Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required 1. How much is the carrying amount of the lease liability on December 31, 2022? 2. Assuming that the asset will revert to the

Required

Required

1. How much is the carrying amount of the lease liability on December 31, 2022?

2. Assuming that the asset will revert to the lessor at the end of the lease term and all improvements were borne by the lessee, compute the total expenses to be reported in the income statement for the year 2023?

3. How much will be reported as non-current assets (assuming all data in the previous numbers) in the statement of financial position on December 31, 2021

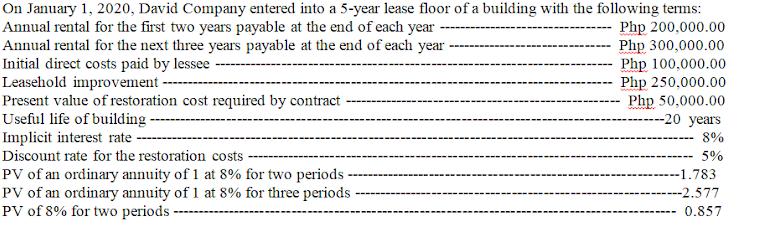

On January 1, 2020, David Company entered into a 5-year lease floor of a building with the following terms: Annual rental for the first two years payable at the end of each year Annual rental for the next three years payable at the end of each year Initial direct costs paid by lessee Leasehold improvement Present value of restoration cost required by contract Useful life of building- Implicit interest rate Discount rate for the restoration costs Php 200,000.00 Php 300,000.00 Php 100,000.00 Php 250,000.00 Php 50,000.00 --20 years 8% 5% PV of an ordinary annuity of 1 at 8% for two periods- PV of an ordinary annuity of 1 at 8% for three periods PV of 8% for two periods- -1.783 -2.577 0.857

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

the Delriniutium 301740 year Awwer 3 N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started