Question

Required 1. what was the balance of investment in miller on Cathy's book as of December 31, 2020 2 what is the amount of equity

Required

Required1. what was the balance of investment in miller on Cathy's book as of December 31, 2020?

2 what is the amount of equity in miller earnings for year 2021

3. what is the amount of noncontrolling interest net income for 2021

4 determine the consolidated total of sales for 2021

5 determine the consolidated total of cost of goods sold for 2021

6 consolidated total of operating expenses for 2021

7. determine the consolidated total of inventory as of December 31 2021

8 determine the consolidated total of buildings as of December 31, 2021

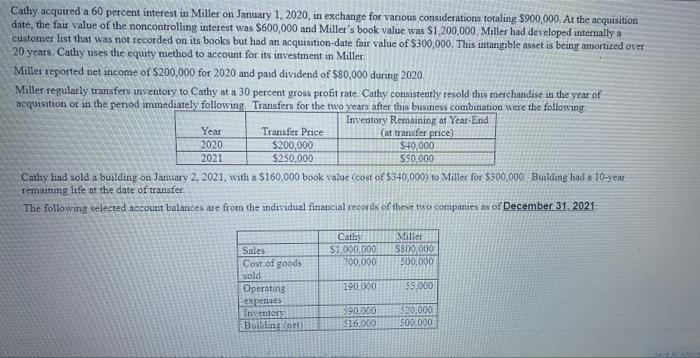

Cathy acquired a 60 percent interest in Miller on January 1, 2020, in exchange for various considerations totaling S900,000. Ar the acquisition date, the fair value of the nomcontrolling interest was $600,000 and Miller's book value was $1,200,000 Miller had developed internally a customer list that was not recorded on its books but had an acquisition-date fair value of S300,000. This intangible asset is being amortized over 20 years. Cathy uses the equity method to account for its investment in Miller. Miller reported net income of $200,000 for 2020 and paid dividend of $80,000 during 2020. Miller regularly transfers inventory to Cathy at a 30 percent gross profit rate Cathy consistently resold this merchandise in the year of acquisition or in the penod immediately following. Transfers for the two years after this business combination were the following Inventory Remaining at Year-End (at transfer price) $40,000 S50,000 Year Transfer Price 2020 $200,000 $250,000 2021 Cathy had sold a building on January 2, 2021, with a S160,000 book value (cost of $340,000) to Miller for $300,000 Building had a 10-year remaining life at the dare of transfer. The following selected account balances are from the individual financial records of these two companies as of December 31, 2021 Cathy $1.000.000 700,000 Miller SS00,000 500,000 Sales Cost of goods sold 190.000 155.000 Operating expenses Inventery Buildang (net) 320,000 500.000 390.000 $16.000

Step by Step Solution

3.61 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 The balance of investment in Miller on Cathys book as of December 31 2020 is 1200000 2 The amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started