Answered step by step

Verified Expert Solution

Question

1 Approved Answer

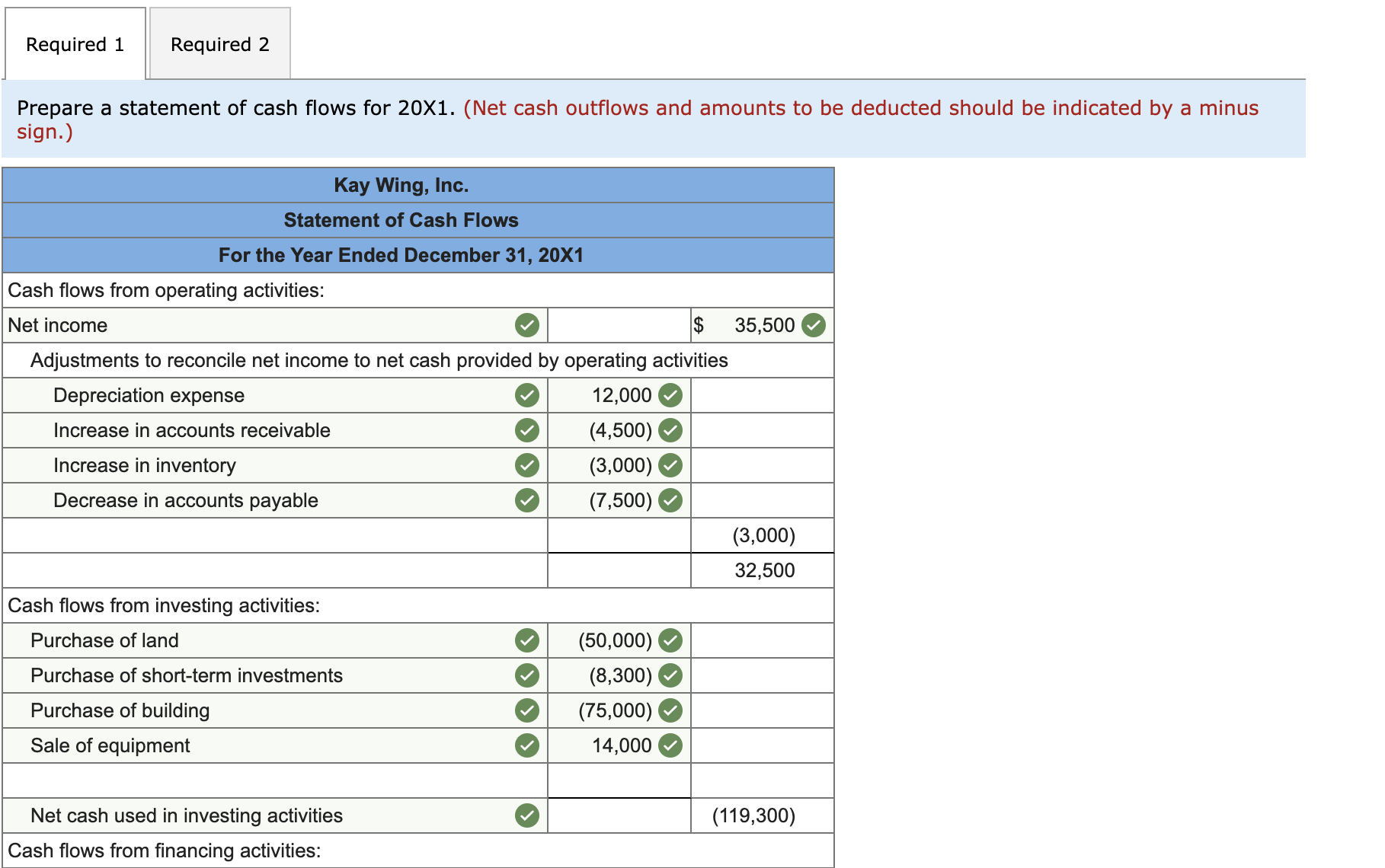

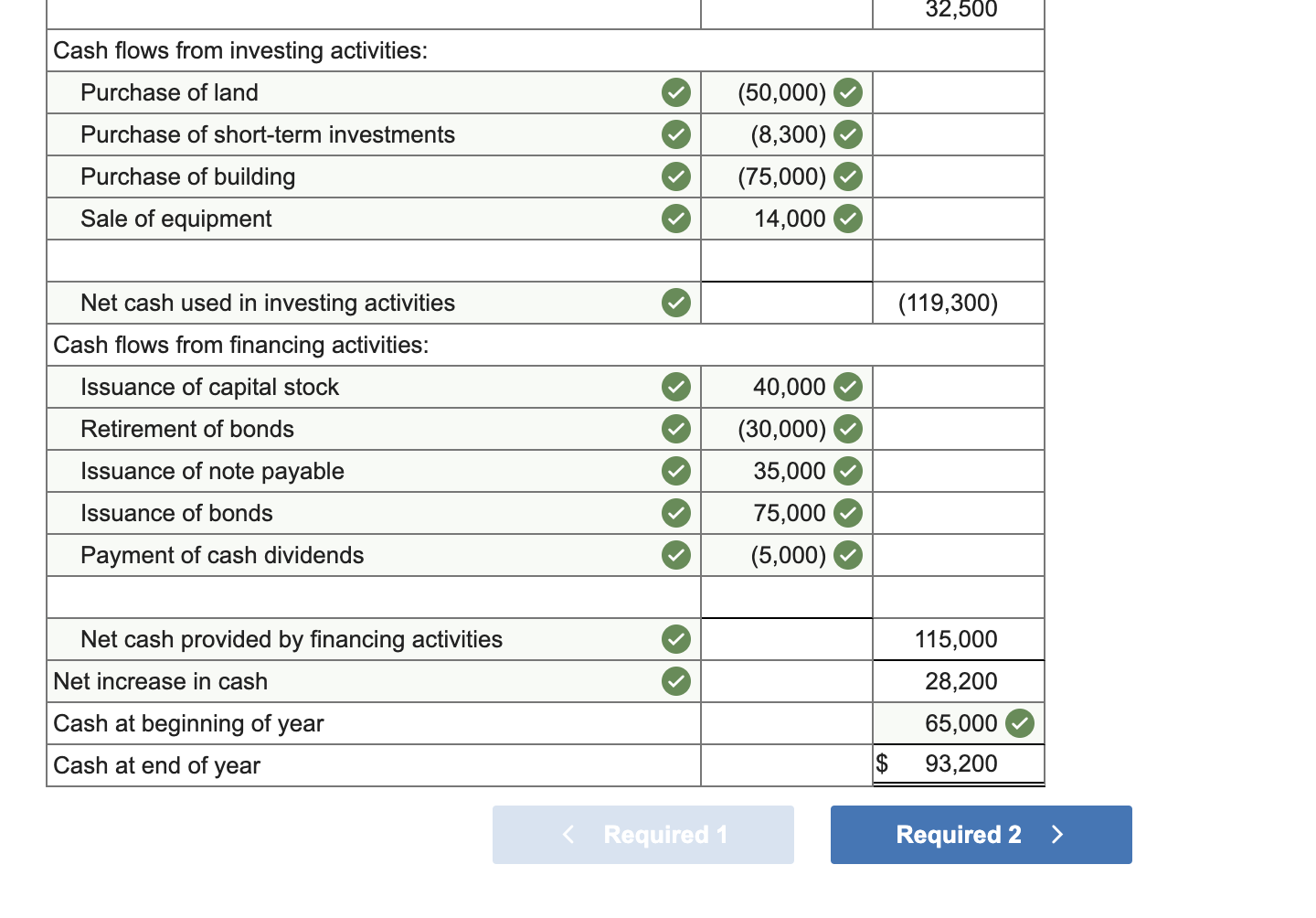

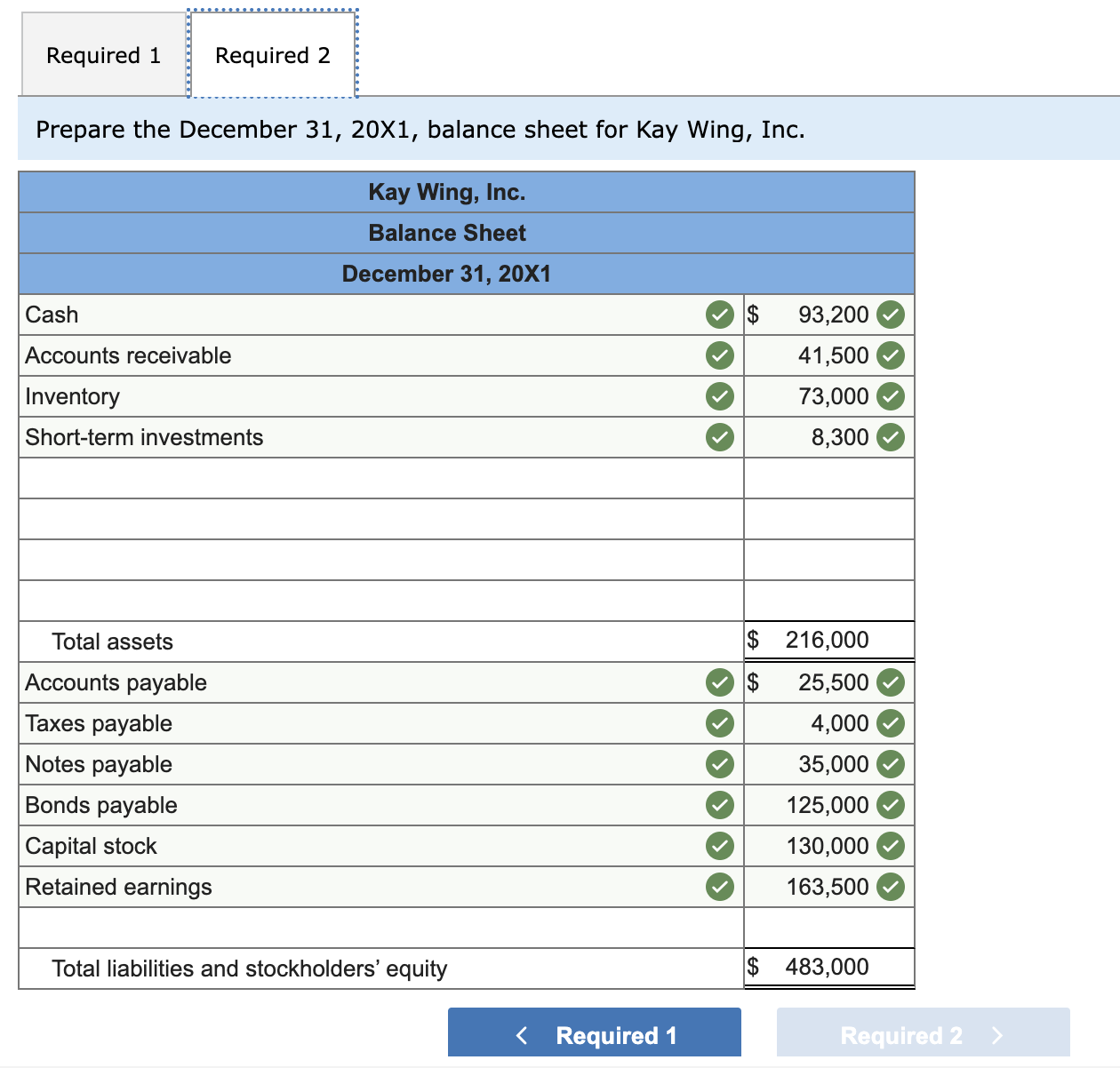

Required: 1. Prepare a statement of cash flows for 201. 2. Prepare the December 31, 20X1, balance sheet for Kay Wing, Inc. Prepare a statement

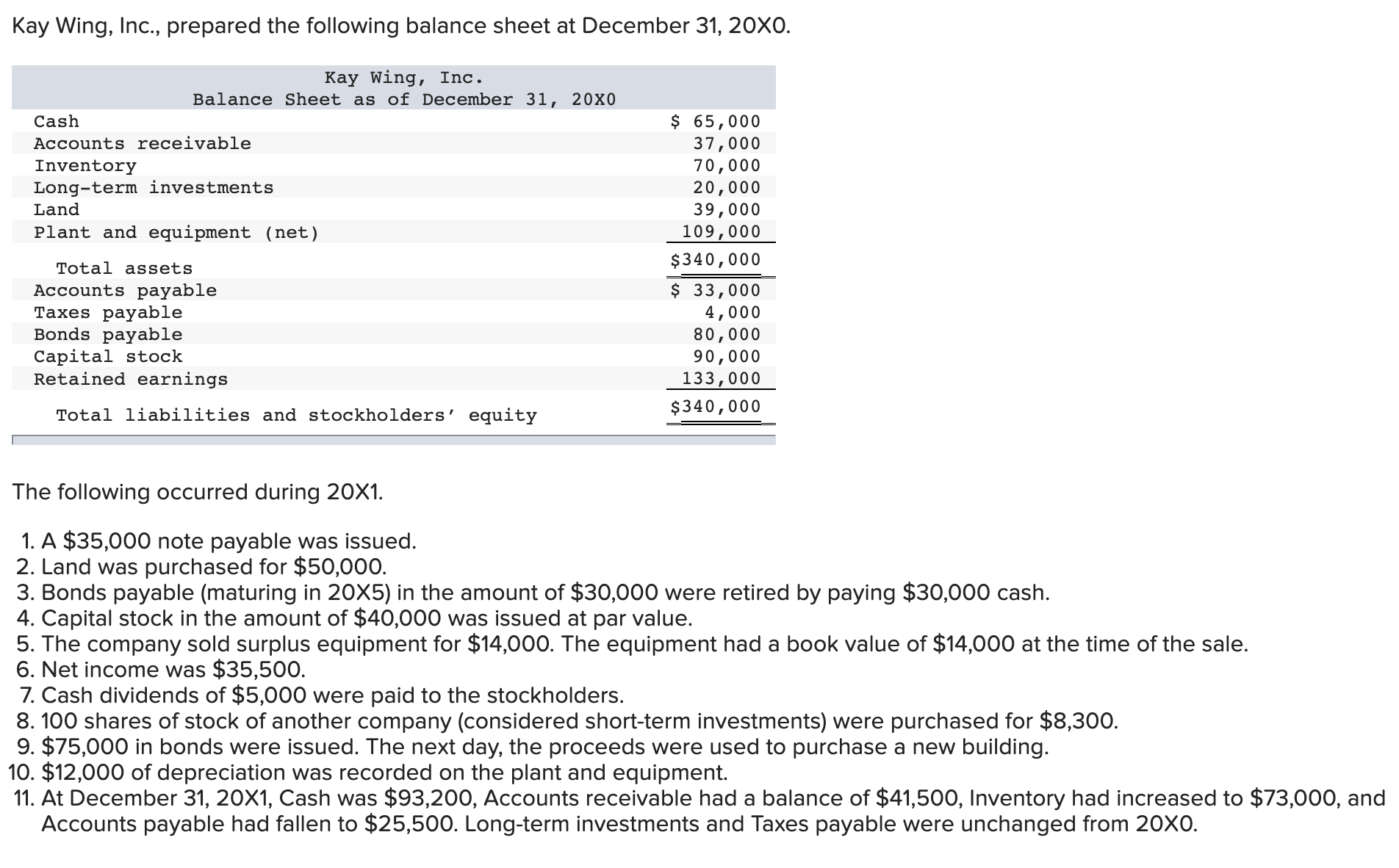

Required: 1. Prepare a statement of cash flows for 201. 2. Prepare the December 31, 20X1, balance sheet for Kay Wing, Inc. Prepare a statement of cash flows for 20X1. (Net cash outflows and amounts to be deducted should be indicated by a minus sign.) Kay Wing, Inc., prepared the following balance sheet at December 31, 200. The following occurred during 201. 1. A $35,000 note payable was issued. 2. Land was purchased for $50,000. 3. Bonds payable (maturing in 205 ) in the amount of $30,000 were retired by paying $30,000 cash. 4. Capital stock in the amount of $40,000 was issued at par value. 5. The company sold surplus equipment for $14,000. The equipment had a book value of $14,000 at the time of the sale. 6. Net income was $35,500. 7. Cash dividends of $5,000 were paid to the stockholders. 8. 100 shares of stock of another company (considered short-term investments) were purchased for $8,300. 9. $75,000 in bonds were issued. The next day, the proceeds were used to purchase a new building. 10. $12,000 of depreciation was recorded on the plant and equipment. 11. At December 31, 20X1, Cash was $93,200, Accounts receivable had a balance of $41,500, Inventory had increased to $73,000, Accounts payable had fallen to $25,500. Long-term investments and Taxes payable were unchanged from 200. Prenare the Deremher 31.201. halance sheet for Kav Wind. Inc. Required: 1. Prepare a statement of cash flows for 201. 2. Prepare the December 31, 20X1, balance sheet for Kay Wing, Inc. Prepare a statement of cash flows for 20X1. (Net cash outflows and amounts to be deducted should be indicated by a minus sign.) Kay Wing, Inc., prepared the following balance sheet at December 31, 200. The following occurred during 201. 1. A $35,000 note payable was issued. 2. Land was purchased for $50,000. 3. Bonds payable (maturing in 205 ) in the amount of $30,000 were retired by paying $30,000 cash. 4. Capital stock in the amount of $40,000 was issued at par value. 5. The company sold surplus equipment for $14,000. The equipment had a book value of $14,000 at the time of the sale. 6. Net income was $35,500. 7. Cash dividends of $5,000 were paid to the stockholders. 8. 100 shares of stock of another company (considered short-term investments) were purchased for $8,300. 9. $75,000 in bonds were issued. The next day, the proceeds were used to purchase a new building. 10. $12,000 of depreciation was recorded on the plant and equipment. 11. At December 31, 20X1, Cash was $93,200, Accounts receivable had a balance of $41,500, Inventory had increased to $73,000, Accounts payable had fallen to $25,500. Long-term investments and Taxes payable were unchanged from 200. Prenare the Deremher 31.201. halance sheet for Kav Wind. Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started