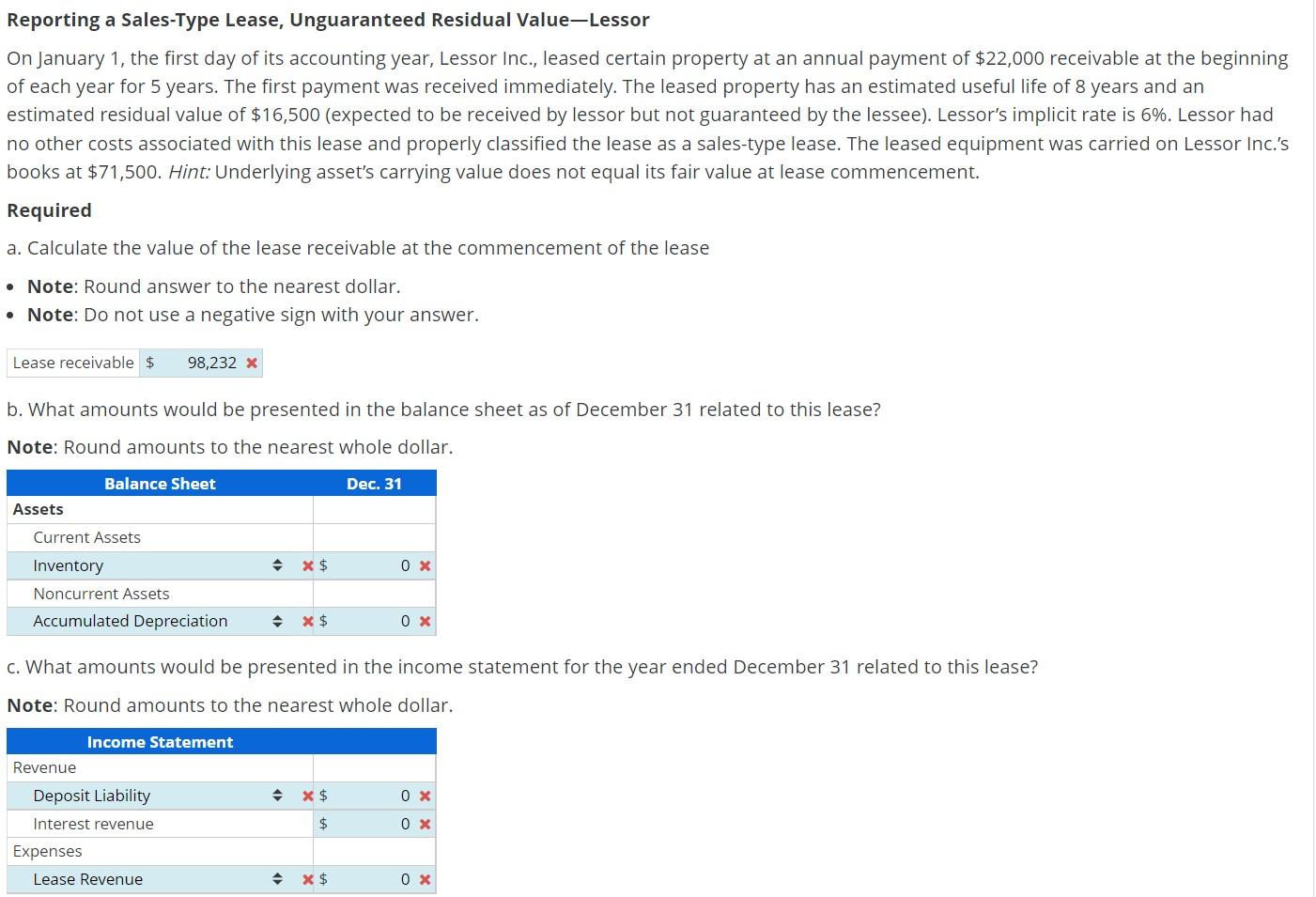

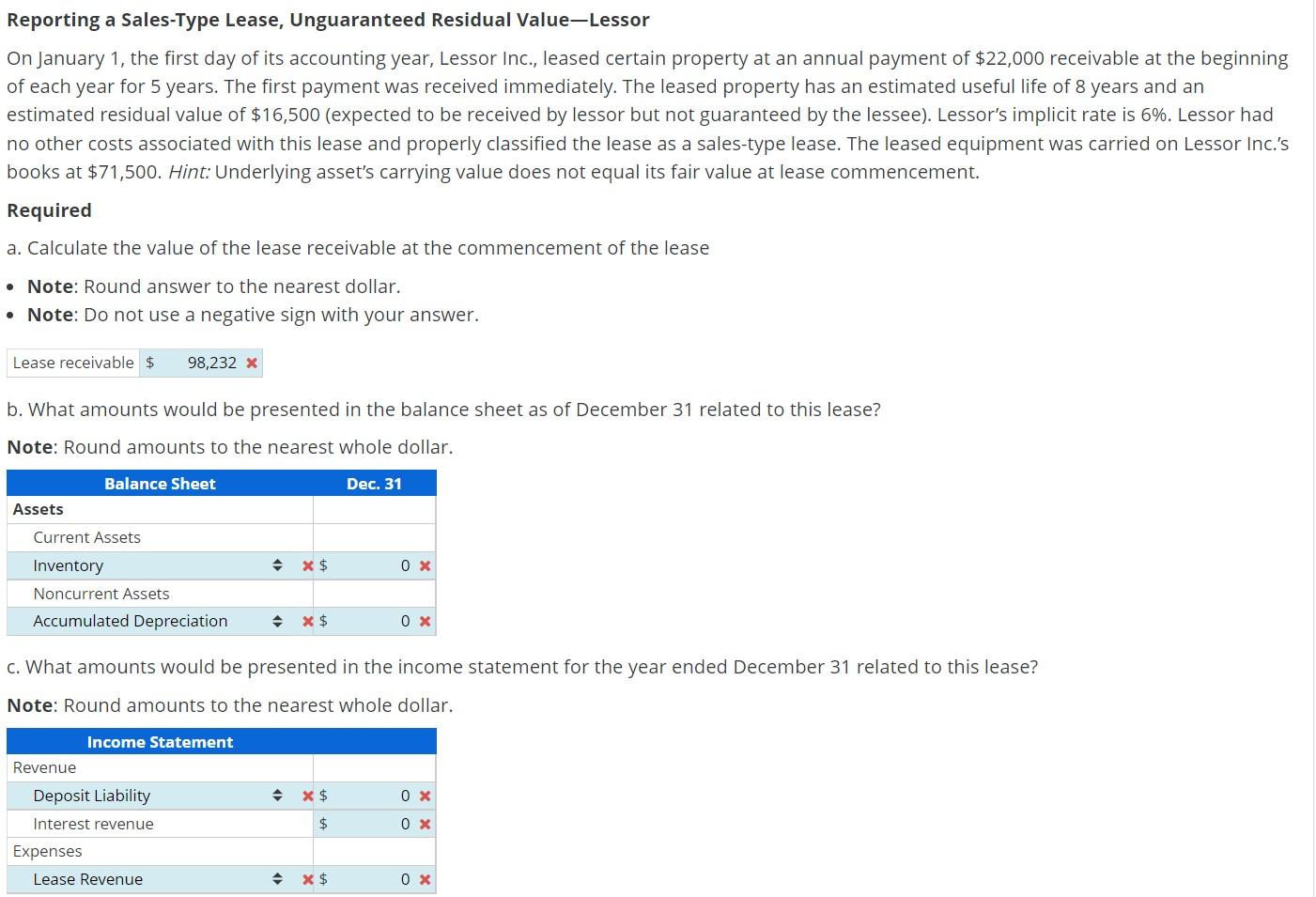

Reporting a Sales-Type Lease, Unguaranteed Residual Value-Lessor On January 1, the first day of its accounting year, Lessor Inc., leased certain property at an annual payment of $22,000 receivable at the beginning of each year for 5 years. The first payment was received immediately. The leased property has an estimated useful life of 8 years and an estimated residual value of $16,500 (expected to be received by lessor but not guaranteed by the lessee). Lessor's implicit rate is 6%. Lessor had no other costs associated with this lease and properly classified the lease as a sales-type lease. The leased equipment was carried on Lessor Inc.'s books at $71,500. Hint: Underlying asset's carrying value does not equal its fair value at lease commencement. Required a. Calculate the value of the lease receivable at the commencement of the lease - Note: Round answer to the nearest dollar. - Note: Do not use a negative sign with your answer. b. What amounts would be presented in the balance sheet as of December 31 related to this lease? Note: Round amounts to the nearest whole dollar. c. What amounts would be presented in the income statement for the year ended December 31 related to this lease? Note: Round amounts to the nearest whole dollar. Reporting a Sales-Type Lease, Unguaranteed Residual Value-Lessor On January 1, the first day of its accounting year, Lessor Inc., leased certain property at an annual payment of $22,000 receivable at the beginning of each year for 5 years. The first payment was received immediately. The leased property has an estimated useful life of 8 years and an estimated residual value of $16,500 (expected to be received by lessor but not guaranteed by the lessee). Lessor's implicit rate is 6%. Lessor had no other costs associated with this lease and properly classified the lease as a sales-type lease. The leased equipment was carried on Lessor Inc.'s books at $71,500. Hint: Underlying asset's carrying value does not equal its fair value at lease commencement. Required a. Calculate the value of the lease receivable at the commencement of the lease - Note: Round answer to the nearest dollar. - Note: Do not use a negative sign with your answer. b. What amounts would be presented in the balance sheet as of December 31 related to this lease? Note: Round amounts to the nearest whole dollar. c. What amounts would be presented in the income statement for the year ended December 31 related to this lease? Note: Round amounts to the nearest whole dollar