Require: provide a recommendation for materiality for the upcoming audit. Include all necessary calculations and rationales.

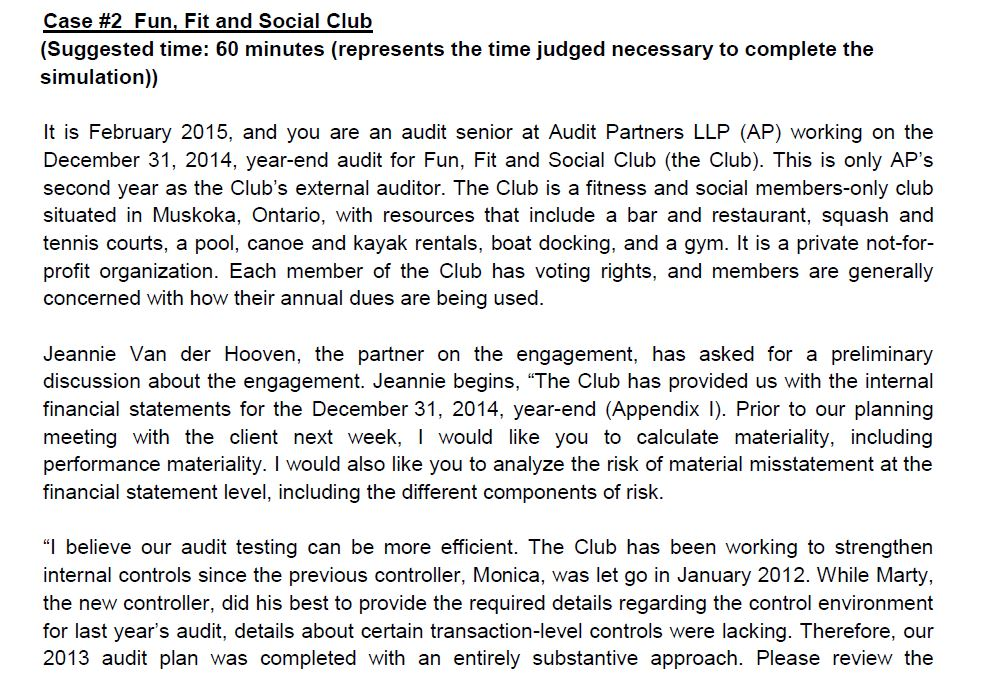

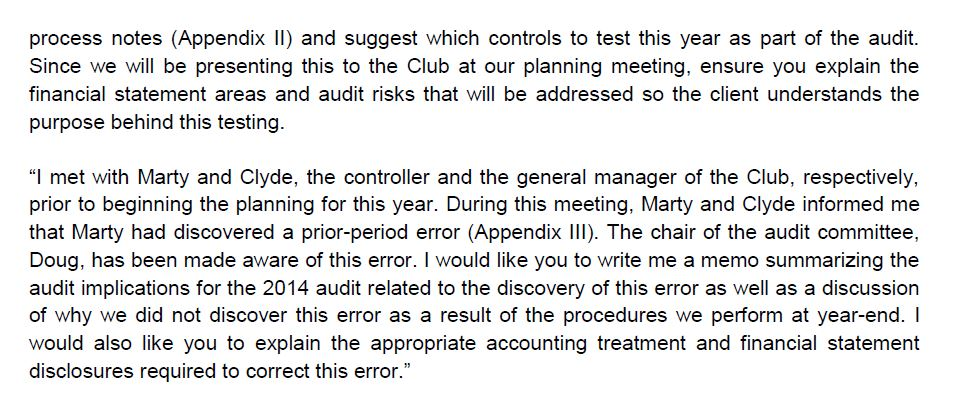

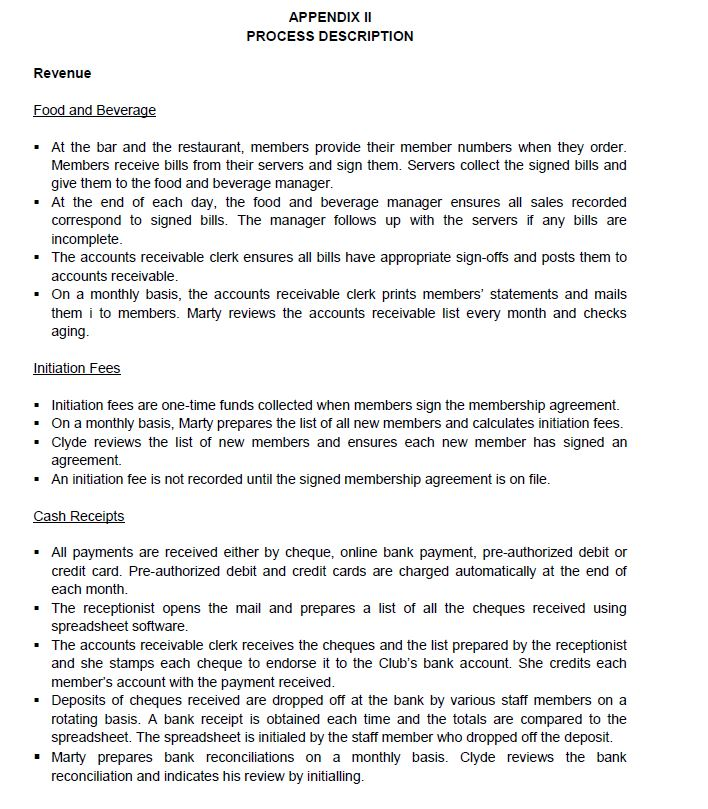

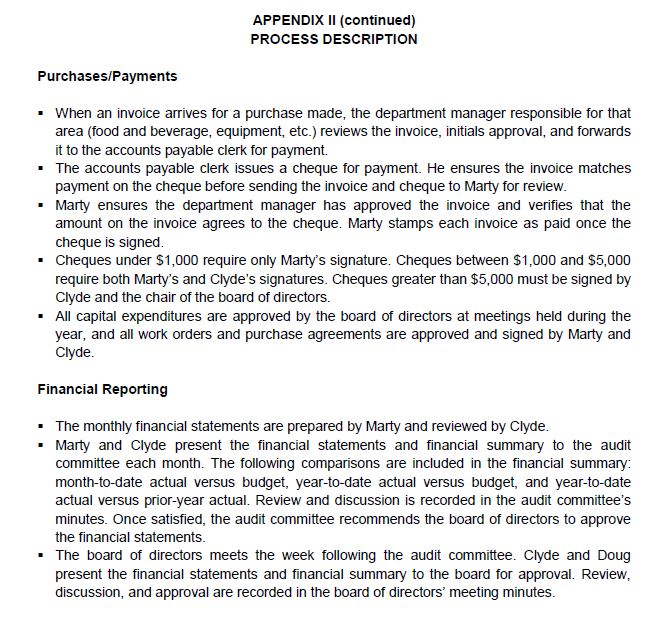

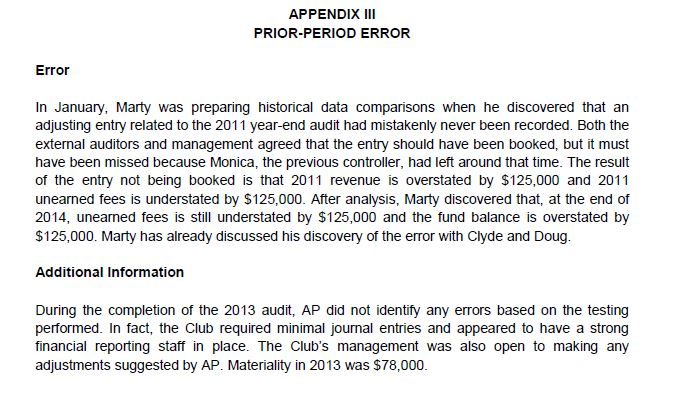

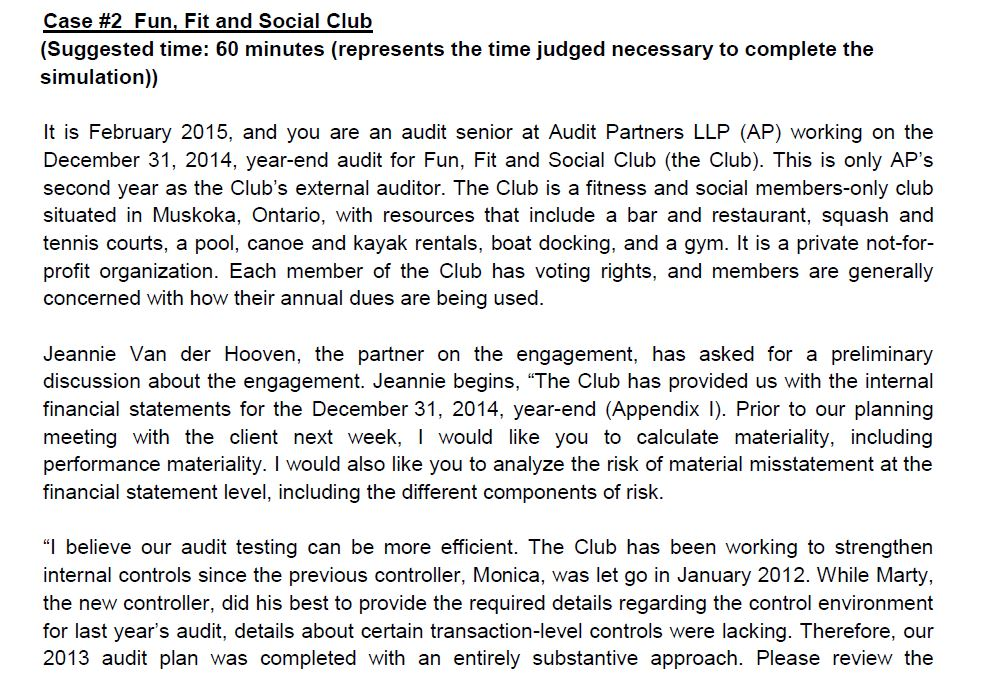

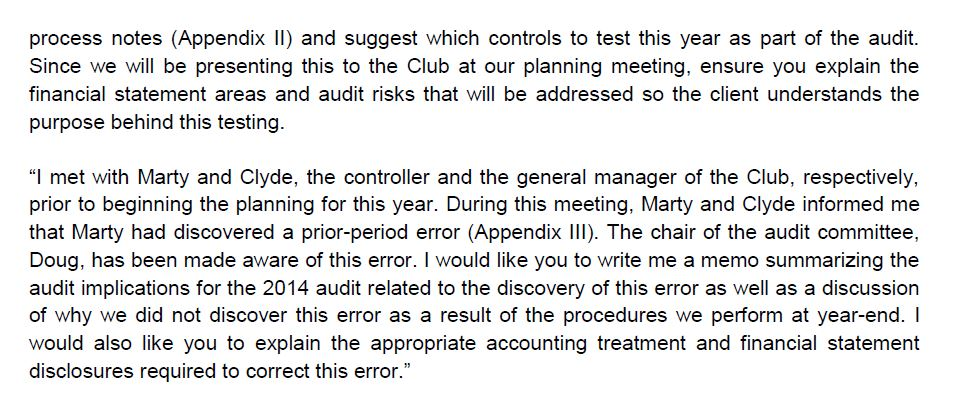

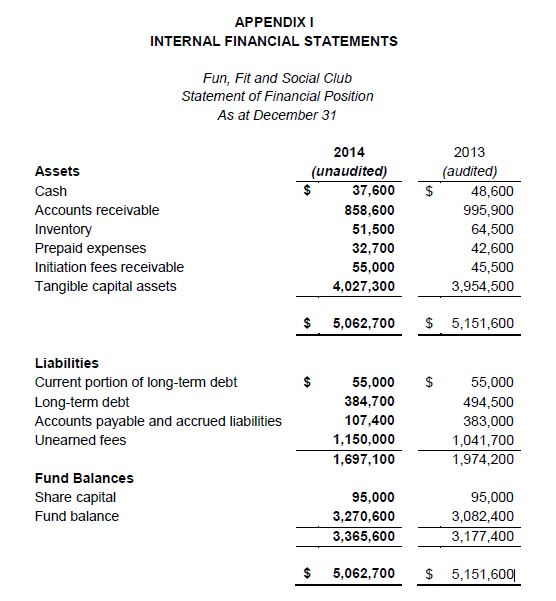

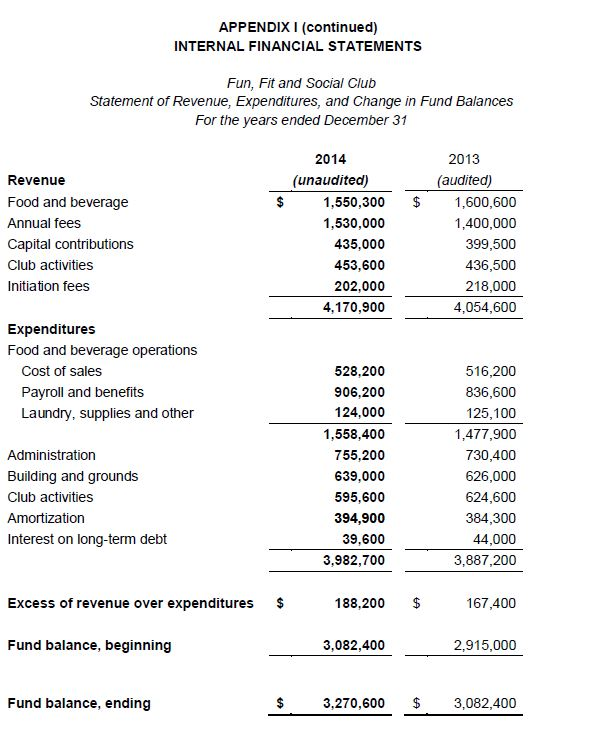

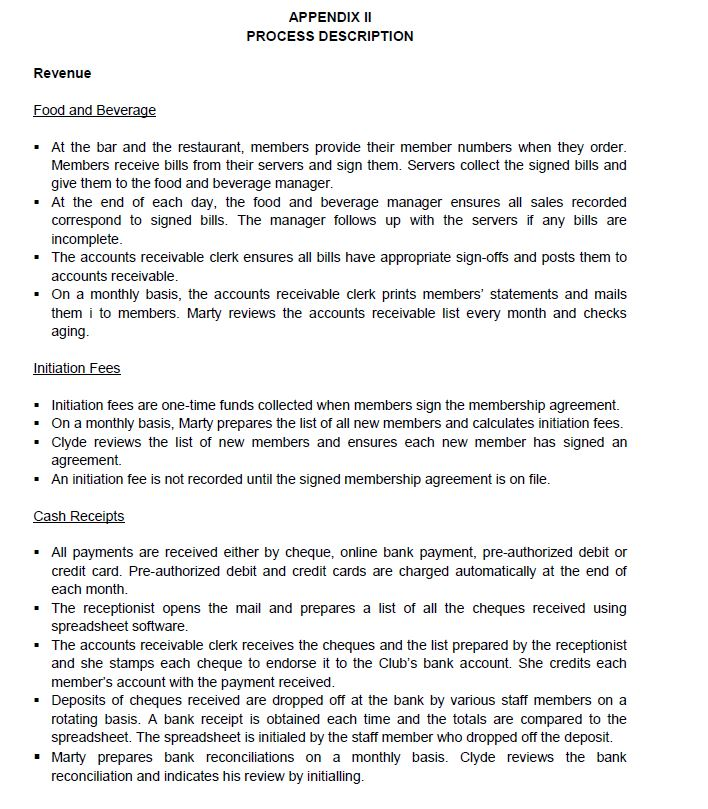

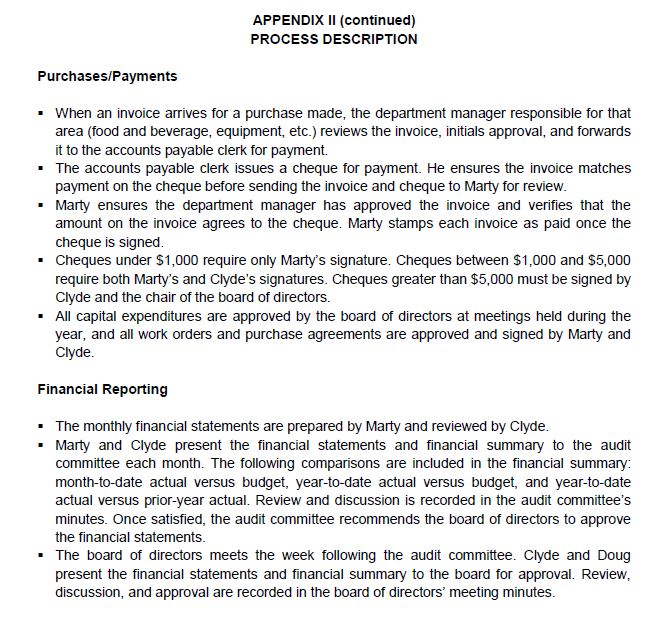

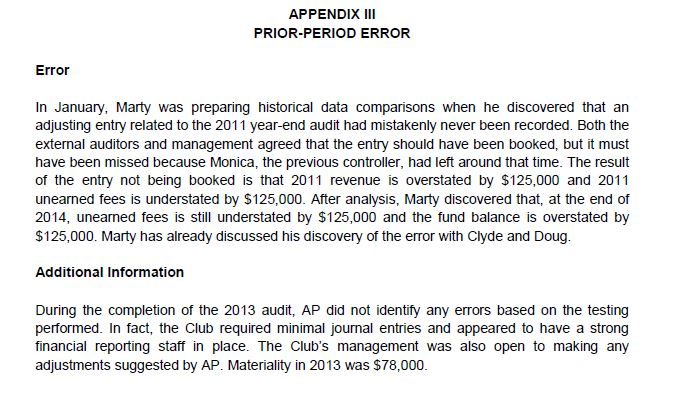

Case #2 Fun, Fit and Social Club (Suggested time: 60 minutes (represents the time judged necessary to complete the simulation)) It is February 2015, and you are an audit senior at Audit Partners LLP (AP) working on the December 31, 2014, year-end audit for Fun, Fit and Social Club (the Club). This is only AP's second year as the Club's external auditor. The Club is a fitness and social members-only club situated in Muskoka, Ontario, with resources that include a bar and restaurant, squash and tennis courts, a pool, canoe and kayak rentals, boat docking, and a gym. It is a private not-for- profit organization. Each member of the Club has voting rights, and members are generally concerned with how their annual dues are being used. Jeannie Van der Hooven, the partner on the engagement, has asked for a preliminary discussion about the engagement. Jeannie begins, The Club has provided us with the internal financial statements for the December 31, 2014, year-end (Appendix 1). Prior to our planning meeting with the client next week, would like you to calculate materiality, including performance materiality. I would also like you to analyze the risk of material misstatement at the financial statement level, including the different components of risk. I believe our audit testing can be more efficient. The Club has been working to strengthen internal controls since the previous controller, Monica, was let go in January 2012. While Marty, the new controller, did his best to provide the required details regarding the control environment for last year's audit, details about certain transaction-level controls were lacking. Therefore, our 2013 audit plan was completed with an entirely substantive approach. Please review the process notes (Appendix II) and suggest which controls to test this year as part of the audit. Since we will be presenting this to the Club at our planning meeting, ensure you explain the financial statement areas and audit risks that will be addressed so the client understands the purpose behind this testing. "I met with Marty and Clyde, the controller and the general manager of the Club, respectively, prior to beginning the planning for this year. During this meeting, Marty and Clyde informed me that Marty had discovered a prior-period error (Appendix III). The chair of the audit committee, Doug, has been made aware of this error. I would like you to write me a memo summarizing the audit implications for the 2014 audit related to the discovery of this error as well as a discussion of why we did not discover this error as a result of the procedures we perform at year-end. I would also like you to explain the appropriate accounting treatment and financial statement disclosures required to correct this error." APPENDIXI INTERNAL FINANCIAL STATEMENTS Fun, Fit and Social Club Statement of Financial Position As at December 31 $ Assets Cash Accounts receivable Inventory Prepaid expenses Initiation fees receivable Tangible capital assets 2014 (unaudited) $ 37,600 858,600 51,500 32,700 55,000 4,027,300 2013 (audited) 48,600 995,900 64,500 42,600 45,500 3,954,500 $ 5,062,700 $ 5,151,600 $ $ Liabilities Current portion of long-term debt Long-term debt Accounts payable and accrued liabilities Unearned fees 55,000 384,700 107,400 1,150,000 1,697,100 55,000 494,500 383,000 1,041,700 1,974,200 Fund Balances Share capital Fund balance 95,000 3,270,600 3,365,600 95,000 3,082,400 3,177,400 $ 5,062,700 $ 5,151,600 APPENDIX I (continued) INTERNAL FINANCIAL STATEMENTS Fun, Fit and Social Club Statement of Revenue, Expenditures, and Change in Fund Balances For the years ended December 31 $ Revenue Food and beverage Annual fees Capital contributions Club activities Initiation fees 2014 (unaudited) 1,550,300 1,530,000 435,000 453,600 202,000 4,170,900 2013 (audited) 1,600,600 1,400,000 399,500 436,500 218,000 4,054,600 Expenditures Food and beverage operations Cost of sales Payroll and benefits Laundry, supplies and other Administration Building and grounds Club activities Amortization Interest on long-term debt 528,200 906,200 124,000 1,558,400 755,200 639,000 595,600 394,900 39,600 3,982,700 516,200 836,600 125,100 1,477,900 730,400 626,000 624,600 384,300 44,000 3,887,200 Excess of revenue over expenditures $ 188,200 $ 167,400 Fund balance, beginning 3,082,400 2,915,000 Fund balance, ending $ 3,270,600 $ 3,082,400 APPENDIX II PROCESS DESCRIPTION Revenue Food and Beverage . At the bar and the restaurant, members provide their member numbers when they order. Members receive bills from their servers and sign them. Servers collect the signed bills and give them to the food and beverage manager. At the end of each day, the food and beverage manager ensures all sales recorded correspond to signed bills. The manager follows up with the servers if any bills are incomplete The accounts receivable clerk ensures all bills have appropriate sign-offs and posts them to accounts receivable. . On a monthly basis, the accounts receivable clerk prints members' statements and mails them i to members. Marty reviews the accounts receivable list every month and checks aging. Initiation Fees Initiation fees are one-time funds collected when members sign the membership agreement. . On a monthly basis, Marty prepares the list of all new members and calculates initiation fees. Clyde reviews the list of new members and ensures each new member has signed an agreement An initiation fee is not recorded until the signed membership agreement is on file. Cash Receipts All payments are received either by cheque, online bank payment, pre-authorized debit or credit card. Pre-authorized debit and credit cards are charged automatically at the end of each month. The receptionist opens the mail and prepares a list of all the cheques received using spreadsheet software. The accounts receivable clerk receives the cheques and the list prepared by the receptionist and she stamps each cheque to endorse it to the Club's bank account. She credits each member's account with the payment received. Deposits of cheques received are dropped off at the bank by various staff members on a rotating basis. A bank receipt is obtained each time and the totals are compared to the spreadsheet. The spreadsheet is initialed by the staff member who dropped off the deposit. Marty prepares bank reconciliations on a monthly basis. Clyde reviews the bank reconciliation and indicates his review by initialling. APPENDIX II (continued) PROCESS DESCRIPTION Purchases/Payments When an invoice arrives for a purchase made, the department manager responsible for that area (food and beverage, equipment, etc.) reviews the invoice, initials approval, and forwards it to the accounts payable clerk for payment. The accounts payable clerk issues a cheque for payment. He ensures the invoice matches payment on the cheque before sending the invoice and cheque to Marty for review. Marty ensures the department manager has approved the invoice and verifies that the amount on the invoice agrees to the cheque. Marty stamps each invoice as paid once the cheque is signed. Cheques under $1,000 require only Marty's signature. Cheques between $1,000 and $5,000 require both Marty's and Clyde's signatures. Cheques greater than $5,000 must be signed by Clyde and the chair of the board of directors. All capital expenditures are approved by the board of directors at meetings held during the year, and all work orders and purchase agreements are approved and signed by Marty and Clyde. Financial Reporting The monthly financial statements are prepared by Marty and reviewed by Clyde. Marty and Clyde present the financial statements and financial summary to the audit committee each month. The following comparisons are included in the financial summary: month-to-date actual versus budget, year-to-date actual versus budget, and year-to-date actual versus prior-year actual. Review and discussion is recorded in the audit committee's minutes. Once satisfied, the audit committee recommends the board of directors to approve the financial statements. The board of directors meets the week following the audit committee. Clyde and Doug present the financial statements and financial summary to the board for approval. Review, discussion, and approval are recorded in the board of directors' meeting minutes. APPENDIX III PRIOR-PERIOD ERROR Error In January, Marty was preparing historical data comparisons when he discovered that an adjusting entry related to the 2011 year-end audit had mistakenly never been recorded. Both the external auditors and management agreed that the entry should have been booked, but it must have been missed because Monica, the previous controller, had left around that time. The result of the entry not being booked is that 2011 revenue is overstated by $125,000 and 2011 unearned fees is understated by $125,000. After analysis, Marty discovered that, at the end of 2014, unearned fees is still understated by $125,000 and the fund balance is overstated by $125,000. Marty has already discussed his discovery of the error with Clyde and Doug. Additional Information During the completion of the 2013 audit, AP did not identify any errors based on the testing performed. In fact, the Club required minimal journal entries and appeared to have a strong financial reporting staff in place. The Club's management was also open to making any adjustments suggested by AP. Materiality in 2013 was $78,000. Case #2 Fun, Fit and Social Club (Suggested time: 60 minutes (represents the time judged necessary to complete the simulation)) It is February 2015, and you are an audit senior at Audit Partners LLP (AP) working on the December 31, 2014, year-end audit for Fun, Fit and Social Club (the Club). This is only AP's second year as the Club's external auditor. The Club is a fitness and social members-only club situated in Muskoka, Ontario, with resources that include a bar and restaurant, squash and tennis courts, a pool, canoe and kayak rentals, boat docking, and a gym. It is a private not-for- profit organization. Each member of the Club has voting rights, and members are generally concerned with how their annual dues are being used. Jeannie Van der Hooven, the partner on the engagement, has asked for a preliminary discussion about the engagement. Jeannie begins, The Club has provided us with the internal financial statements for the December 31, 2014, year-end (Appendix 1). Prior to our planning meeting with the client next week, would like you to calculate materiality, including performance materiality. I would also like you to analyze the risk of material misstatement at the financial statement level, including the different components of risk. I believe our audit testing can be more efficient. The Club has been working to strengthen internal controls since the previous controller, Monica, was let go in January 2012. While Marty, the new controller, did his best to provide the required details regarding the control environment for last year's audit, details about certain transaction-level controls were lacking. Therefore, our 2013 audit plan was completed with an entirely substantive approach. Please review the process notes (Appendix II) and suggest which controls to test this year as part of the audit. Since we will be presenting this to the Club at our planning meeting, ensure you explain the financial statement areas and audit risks that will be addressed so the client understands the purpose behind this testing. "I met with Marty and Clyde, the controller and the general manager of the Club, respectively, prior to beginning the planning for this year. During this meeting, Marty and Clyde informed me that Marty had discovered a prior-period error (Appendix III). The chair of the audit committee, Doug, has been made aware of this error. I would like you to write me a memo summarizing the audit implications for the 2014 audit related to the discovery of this error as well as a discussion of why we did not discover this error as a result of the procedures we perform at year-end. I would also like you to explain the appropriate accounting treatment and financial statement disclosures required to correct this error." APPENDIXI INTERNAL FINANCIAL STATEMENTS Fun, Fit and Social Club Statement of Financial Position As at December 31 $ Assets Cash Accounts receivable Inventory Prepaid expenses Initiation fees receivable Tangible capital assets 2014 (unaudited) $ 37,600 858,600 51,500 32,700 55,000 4,027,300 2013 (audited) 48,600 995,900 64,500 42,600 45,500 3,954,500 $ 5,062,700 $ 5,151,600 $ $ Liabilities Current portion of long-term debt Long-term debt Accounts payable and accrued liabilities Unearned fees 55,000 384,700 107,400 1,150,000 1,697,100 55,000 494,500 383,000 1,041,700 1,974,200 Fund Balances Share capital Fund balance 95,000 3,270,600 3,365,600 95,000 3,082,400 3,177,400 $ 5,062,700 $ 5,151,600 APPENDIX I (continued) INTERNAL FINANCIAL STATEMENTS Fun, Fit and Social Club Statement of Revenue, Expenditures, and Change in Fund Balances For the years ended December 31 $ Revenue Food and beverage Annual fees Capital contributions Club activities Initiation fees 2014 (unaudited) 1,550,300 1,530,000 435,000 453,600 202,000 4,170,900 2013 (audited) 1,600,600 1,400,000 399,500 436,500 218,000 4,054,600 Expenditures Food and beverage operations Cost of sales Payroll and benefits Laundry, supplies and other Administration Building and grounds Club activities Amortization Interest on long-term debt 528,200 906,200 124,000 1,558,400 755,200 639,000 595,600 394,900 39,600 3,982,700 516,200 836,600 125,100 1,477,900 730,400 626,000 624,600 384,300 44,000 3,887,200 Excess of revenue over expenditures $ 188,200 $ 167,400 Fund balance, beginning 3,082,400 2,915,000 Fund balance, ending $ 3,270,600 $ 3,082,400 APPENDIX II PROCESS DESCRIPTION Revenue Food and Beverage . At the bar and the restaurant, members provide their member numbers when they order. Members receive bills from their servers and sign them. Servers collect the signed bills and give them to the food and beverage manager. At the end of each day, the food and beverage manager ensures all sales recorded correspond to signed bills. The manager follows up with the servers if any bills are incomplete The accounts receivable clerk ensures all bills have appropriate sign-offs and posts them to accounts receivable. . On a monthly basis, the accounts receivable clerk prints members' statements and mails them i to members. Marty reviews the accounts receivable list every month and checks aging. Initiation Fees Initiation fees are one-time funds collected when members sign the membership agreement. . On a monthly basis, Marty prepares the list of all new members and calculates initiation fees. Clyde reviews the list of new members and ensures each new member has signed an agreement An initiation fee is not recorded until the signed membership agreement is on file. Cash Receipts All payments are received either by cheque, online bank payment, pre-authorized debit or credit card. Pre-authorized debit and credit cards are charged automatically at the end of each month. The receptionist opens the mail and prepares a list of all the cheques received using spreadsheet software. The accounts receivable clerk receives the cheques and the list prepared by the receptionist and she stamps each cheque to endorse it to the Club's bank account. She credits each member's account with the payment received. Deposits of cheques received are dropped off at the bank by various staff members on a rotating basis. A bank receipt is obtained each time and the totals are compared to the spreadsheet. The spreadsheet is initialed by the staff member who dropped off the deposit. Marty prepares bank reconciliations on a monthly basis. Clyde reviews the bank reconciliation and indicates his review by initialling. APPENDIX II (continued) PROCESS DESCRIPTION Purchases/Payments When an invoice arrives for a purchase made, the department manager responsible for that area (food and beverage, equipment, etc.) reviews the invoice, initials approval, and forwards it to the accounts payable clerk for payment. The accounts payable clerk issues a cheque for payment. He ensures the invoice matches payment on the cheque before sending the invoice and cheque to Marty for review. Marty ensures the department manager has approved the invoice and verifies that the amount on the invoice agrees to the cheque. Marty stamps each invoice as paid once the cheque is signed. Cheques under $1,000 require only Marty's signature. Cheques between $1,000 and $5,000 require both Marty's and Clyde's signatures. Cheques greater than $5,000 must be signed by Clyde and the chair of the board of directors. All capital expenditures are approved by the board of directors at meetings held during the year, and all work orders and purchase agreements are approved and signed by Marty and Clyde. Financial Reporting The monthly financial statements are prepared by Marty and reviewed by Clyde. Marty and Clyde present the financial statements and financial summary to the audit committee each month. The following comparisons are included in the financial summary: month-to-date actual versus budget, year-to-date actual versus budget, and year-to-date actual versus prior-year actual. Review and discussion is recorded in the audit committee's minutes. Once satisfied, the audit committee recommends the board of directors to approve the financial statements. The board of directors meets the week following the audit committee. Clyde and Doug present the financial statements and financial summary to the board for approval. Review, discussion, and approval are recorded in the board of directors' meeting minutes. APPENDIX III PRIOR-PERIOD ERROR Error In January, Marty was preparing historical data comparisons when he discovered that an adjusting entry related to the 2011 year-end audit had mistakenly never been recorded. Both the external auditors and management agreed that the entry should have been booked, but it must have been missed because Monica, the previous controller, had left around that time. The result of the entry not being booked is that 2011 revenue is overstated by $125,000 and 2011 unearned fees is understated by $125,000. After analysis, Marty discovered that, at the end of 2014, unearned fees is still understated by $125,000 and the fund balance is overstated by $125,000. Marty has already discussed his discovery of the error with Clyde and Doug. Additional Information During the completion of the 2013 audit, AP did not identify any errors based on the testing performed. In fact, the Club required minimal journal entries and appeared to have a strong financial reporting staff in place. The Club's management was also open to making any adjustments suggested by AP. Materiality in 2013 was $78,000