Question

Required 1. Calculate certain balances as if Pinnacle used the equity method of accounting. To prove your answer is correct, prepare a consolidating worksheet for

Required

1. Calculate certain balances as if Pinnacle used the equity method of accounting.

To prove your answer is correct, prepare a consolidating worksheet for 2021 as if Pinnacle used the equity method of accounting to account for its investment in Strata. Additionally, prepare a consolidating worksheet if Pinnacle used the partial equity method to record its investment in Strata. HINT: you will need to adjust Pinnacle trial balance for proper balances for certain account balances under the equity method of accounting

2. Calculate the following ratios for both methods of accounting for Pinnacle for the year 2021

Earnings per Share (assume 1,000,000 shares outstanding for Pinnacle

Return on Assets

Return on Equity

Debt to Equity Ratio

Return on Initial Investment

3. Prepare a short professionally written memo to the Board of Directors, analyzing the results of your ratio calculations above. Your memo should reach a conclusion regarding which method you as a manager of Pinnacle would recommend and why. REVIEW YOUR EFFECTIVE WRITNG GUIDELINES POSTED IN MOODLE - use short simple, active voice sentences and avoid unnecessary wording and phrases.

Submission will consist of

1. Consolidating worksheet of Partial Equity and Equity method Investment Accounting

2. Comparative Ratio Analysis of three Investment methods

3. Memo to Board of Analysis of Ratio and accounting method recommendation

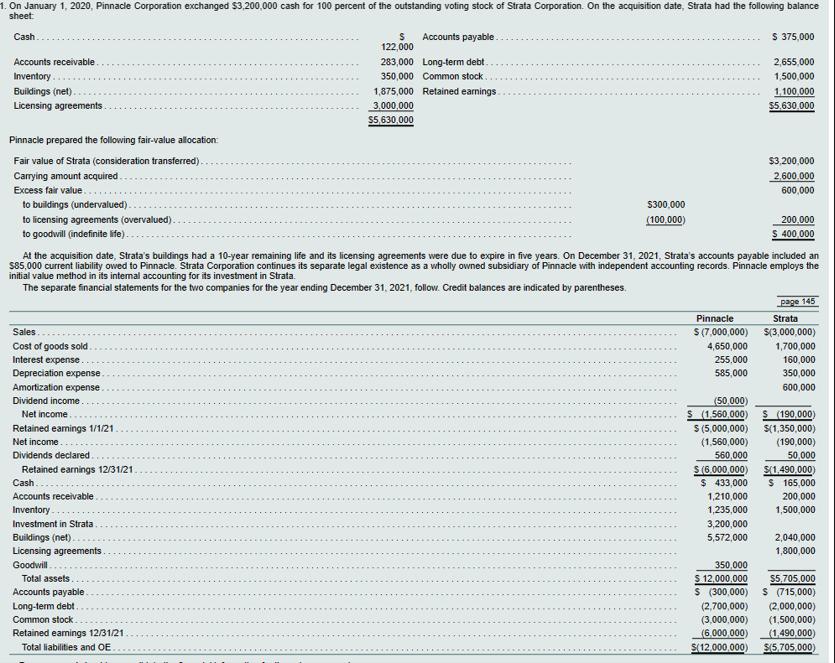

1. On January 1, 2020, Pinnacle Corporation exchanged $3,200,000 cash for 100 percent of the outstanding voting stock of Strata Corporation. On the acquisition date, Strata had the following balance S Accounts payable. 122,000 283,000 Long-term debt. 350,000 Common stock. 1,875,000 Retained earnings. 3,000,000 $5,630,000 Cash. Accounts receivable. Inventory.. Buildings (net). Licensing agreements Pinnacle prepared the following fair-value allocation: Fair value of Strata (consideration transferred). Carrying amount acquired Excess fair value...... to buildings (undervalued). to licensing agreements (overvalued). to goodwill (indefinite life). Sales Cost of goods sold Interest expense... Depreciation expense. Amortization expense. Dividend income. Net income. Retained earnings 1/1/21. Net income. Dividends declared Retained earnings 12/31/21 $300,000 (100,000) Cash. Accounts receivable Inventory. Investment in Strata Buildings (net). Licensing agreements Goodwill Total assets. Accounts payable. Long-term debt.. Common stock. Retained earnings 12/31/21 Total liabilities and OE. At the acquisition date, Strata's buildings had a 10-year remaining life and its licensing agreements were due to expire in five years. On December 31, 2021, Strata's accounts payable included an $85,000 current liability owed to Pinnacle. Strata Corporation continues its separate legal existence as a wholly owned subsidiary of Pinnacle with independent accounting records. Pinnacle employs the initial value method in its internal accounting for its investment in Strata. The separate financial statements for the two companies for the year ending December 31, 2021, follow. Credit balances are indicated by parentheses. Pinnacle $ (7,000,000) 4,650,000 255.000 585,000 (50,000) S (1.560,000) $ (5,000,000) (1,560,000) 560,000 $ (6.000,000) $ 433,000 1,210,000 1,235,000 3,200,000 5,572,000 $ 375,000 350,000 $ 12,000,000 S (300,000) (2,700,000) (3,000,000) (6,000,000) $(12,000,000) 2,655,000 1,500,000 1,100,000 $5,630,000 $3,200,000 2,600,000 600,000 200,000 $ 400,000 page 145 Strata $(3,000,000) 1,700,000 160,000 350,000 600,000 $ (190,000) $(1,350,000) (190,000) 50,000 $(1,490,000) $ 165,000 200,000 1,500,000 2,040,000 1,800,000 $5,705,000 S (715,000) (2,000,000) (1,500,000) (1,490,000) $(5,705,000)

Step by Step Solution

3.48 Rating (138 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started