Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Prepare the relevant consolidation journal entries for the year ended 31 Dec 2020 and prepare the consolidated Statement of Profit or Loss and

Required:

1. Prepare the relevant consolidation journal entries for the year ended 31 Dec 2020 and prepare the consolidated Statement of Profit or Loss and Other Comprehensive Income for XT Berhad and its subsidiary for the year ended 31 Dec 2020

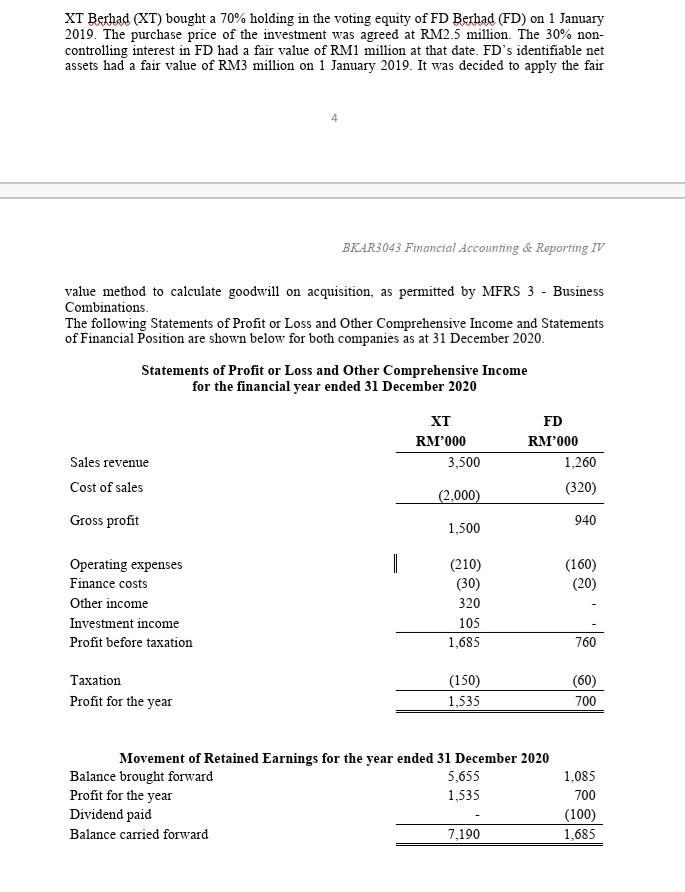

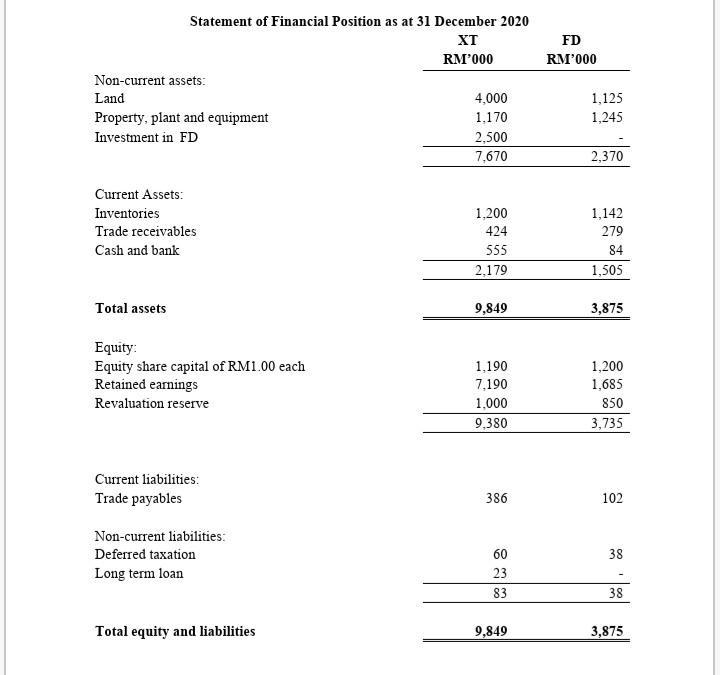

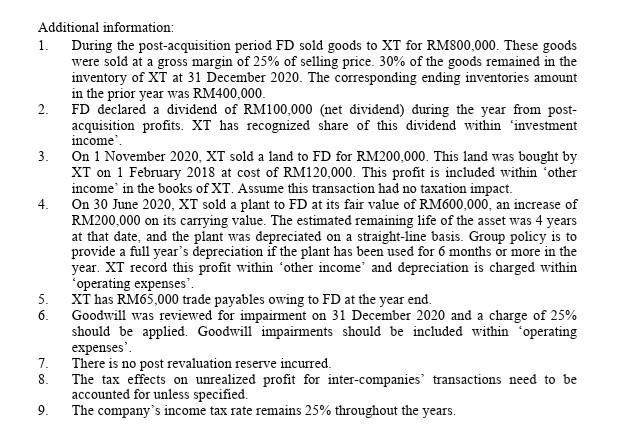

XT Berhad (XT) bought a 70% holding in the voting equity of FD Berhad (FD) on 1 January 2019. The purchase price of the investment was agreed at RM2.5 million. The 30% non- controlling interest in FD had a fair value of RM1 million at that date. FD's identifiable net assets had a fair value of RM3 million on 1 January 2019. It was decided to apply the fair BKAR3043 Financial Accounting & Reporting IV value method to calculate goodwill on acquisition, as permitted by MFRS 3 - Business Combinations. The following Statements of Profit or Loss and Other Comprehensive Income and Statements of Financial Position are shown below for both companies as at 31 December 2020. Statements of Profit or Loss and Other Comprehensive Income for the financial year ended 31 December 2020 Sales revenue Cost of sales Gross profit Operating expenses Finance costs Other income Investment income Profit before taxation Taxation Profit for the year 1 Balance brought forward Profit for the year Dividend paid Balance carried forward XT RM'000 3,500 (2,000) 1,500 (210) (30) 320 105 1,685 (150) 1,535 Movement of Retained Earnings for the year ended 31 December 2020 5,655 1,535 FD RM'000 7,190 1,260 (320) 940 (160) (20) 760 (60) 700 1,085 700 (100) 1,685

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

BKAR3043 Financial Accounting Reporting IV Journal entries for the year ended 31 December 2020 Dr Cash RM1000 Dr Equity share capital RM1000 Dr Retain...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started