Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Some hate it and some love it, but regardless of how you feel oil is still a key part of our daily lives. The

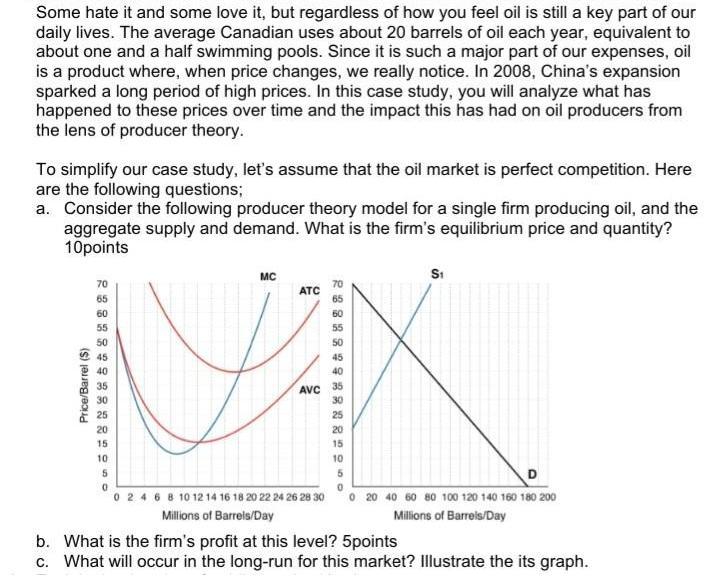

Some hate it and some love it, but regardless of how you feel oil is still a key part of our daily lives. The average Canadian uses about 20 barrels of oil each year, equivalent to about one and a half swimming pools. Since it is such a major part of our expenses, oil is a product where, when price changes, we really notice. In 2008, China's expansion sparked a long period of high prices. In this case study, you will analyze what has happened to these prices over time and the impact this has had on oil producers from the lens of producer theory. To simplify our case study, let's assume that the oil market is perfect competition. Here are the following questions; a. Consider the following producer theory model for a single firm producing oil, and the aggregate supply and demand. What is the firm's equilibrium price and quantity? 10points Price/Barrel (S) 70 65 60 55 50 45 40 MC ATC 35 30 25 20 15 10 5 0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 Millions of Barrels/Day 288289988385950 70 65 45 40 AVC 35 15 10 S1 0 20 40 60 80 100 120 140 160 180 200 Millions of Barrels/Day b. What is the firm's profit at this level? 5points c. What will occur in the long-run for this market? Illustrate the its graph.

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a The equilibrium price and quantity for the oil firm in a perfect competition market can be determined by looking at the market supply and demand The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started