Answered step by step

Verified Expert Solution

Question

1 Approved Answer

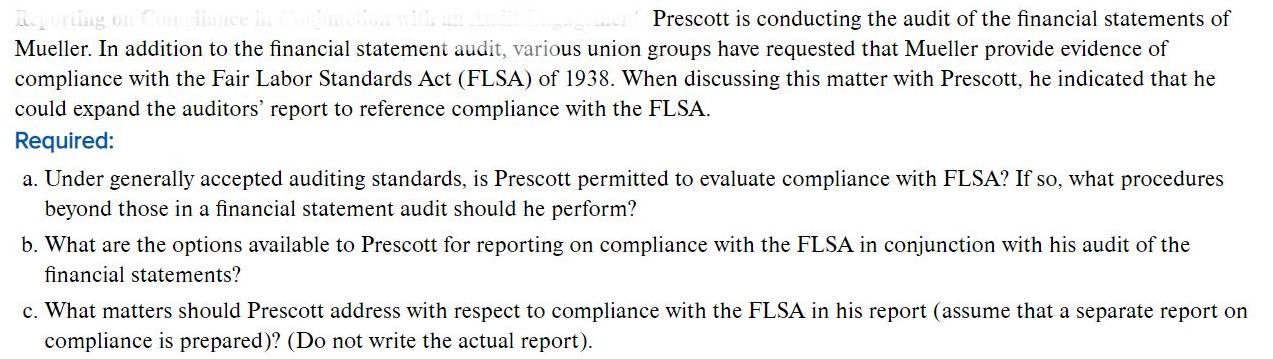

Reporting on Compliance in Prescott is conducting the audit of the financial statements of Mueller. In addition to the financial statement audit, various union

Reporting on Compliance in Prescott is conducting the audit of the financial statements of Mueller. In addition to the financial statement audit, various union groups have requested that Mueller provide evidence of compliance with the Fair Labor Standards Act (FLSA) of 1938. When discussing this matter with Prescott, he indicated that he could expand the auditors' report to reference compliance with the FLSA. Required: a. Under generally accepted auditing standards, is Prescott permitted to evaluate compliance with FLSA? If so, what procedures beyond those in a financial statement audit should he perform? b. What are the options available to Prescott for reporting on compliance with the FLSA in conjunction with his audit of the financial statements? c. What matters should Prescott address with respect to compliance with the FLSA in his report (assume that a separate report on compliance is prepared)? (Do not write the actual report).

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Prescott is permitted to evaluate compliance with FLSA as per SA 250 Consideration of Laws and Regulations in an Audit of Financial Statements As per SA 250 it is the responsibilty of the auditor to consider laws and regulations when performing an audit of financial statements The auditor should obtain a general understanding of the legal and regulatory framework and how the entity complies with that framework The auditor shall obtain sufficient appropriate audit evidence regarding compliance with the provisions of those laws and regulations generally recognised to have a direct effect on the determination of material amounts and disclosures in the financial statements The auditor shall inquire the management and those charged with governance as to whether the entity in compliance with such laws and regualtions During the audit the auditor shall remain alert to the possibility that other audit procedures applied may bring instances of non compliance or suspected non compliance with laws and regulations to the auditors attention The auditor shall request management to rovide written representations that all known instances of noncompliance with laws and regulations whose effect should be considered when preparing financial statements have been disclosed to the auditor b The auditor have the following options for reporting compliance with FLSA Reporting NonCompliance to Those charged With Governance Reporting NonCompliance in the Auditors Report on the Financial Statement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started