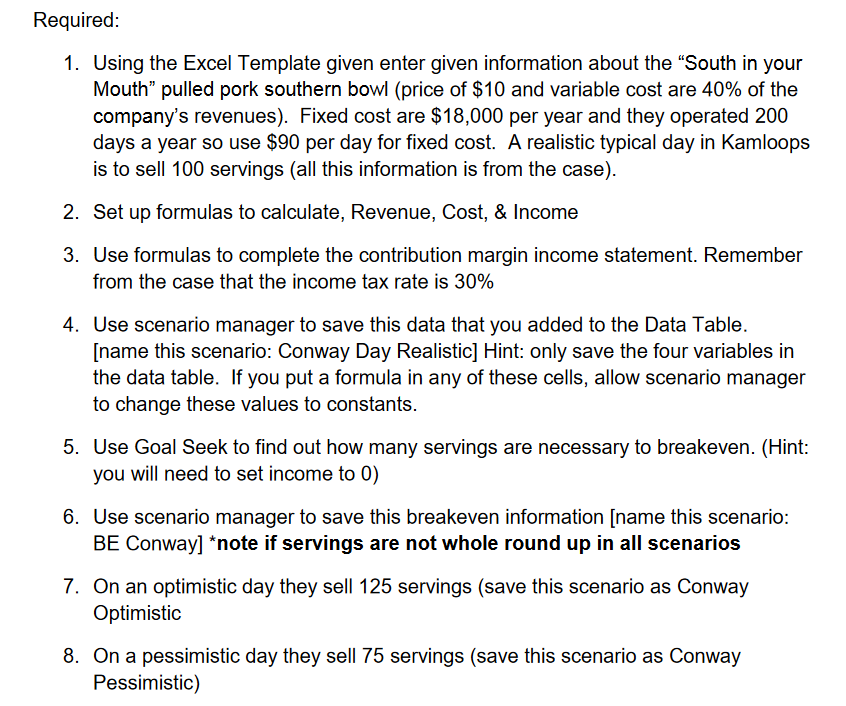

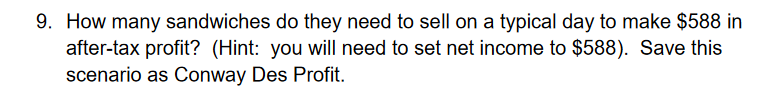

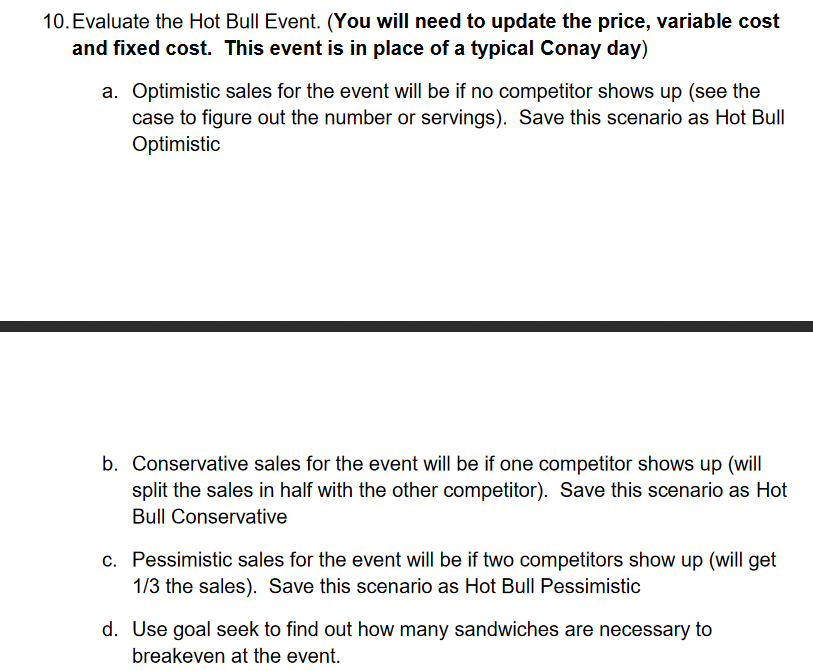

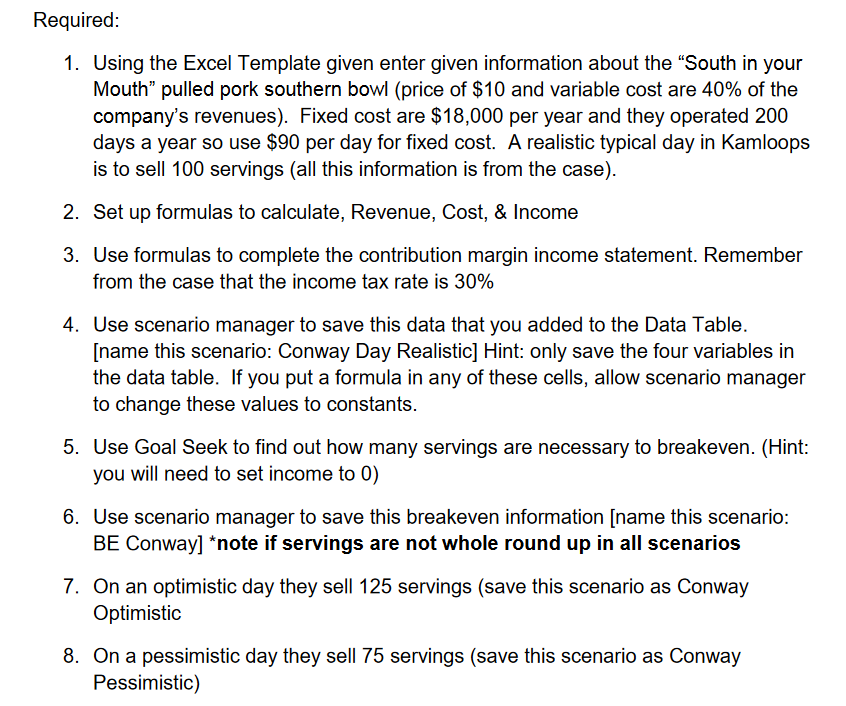

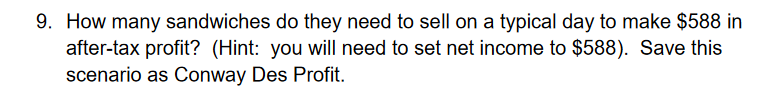

Required 1. Using the Excel Template given enter given information about the "South in your Mouth' pulled pork southern bowl (price of $10 and variable cost are 40% of the company's revenues). Fixed cost are $18,000 per year and they operated 200 days a year so use $90 per day for fixed cost. A realistic typical day in Kamloops is to sell 100 servings (all this information is from the case) 2. Set up formulas to calculate, Revenue, Cost, & Income 3. Use formulas to complete the contribution margin income statement. Remember from the case that the income tax rate is 30% 4. Use scenario manager to save this data that you added to the Data Table name this scenario: Conway Day Realistic] Hint: only save the four variables in the data table. If you put a formula in any of these cells, allow scenario manager to change these values to constants 5. Use Goal Seek to find out how many servings are necessary to breakeven. (Hint you will need to set income to 0) 6. Use scenario manager to save this breakeven information Iname this scenario: BE Conway] "note if servings are not whole round up in all scenarios 7. On an optimistic day they sell 125 servings (save this scenario as Conway Optimistic 8. On a pessimistic day they sell 75 servings (save this scenario as Conway Pessimistic) Required 1. Using the Excel Template given enter given information about the "South in your Mouth' pulled pork southern bowl (price of $10 and variable cost are 40% of the company's revenues). Fixed cost are $18,000 per year and they operated 200 days a year so use $90 per day for fixed cost. A realistic typical day in Kamloops is to sell 100 servings (all this information is from the case) 2. Set up formulas to calculate, Revenue, Cost, & Income 3. Use formulas to complete the contribution margin income statement. Remember from the case that the income tax rate is 30% 4. Use scenario manager to save this data that you added to the Data Table name this scenario: Conway Day Realistic] Hint: only save the four variables in the data table. If you put a formula in any of these cells, allow scenario manager to change these values to constants 5. Use Goal Seek to find out how many servings are necessary to breakeven. (Hint you will need to set income to 0) 6. Use scenario manager to save this breakeven information Iname this scenario: BE Conway] "note if servings are not whole round up in all scenarios 7. On an optimistic day they sell 125 servings (save this scenario as Conway Optimistic 8. On a pessimistic day they sell 75 servings (save this scenario as Conway Pessimistic)