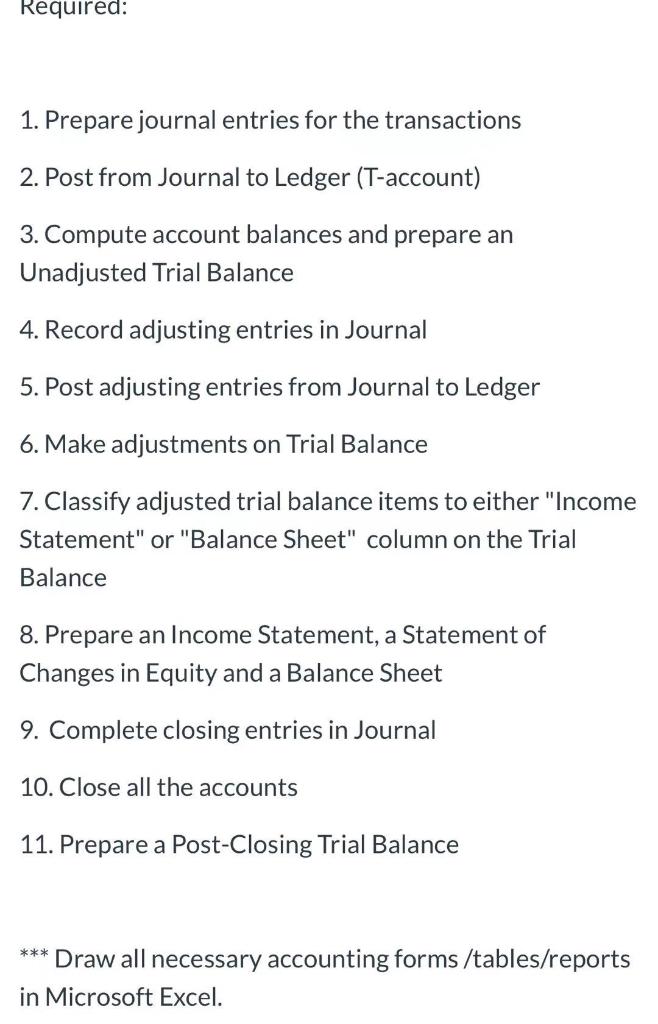

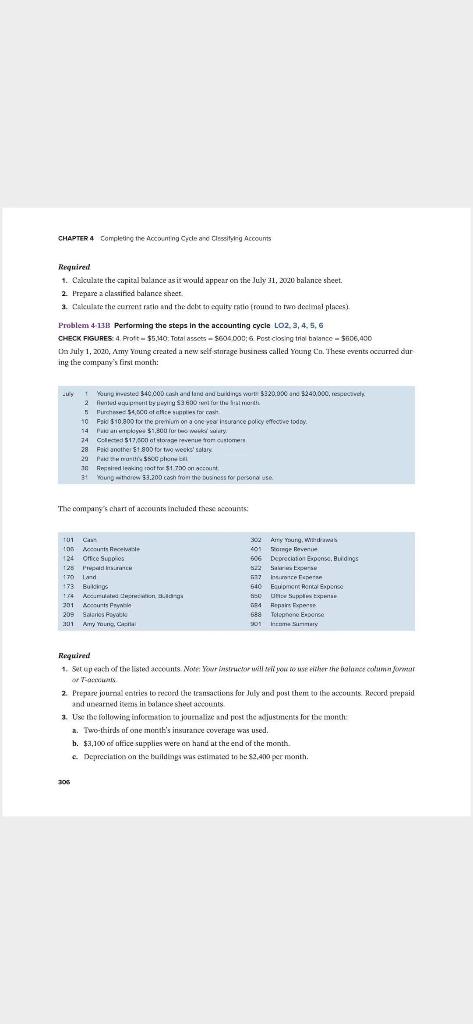

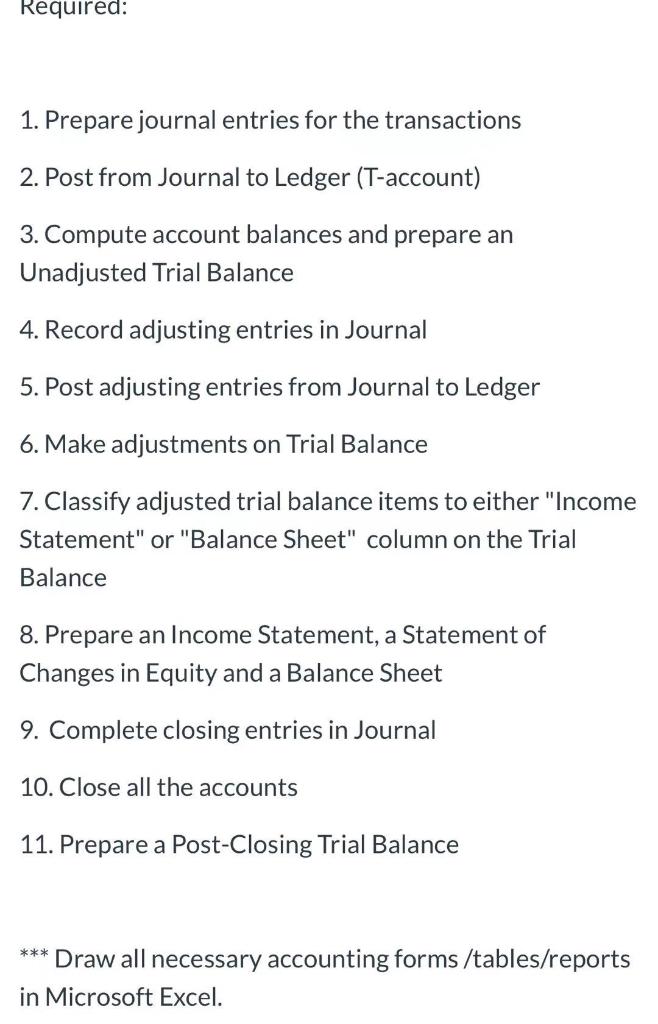

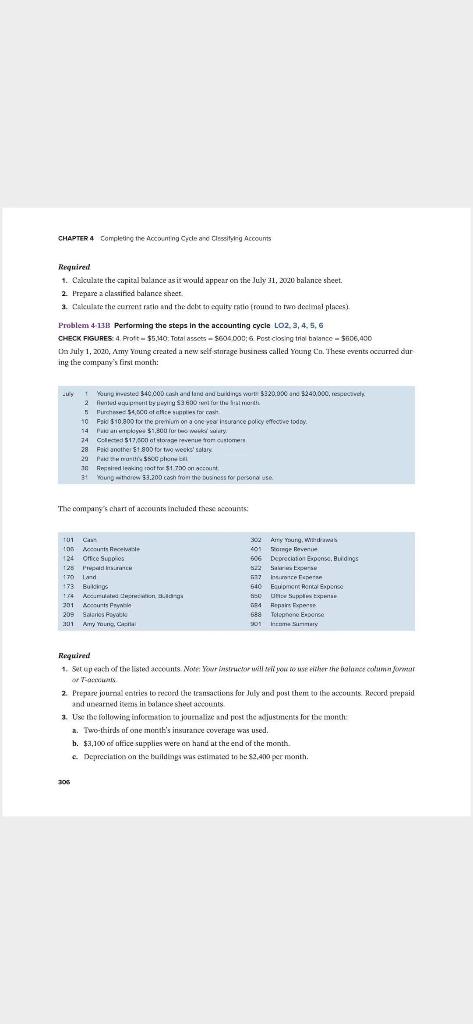

Required: 1. Prepare journal entries for the transactions 2. Post from Journal to Ledger (T-account) 3. Compute account balances and prepare an Unadjusted Trial Balance 4. Record adjusting entries in Journal 5. Post adjusting entries from Journal to Ledger 6. Make adjustments on Trial Balance 7. Classify adjusted trial balance items to either "Income Statement" or "Balance Sheet" column on the Trial Balance 8. Prepare an Income Statement, a Statement of Changes in Equity and a Balance Sheet 9. Complete closing entries in Journal 10. Close all the accounts 11. Prepare a Post-Closing Trial Balance *** Draw all necessary accounting forms /tables/reports in Microsoft Excel. CHAPTER 4 Completing the Accounting Cycle and Classiting Accounts Required 1. Calculate the capital balance as it would appear on the July 31, 2020 balance sheet. 2. Prepare a classified balance sheet. 2. Calculate the current rain and the debt to quity ratio cromed to two decimal places) Problem 4 138 Performing the steps in the accounting cycle LO2, 3, 4, 5, 6 CHECK FIGURES 4. Proft - $5.140: Total aseets - 56040OCPost closing trial balance - $606,450 Der July 1, 2020, Amy Young created a new self storage business called Young En. These events occurred car ing the company's first month: 1 Youngeste 340.000 cash and land and build War 5320.000 and $240.000, ecc 2. Fwd pull 9600 for the more Purch $4,000 festas 10 Faks $10.2001or the premium on a one to insurance policy effocowe odby. 14 Paletky $1.00 uur 74 Cod $17.00 og 28 Fake another 1 900 Fortwo wektory 20 PM $SC po bil 16 Freedeng mot for 51 700 3 Young how 13.200 cash from the business for person use The company's chart of accounts included these accounts TO1 C to counts we 124 Offce Supplies 125 PM 170 land 173 Bugs 114 Mecumulated in Bangs 301 Accounts Frywin 209 Salaries Payu 301 Any Young, Cara 302 Any Young, 401 omg over 506 Deprecaponse, Budings 22 Seco 27 540 Bounce Experte op 184 Hepsi 688 Topnione Euro 301 Inen Sie Required 1. Set up each of the listel accounts. Note: Your instructor will low to use her the balance calamar or T- 2. Prepuce jour entries to record the transactions for July and post them to the accounts Record prepaid and uneared items in balance sheet accounts 3. Use the following informatie to joutseline and post the adjustments for the month a. Two-thirds of one month's insurance coverage was used. b. $3,100 of aftice supplies were on hand at the end of the month c. Depreciations on the buildings was estimated to he $2,400 per month. 205 Required: 1. Prepare journal entries for the transactions 2. Post from Journal to Ledger (T-account) 3. Compute account balances and prepare an Unadjusted Trial Balance 4. Record adjusting entries in Journal 5. Post adjusting entries from Journal to Ledger 6. Make adjustments on Trial Balance 7. Classify adjusted trial balance items to either "Income Statement" or "Balance Sheet" column on the Trial Balance 8. Prepare an Income Statement, a Statement of Changes in Equity and a Balance Sheet 9. Complete closing entries in Journal 10. Close all the accounts 11. Prepare a Post-Closing Trial Balance *** Draw all necessary accounting forms /tables/reports in Microsoft Excel. CHAPTER 4 Completing the Accounting Cycle and Classiting Accounts Required 1. Calculate the capital balance as it would appear on the July 31, 2020 balance sheet. 2. Prepare a classified balance sheet. 2. Calculate the current rain and the debt to quity ratio cromed to two decimal places) Problem 4 138 Performing the steps in the accounting cycle LO2, 3, 4, 5, 6 CHECK FIGURES 4. Proft - $5.140: Total aseets - 56040OCPost closing trial balance - $606,450 Der July 1, 2020, Amy Young created a new self storage business called Young En. These events occurred car ing the company's first month: 1 Youngeste 340.000 cash and land and build War 5320.000 and $240.000, ecc 2. Fwd pull 9600 for the more Purch $4,000 festas 10 Faks $10.2001or the premium on a one to insurance policy effocowe odby. 14 Paletky $1.00 uur 74 Cod $17.00 og 28 Fake another 1 900 Fortwo wektory 20 PM $SC po bil 16 Freedeng mot for 51 700 3 Young how 13.200 cash from the business for person use The company's chart of accounts included these accounts TO1 C to counts we 124 Offce Supplies 125 PM 170 land 173 Bugs 114 Mecumulated in Bangs 301 Accounts Frywin 209 Salaries Payu 301 Any Young, Cara 302 Any Young, 401 omg over 506 Deprecaponse, Budings 22 Seco 27 540 Bounce Experte op 184 Hepsi 688 Topnione Euro 301 Inen Sie Required 1. Set up each of the listel accounts. Note: Your instructor will low to use her the balance calamar or T- 2. Prepuce jour entries to record the transactions for July and post them to the accounts Record prepaid and uneared items in balance sheet accounts 3. Use the following informatie to joutseline and post the adjustments for the month a. Two-thirds of one month's insurance coverage was used. b. $3,100 of aftice supplies were on hand at the end of the month c. Depreciations on the buildings was estimated to he $2,400 per month. 205