Answered step by step

Verified Expert Solution

Question

1 Approved Answer

: Required: 1) Prepare a group cash flows from operating activities (ONLY) for the Sunrise Group for the year ended 30 June 2020 using the

:

Required:

1) Prepare a group cash flows from operating activities (ONLY) for the Sunrise Group for the year ended 30 June 2020 using the indirect method

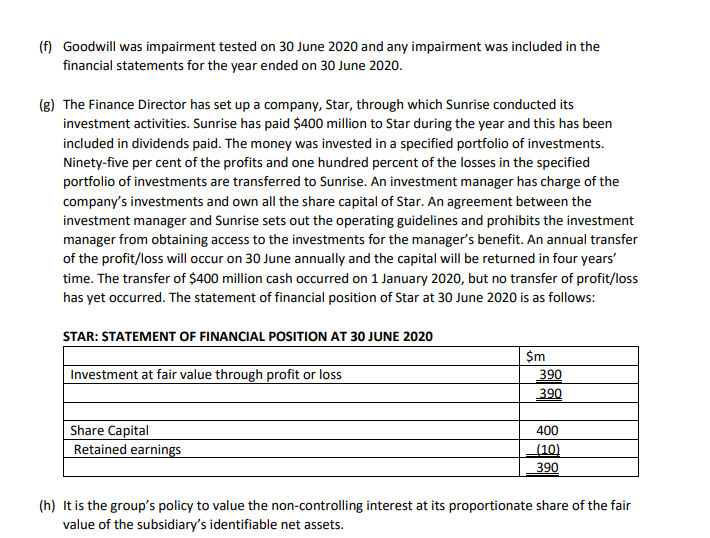

2) Discuss the issues which determine whether STAR should be consolidated by SUNRISE in the group financial statement

3) Discuss briefly the importance of ethical behavior in the preparation of financial statements and whether the creation of Star could constitute unethical practice by the finance director of Sunrise.

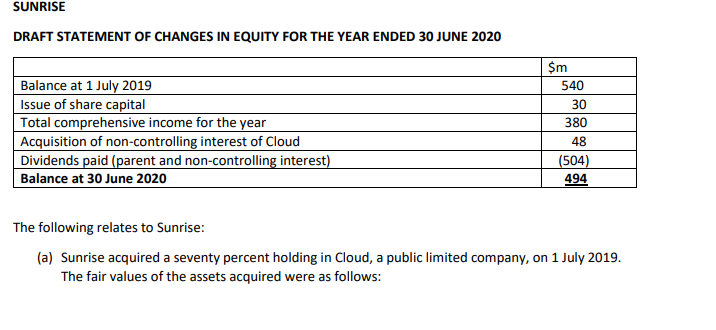

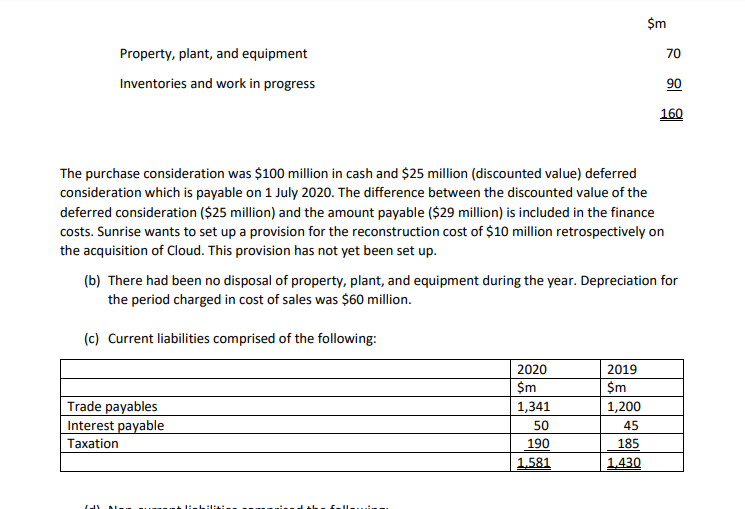

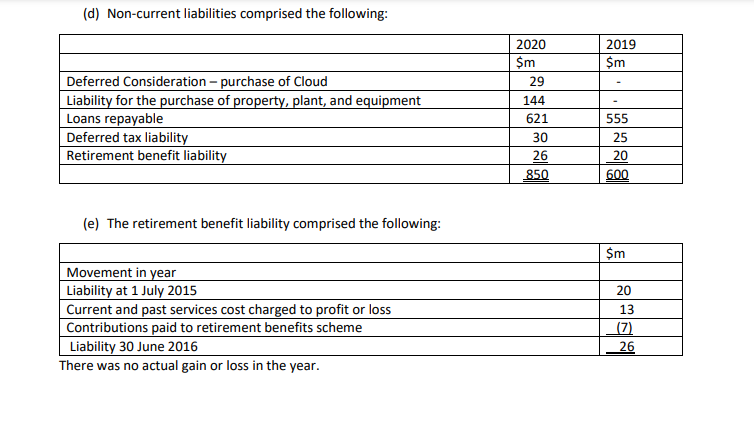

SUNRISE DRAFT STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 30 JUNE 2020 Balance at 1 July 2019 Issue of share capital Total comprehensive income for the year Acquisition of non-controlling interest of Cloud Dividends paid (parent and non-controlling interest) Balance at 30 June 2020 $m 540 30 380 48 (504) 494 The following relates to Sunrise: (a) Sunrise acquired a seventy percent holding in Cloud, a public limited company, on 1 July 2019. The fair values of the assets acquired were as follows:

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to prepare the group cash flows from operating activities for the Sunrise Group f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started