stated that she understood all the consequences but did not want a money-losing processing center on her performance report. She said she could explain a write-off to corporate headquarters; hiring an inexperienced contractor to build the Clayton facility was her predecessor's mistake. She believes that her bosses at headquarters would have her head if she showed operating losses every year at one of the processing centers. Therefore, Clayton had to go. At the next corporate board meeting, Romeros planned to recommend that the Clayton facility be shut down and that the existing business be sifted to the other two check processing centers in the reqgion. O O O Required: 1. Using the information from the departmental income statements, prepare a report of departmental contribution to overhead (See Chapter 9) 2. Evaluate whether the company officials took the correct approach when they determined that the company could not compete with the bid of the national company. According to Littlebear, "clayton's costs, particularly the facility just too high." Should this have been a expenses, were Please explain why or why consideration in that decision? not 3. What influence should the depreciation on the facilities at Clayton have on 4. Analyze the departmental income statements. standpoint of the company as a whole, should the clayton processing center be shut down and its work redistributed to other processing centers in the region? Please explain why or why not and show your work to support your conclusion. 5. Do you think that Haley Romeros is thinking about the best interests of the company when making her decision to shut down the Clayton facility? explain why or why not. 6. What other financial and non-financial impacts could shutting prices charged by Clayton for its services? From the Is she acting ethically? Please down the clayton facility have on BSC's business? explain. Hint: Use concepts from the Balanced Scorecard on Please page 372 of your textbookStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started