Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reporting Uncollectible Accounts and Accounts Receivable (FSET) LaFond Company analyzes its accounts receivable at December 31 and arrives at the aged categories below along

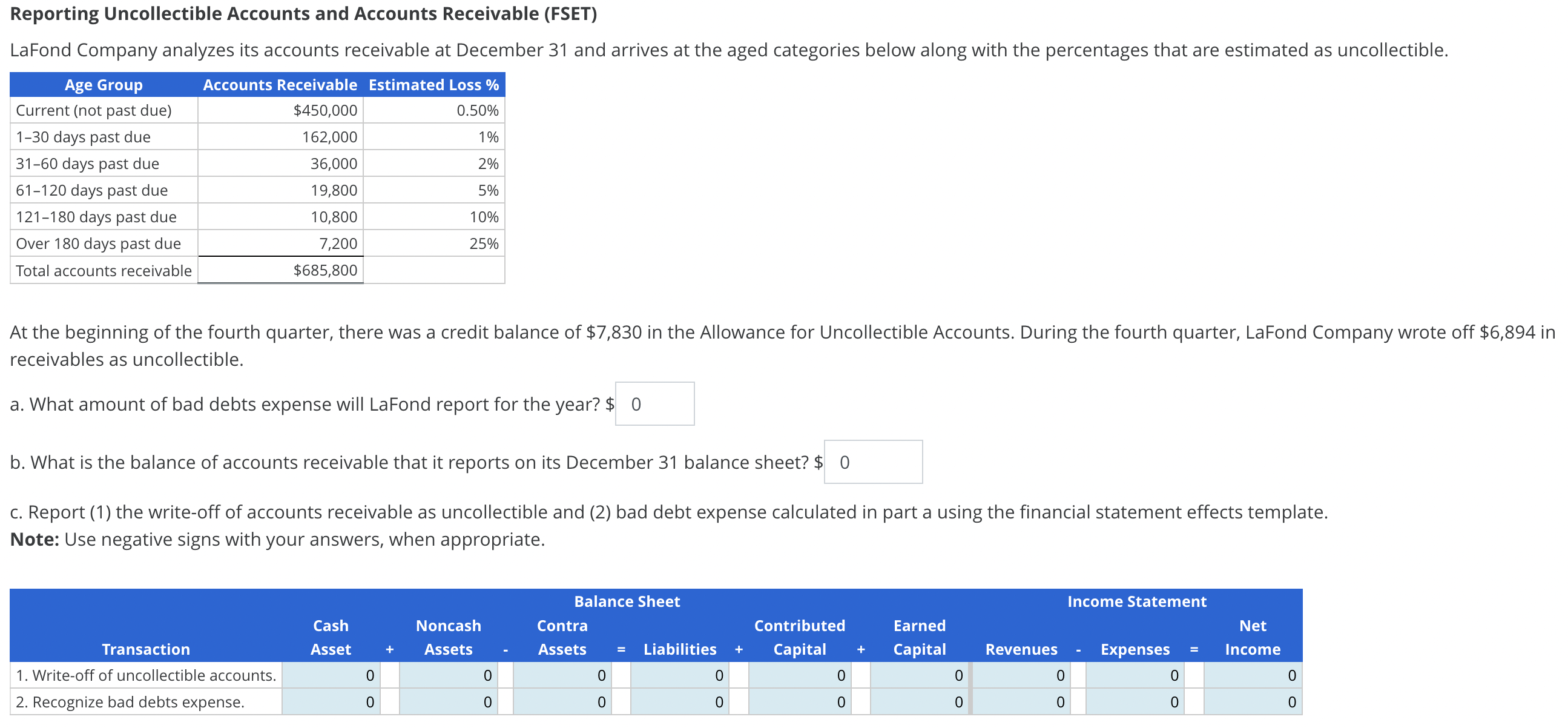

Reporting Uncollectible Accounts and Accounts Receivable (FSET) LaFond Company analyzes its accounts receivable at December 31 and arrives at the aged categories below along with the percentages that are estimated as uncollectible. Age Group Current (not past due) Accounts Receivable Estimated Loss % $450,000 0.50% 1-30 days past due 162,000 1% 31-60 days past due 36,000 2% 61-120 days past due 19,800 5% 121-180 days past due Over 180 days past due Total accounts receivable 10,800 10% 7,200 $685,800 25% At the beginning of the fourth quarter, there was a credit balance of $7,830 in the Allowance for Uncollectible Accounts. During the fourth quarter, LaFond Company wrote off $6,894 in receivables as uncollectible. a. What amount of bad debts expense will LaFond report for the year? $ 0 b. What is the balance of accounts receivable that it reports on its December 31 balance sheet? $ 0 c. Report (1) the write-off of accounts receivable as uncollectible and (2) bad debt expense calculated in part a using the financial statement effects template. Note: Use negative signs with your answers, when appropriate. Transaction 1. Write-off of uncollectible accounts. 2. Recognize bad debts expense. Balance Sheet Income Statement Cash Asset + Noncash Assets Contra Assets Contributed Earned Net Liabilities + Capital + Capital Revenues Expenses Income 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The amount of bad debts expense reported by LaFond for the year would be the increase in the allow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started