Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Prepare Journal & Adjusting Entries ,Chart of Accounts ,Trial Balance 2. Prepare Closing Entries 3. Prepare Financial Statement Jeffrey Dulow began professional practice

Required:

Required:1. Prepare Journal & Adjusting Entries ,Chart of Accounts ,Trial Balance

2. Prepare Closing Entries

3. Prepare Financial Statement

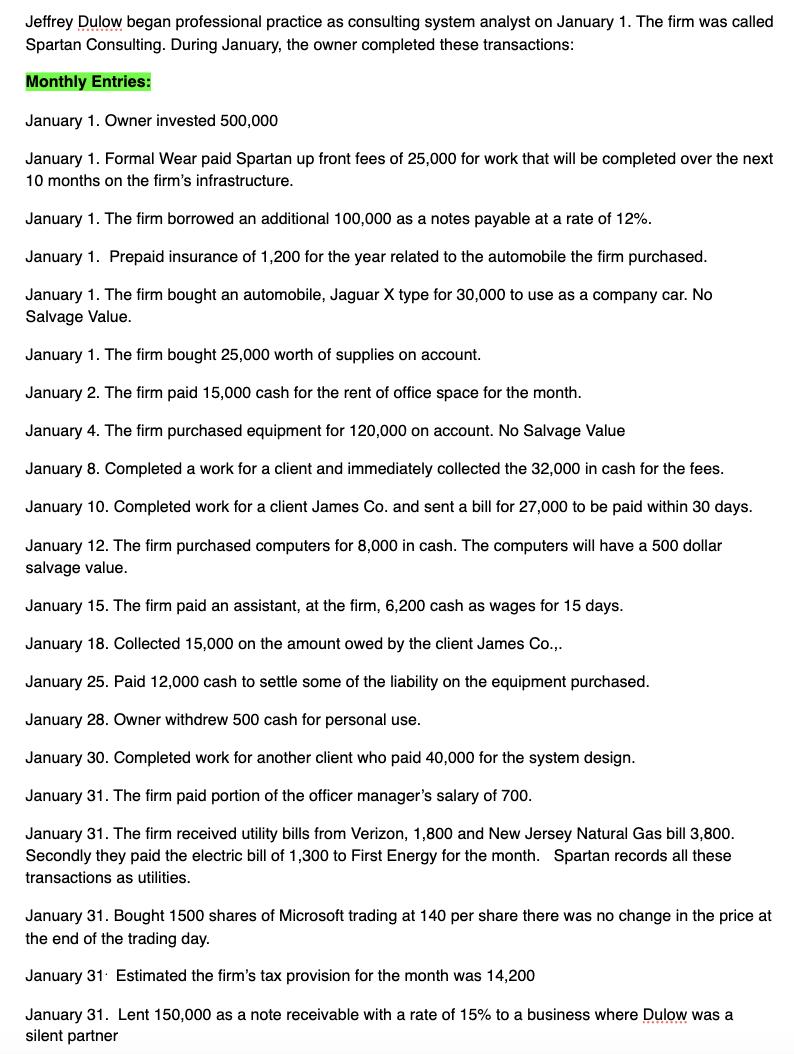

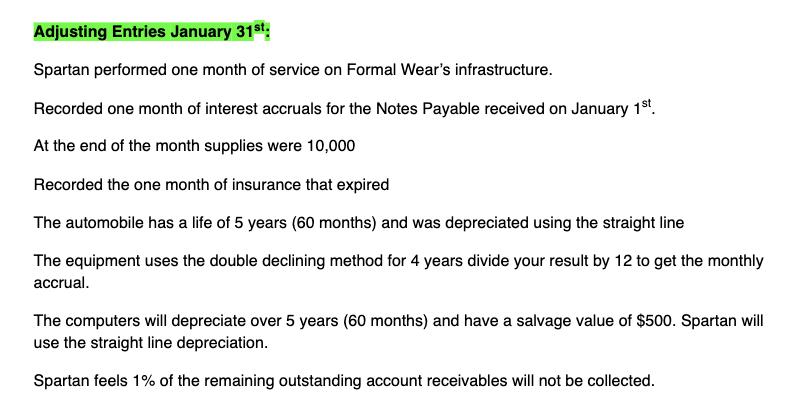

Jeffrey Dulow began professional practice as consulting system analyst on January 1. The firm was called Spartan Consulting. During January, the owner completed these transactions: Monthly Entries: January 1. Owner invested 500,000 January 1. Formal Wear paid Spartan up front fees of 25,000 for work that will be completed over the next 10 months on the firm's infrastructure. January 1. The firm borrowed an additional 100,000 as a notes payable at a rate of 12%. January 1. Prepaid insurance of 1,200 for the year related to the automobile the firm purchased. January 1. The firm bought an automobile, Jaguar X type for 30,000 to use as a company car. No Salvage Value. January 1. The firm bought 25,000 worth of supplies on account. January 2. The firm paid 15,000 cash for the rent of office space for the month. January 4. The firm purchased equipment for 120,000 on account. No Salvage Value January 8. Completed a work for a client and immediately collected the 32,000 in cash for the fees. January 10. Completed work for a client James Co. and sent a bill for 27,000 to be paid within 30 days. January 12. The firm purchased computers for 8,000 in cash. The computers will have a 500 dollar salvage value. January 15. The firm paid an assistant, at the firm, 6,200 cash as wages for 15 days. January 18. Collected 15,000 on the amount owed by the client James Co.,. January 25. Paid 12,000 cash to settle some of the liability on the equipment purchased. January 28. Owner withdrew 500 cash for personal use. January 30. Completed work for another client who paid 40,000 for the system design. January 31. The firm paid portion of the officer manager's salary of 700. January 31. The firm received utility bills from Verizon, 1,800 and New Jersey Natural Gas bill 3,800. Secondly they paid the electric bill of 1,300 to First Energy for the month. Spartan records all these transactions as utilities. January 31. Bought 1500 shares of Microsoft trading at 140 per share there was no change in the price at the end of the trading day. January 31 Estimated the firm's tax provision for the month was 14,200 January 31. Lent 150,000 as a note receivable with a rate of 15% to a business where Dulow was a silent partner

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address your request Ill provide you with a summary of the journal entries chart of accounts trial balance closing entries and financial statements ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started