Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Republic Act No. 14344 imposes an excise tax on internet services. The tax is imposed by the Congress to (1) defer the rising costs

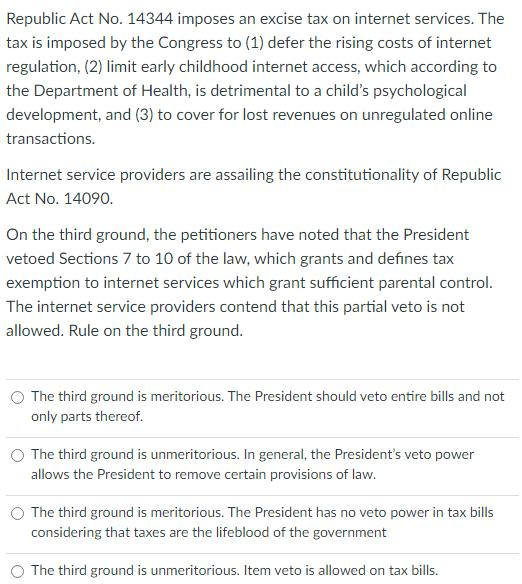

Republic Act No. 14344 imposes an excise tax on internet services. The tax is imposed by the Congress to (1) defer the rising costs of internet regulation, (2) limit early childhood internet access, which according to the Department of Health, is detrimental to a child's psychological development, and (3) to cover for lost revenues on unregulated online transactions. Internet service providers are assailing the constitutionality of Republic Act No. 14090. On the third ground, the petitioners have noted that the President vetoed Sections 7 to 10 of the law, which grants and defines tax exemption to internet services which grant sufficient parental control. The internet service providers contend that this partial veto is not allowed. Rule on the third ground. The third ground is meritorious. The President should veto entire bills and not only parts thereof. The third ground is unmeritorious. In general, the President's veto power allows the President to remove certain provisions of law. The third ground is meritorious. The President has no veto power in tax bills considering that taxes are the lifeblood of the government The third ground is unmeritorious. Item veto is allowed on tax bills.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

D The third ground is unmeritorious item veto is allowed on tax bills In The United States It Has Be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started