Reporting (Assignment #4)

Reporting (Assignment #4)

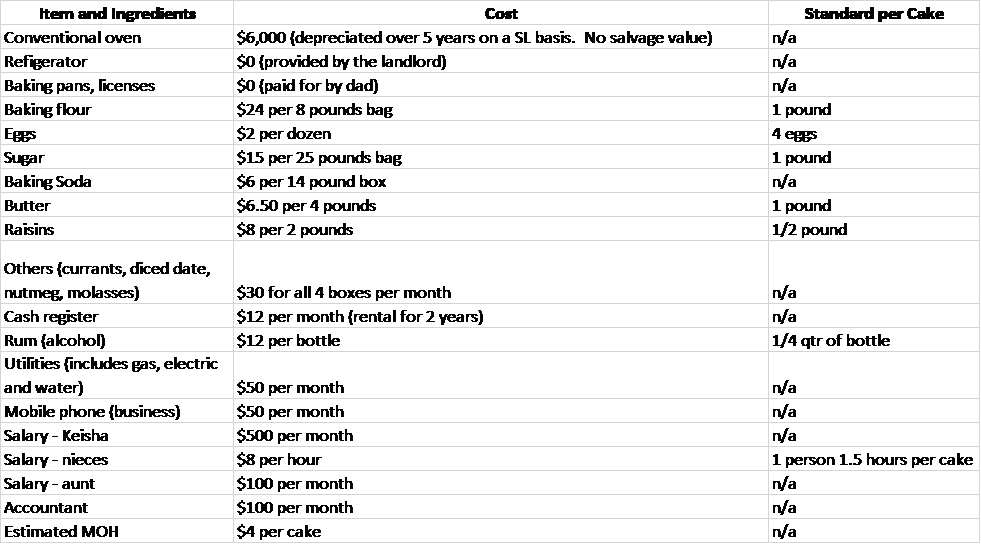

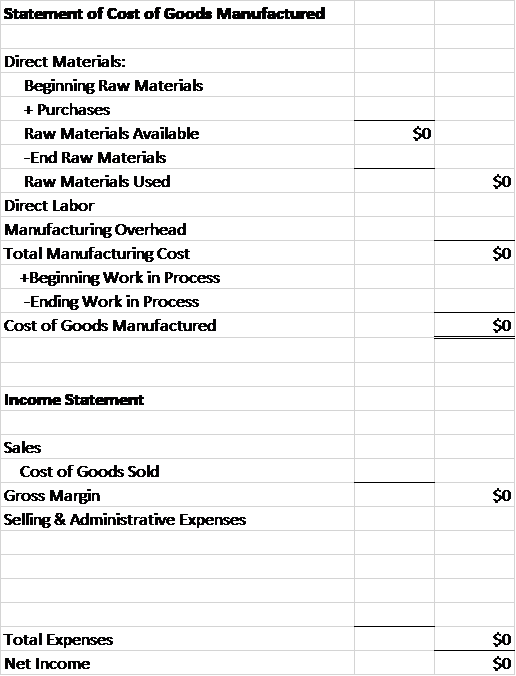

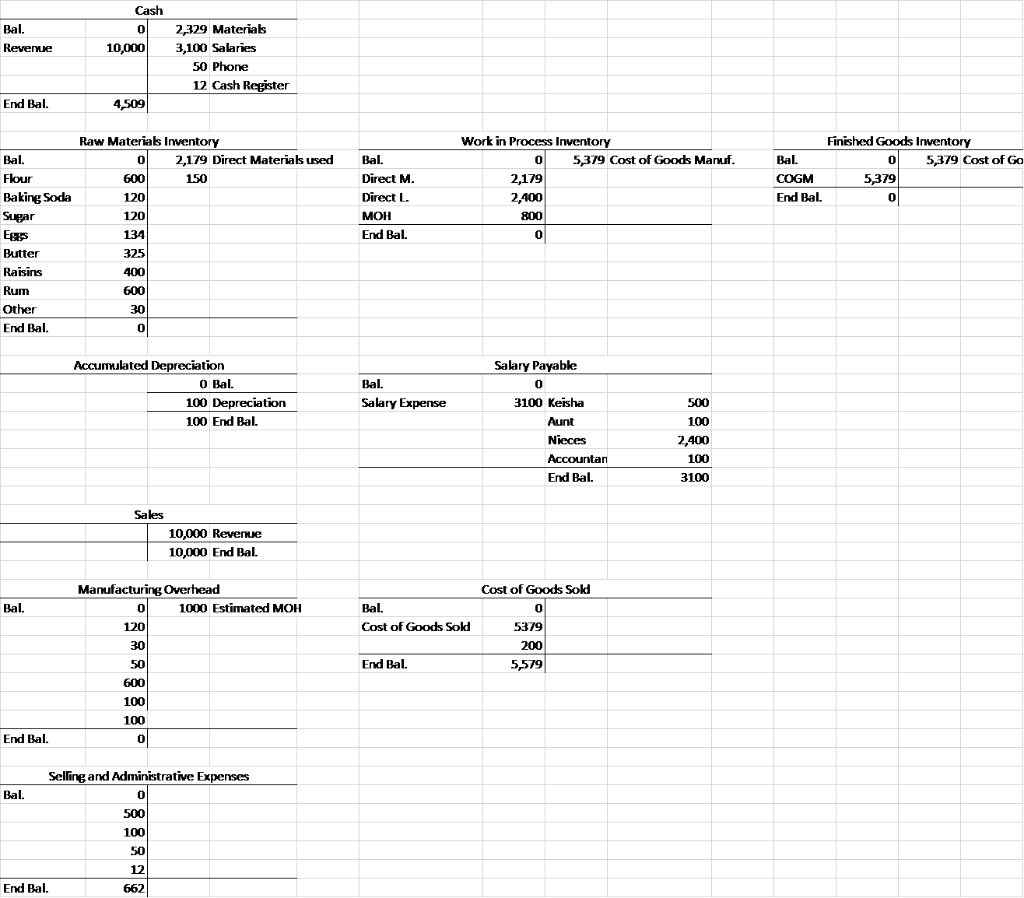

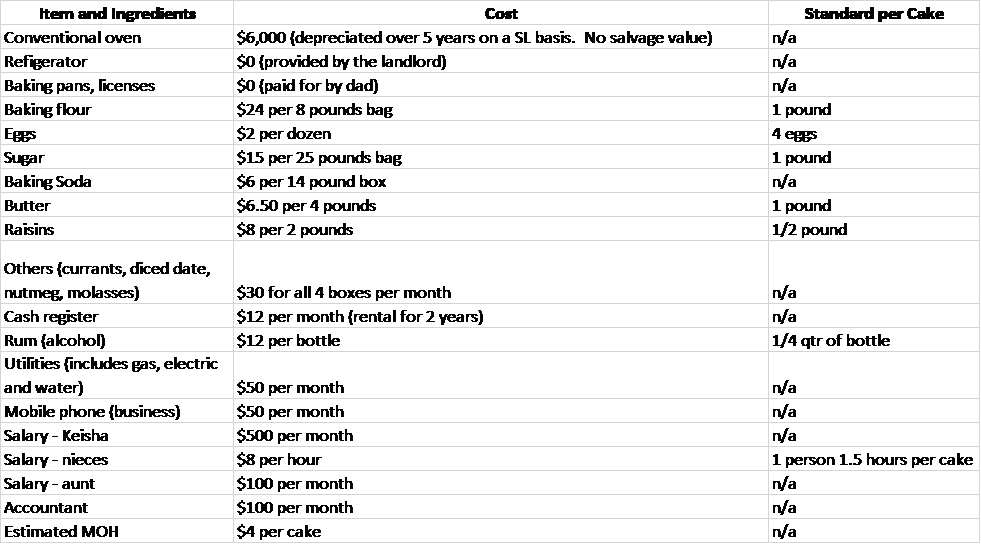

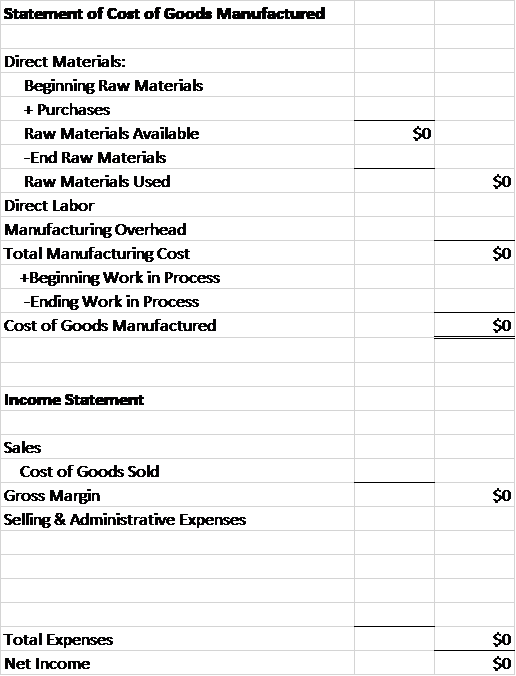

Since Mary was not paying much attention to the discussion on journal entries in her one accounting class, she does not understand the T-accounts that you provided. However, she heard through her accountant that there is a manufacturing report that would provide her with the same information as the T-accounts and is more user friendly. She believes that the report is called the Statement of Cost of Goods Manufactured.

Required: Prepare the Statement of Cost of Goods Manufactured for January. Also, prepare an Income Statement for the month of January.

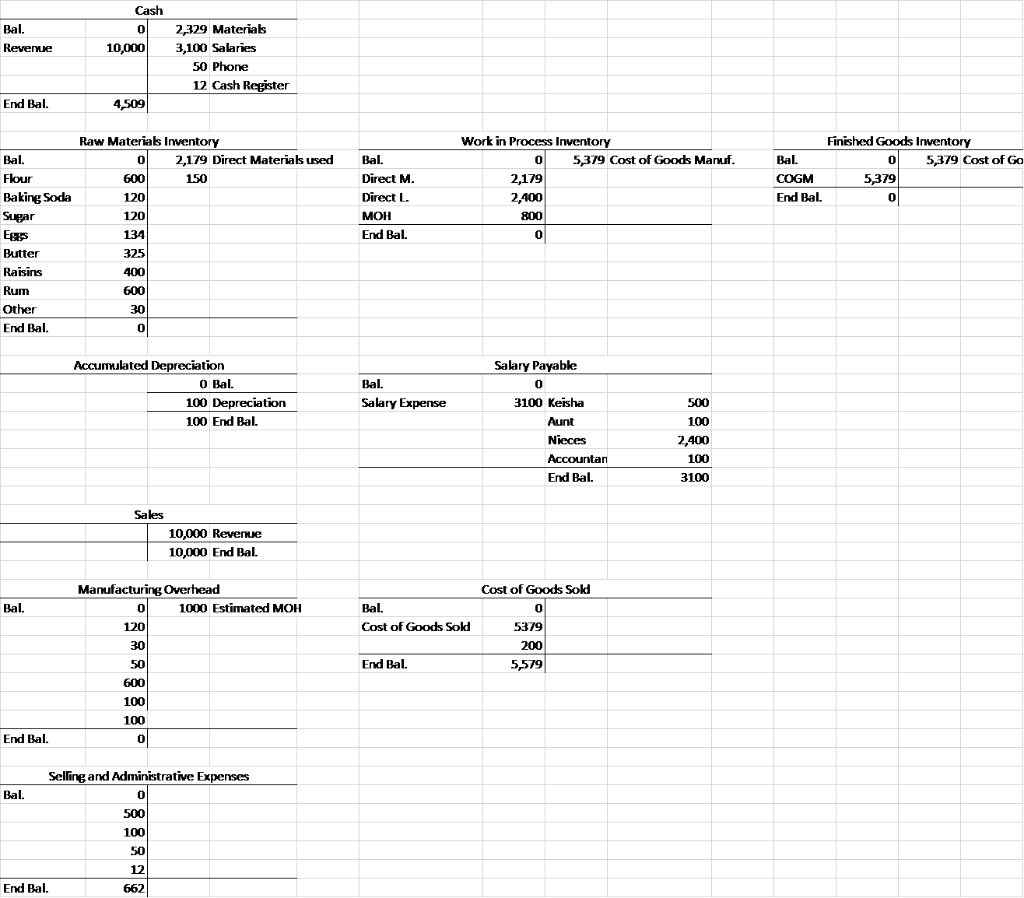

Bal. Revenue 0 2,329 Materias 10,000 3,100 Salaries 50 Phone 12 Cash Register End Bal. 4,509 Raw Materials Inventory Work in Process Inventory Finished Goods Inventory Bal. Flour Baking Soda Sugar Bal. COGM End Bal. 0 2,179 Direct Materials used Bal. 05379 Cost of Goods Manuf 0 5379 Cost of Go 5,379 0 Direct M Direct L 150 2,179 2,400 800 0 End Bal. Butter Raisins other End Bal. 0 Accumulated Depreciation Salary Payable 0 O Bal. 100 Depreciation 100 End Bal. Bal. Salary Expense 3100 Keisha Nieces Accountan End Bal. 2,400 3100 Sales 10,000 Revenue 10,000 End Bal. Manufacturing Overhead Cost of Goods Sold Bal. 1000 Estimated MOH Bal. Cost of Goods Sold 0 0 5379 End Bal. 50 5,579 100 End Bal. Selling and Administrative Expenses Bal. 100 12 End Bal. Standard per Cake tem and Ingredients Cost $6,000 (depreciated over 5 years on a SL basis. No salvage vakue) $0 (provided by the landlord) $0 (paid for by dad) $24 per 8 pounds bag $2 per dozen S15 per 25 pounds bag $6 per 14 pound boix $6.50 per 4 pounds $8 per 2 pounds Conventional oven Refigerator Baking pans, licenses Baking flour 1 pound 4 ety* 1 pound Sugar Baking Soda Butter Rasins 1 pound 1/2 pound Others (currants, diced date, Mitmeg. molasses) Cash register Rum (akohol) Utilities fincludes gas, electric and water) Mobile phone {business) Salary Keisha Salary - nieces Salary - aunt Accountant Estimated MOH $30 for all 4 boxes per month 12 per month (rental for 2 years) $12 per bottle 1/4 qtr of bottle per month per month per month $8 per hour $100 per month $100 per month $4 per cake 1 person 1.5 hours per cake Statement of Cost of Goods Manufactured Direct Materials Beginning Raw Materials + Purchases Raw Materials Available $0 End Raw Materials $0 Raw Materials Used Direct Labor Manufacturing Overhead Total Maufacturing Cost $0 +Beginning Work in Process Ending Work in Process Cost of Goods Manufactured $0 Sales Cost of Goods Sold Gross Margin Selling & Administrative Expenses $0 $0 $0 Total Expenses Net Income Bal. Revenue 0 2,329 Materias 10,000 3,100 Salaries 50 Phone 12 Cash Register End Bal. 4,509 Raw Materials Inventory Work in Process Inventory Finished Goods Inventory Bal. Flour Baking Soda Sugar Bal. COGM End Bal. 0 2,179 Direct Materials used Bal. 05379 Cost of Goods Manuf 0 5379 Cost of Go 5,379 0 Direct M Direct L 150 2,179 2,400 800 0 End Bal. Butter Raisins other End Bal. 0 Accumulated Depreciation Salary Payable 0 O Bal. 100 Depreciation 100 End Bal. Bal. Salary Expense 3100 Keisha Nieces Accountan End Bal. 2,400 3100 Sales 10,000 Revenue 10,000 End Bal. Manufacturing Overhead Cost of Goods Sold Bal. 1000 Estimated MOH Bal. Cost of Goods Sold 0 0 5379 End Bal. 50 5,579 100 End Bal. Selling and Administrative Expenses Bal. 100 12 End Bal. Standard per Cake tem and Ingredients Cost $6,000 (depreciated over 5 years on a SL basis. No salvage vakue) $0 (provided by the landlord) $0 (paid for by dad) $24 per 8 pounds bag $2 per dozen S15 per 25 pounds bag $6 per 14 pound boix $6.50 per 4 pounds $8 per 2 pounds Conventional oven Refigerator Baking pans, licenses Baking flour 1 pound 4 ety* 1 pound Sugar Baking Soda Butter Rasins 1 pound 1/2 pound Others (currants, diced date, Mitmeg. molasses) Cash register Rum (akohol) Utilities fincludes gas, electric and water) Mobile phone {business) Salary Keisha Salary - nieces Salary - aunt Accountant Estimated MOH $30 for all 4 boxes per month 12 per month (rental for 2 years) $12 per bottle 1/4 qtr of bottle per month per month per month $8 per hour $100 per month $100 per month $4 per cake 1 person 1.5 hours per cake Statement of Cost of Goods Manufactured Direct Materials Beginning Raw Materials + Purchases Raw Materials Available $0 End Raw Materials $0 Raw Materials Used Direct Labor Manufacturing Overhead Total Maufacturing Cost $0 +Beginning Work in Process Ending Work in Process Cost of Goods Manufactured $0 Sales Cost of Goods Sold Gross Margin Selling & Administrative Expenses $0 $0 $0 Total Expenses Net Income

Reporting (Assignment #4)

Reporting (Assignment #4)