Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Prepare a contribution format income statement that shows the expected net operating income each year from the franchise outlet. 2-a. Compute the simple

Required:

1. Prepare a contribution format income statement that shows the expected net operating income each year from the franchise outlet.

2-a. Compute the simple rate of return promised by the outlet.

3-a. Compute the payback period on the outlet.

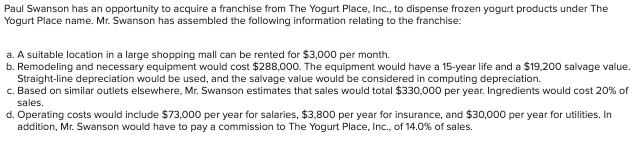

Paul Swanson has an opportunity to acquire a franchise from The Yogurt Place, Inc., to dispense frozen yogurt products under The Yogurt Place name. Mr. Swanson has assembled the following information relating to the franchise: a. A suitable location in a large shopping mall can be rented for $3,000 per month. b. Remodeling and necessary equipment would cost $288,000. The equipment would have a 15-year life and a $19,200 salvage value. Straight-line depreciation would be used, and the salvage value would be considered in computing depreciation. c. Based on similar outlets elsewhere, Mr. Swanson estimates that sales would total $330,000 per year. Ingredients would cost 20% of sales. d. Operating costs would include $73,000 per year for salaries, $3,800 per year for insurance, and $30,000 per year for utilities. In addition, Mr. Swanson would have to pay a commission to The Yogurt Place, Inc., of 14.0% of sales.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Contribution Format Income Statement Sales 330000 Less Cost of Ingredients 20 of Sales 66000 Gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started