Answered step by step

Verified Expert Solution

Question

1 Approved Answer

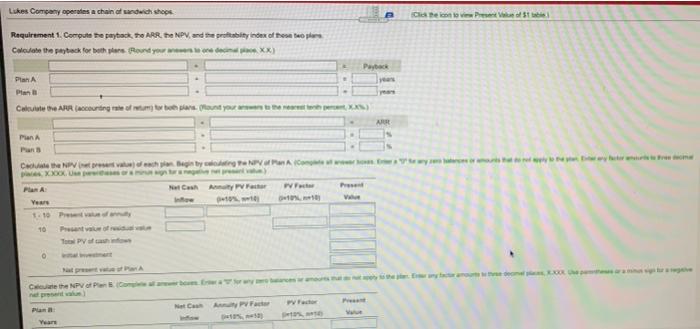

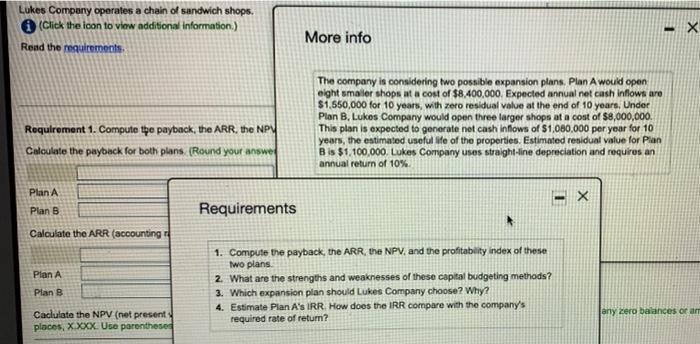

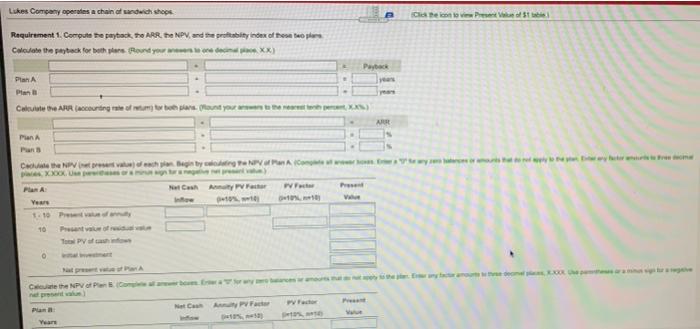

req 1: Computer payback, the ARR, the NPV, and the profitability index of these two plans. calculate the accounting rate of return for both plans.

req 1: Computer payback, the ARR, the NPV, and the profitability index of these two plans.

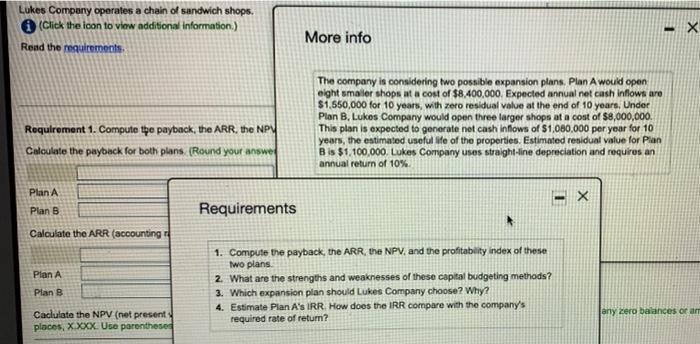

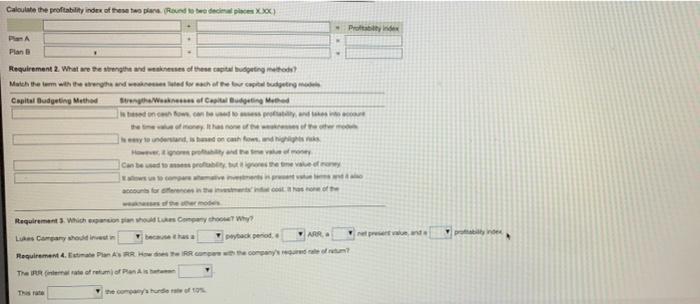

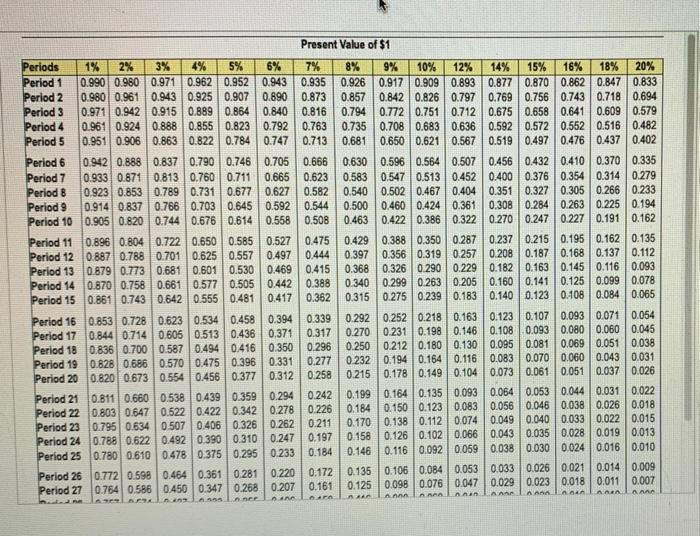

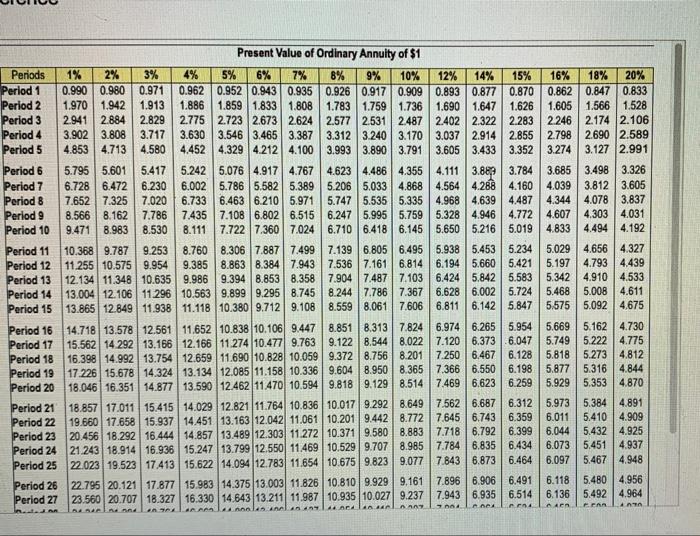

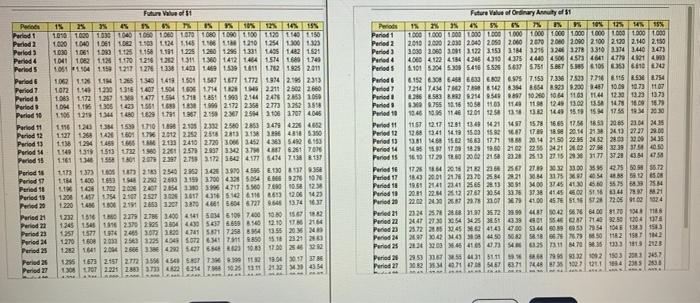

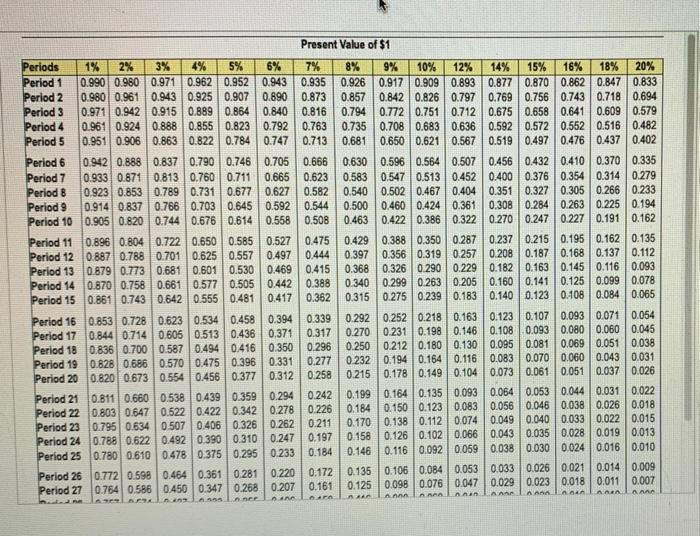

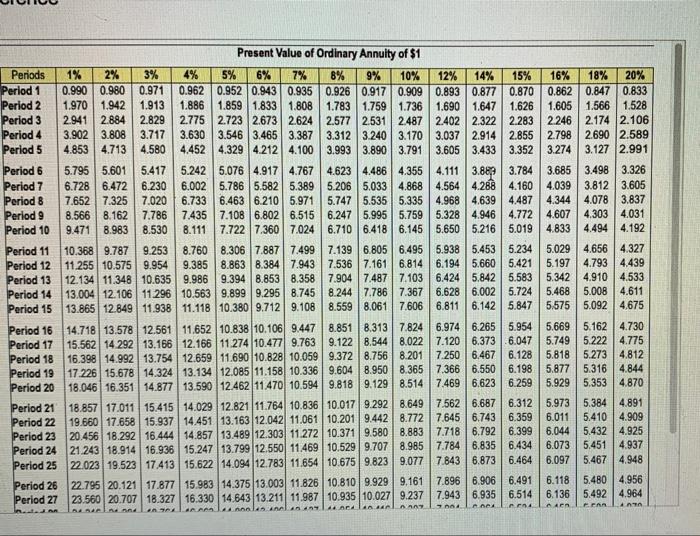

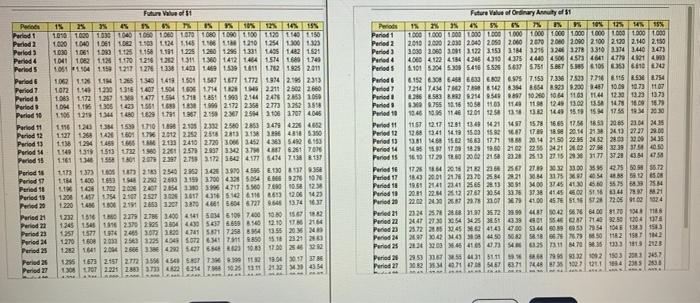

Lukes Company operates a chain of sandwich shops. (Click the loon to view additional Information) Read the requirements x 1 More info The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8.400,000. Expected annual net cash inflows are $1,550,000 for 10 years, with zero residual value at the end of 10 years, Under Plan B, Lukes Company would open three larger shops at a cost of $8,000,000. This plan is expected to generate net cash inflows of $1,000,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan Bis $1,100,000. Lukes Company uses straight-line depreciation and requires an annual return of 10% Requirement 1. Compute the payback, the ARR. the NPY Calculate the payback for both plans (Round your answe Plan A -X Plan B Requirements Calculate the ARR (accounting Plan A Plan B 1. Compute the payback, the ARR, the NPV and the profitability index of these Two plans 2. What are the strengths and weaknesses of these capital budgeting methods? 3. Which expansion plan should Lukes Company choose? Why? 4. Estimate Plan A's IRR How does the IRR compare with the company's required rate of return? any zero balances or ar Caclulate the NPV (net present places, X.XXX. Use parentheses Lukes Company operates a chain wich shops Gli e icon to vien Pee Weed Steel Requirement 1. Compute the pack. The ARR the NPV and se probitynex of the oper Calculate the pack for both plans Round your XX) Payback PA Calculate the ARR con le foto) Pian Pans Chung Ha Na Nga v nam gia BH ty qu v MV | Pa A SH M PHU NHI VUI PF CAP . Veure 10 Ce the NPVP wrote Net APF pa Year Lukes Company operis a chain of sandwich Shops Click the icon to virent Value of $1 tabi Calculate the NPV of Plan B. (Complete all answer bows. Enter a more for any zero balances or amounts that do not nowy to the plu. Enter any cor amants to the decimal plane XOX. Une parentheses or a minut sign tour a negu present) Plan Net Cash Annuity PV Factor PV Factor Present Year Inflow 10%, 10) Dw10%) Value 1-10 Present value of nuty 10 Present value ofruar Total PV of cashine 0 Investment Net present value of Pan Calculate the profitability index of these two plans found to decis XX Proinde PA Dans Requirement 2. What the strengths and was of these bugeting methods Match them with the strengths and weaknessed for each of the four budgeing made Capital Budgeting Method Strength.Ws of Capital Buleting Method isted on how can be the money weer models is yoon and How to Drawind way Can betul tema of money Calculate the profitability index of these two para proud be decine Xxx) Probe Plan Requirement 2. What are the strength and wees of these capital puting? Maich them with the headed for the budget Capital Budgeting Method Berth/Wake of Capilding se once for andre the one that one Nodon how Hord Can bedre for of the Requirements. Which on the Company W La Company that A. Wewe po Requirement 4. Etter ASRR RR Record The Refram of Paris Present Value of $1 Periods 1% 2% 3% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.9520.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.7180.694 Period 3 0.971 0.942 0.915 0.8890.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.8230.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.5520.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.5190.497 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.833 0.871 0.813 0.760 0.7110.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.1910.162 Period 110.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.1600.141 0.125 0.099 0.078 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.2390.183 0.140 0.123 0.108 0.084 0.065 Period 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 Period 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.1980.146 0.108 0.093 0.080 0.060 0.045 Period 18 0.836 0.700 0.587 0.4940.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 Period 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 Period 20 0.820 0.673 0.554 0.456 0.377 0.3120.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 Period 21 0.811 0.660 0.538 0.439 0.359 0.294 0.242 0.1990.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 Period 22 0.803 0.647 0.522 0422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 Period 23 0.795 0.634 0.507 0.4060.3260.262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 Period 24 0.788 0.622 0.492 0.390 0.310 0.247 0.19 0.158 0.126 0.1020.066 0.043 0.035 0.028 0.019 0.013 Period 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.0590.038 0.030 0.024 0.016 0.010 Period 26 0.772 0.598 0.464 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009 Period 27 0.764 0.586 0.450 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.047 0.029 0.023 0.018 0.0110.007 LAETA AAAA An nin AAN AM AMA AF NAFA Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.9520.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 2 1.970 1.942 1.913 1.886 1.859 1.833 1.8081.783 1.759 1.736 1.6901.647 1.626 1.605 1.566 1.528 Period 3 2.9412.884 2.829 2.775 2.723 2.673 2624 2.577 2.531 2487 2.402 2.322 2.283 2246 2.174 2.106 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 Period 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.882 3.784 3.685 3.498 3.326 Period 7 6.728 6.472 6.230 6.002 5.786 5,582 5.389 5.206 5,033 4.868 4.564 4.288 4.160 4.039 3.812 3.605 Period 8 7,652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 Period 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.9955.759 5.328 4.946 4.772 4.607 4.303 4,031 Period 10 9.471 8.983 | 8.530 8.111 7.722 7.360 7.024 | 6.710 6.418 6.145 5.6505.216 5.019 4.833 4.494 4.192 Period 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.1616.814 6.1945.660 5.421 5.1974.793 4.439 Period 13 12.134 11.348 10.635 9.986 9.3948.853 8.358 7.904 7.487 7.103 6.424 5.8425.583 5.3424.910 4.533 Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 Period 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.5598.061 7.606 6.811 6.142 5.8475.575 5.092 4.675 Period 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.9746.265 5.954 5.669 5.1624.730 Period 17 15.562 14 292 13.166 | 12.166 11 274 10.477 9.763 9.122 8.544 8.022 7.120 6.373.6.047 5.749 5.222 4.775 Period 18 16.398 14.992 13.754 12.659 11.690 10.828 10.0599.372 8.756 8.2017.250 6.467 6.128 5.818 5.273 4.812 Period 19 17.226 15.678 14.32413.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.1985.877 5.316 4.844 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 10.5949.818 9.1298.514 7.469 6.623 6.259 5.929 5.353 4.870 Period 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.0179.292 8.6497.562 6.687 6.3125.973 5.384 4.891 Period 22 19.660 17.658 15.93714451 13.163 12.042 11.061 10.2019.442 8.7727.645 6.7436.3596.011 5.410 4.909 Period 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.5808.8837.718 6.792 6.399 6.044 5.432 4.925 Period 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.7078.9857.784 6.835 6.4346.073 5.451 4.937 Period 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.8239.077 7.8436.8736.464 6.097 5.467 4.948 Period 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.8109.929 9,1617.896 6.906 6.491 6.118 5.480 4.956 Period 27 23.560 20.707 18.327 16.330 14 643 13.211 11.987 10.935 10.027 9.237 7.943 6.935 6.514 6.136 5.492 4.964 In.. nalala 4 4d HARA ARA na AAA AR PEAR w 145 ONEI S 20 D W Future Value of 1 Pein 15 th 10% 12% 14% 15% Periodi 7.016 1020 10301040 105 106 1070 1080 100 1100 1120 1140 1150 Period 2 1000 1040 1061 100 1.100 1.1 1.1 110 110 12541.300 1.32 Period 1090 100 100 1125 115 1.181 1.225 120 125 1301 LAOS TARP 1521 Period 4 104 1042 1.1 1.17012161212311130014121484154 1601745 Periods 101 104 1.15217127330 1400 1.469 1.539 762 1925 2011 Period 1092 113 114 1140 141 1501 1567 177 1772 1914212313 Period 7 107211120011407 1.50 1.63 1714 1021122112.5022660 Period 1083 172 1257 1477 154 1710 185 195 214 34 253 1059 Period 1094 1.16 1905 1423 1561 101 2172 25 2773 2355 Period 10 110512115441829 179 1867 20 23 25 316 1707 4046 Period 11 1.116 120 13 15 17 19 21952.332 2.58028551474228462 Period 12 1.127 126 11601 79 2012 252 253 2321331341350 Period 13 1.138 129 14 TAM 2133 2410 2720 3006345243835426953 Period 14 1.540 131 1513 7221960 2261 2.570 207 3.2 3.7621 701 Period 15 1.161 1340 15 10 2017 211031723540417747130137 Period 10 11 137 s 12240 2.42 143.9704596108179.35 Period 1.14 14001 2200 200 3150 370043250542100 Period 10 1.1 11702200 201 2.54 310 396 470.00 7610125 Period 19 1.200 147 154 2107 25273 2017 15 16 12.06 1423 Period 1220 11000 2191 2653 12012046604 67279.541 15.74637 Period 123211 MO 279 2786 3.400 4541 5045100740010012 Period 1245154116 2570 2010044430567 6.610846 210 1721 Period 23 125 577 LT 2.40 30 1820 7250 BM 15.55 205 Period 24 1270 160 200 25312254043 072 641741185095.18 23 21 20 Periods 1282164120 26 34 Se ES10128042 Period 20 28516732457 22 15 12 12.0437 Period 27 1308 10 29 28 27 26 1031324354 . EST Periods Period 1 Period Period Period Periods Period Period Period Period Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Perid 17 Period 18 Period 18 Period 20 Pod1 Period 22 Period Period 24 Period 25 Period 20 Period 27 Future Value of Ordinary Annuity 11 19 4% 5% 6% 7 10% 135 145 15% 1000 1000 100 100 100 1000 1000 1000 10000 1000 1000 1000 2010 2.00 2.000 2040 2050 2.000 2.670 2.0 2.0 2.100 2.120 2.140 2.150 3.000 1.000.00312 3.153 1843216 320 330 341.4401473 4000 4122418434010375 4.440 450 45 46414140 101 5.204 300 5.450.5256575.675.985 105 635 6.110 6.152 6.300 662 6.75 7.155 7.30 7523 771681166754 1-21474472 28344 654.03.200 1467 10.09 10.73 11.07 02869214D 10.20010641101330 131 13.73 75512.16 0.1103 114 115 12.491302135017 16.00 16.79 19.46611401211241343.214.495.715 178 M200 118712.17 1201 121 1457 158 16.85.185 2085 2004 2435 126 41 10 15.0 15.827 1820.141241223722.00 13.81 14.5 15.2 117 11 18 20.14 215 225 242 2800.00 14.35 1401701039.602102 2255 2421 262 273237050 16.10 1720 12:30 20:00 215 220 2213 22:15 231773720 MM 17264201621267 27.10323300515 555.72 12001212370842821542835 12.08 19.51 2141 234136523301004540306 55 54 2011 22 12 20.5405373841456471 22.02 20 27 74100556720720634 23 24 25 28 3572 2599 0424.0081704 2047 2730 20 54 425 39 547142.50 1204 25.72 245 4145 000 $34450890057 1045 132 153 269438 58.8677850 H21T14 2034 2035 416 41.311 473835 03113213 29531 MS441 511102 102 7503012457 07522714102t21 14 235 238 OO WERE Do DOS OS 90 calculate the accounting rate of return for both plans.

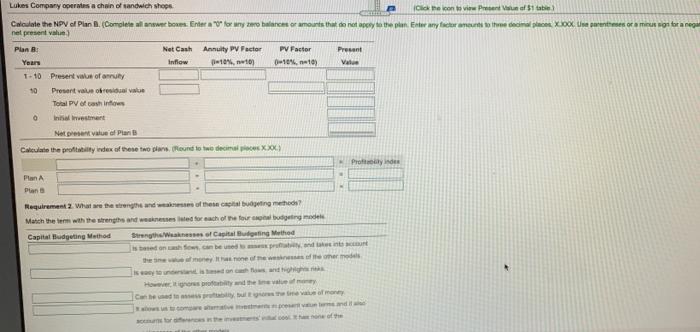

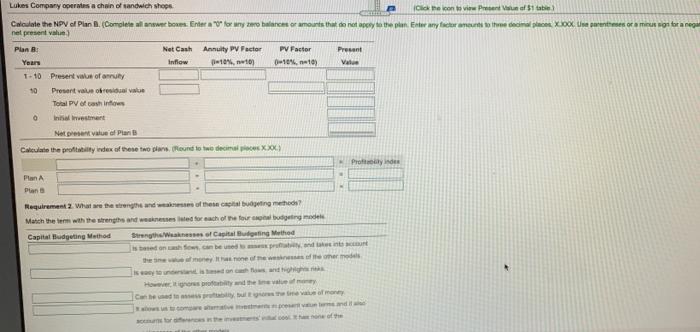

calculate the net present value of each plan. begin by calculating the NPV of plan A then Plan B.

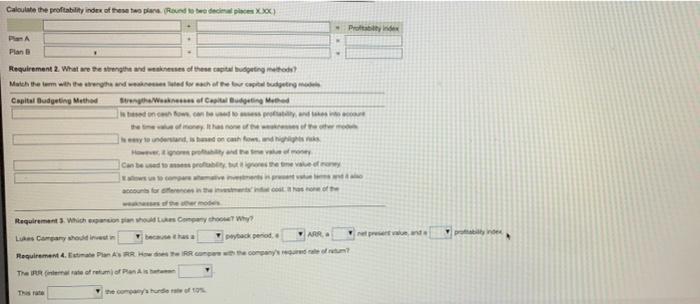

calculate the profitability index of these two plans.

Req 2: Match the term with the strength and weakness listed for each of the four capital budget models.

req 3: which expansion plans should Luke's company choose? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started