Required: 1. Determine the inventory on March 31 and the cost of merchandise sold for the three-month period, using the first-in, first-out method and

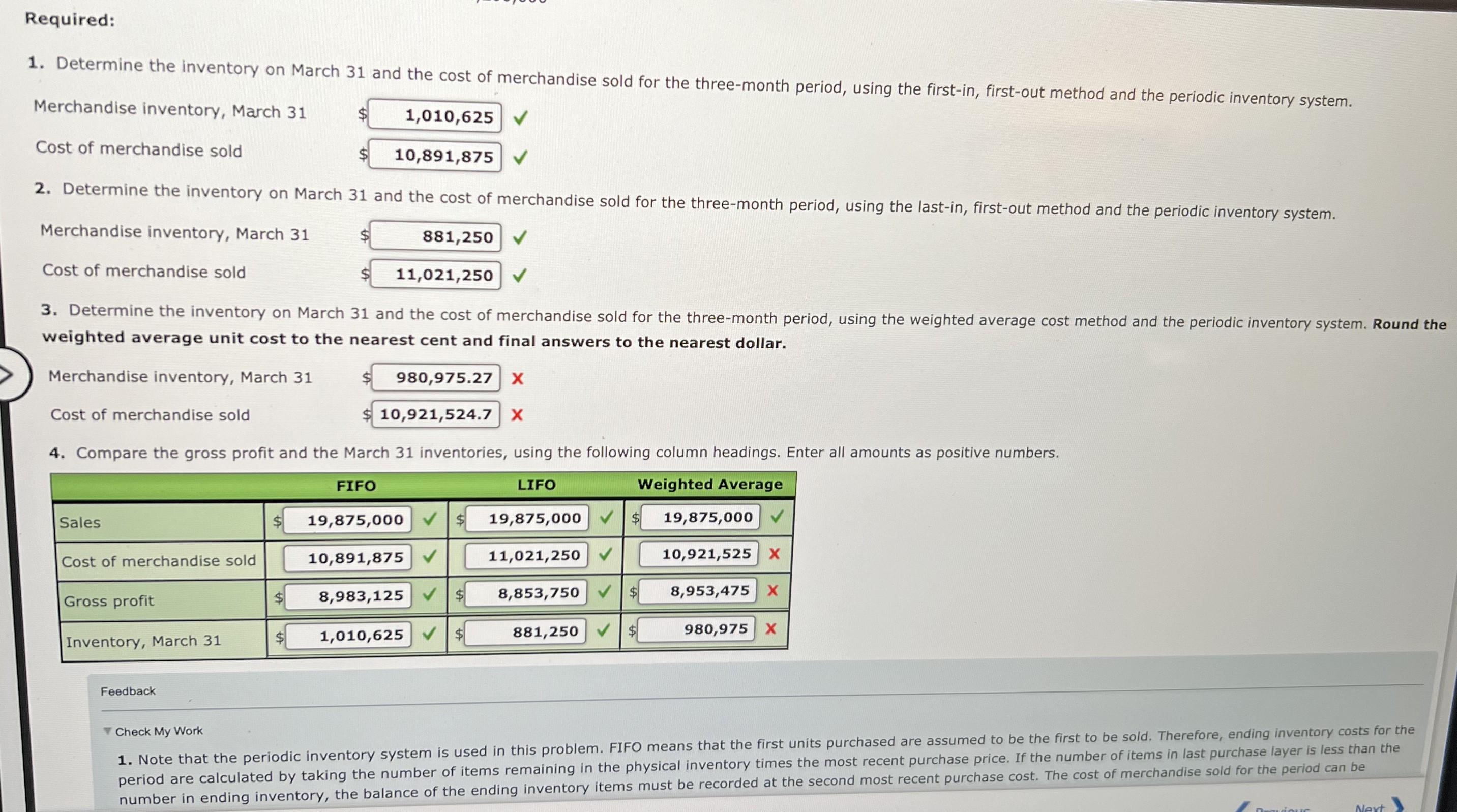

Required: 1. Determine the inventory on March 31 and the cost of merchandise sold for the three-month period, using the first-in, first-out method and the periodic inventory system. Merchandise inventory, March 31 Cost of merchandise sold $ 1,010,625 10,891,875 2. Determine the inventory on March 31 and the cost of merchandise sold for the three-month period, using the last-in, first-out method and the periodic inventory system. Merchandise inventory, March 31 Cost of merchandise sold 881,250 11,021,250 3. Determine the inventory on March 31 and the cost of merchandise sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent and final answers to the nearest dollar. Merchandise inventory, March 31 980,975.27 X 10,921,524.7 | X Cost of merchandise sold 4. Compare the gross profit and the March 31 inventories, using the following column headings. Enter all amounts as positive numbers. FIFO LIFO Weighted Average Sales 19,875,000 $ 19,875,000 19,875,000 Cost of merchandise sold 10,891,875 V 11,021,250 V 10,921,525 X Gross profit 8,983,125 8,853,750 8,953,475 X Inventory, March 31 1,010,625 881,250 V 980,975 X Feedback Check My Work 1. Note that the periodic inventory system is used in this problem. FIFO means that the first units purchased are assumed to be the first to be sold. Therefore, ending inventory costs for the period are calculated by taking the number of items remaining in the physical inventory times the most recent purchase price. If the number of items in last purchase layer is less than the number in ending inventory, the balance of the ending inventory items must be recorded at the second most recent purchase cost. The cost of merchandise sold for the period can be Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started