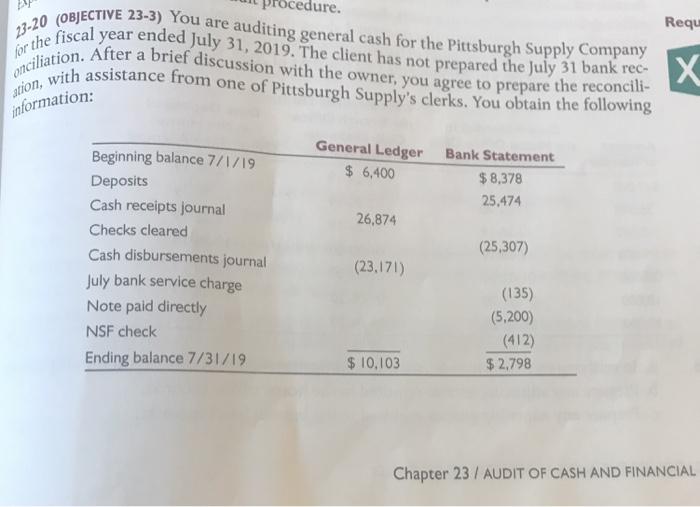

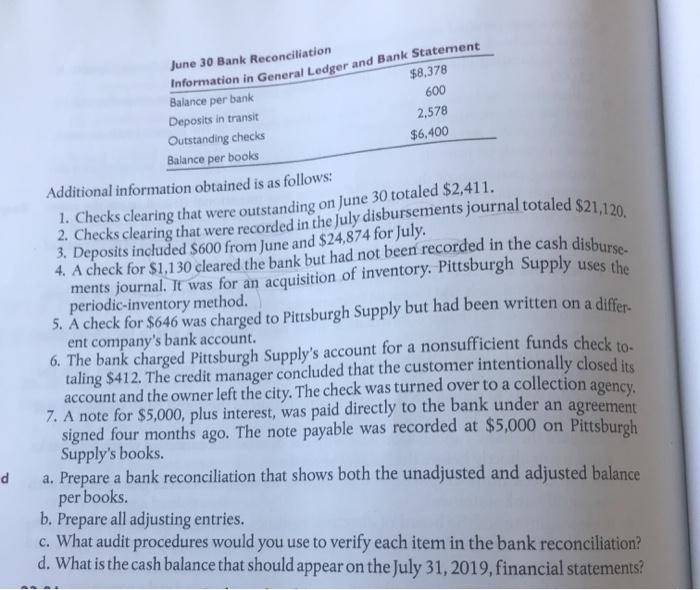

Requ 23-20 (OBJECTIVE 23-3) You are auditing general cash for the Pittsburgh Supply Company onciliation. After a brief discussion with the owner, you agree to prepare the reconcili- for the fiscal year ended July 31, 2019. The client has not prepared the July 31 bank rec- with assistance from one of Pittsburgh Supply's clerks. You obtain the following X ation, information: General Ledger $ 6,400 Bank Statement $ 8.378 25,474 26,874 (25,307) Beginning balance 7/1/19 Deposits Cash receipts journal Checks cleared Cash disbursements journal July bank service charge Note paid directly NSF check Ending balance 7/31/19 (23,171) (135) (5,200) (412) $ 2,798 $ 10,103 Chapter 23 / AUDIT OF CASH AND FINANCIAL 2. Checks clearing that were recorded in the July disbursements journal totaled $21,120. 4. A check for $1.130 cleared the bank but had not been recorded in the cash disburse- June 30 Bank Reconciliation Information in General Ledger and Bank Statement $8,378 Balance per bank 600 Deposits in transit 2,578 Outstanding checks $6,400 Balance per books Additional information obtained is as follows: 1. Checks clearing that were outstanding on June 30 totaled $2,411. 3. Deposits included $600 from June and $24,874 for July. ments journal. It was for an acquisition of inventory. Pittsburgh Supply uses the periodic-inventory method. 5. A check for $646 was charged to Pittsburgh Supply but had been written on a differ- ent company's bank account. 6. The bank charged Pittsburgh Supply's account for a nonsufficient funds check to taling $412. The credit manager concluded that the customer intentionally closed its account and the owner left the city. The check was turned over to a collection agency. 7. A note for $5,000, plus interest, was paid directly to the bank under an agreement signed four months ago. The note payable was recorded at $5,000 on Pittsburgh Supply's books. per books. d a. Prepare a bank reconciliation that shows both the unadjusted and adjusted balance b. Prepare all adjusting entries. c. What audit procedures would you use to verify each item in the bank reconciliation? d. What is the cash balance that should appear on the July 31, 2019, financial statements? Requ 23-20 (OBJECTIVE 23-3) You are auditing general cash for the Pittsburgh Supply Company onciliation. After a brief discussion with the owner, you agree to prepare the reconcili- for the fiscal year ended July 31, 2019. The client has not prepared the July 31 bank rec- with assistance from one of Pittsburgh Supply's clerks. You obtain the following X ation, information: General Ledger $ 6,400 Bank Statement $ 8.378 25,474 26,874 (25,307) Beginning balance 7/1/19 Deposits Cash receipts journal Checks cleared Cash disbursements journal July bank service charge Note paid directly NSF check Ending balance 7/31/19 (23,171) (135) (5,200) (412) $ 2,798 $ 10,103 Chapter 23 / AUDIT OF CASH AND FINANCIAL 2. Checks clearing that were recorded in the July disbursements journal totaled $21,120. 4. A check for $1.130 cleared the bank but had not been recorded in the cash disburse- June 30 Bank Reconciliation Information in General Ledger and Bank Statement $8,378 Balance per bank 600 Deposits in transit 2,578 Outstanding checks $6,400 Balance per books Additional information obtained is as follows: 1. Checks clearing that were outstanding on June 30 totaled $2,411. 3. Deposits included $600 from June and $24,874 for July. ments journal. It was for an acquisition of inventory. Pittsburgh Supply uses the periodic-inventory method. 5. A check for $646 was charged to Pittsburgh Supply but had been written on a differ- ent company's bank account. 6. The bank charged Pittsburgh Supply's account for a nonsufficient funds check to taling $412. The credit manager concluded that the customer intentionally closed its account and the owner left the city. The check was turned over to a collection agency. 7. A note for $5,000, plus interest, was paid directly to the bank under an agreement signed four months ago. The note payable was recorded at $5,000 on Pittsburgh Supply's books. per books. d a. Prepare a bank reconciliation that shows both the unadjusted and adjusted balance b. Prepare all adjusting entries. c. What audit procedures would you use to verify each item in the bank reconciliation? d. What is the cash balance that should appear on the July 31, 2019, financial statements