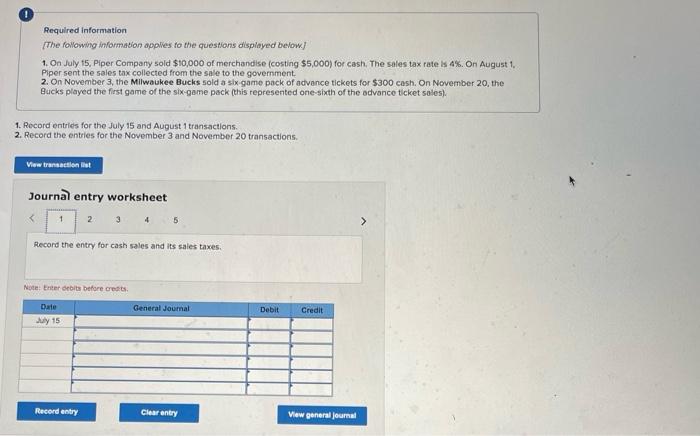

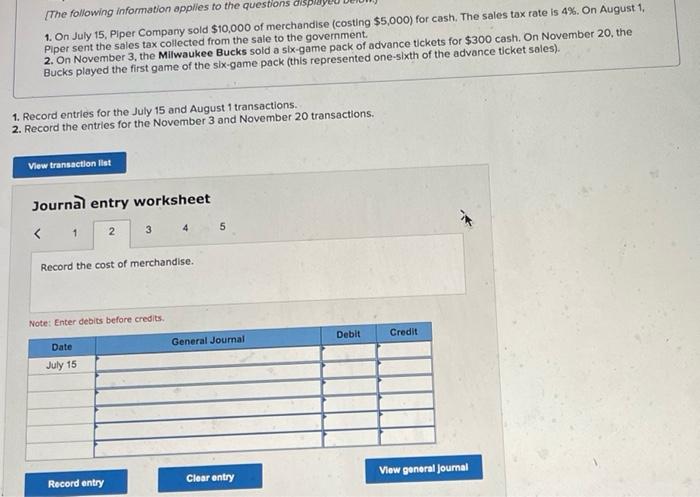

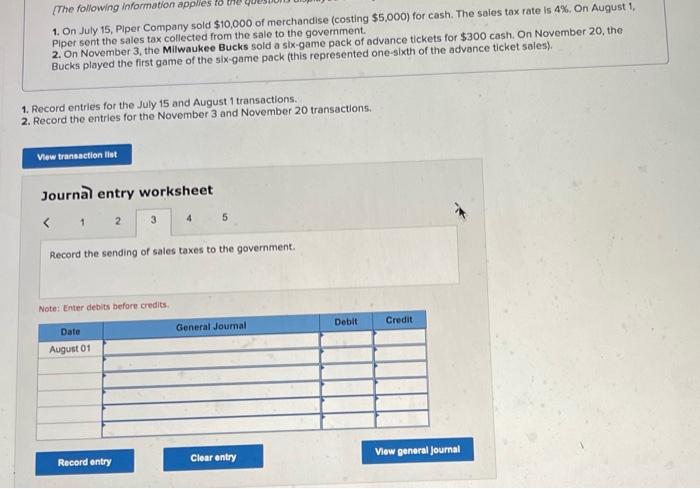

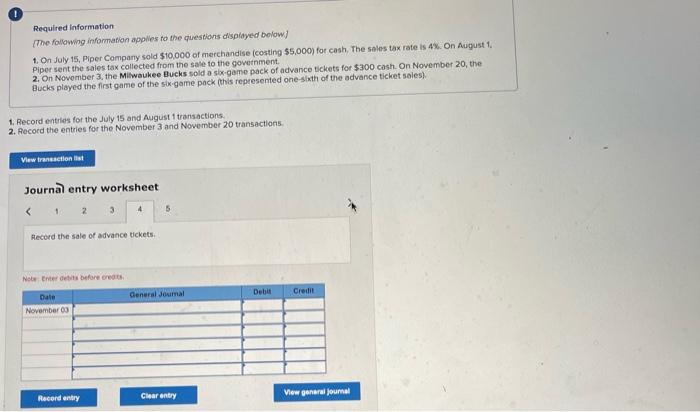

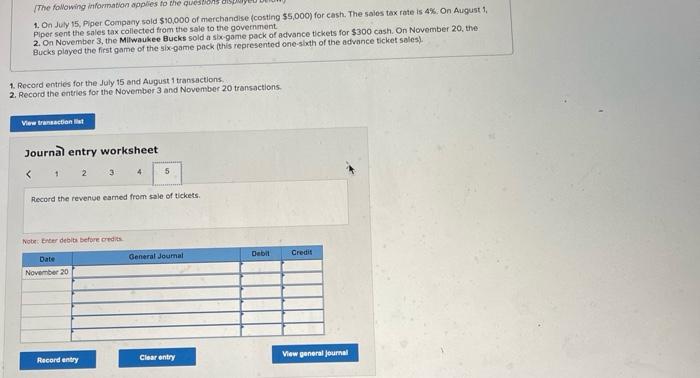

Requilred information [The following information applies to the questions displayed below] 1. On July 15, Piper Company sold $10,000 of merchandise (costing $5,000 ) for cash, The sales tax rate is 4%. On August 1. Piper sent the sales tax collected from the sale to the govemment. 2. On November 3, the Milwaukee Bucks sold a slx-game pack of advance tickets for 5300 cash. On November 20 , the Gucks played the first game of the six-game pack (this represented one-sixth of the advance ticket sales). 1. Rocord entrids for the July 15 and August 1 transactlons. 2. Record the entries for the November 3 and November 20 transactions. 1. On July 15, Piper Company sold $10,000 of merchandise (costing $5,000 ) for cash. The sales tax rate is 4%. On August 1 , Piper sent the sales tax collected from the sale to the government. 2. On November 3, the Milwaukee Bucks sold a six-game pack of advance tickets for $300 cash. On November 20 , the Bucks played the first game of the six-game pack (this represented one-sixth of the advance ticket sales). 1. Record entries for the July 15 and August 1 transactions. 2. Record the entries for the November 3 and November 20 transactions. Journal entry worksheet Record the cost of merchandise. Note: Enter debits before credits. 1. On July 15 , Piper Company sold $10,000 of merchandise (costing $5,000 ) for cash. The sales tax rate is 4%, On August 1 , Piper sent the sales tax collected from the sale to the government. 2. On November 3, the Milwaukee Bucks sold a six-game pack of advance tickets for $300 cash. On November 20 , the Bucks played the first game of the six-game pack (this represented one-sixth of the advance ticket sales). 1. Record entries for the July 15 and August 1 transactions. 2. Record the entries for the November 3 and November 20 transactions. Journal entry worksheet: 5 Record the sending of sales taxes to the government. Note: Enter debits before credits. Required information [The following information applies to the questionis displayed bolow] 1. On July 15, Piper Company sold $10,000 of merchandise (costing 55,000) for cash, The soles tax rate is 4%. On August 1. Piper sent the sales tax collected from the sale to the gowetnment. 2. On Nowember 3. the Milwaukee Bucks sold a six-game pack of advance tickets for $300 cash. On Nowember 20 , the Bucks played the first game of the sto-game pack (this represented one-sixth of the advance ticket soles). 1. Record entikes for the July 15 and August 1 transactions. 2. Fecord the entries for the November 3 and November 20 transactions. Journal entry worksheet Hecord the sale of advance tickets. Nown Enter detis befare crears 1. On July 15, Piper Company sold $10,000 of merchandise (costing $5,000 ) for cash. The sales tax rate is 4% : On August 1 , Piper sent the soles tax collected from the sale to the govemment 2. On November 3, the Miliwaukee Bucks sold a skx-game pack of advance tickets for $300 cash. On November 20 , the Bucks ployed the first game of the six-game pack (this represented one-shath of the atwance ticket soles). 1. Record entries for the July 15 and August 1 transactions. 2. Record the entries for the Nowember 3 and November 20 transactions. Journal entry worksheet Record the revenioe earned frect sale of tickets. Wobes beter debla befare Tdits