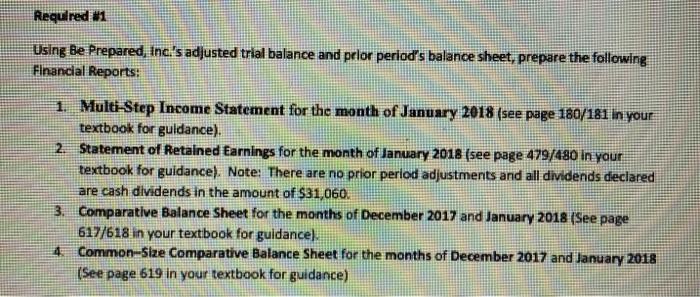

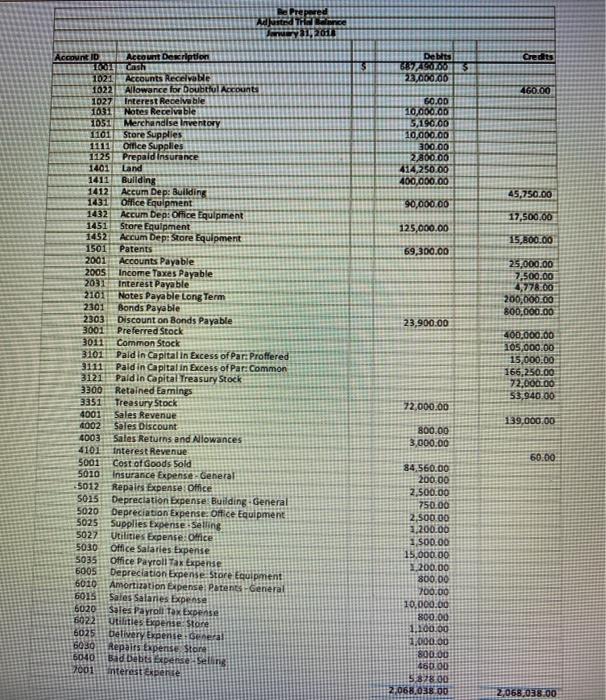

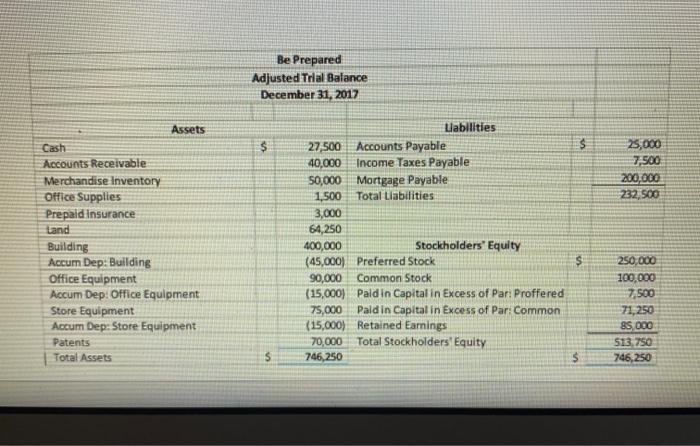

Required 1 Using Be Prepared, Inc.'s adjusted trial balance and pelor period's balance sheet, prepare the following Financial Reports: 1. Multi-Step Income Statement for the month of January 2018 (see page 180/181 in your textbook for guidance). 2. Statement of Retained Earnings for the month of January 2018 (see page 479/480 in your textbook for guidance). Note: There are no prior period adjustments and all dividends declared are cash dividends in the amount of $31,060. 3. Comparative Balance Sheet for the months of December 2017 and January 2018 (See page 617/618 in your textbook for guidance), 4. Common-Size Comparative Balance Sheet for the months of December 2017 and January 2018 (See page 619 in your textbook for guidance) pated Ajusted Handance 312610 Credits 13 Debits 687400 31 23,000/06 460TOO GOOD 10,000.00 3.190.00 10,000.00 300.00 2,800.00 414,250.00 400,000.00 45,750.00 90,000.00 17,500.00 125,000.00 15,800.00 69,300.00 25.000.00 7,500.00 4,776.00 200,000.00 800,000.00 23,900.00 Account ID Account Description CASH 1021 Accounts Receive 16232 Allowance for Doubtful Accounts 1027 Interest Receivable 1031 Notes Receivable 1051 Merchandise Inventory 610 Store Supplies 1111 Office Supplies 1125 Prepaid Insurance 1401 Land 1411 Buliding 1412 Aceum Dep: Building 1431 Office Equipment 1432 Accum Dep: Office Equipment 1451 Store Equipment 1452 Accum Dep: Store Equipment 1501 Patents 2001 Accounts Payable 2005 Income Taxes Payable 2031 Interest Payable 2101 Notes Payable Long Term 2301 Bonds Payable 2303 Discount on Bonds Payable 3001 Preferred Stock 3011 Common Stock 3101 Paldin Capitalin Excess of Par: Proffered 3111 Paldin Capital in Excess of Par: Common 3121 Paldin Capital Treasury Stock 3300 Retained Earnings 3351 Treasury Stock 4001 Sales Revenue 4002 Sales Discount 4003 Sales Returns and Allowances 4101 Interest Revenue 5001 Cost of Goods Sold 5010 Insurance Expense - General 5012 Repairs Expenser Office S015 Depreciation Expenses Building General 5020 Depreciation Expense: Office Equipment 5025 Supplies Expense.Selling 5027 Utilities Expense: Office 5030 Office Salaries Expense 5035 Office Payroll Tax Expense 6005 Depreciation Expense Store Equipment 6010 Amortization Expense. Patents - General 6015 Sales Salaries Expense 6020 Sales Payroll Tax Expense 5022 Utilities Expense Store 6025 Delivery Expenie: Seneral 6030 Repairs Expense Stare 6040 Bad Debt Expensesel 2001 interest expense 400.000.00 105,000.00 15,000.00 166,250.00 72.000.00 53,940.00 72,000.00 139,000.00 800.00 3,000.00 60.00 84,560.00 200.00 2.500.00 750.00 2,500.00 1,200.00 1 500.00 15,000.00 1.200.00 800,00 700.00 10,000.00 800.00 1.100.00 1,000.00 800.00 460.00 5328.00 2.068,038 00 2,068.038.00 Be Prepared Adjusted Trial Balance December 31, 2017 Assets $ $ 25,000 7,500 200,000 232,500 Cash Accounts Receivable Merchandise Inventory Office Supplies Prepaid Insurance Land Building Accum Dep: Building Office Equipment Accum Dep: Office Equipment Store Equipment Accum Dep: Store Equipment Patents Total Assets Labilities 27,500 Accounts Payable 40,000 Income Taxes Payable 50,000 Mortgage Payable 1,500 Total Liabilities 3,000 64,250 400,000 Stockholders' Equity (45,000) Preferred Stock 90,000 Common Stock (15,000) Paldin Capital in Excess of Par: Proffered 75,000 Pald in Capital in Excess of Par Common (15,000) Retained Earnings 70,000 Total Stockholders' Equity 746,250 $ 250,000 100,000 7,500 71,250 85 000 513 750 746,250 $