Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required 1. Prepare the journal entries 2. Prepare adjusting journal entries for P2 Pte Ltd for the year ending 20X6. Note: Dates and narratives must

Required

1. Prepare the journal entries

2. Prepare adjusting journal entries for P2 Pte Ltd for the year ending 20X6.

Note: Dates and narratives must be clearly indicated.

Journal entries are to follow the order and number system given in the question.

Wrong and incomplete answers will be downvoted.

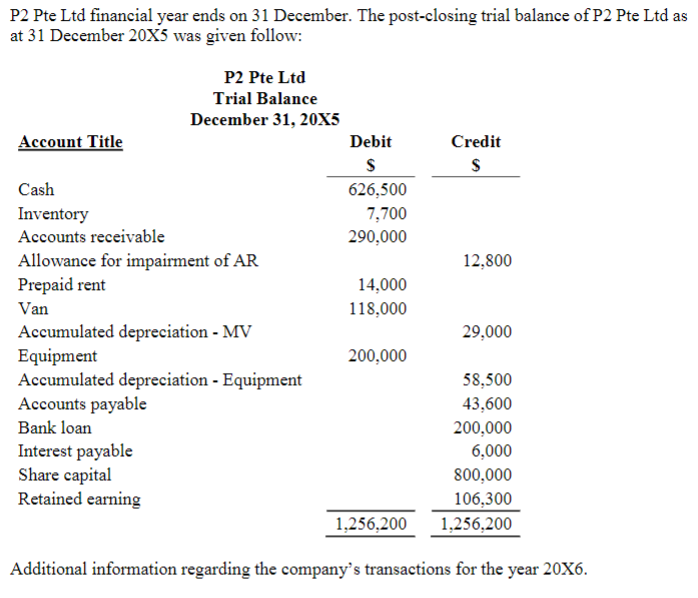

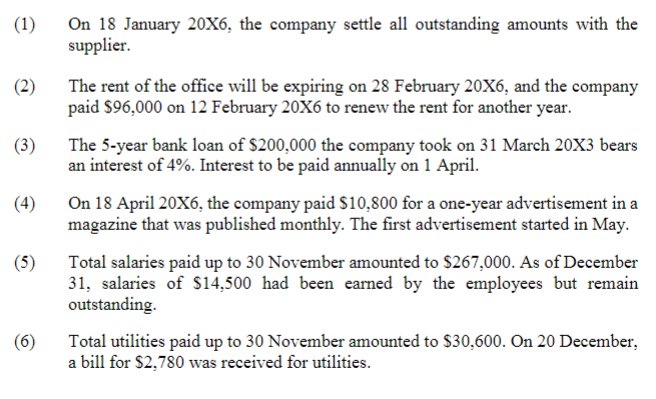

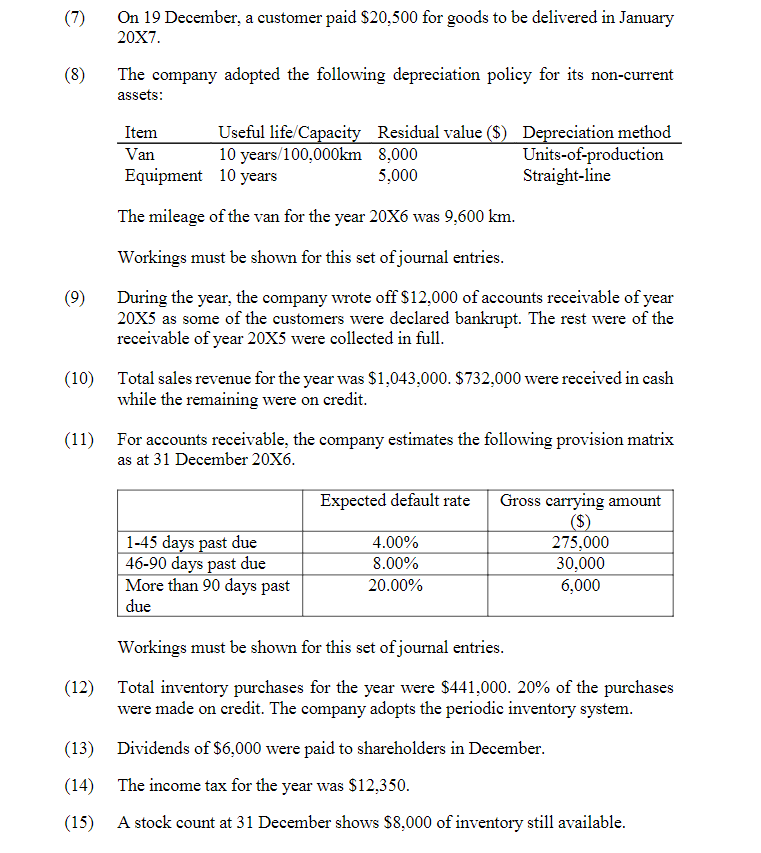

P2 Pte Ltd financial year ends on 31 December. The post-closing trial balance of P 2 Pte Ltd as at 31 December 20X5 was given follow: Additional information regarding the company's transactions for the year 20X6. (1) On 18 January 20X6, the company settle all outstanding amounts with the supplier. (2) The rent of the office will be expiring on 28 February 20X6, and the company paid $96,000 on 12 February 20X6 to renew the rent for another year. (3) The 5-year bank loan of $200,000 the company took on 31 March 20X3 bears an interest of 4%. Interest to be paid annually on 1 April. (4) On 18 April 20X6, the company paid $10,800 for a one-year advertisement in a magazine that was published monthly. The first advertisement started in May. (5) Total salaries paid up to 30 November amounted to $267,000. As of December 31 , salaries of $14,500had been earned by the employees but remain outstanding. (6) Total utilities paid up to 30 November amounted to $30,600. On 20 December, a bill for $2,780 was received for utilities. (7) On 19 December, a customer paid $20,500 for goods to be delivered in January 207. (8) The company adopted the following depreciation policy for its non-current assets: The mileage of the van for the year 20X6 was 9,600km. Workings must be shown for this set of journal entries. (9) During the year, the company wrote off $12,000 of accounts receivable of year 205 as some of the customers were declared bankrupt. The rest were of the receivable of year 20X5 were collected in full. (10) Total sales revenue for the year was $1,043,000.$732,000 were received in cash while the remaining were on credit. (11) For accounts receivable, the company estimates the following provision matrix as at 31 December 20X6. Workings must be shown for this set of journal entries. (12) Total inventory purchases for the year were $441,000.20% of the purchases were made on credit. The company adopts the periodic inventory system. (13) Dividends of $6,000 were paid to shareholders in December. (14) The income tax for the year was $12,350. (15) A stock count at 31 December shows $8,000 of inventory still availableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started