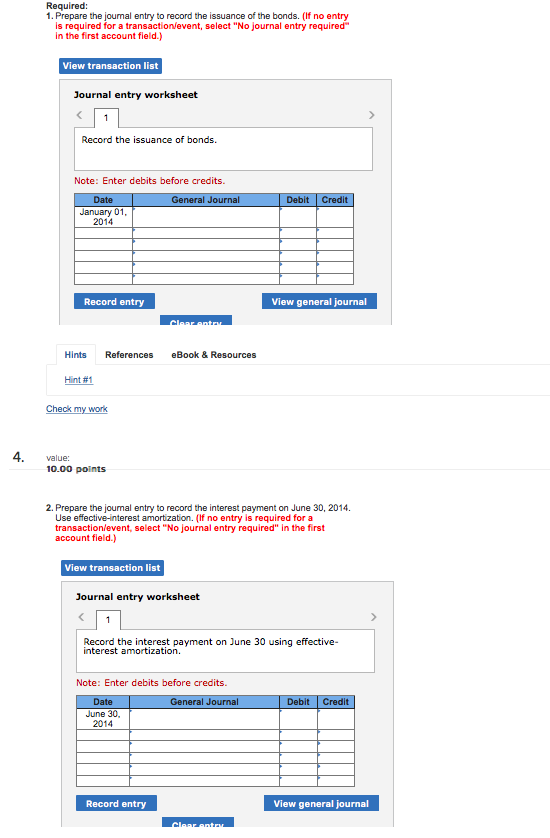

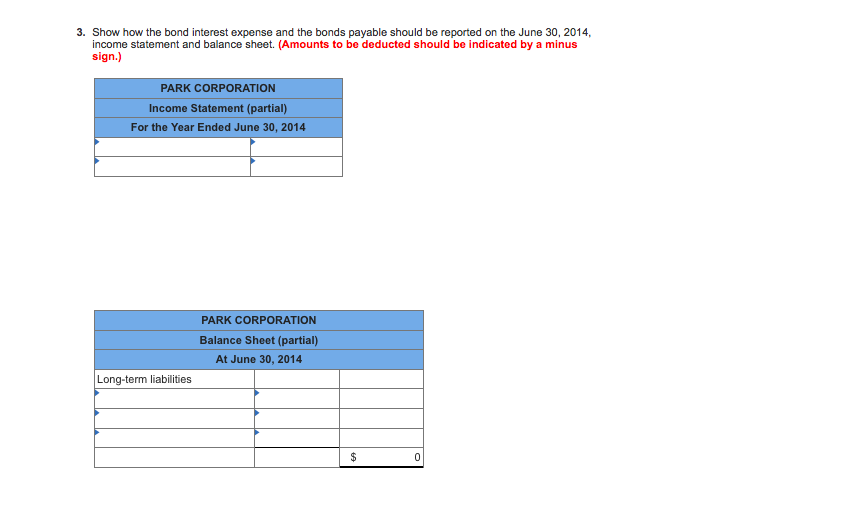

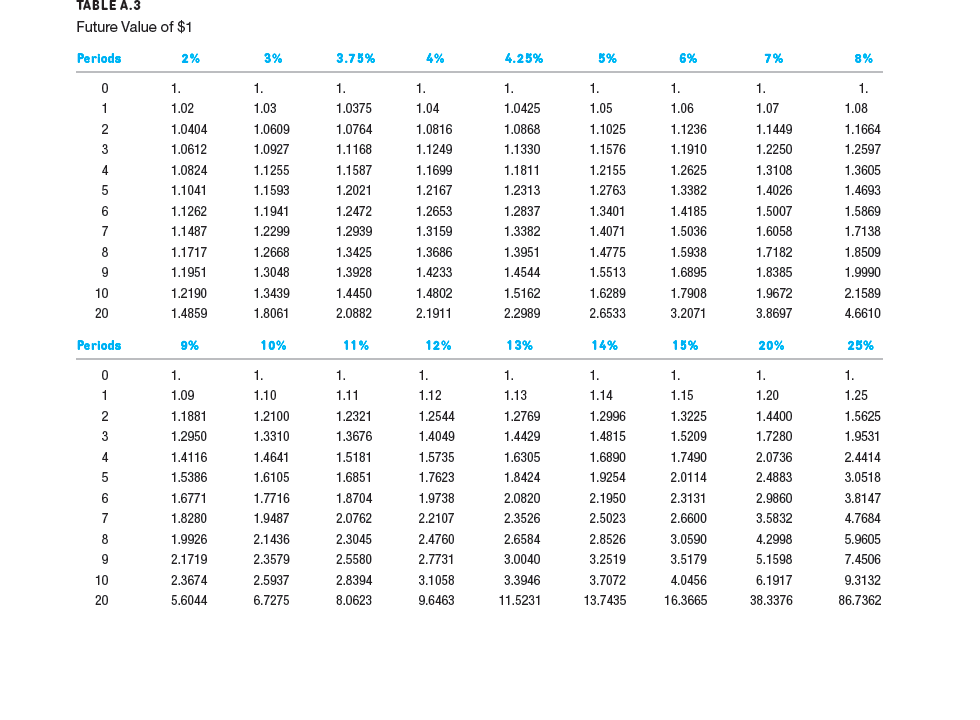

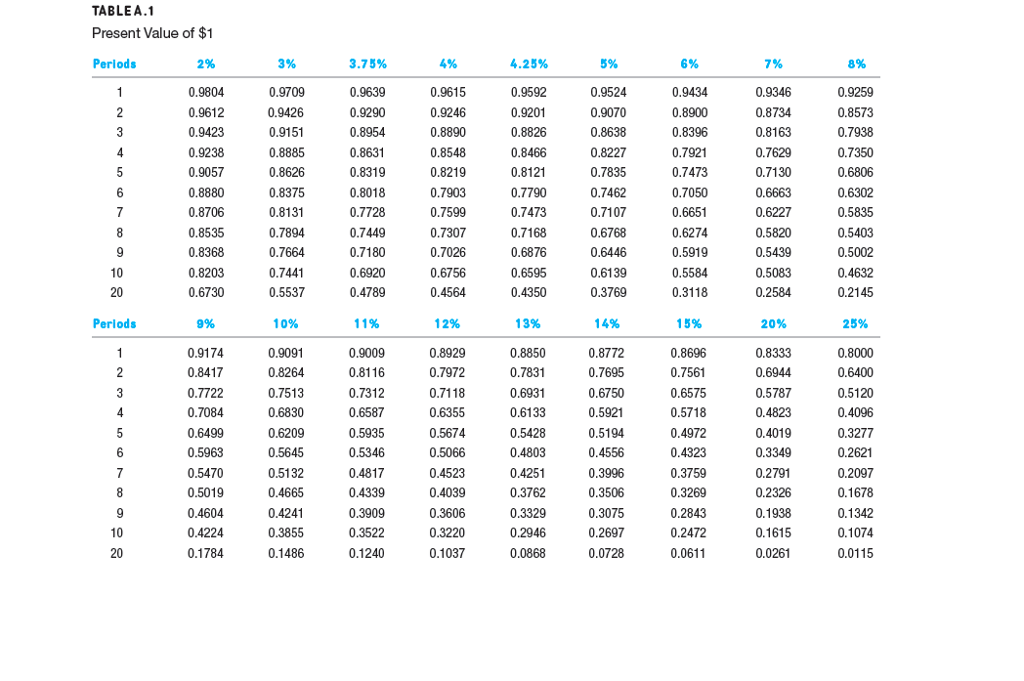

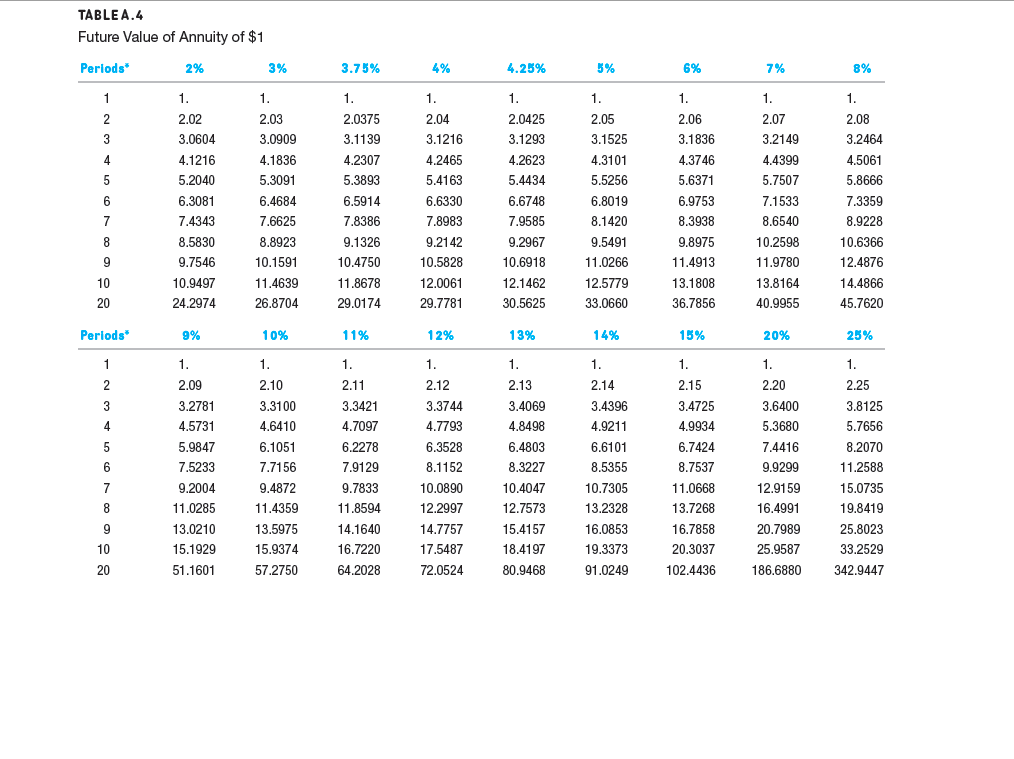

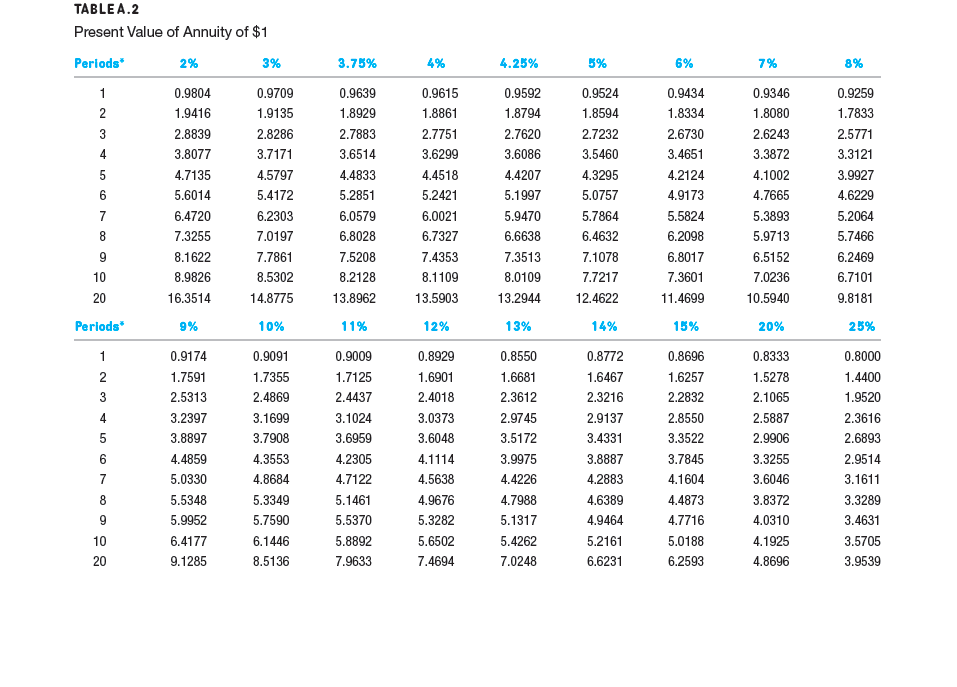

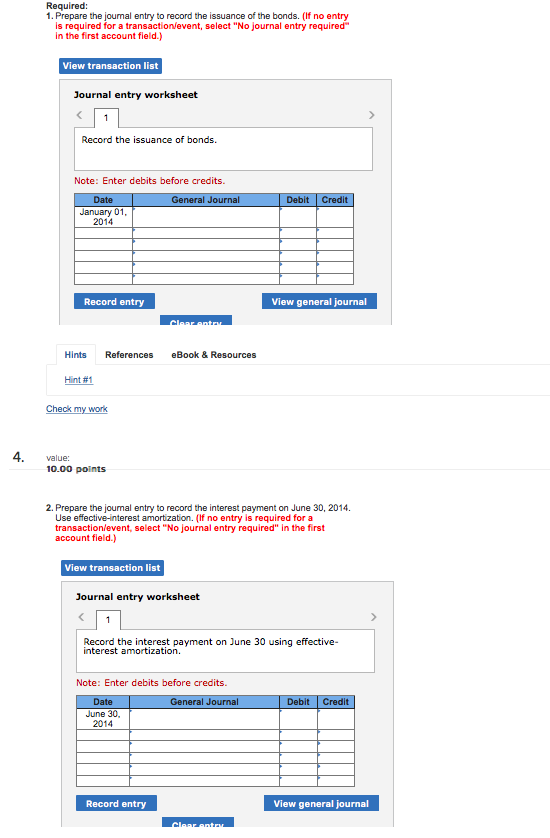

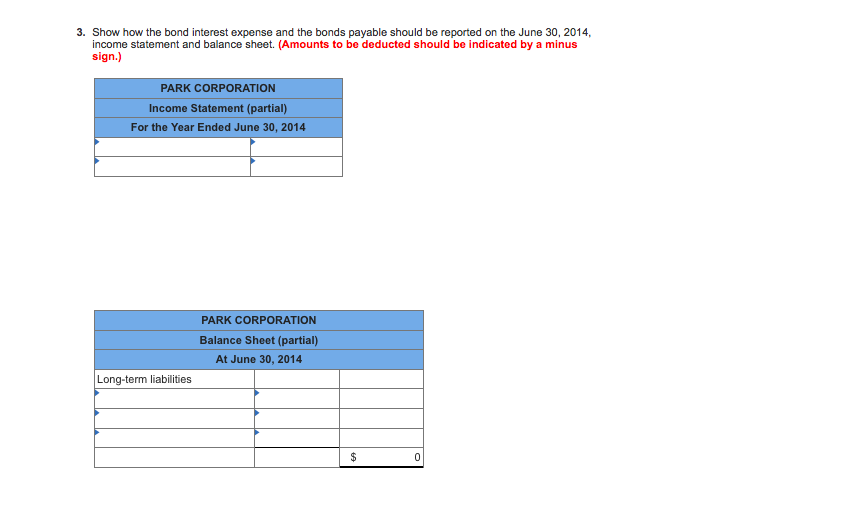

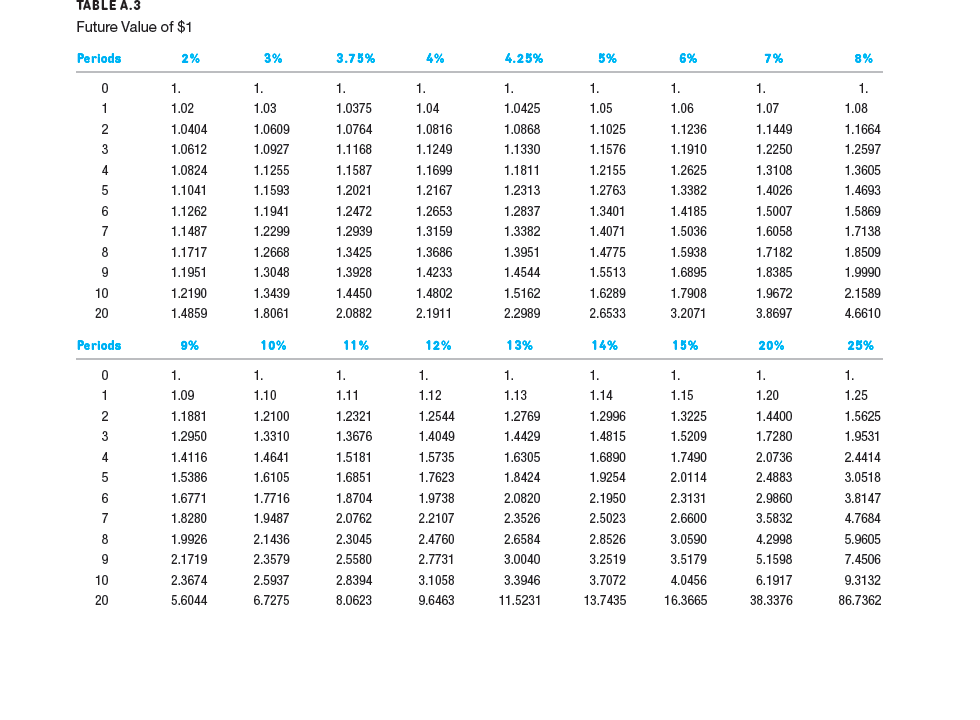

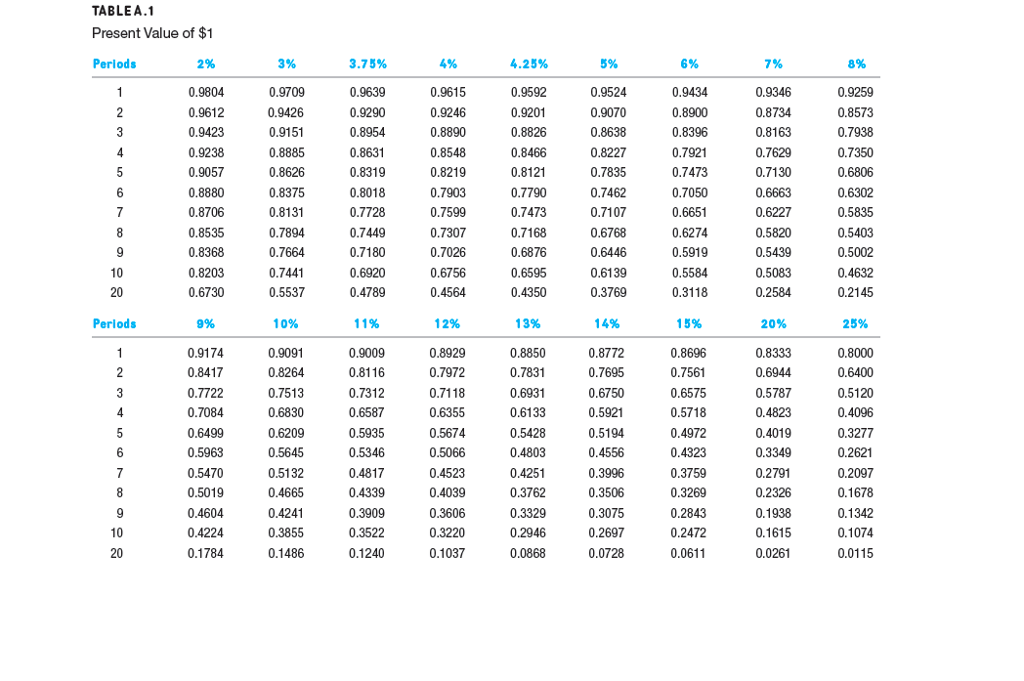

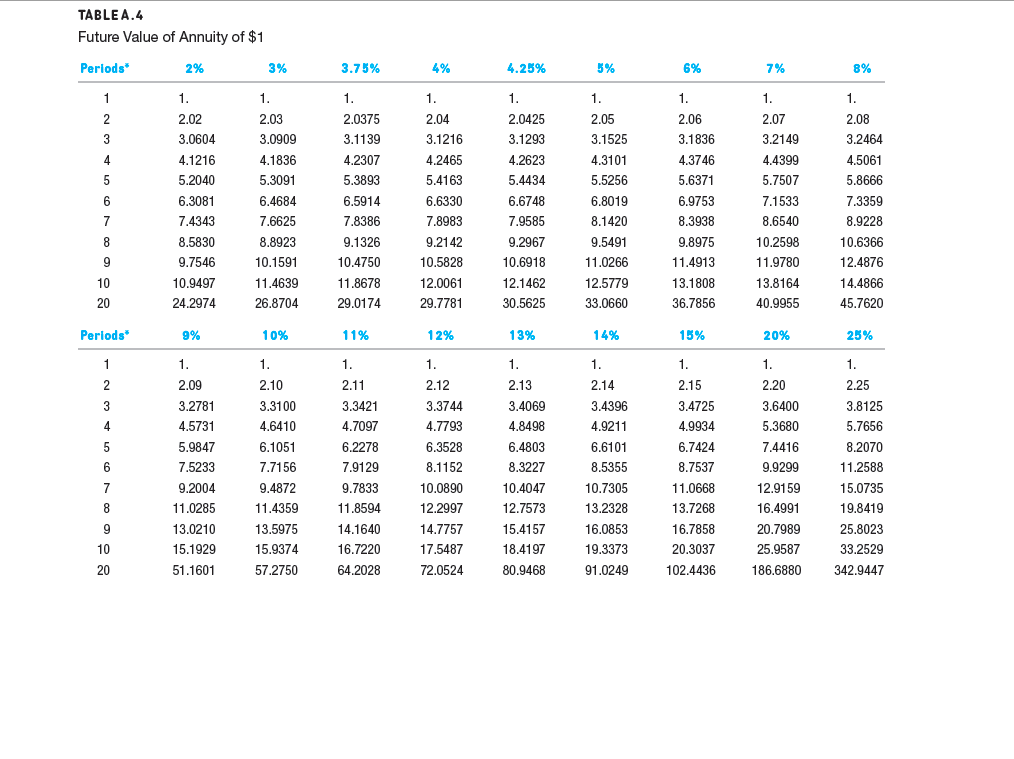

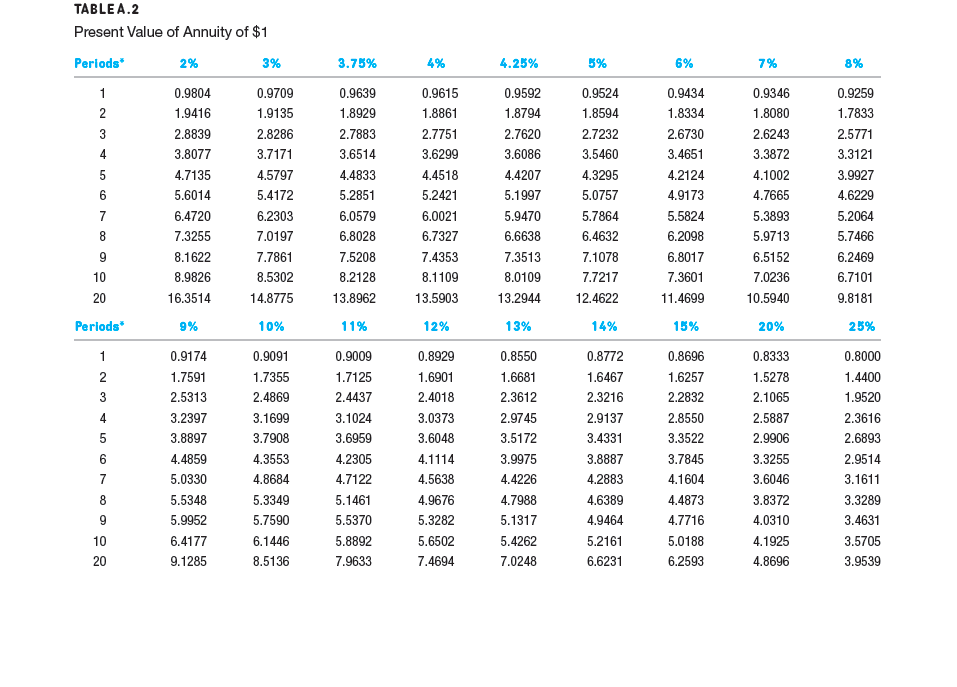

Required: 1. Prepare the journal entry to record the issuance of the bonds. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the issuance of bonds. Note: Enter debits before credits January 01 2014 Record entry View general journal Hints References eBook & Resources Hint #1 Check my work value: 10.00 points 2. Prepare the journal entry to record the interest payment on June 30, 2014 Use effective-interest amortzation. (If no entry is required for a transactionlevent, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the interest payment on June 30 using effective- interest amortization. Note: Enter debits before credits. June 30, 2014 Record entry View general journal 3. Show how the bond interest expense and the bonds payable should be reported on the June 30, 2014, income statement and balance sheet. (Amounts to be deducted should be indicated by a minus sign.) PARK CORPORATION Income Statement (partial) For the Year Ended June 30, 2014 PARK CORPORATION Balance Sheet (partial) At June 30, 2014 Long-term liabilities TABLE A.3 Future Value of $1 1.0404 1.0612 1.0824 1.0375 1.0764 1.0425 1.0868 1.1330 1.1449 1.2250 1.0609 1.0927 1.1255 1.0816 1.1249 1.1025 1.2597 1.1587 1.2021 1.2472 1.2939 1.3425 1.3928 1.4450 2.0882 1.2155 1.2763 1.3401 1.4071 1.4775 1.2625 1.3108 1.2313 1.2837 1.3382 1.3951 1.4544 1.5162 2.2989 1.1941 1.2299 1.2653 1.3159 1.3686 1.4233 1.5007 1.6058 1.7182 1.8385 1.9672 3.8697 1.5036 1.5938 1.1487 1.1951 1.2190 1.4859 1.3048 1.6289 1.7908 3.2071 2.1589 4.6610 1.8061 2.6533 1.1881 1.2950 1.4116 1.5386 1.6771 1.8280 1.9926 2.1719 2.3674 5.6044 1.2321 1.3676 1.5181 1.6851 1.8704 2.0762 2.3045 2.5580 2.8394 8.0623 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 11.5231 1.3225 1.5209 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 9.6463 1.9531 2.4414 3.0518 3.8147 4.7684 5.9605 1.3310 1.4641 1.6105 1.7280 1.6890 1.9254 2.1950 2.5023 2.8526 3.2519 3.7072 13.7435 2.3131 3.0590 3.5179 4.0456 16.3665 2.9860 3.5832 4.2998 5.1598 6.1917 38.3376 2.3579 2.5937 6.7275 9.3132 86.7362 5 2 8877 2 149 18 %-96 6 58 72 23 59 69 43 72 11 88777 553 24 70 38 27 35 62 07 67 67 87655 1 4-00000000000 854 |00000000000 198 7 3-00000000000 17 309 156 775 $2 888886 9-9 0|1234567890 0|1234567890 TPP TABLEA.4 Future Value of Annuity of $1 2.0375 3.2464 4.5061 3.1525 4.3101 5.5256 6.8019 3.2149 4.4399 5.7507 3.0604 3.0909 4.1836 5.3091 6.4684 3.1836 4.3746 5.6371 6.9753 8.3938 9.8975 11.4913 13.1808 36.7856 4.2307 5.3893 6.5914 4.2465 5.4163 6.6330 7.8983 9.2142 10.5828 12.0061 29.7781 4.2623 5.4434 6.3081 7.3359 8.9228 10.6366 12.4876 14.4866 45.7620 8.5830 9.7546 10.9497 24.2974 8.8923 10.1591 11.4639 26.8704 9.1326 10.4750 11.8678 29.0174 7.9585 9.2967 10.6918 9.5491 11.0266 12.5779 33.0660 8.6540 10.2598 11.9780 13.8164 40.9955 10 30.5625 3.3744 4.7793 6.3528 3.8125 5.7656 8.2070 11.2588 15.0735 19.8419 25.8023 33.2529 342.9447 3.2781 4.5731 5.9847 3.3421 4.7097 6.2278 3.4396 3.4725 4.6410 9.2004 11.0285 13.0210 15.1929 51.1601 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 80.9468 6.6101 8.5355 10.7305 13.2328 16.0853 19.3373 91.0249 6.7424 8.7537 11.0668 13.7268 16.7858 20.3037 102.4436 7.4416 9.9299 12.9159 16.4991 20.7989 25.9587 186.6880 11.4359 13.5975 15.9374 57.2750 9.7833 11.8594 14.1640 10.0890 12.2997 14.7757 17.5487 72.0524 64.2028 TABLEA.2 Present Value of Annuity of $1 0.9804 1.9416 2.8839 3.8077 4.7135 5.6014 0.9709 2.8286 4.5797 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 6.0021 6.7327 7.4353 0.9434 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 10.5940 0.9259 1.7833 2.5771 3.3121 3.9927 1.8794 2.6730 3.4651 3.6514 4.4833 5.2851 6.0579 6.8028 7.5208 8.2128 13.8962 3.6086 4.4207 5.1997 5.9470 6.2303 5.5824 6.2098 7.3255 8.1622 8.9826 16.3514 7.7861 8.5302 14.8775 7.3513 8.0109 13.2944 5.7466 6.2469 6.7101 9.8181 13.5903 12.4622 11.4699 0.9174 1.7591 0.8772 1.6467 2.3216 0.9009 0.8929 0.8550 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 0.8333 0.8000 2.4437 3.1024 3.6959 4.2305 2.3612 2.9745 3.5172 3.9975 4.4226 2.4018 2.3616 2.6893 3.2397 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 2.5887 4.1114 4.5638 4.9676 5.3282 3.4331 3.8887 4.2883 4.6389 4.9464 3.3255 4.4859 5.0330 5.5348 3.3289 3.4631 3.5705 3.9539 6.4177 9.1285 5.5370 5.8892 4.0310 4.1925 4.8696 5.4262 6.6231 6.2593 Required: 1. Prepare the journal entry to record the issuance of the bonds. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the issuance of bonds. Note: Enter debits before credits January 01 2014 Record entry View general journal Hints References eBook & Resources Hint #1 Check my work value: 10.00 points 2. Prepare the journal entry to record the interest payment on June 30, 2014 Use effective-interest amortzation. (If no entry is required for a transactionlevent, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the interest payment on June 30 using effective- interest amortization. Note: Enter debits before credits. June 30, 2014 Record entry View general journal 3. Show how the bond interest expense and the bonds payable should be reported on the June 30, 2014, income statement and balance sheet. (Amounts to be deducted should be indicated by a minus sign.) PARK CORPORATION Income Statement (partial) For the Year Ended June 30, 2014 PARK CORPORATION Balance Sheet (partial) At June 30, 2014 Long-term liabilities TABLE A.3 Future Value of $1 1.0404 1.0612 1.0824 1.0375 1.0764 1.0425 1.0868 1.1330 1.1449 1.2250 1.0609 1.0927 1.1255 1.0816 1.1249 1.1025 1.2597 1.1587 1.2021 1.2472 1.2939 1.3425 1.3928 1.4450 2.0882 1.2155 1.2763 1.3401 1.4071 1.4775 1.2625 1.3108 1.2313 1.2837 1.3382 1.3951 1.4544 1.5162 2.2989 1.1941 1.2299 1.2653 1.3159 1.3686 1.4233 1.5007 1.6058 1.7182 1.8385 1.9672 3.8697 1.5036 1.5938 1.1487 1.1951 1.2190 1.4859 1.3048 1.6289 1.7908 3.2071 2.1589 4.6610 1.8061 2.6533 1.1881 1.2950 1.4116 1.5386 1.6771 1.8280 1.9926 2.1719 2.3674 5.6044 1.2321 1.3676 1.5181 1.6851 1.8704 2.0762 2.3045 2.5580 2.8394 8.0623 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 11.5231 1.3225 1.5209 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 9.6463 1.9531 2.4414 3.0518 3.8147 4.7684 5.9605 1.3310 1.4641 1.6105 1.7280 1.6890 1.9254 2.1950 2.5023 2.8526 3.2519 3.7072 13.7435 2.3131 3.0590 3.5179 4.0456 16.3665 2.9860 3.5832 4.2998 5.1598 6.1917 38.3376 2.3579 2.5937 6.7275 9.3132 86.7362 5 2 8877 2 149 18 %-96 6 58 72 23 59 69 43 72 11 88777 553 24 70 38 27 35 62 07 67 67 87655 1 4-00000000000 854 |00000000000 198 7 3-00000000000 17 309 156 775 $2 888886 9-9 0|1234567890 0|1234567890 TPP TABLEA.4 Future Value of Annuity of $1 2.0375 3.2464 4.5061 3.1525 4.3101 5.5256 6.8019 3.2149 4.4399 5.7507 3.0604 3.0909 4.1836 5.3091 6.4684 3.1836 4.3746 5.6371 6.9753 8.3938 9.8975 11.4913 13.1808 36.7856 4.2307 5.3893 6.5914 4.2465 5.4163 6.6330 7.8983 9.2142 10.5828 12.0061 29.7781 4.2623 5.4434 6.3081 7.3359 8.9228 10.6366 12.4876 14.4866 45.7620 8.5830 9.7546 10.9497 24.2974 8.8923 10.1591 11.4639 26.8704 9.1326 10.4750 11.8678 29.0174 7.9585 9.2967 10.6918 9.5491 11.0266 12.5779 33.0660 8.6540 10.2598 11.9780 13.8164 40.9955 10 30.5625 3.3744 4.7793 6.3528 3.8125 5.7656 8.2070 11.2588 15.0735 19.8419 25.8023 33.2529 342.9447 3.2781 4.5731 5.9847 3.3421 4.7097 6.2278 3.4396 3.4725 4.6410 9.2004 11.0285 13.0210 15.1929 51.1601 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 80.9468 6.6101 8.5355 10.7305 13.2328 16.0853 19.3373 91.0249 6.7424 8.7537 11.0668 13.7268 16.7858 20.3037 102.4436 7.4416 9.9299 12.9159 16.4991 20.7989 25.9587 186.6880 11.4359 13.5975 15.9374 57.2750 9.7833 11.8594 14.1640 10.0890 12.2997 14.7757 17.5487 72.0524 64.2028 TABLEA.2 Present Value of Annuity of $1 0.9804 1.9416 2.8839 3.8077 4.7135 5.6014 0.9709 2.8286 4.5797 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 6.0021 6.7327 7.4353 0.9434 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 10.5940 0.9259 1.7833 2.5771 3.3121 3.9927 1.8794 2.6730 3.4651 3.6514 4.4833 5.2851 6.0579 6.8028 7.5208 8.2128 13.8962 3.6086 4.4207 5.1997 5.9470 6.2303 5.5824 6.2098 7.3255 8.1622 8.9826 16.3514 7.7861 8.5302 14.8775 7.3513 8.0109 13.2944 5.7466 6.2469 6.7101 9.8181 13.5903 12.4622 11.4699 0.9174 1.7591 0.8772 1.6467 2.3216 0.9009 0.8929 0.8550 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 0.8333 0.8000 2.4437 3.1024 3.6959 4.2305 2.3612 2.9745 3.5172 3.9975 4.4226 2.4018 2.3616 2.6893 3.2397 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 2.5887 4.1114 4.5638 4.9676 5.3282 3.4331 3.8887 4.2883 4.6389 4.9464 3.3255 4.4859 5.0330 5.5348 3.3289 3.4631 3.5705 3.9539 6.4177 9.1285 5.5370 5.8892 4.0310 4.1925 4.8696 5.4262 6.6231 6.2593