Answered step by step

Verified Expert Solution

Question

1 Approved Answer

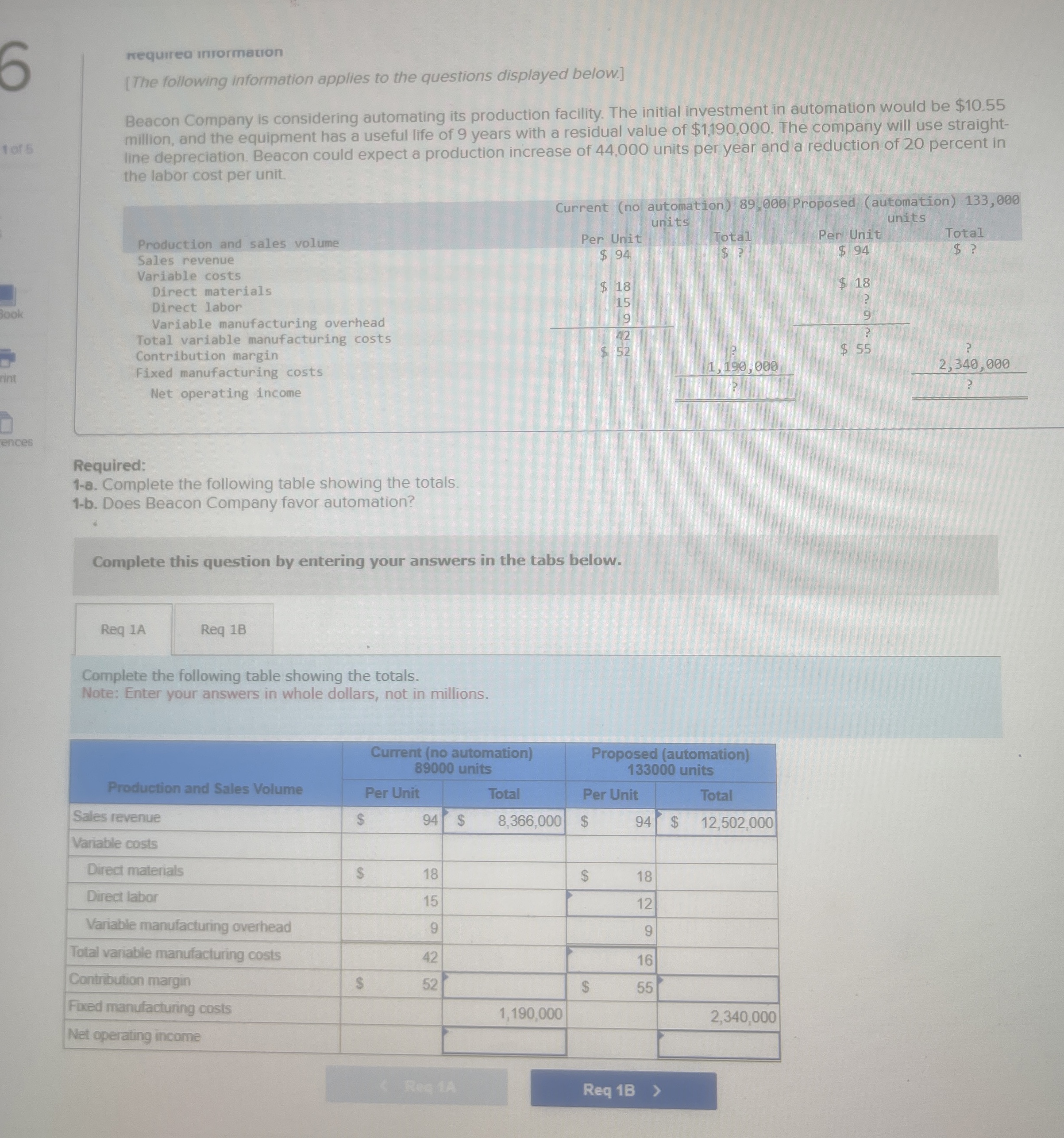

requirea iniormation IThe following information applies to the questions displayed below. ] Beacon Company is considering automating its production facility. The initial investment in automation

requirea iniormation

IThe following information applies to the questions displayed below.

Beacon Company is considering automating its production facility. The initial investment in automation would be $ million, and the equipment has a useful life of years with a residual value of $ The company will use straightline depreclation. Beacon could expect a production increase of units per year and a reduction of percent in the labor cost per unit.

Required:

a Complete the following table showing the totals.

b Does Beacon Company favor automation?

Complete this question by entering your answers in the tabs below.

Req A

Req

Complete the following table showing the totals.

Note: Enter your answers in whole dollars, not in millions.

tableProduction and Sales Volume,tableCurrent no automation unitstableProposed automation unitsPer Unit,Total,Per Unit,

tableTotal$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started