Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. prepare the journal entries to account for adjustiments b to g. journal narratiins are not required. 2. prepare the statement of profit or

Required:

1. prepare the journal entries to account for adjustiments b to g. journal narratiins are not required.

2. prepare the statement of profit or loss of Kasirye and Sons for the reporting period eneded 31 December 2018.

3. prepare the statement of financial position of Kasirye and Sons as at 31 December 2018

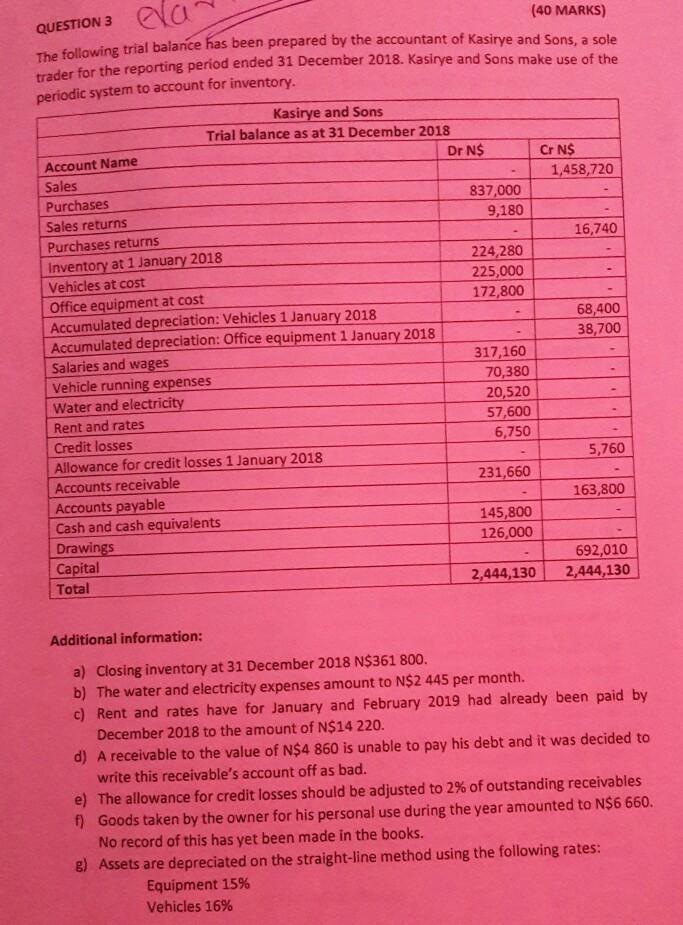

QUESTION 3 ela (40 MARKS) The following trial balance has been prepared by the accountant of Kasirye and Sons, a sole trader for the reporting period ended 31 December 2018. Kasirye and Sons make use of the periodic system to account for inventory. Kasirye and Sons Trial balance as at 31 December 2018 Account Name Dr N$ Cr N$ Sales 1,458,720 Purchases 837,000 Sales returns 9,180 Purchases returns 16,740 Inventory at 1 January 2018 224,280 Vehicles at cost 225,000 Office equipment at cost 172,800 Accumulated depreciation: Vehicles 1 January 2018 68,400 Accumulated depreciation: Office equipment 1 January 2018 38,700 Salaries and wages 317,160 Vehicle running expenses 70,380 Water and electricity 20,520 Rent and rates 57,600 Credit losses 6,750 Allowance for credit losses 1 January 2018 5,760 Accounts receivable 231,660 Accounts payable 163,800 Cash and cash equivalents 145,800 Drawings 126,000 Capital 692,010 Total 2,444,130 2,444,130 . Additional information: a) Closing inventory at 31 December 2018 N$361 800. b) The water and electricity expenses amount to N$2 445 per month c) Rent and rates have for January and February 2019 had already been paid by December 2018 to the amount of N$14 220. d) A receivable to the value of N$4 860 is unable to pay his debt and it was decided to write this receivable's account off as bad. e) The allowance for credit losses should be adjusted to 2% of outstanding receivables f) Goods taken by the owner for his personal use during the year amounted to N$6 660. No record of this has yet been made in the books. g) Assets are depreciated on the straight-line method using the following rates: Equipment 15% Vehicles 16%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started