Question

REQUIRED: 1.1) Calculate the revenue generated from the laptops sold during November 2023. 1.2) Discuss and calculate in terms of IAS 2 Inventories what the

REQUIRED:

1.1) Calculate the revenue generated from the laptops sold during November 2023.

1.2) Discuss and calculate in terms of IAS 2 Inventories what the additional cost per laptop will be. Reasons to support your inclusion or exclusion of an amount should be provided.

1.3) Calculate the cost price of the laptops sold on the 10th of November 2023.

1.4) Calculate the cost price of the laptops sold on the 17th of November 2023.

1.5) Prepare the general journal entries to account for all the laptops sold during the month of November 2023. Note: All the calculations performed in 1.1,1.3 and 1.4 will be used in your response. Journal dates and narrations are not required.

1.6) Prepare the general journal entries to account for the purchase of laptops made on the 15th of November 2023. Only general journal entries relating to the month of November 2023 are required. Journal dates and narrations are not required.

1.7) Due to a newer model of the Pro-line laptop being released on the 15th of December 2023, the current Pro-line V1 is being replaced by the V2. The Pro- line V1 can currently be sold, during November 2023, at R1 250 (excluding VAT) per unit with selling costs amounting to R150 (excluding VAT) per unit. Calculate the closing stock value of laptops to be disclosed in the Statement of Financial Position of Computerworld (Pty) Ltd on the 30th of November 2023. Note: You are not required to prepare the Statement of Financial Position.

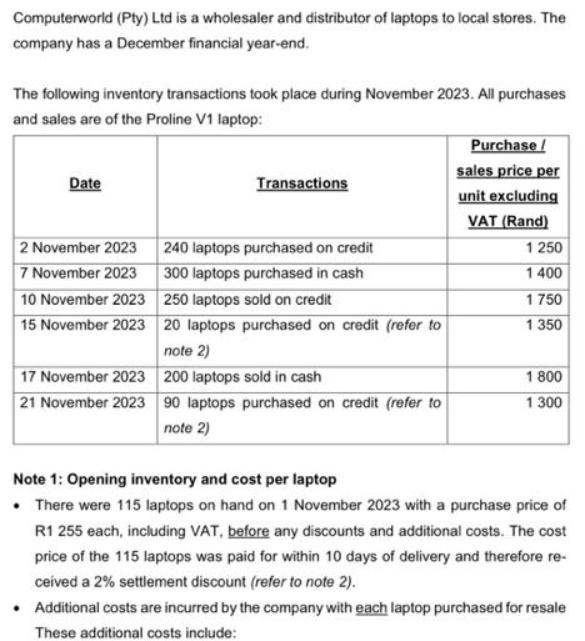

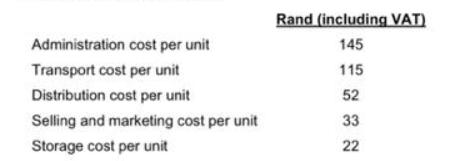

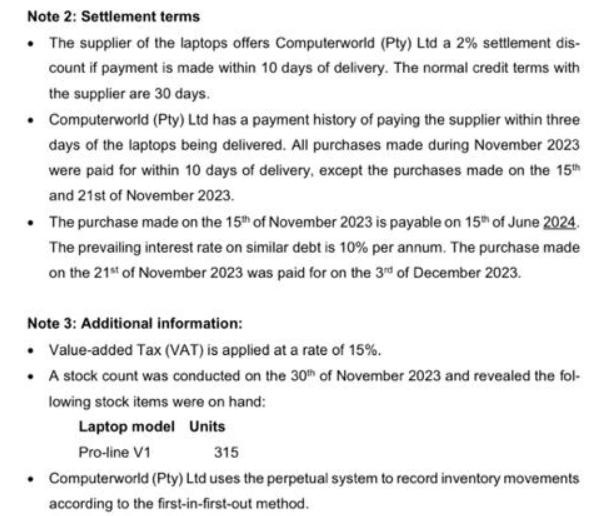

Computerworld (Pty) Ltd is a wholesaler and distributor of laptops to local stores. The company has a December financial year-end. The following inventory transactions took place during November 2023. All purchases and sales are of the Proline V1 laptop: Date 2 November 2023 7 November 2023 10 November 2023 15 November 2023 17 November 2023 21 November 2023 Transactions 240 laptops purchased on credit 300 laptops purchased in cash 250 laptops sold on credit 20 laptops purchased on credit (refer to note 2) 200 laptops sold in cash 90 laptops purchased on credit (refer to note 2) Purchase/ sales price per unit excluding VAT (Rand) 1250 1400 1750 1 350 1800 1 300 Note 1: Opening inventory and cost per laptop There were 115 laptops on hand on 1 November 2023 with a purchase price of R1 255 each, including VAT, before any discounts and additional costs. The cost price of the 115 laptops was paid for within 10 days of delivery and therefore re- ceived a 2% settlement discount (refer to note 2). Additional costs are incurred by the company with each laptop purchased for resale These additional costs include:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 11 To calculate the revenue generated from the laptops sold during November 2023 we need to determine the number of laptops sold and the selling price per unit On November 10 250 laptops were ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started