Answered step by step

Verified Expert Solution

Question

1 Approved Answer

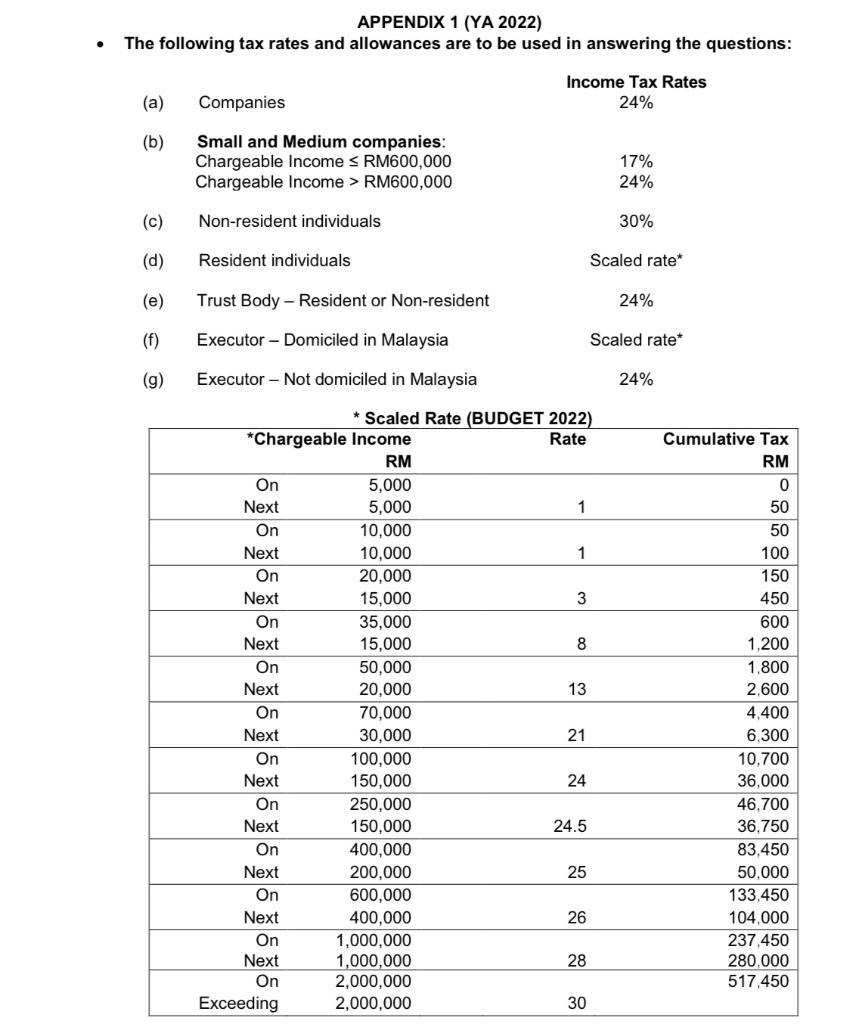

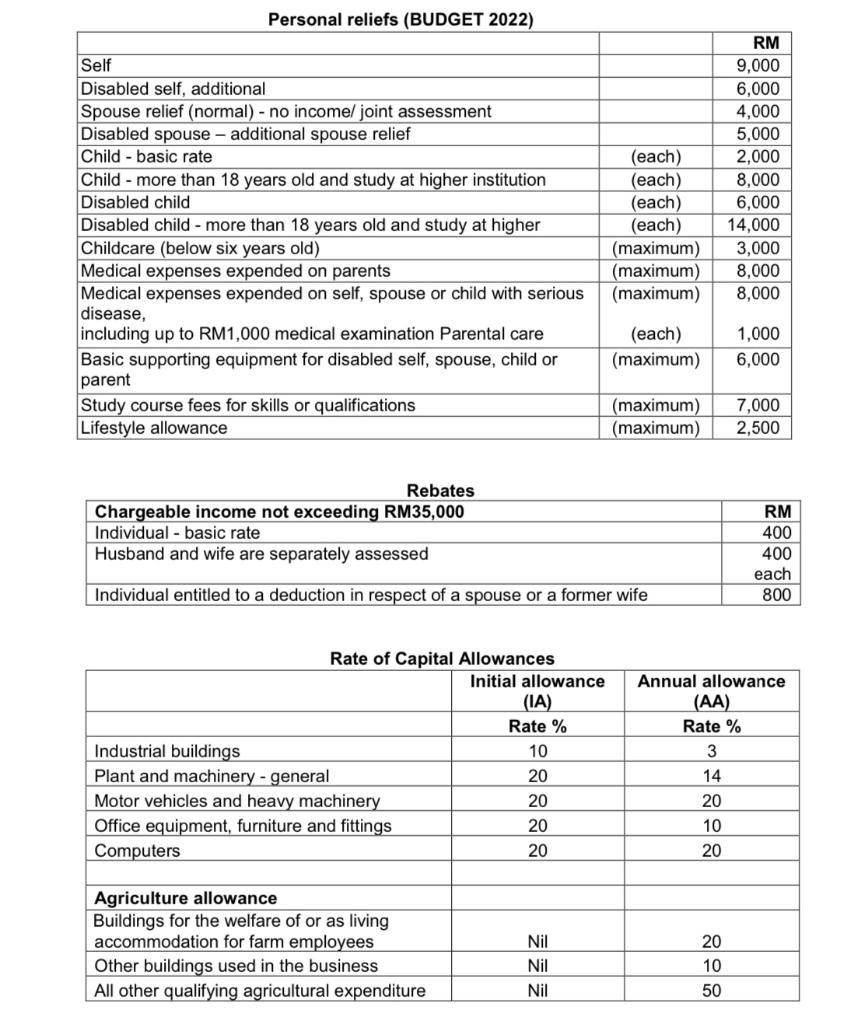

REQUIRED: 1. Assuming that Section 61(2) is to be applied, for the year of assessment 2022, compute the following: I. The income tax payable by

REQUIRED:

1. Assuming that Section 61(2) is to be applied, for the year of assessment 2022, compute the following:

I. The income tax payable by the trust body.

II. The chargeable income of Farha and Amir (assuming that they do not have other sources of income except from the trust).

Note: Calculate the answers to the nearest ringgit. (13 MARKS)

2. Briefly explain the benefit of applying Section 61(2). (2 MARKS)

Encik Salman died on 31 October 2021. He left behind a wife, Farha and three children, Nina, Afif and Amir. A trust, resident in Malaysia was created under the terms of his will. Information with regard to the income and expenditure of the trust body for the basis year 2022 is provided as follows: Income: Business (Malaysia) Business (Thailand) Rent (Malaysia) Dividends from Malaysia (single tier) Interest from fixed deposits in Malaysia Expenditure: Donation Donation Other information: 2. 3. 5. Statutory income Statutory income (RM200,000 remitted to Malaysia) Gross Income Revenue Expenditure Capital Expenditure 6. Approved Not approved 1. Administration fee of RM15,000 per annum is to be paid to the trust body. According to the trust deed, an annuity of RM48,000 per annum is to be paid to Farha. However, until the end of the year 2022, the trust body only paid RM30,000 to Farha. Nina is entitled to one quarter (1/4) of the trust's income. 4. The balance of the trust's income is to be distributed to Afif and Amir at the discretion of the trustee. RM 680,000 300,000 The actual amount received by the beneficiaries are as follows: Nina Afif Amir RM RM RM Amount received in Malaysia 290,000 260,800 250,000 36,000 8,000 5,000 20,000 8,000 6,000 2,000 For the year of assessment 2022, all beneficiaries are resident in Malaysia except for Amir.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Personal reliefs BUDGET 2022 Self Disabled self additional Spouse relief normal no incomejoint asses...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started