Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reporting Operating Lease-Lessee Renewable Co. uses leasing as a secondary means of selling its products. The company contracted with Green Corporation to lease a

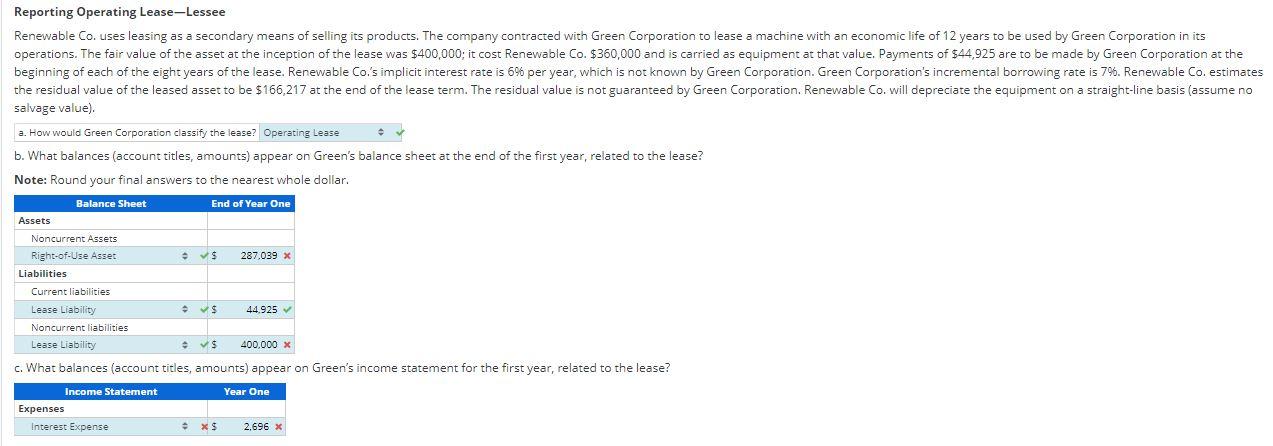

Reporting Operating Lease-Lessee Renewable Co. uses leasing as a secondary means of selling its products. The company contracted with Green Corporation to lease a machine with an economic life of 12 years to be used by Green Corporation in its operations. The fair value of the asset at the inception of the lease was $400,000; it cost Renewable Co. $360,000 and is carried as equipment at that value. Payments of $44,925 are to be made by Green Corporation at the beginning of each of the eight years of the lease. Renewable Co.'s implicit interest rate is 6% per year, which is not known by Green Corporation. Green Corporation's incremental borrowing rate is 7%. Renewable Co. estimates the residual value of the leased asset to be $166,217 at the end of the lease term. The residual value is not guaranteed by Green Corporation. Renewable Co. will depreciate the equipment on a straight-line basis (assume no salvage value). a. How would Green Corporation classify the lease? Operating Lease b. What balances (account titles, amounts) appear on Green's balance sheet at the end of the first year, related to the lease? Note: Round your final answers to the nearest whole dollar. Balance Sheet End of Year One Assets Noncurrent Assets Right-of-Use Asset $ 287,039 x Liabilities Current liabilities Lease Liability S 44.925 Noncurrent liabilities Lease Liability 400,000 x c. What balances (account titles, amounts) appear on Green's income statement for the first year, related to the lease? Income Statement Expenses Year One Interest Expense * * $ 2.696 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started