Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1) Compute the company's ROI assuming that all assets are used in the operation and all income is from operations. Compute ROI by first

Required: 1) Compute the company's ROI assuming that all assets are used in the operation and all income is from operations. Compute ROI by first computing margin and turnover.

2) If the required ROI is 14%, what is the residual income.

3) If the senior manager has the opportunity to invest $160,000 in another product line that will generate operating income of $25,000, based on ROI, would he/she make the investment?

4) Based on Residual Income, will he/she make the investment

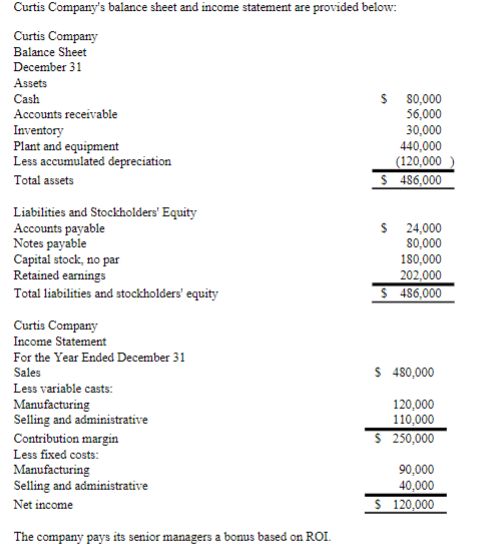

Curtis Company's balance sheet and income statement are provided below: Curtis Company Balance Sheet December 31 Assets Cash $ 80,000 Accounts receivable 56,000 Inventory 30,000 Plant and equipment 440,000 Less accumulated depreciation (120,000 Total assets 486,000 Liabilities and Stockholders' Equity Accounts payable $ 24,000 Notes payable 80,000 Capital stock, no par 180,000 Retained earnings 202,000 Total liabilities and stockholders' equity S486,000 Curtis Company Income Statement For the Year Ended December 31 Sales $ 480,000 Less variable casts: Manufacturing 120,000 Selling and administrative 110,000 Contribution margin $ 250,000 Less fixed costs: Manufacturing 90,000 Selling and administrative 40,000 Net income $ 120,000 The company pays its senior managers a bonus based on ROIStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started