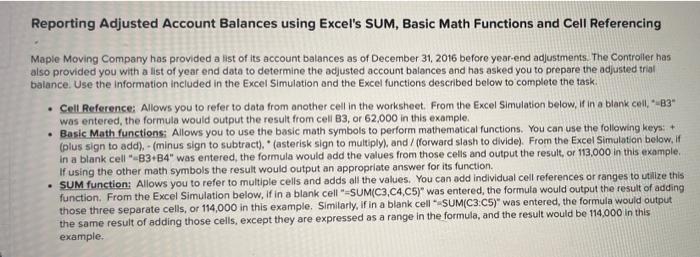

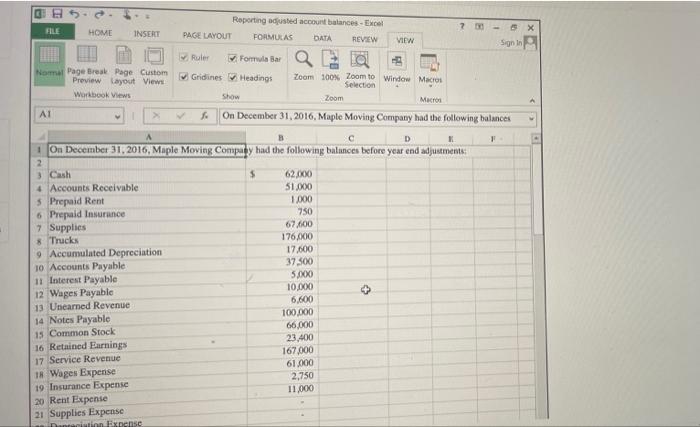

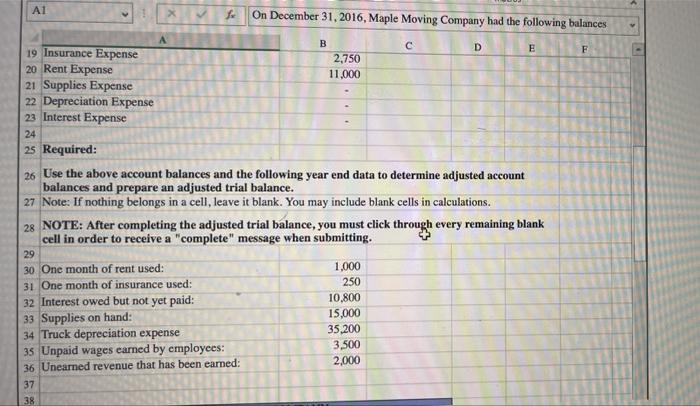

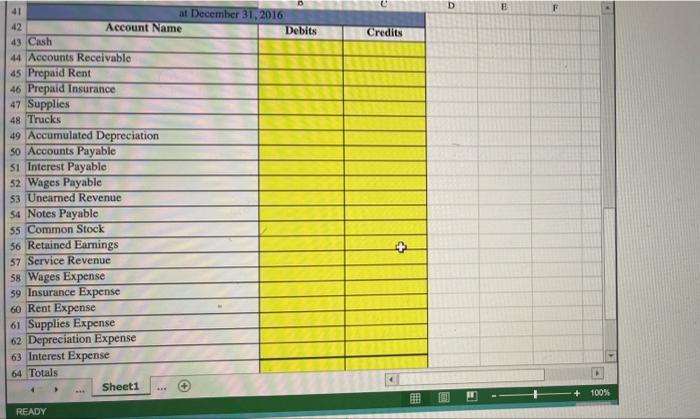

Reporting Adjusted Account Balances using Excel's SUM, Basic Math Functions and Cell Referencing Maple Moving Company has provided a list of its account balances as of December 31, 2016 before year-end adjustments. The Controller has also provided you with a list of year end data to determine the adjusted account balances and has asked you to prepare the adjusted trial balance. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. . Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, "-83" was entered, the formula would output the result from cell B3, or 62,000 in this example. . Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add),- (minus sign to subtract). (asterisk sign to multiply), and/ (forward slash to divide). From the Excel Simulation below, if in a blank cell "B3+84" was entered, the formula would add the values from those cells and output the result, or 113,000 in this example. If using the other math symbols the result would output an appropriate answer for its function. . SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this i function. From the Excel Simulation below, if in a blank cell "-SUM(C3,C4,C5)" was entered, the formula would output the result of adding those three separate cells, or 114,000 in this example. Similarly, if in a blank cell "SUM(C3:C5)" was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 114,000 in this example. CH Reporting adjusted account balances-Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Ruler Formula Bar Q Normal Page Break Page Custom Gridines Headings Preview Layout Views Zoom 100% Zoom to Window Macros Selection Workbook Views Show Zoom Macros A1 X V On December 31, 2016, Maple Moving Company had the following balances C D K F 1 On December 31, 2016, Maple Moving Company had the following balances before year end adjustments: 2 3 Cash S 4 Accounts Receivable 62,000 51,000 1,000 5 Prepaid Rent 6 Prepaid Insurance 750 7 Supplies 67,600 8 Trucks 176,000 9 Accumulated Depreciation 17,600 10 Accounts Payable 37,500 5,000 11 Interest Payable 10,000 12 Wages Payable 6,600 13 Unearned Revenue 100,000 14 Notes Payable 66,000 15 Common Stock 23,400 16 Retained Earnings 167,000 17 Service Revenue 61,000 18 Wages Expense 2,750 19 Insurance Expense 11,000 20 Rent Expense 21 Supplies Expense Depreciation Expense 7 0 5 x Al fr On December 31, 2016, Maple Moving Company had the following balances B D 19 Insurance Expense E F 20 Rent Expense 2,750 11,000 21 Supplies Expense 22 Depreciation Expense 23 Interest Expense 24 25 Required: 26 Use the above account balances and the following year end data to determine adjusted account balances and prepare an adjusted trial balance. 27 Note: If nothing belongs in a cell, leave it blank. You may include blank cells in calculations. 28 NOTE: After completing the adjusted trial balance, you must click through every remaining blank cell in order to receive a message when 29 30 One month of rent used: 1,000 31 One month of insurance used: 250 32 Interest owed but not yet paid: 10,800 15,000 33 Supplies on hand: 35,200 34 Truck depreciation expense 3,500 35 Unpaid wages earned by employees: 2,000 36 Unearned revenue that has been earned: 37 38 > [M | 41 42 43 Cash 44 Accounts Receivable 45 Prepaid Rent 46 Prepaid Insurance 47 Supplies 48 Trucks 49 Accumulated Depreciation 50 Accounts Payable 51 Interest Payable 52 Wages Payable 53 Unearned Revenue 54 Notes Payable 55 Common Stock 56 Retained Earnings 57 Service Revenue 58 Wages Expense 59 Insurance Expense 60 Rent Expense 61 Supplies Expense 62 Depreciation Expense 63 Interest Expense 64 Totals Sheet1 READY at December 31, 2016 Account Name ALE Debits Credits + EI 100%