Answered step by step

Verified Expert Solution

Question

1 Approved Answer

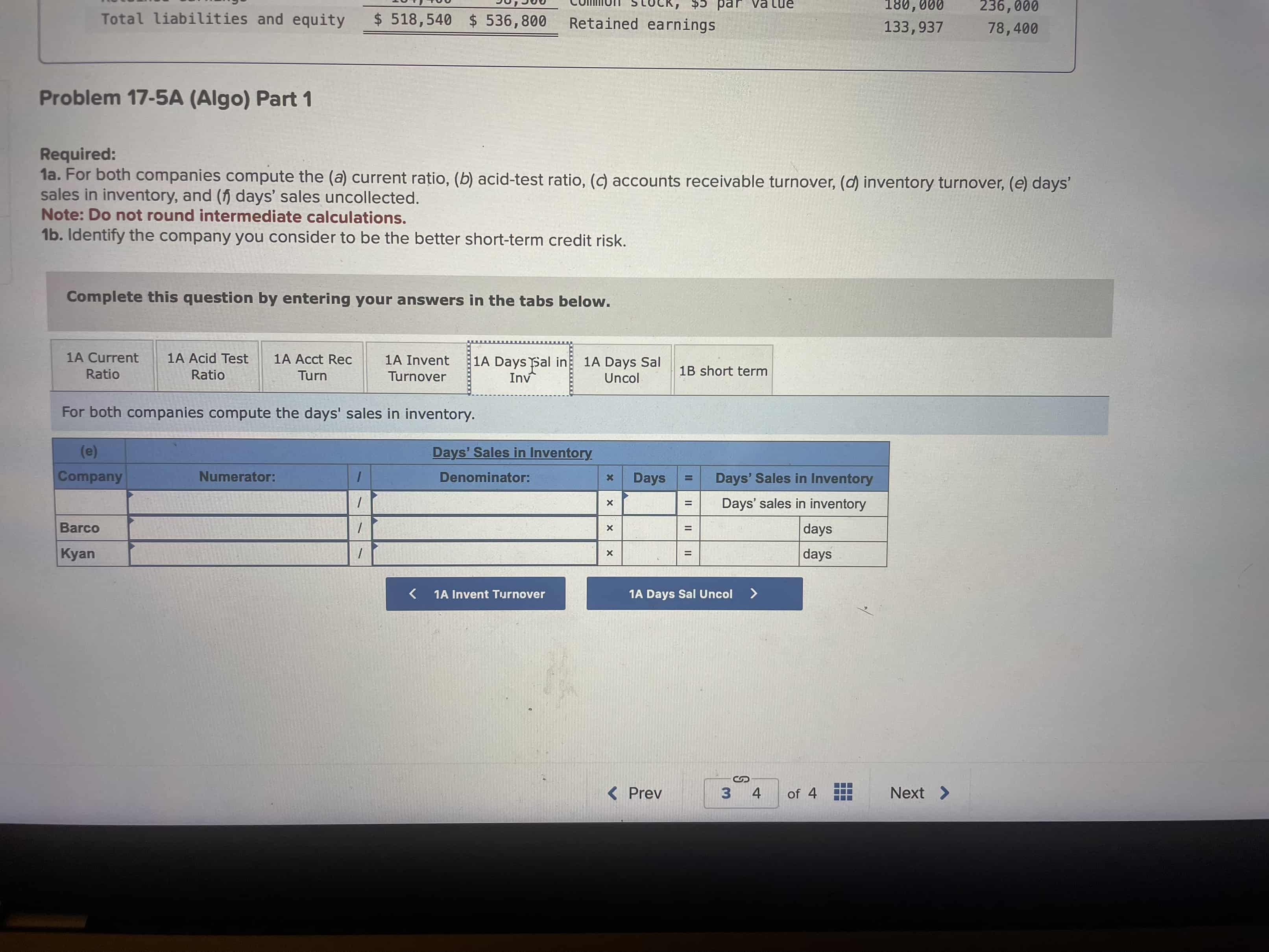

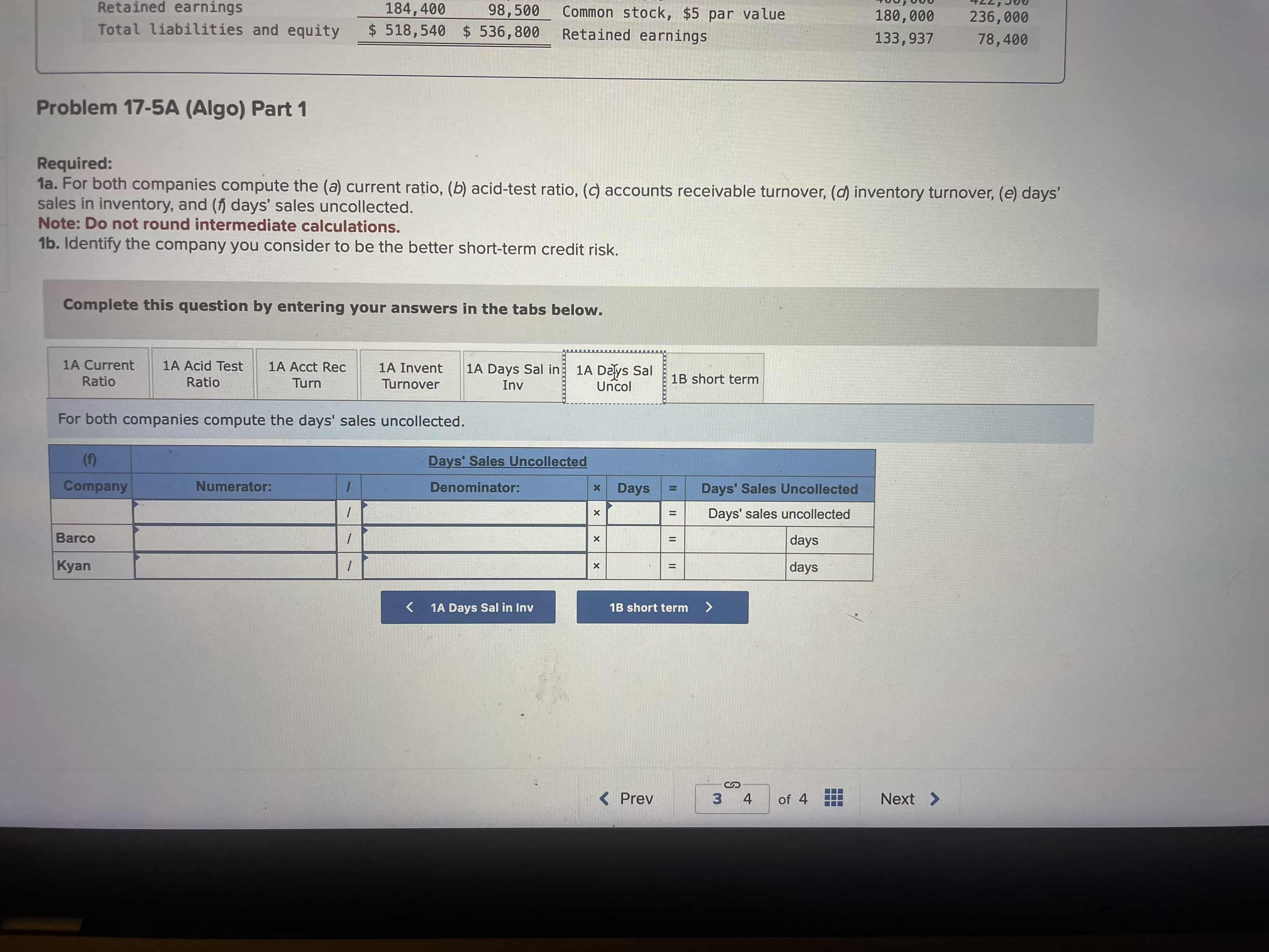

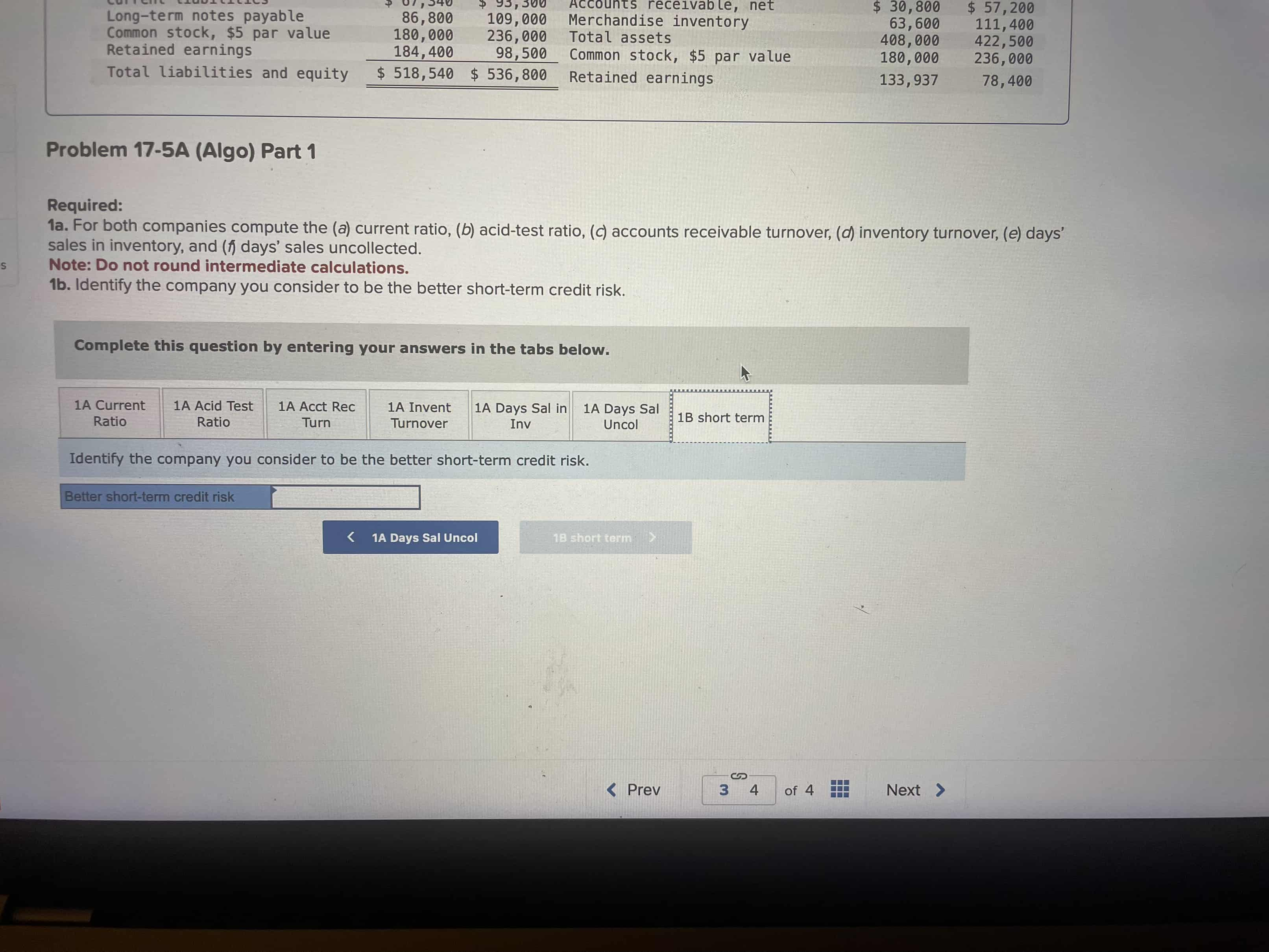

Required: 1a. For both companies compute the (a) current ratio, ( (b) ) acid-test ratio, ( (c) ) accounts receivable turnover, ( (d) ) inventory

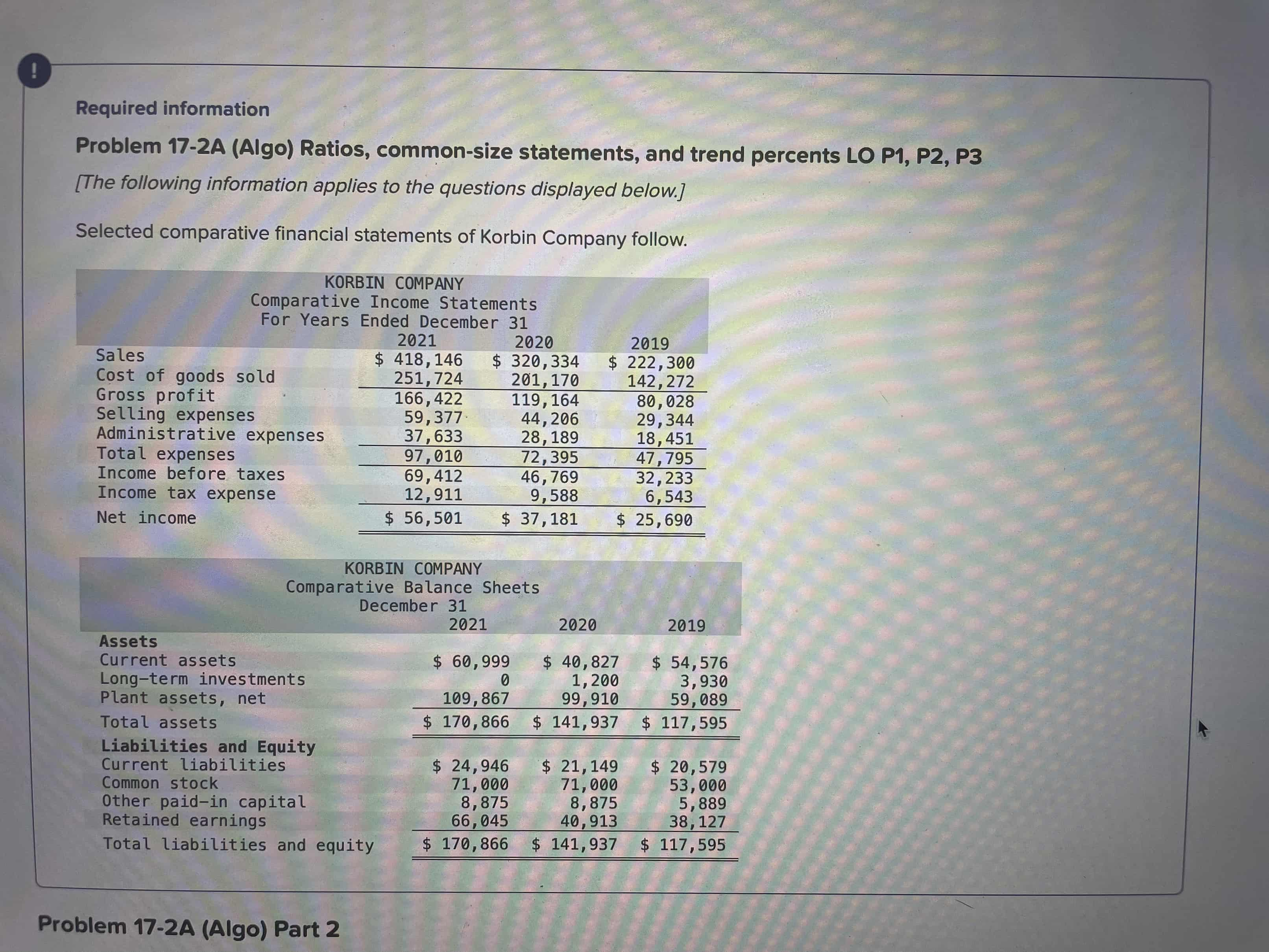

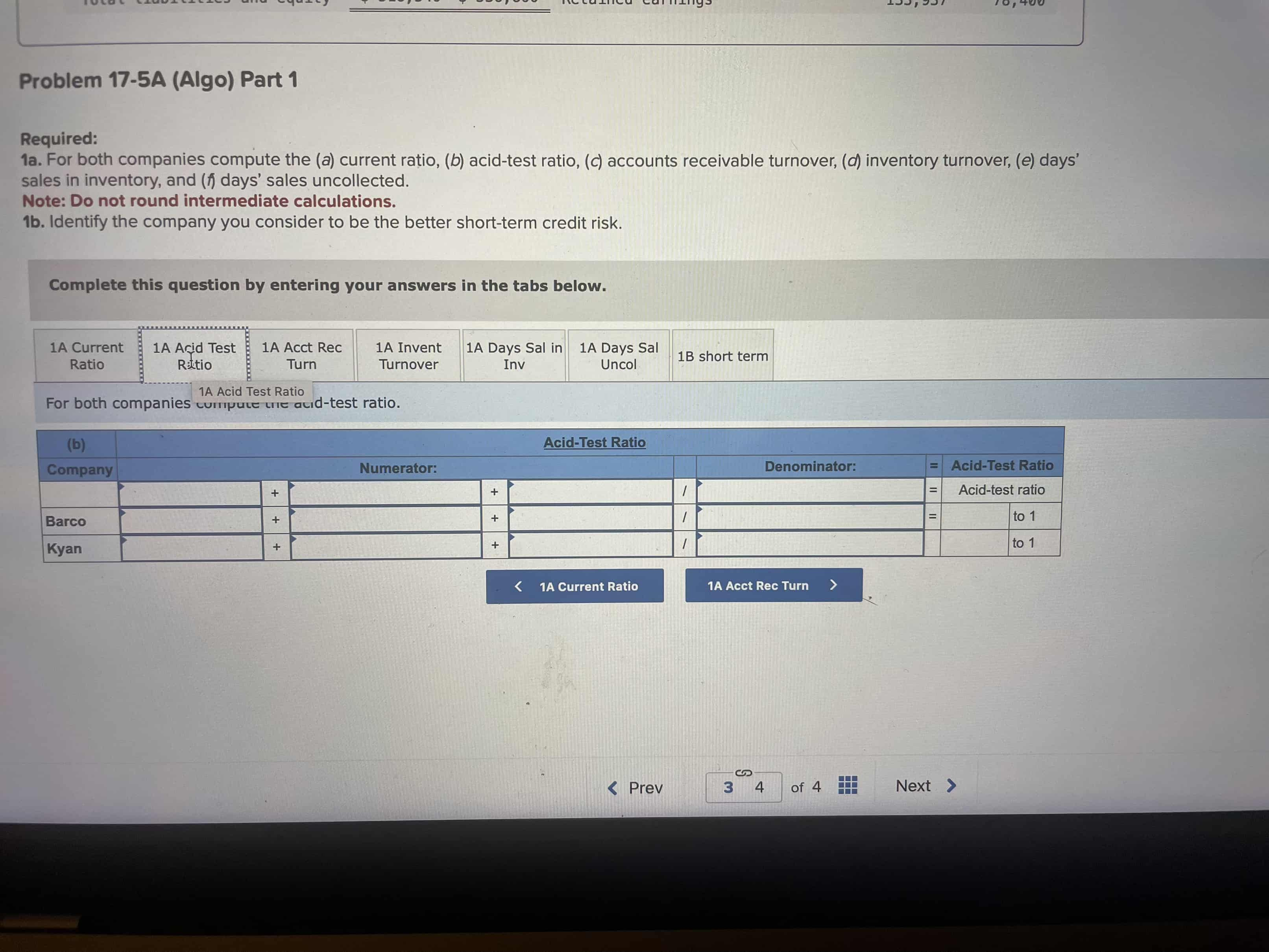

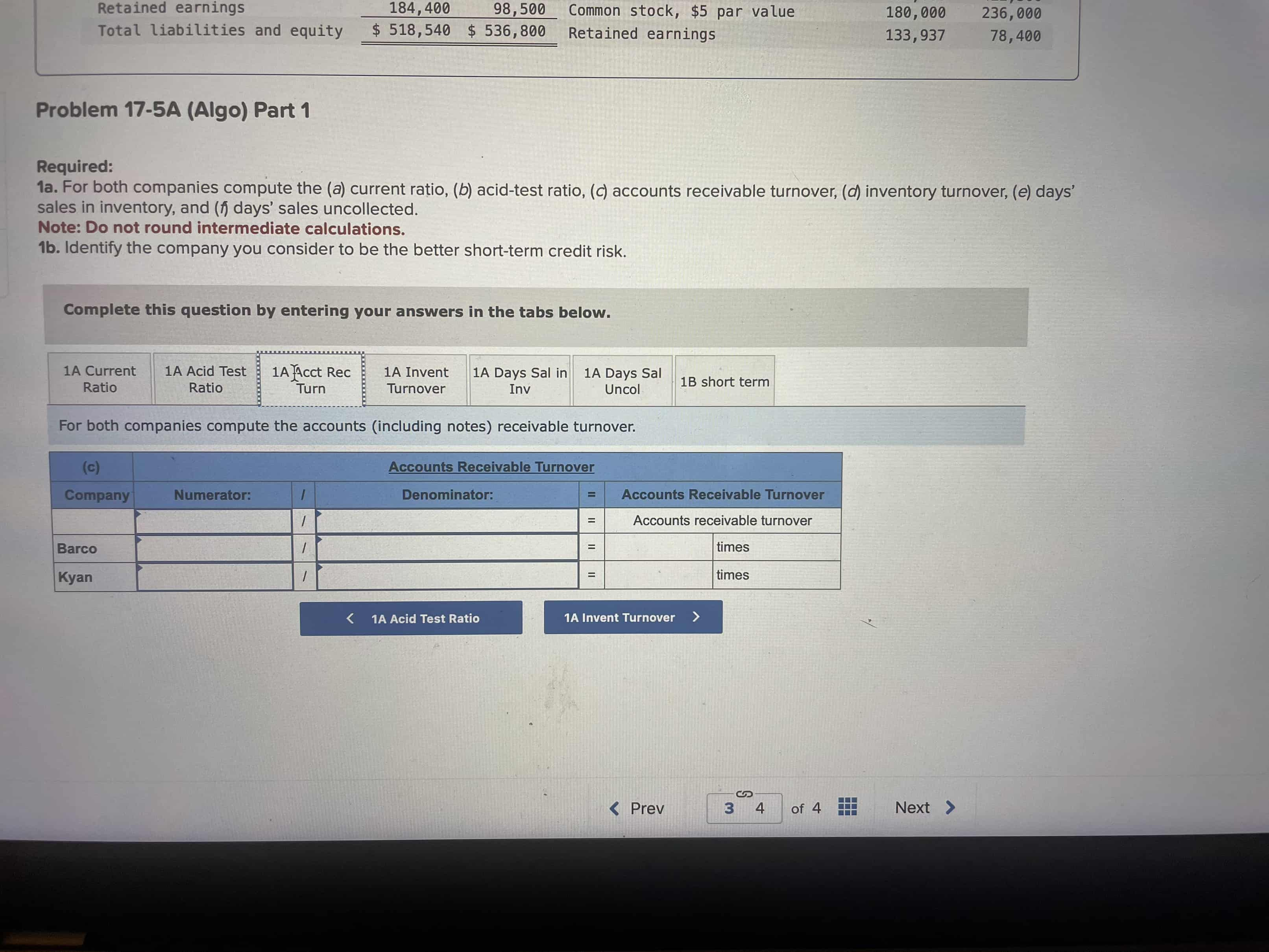

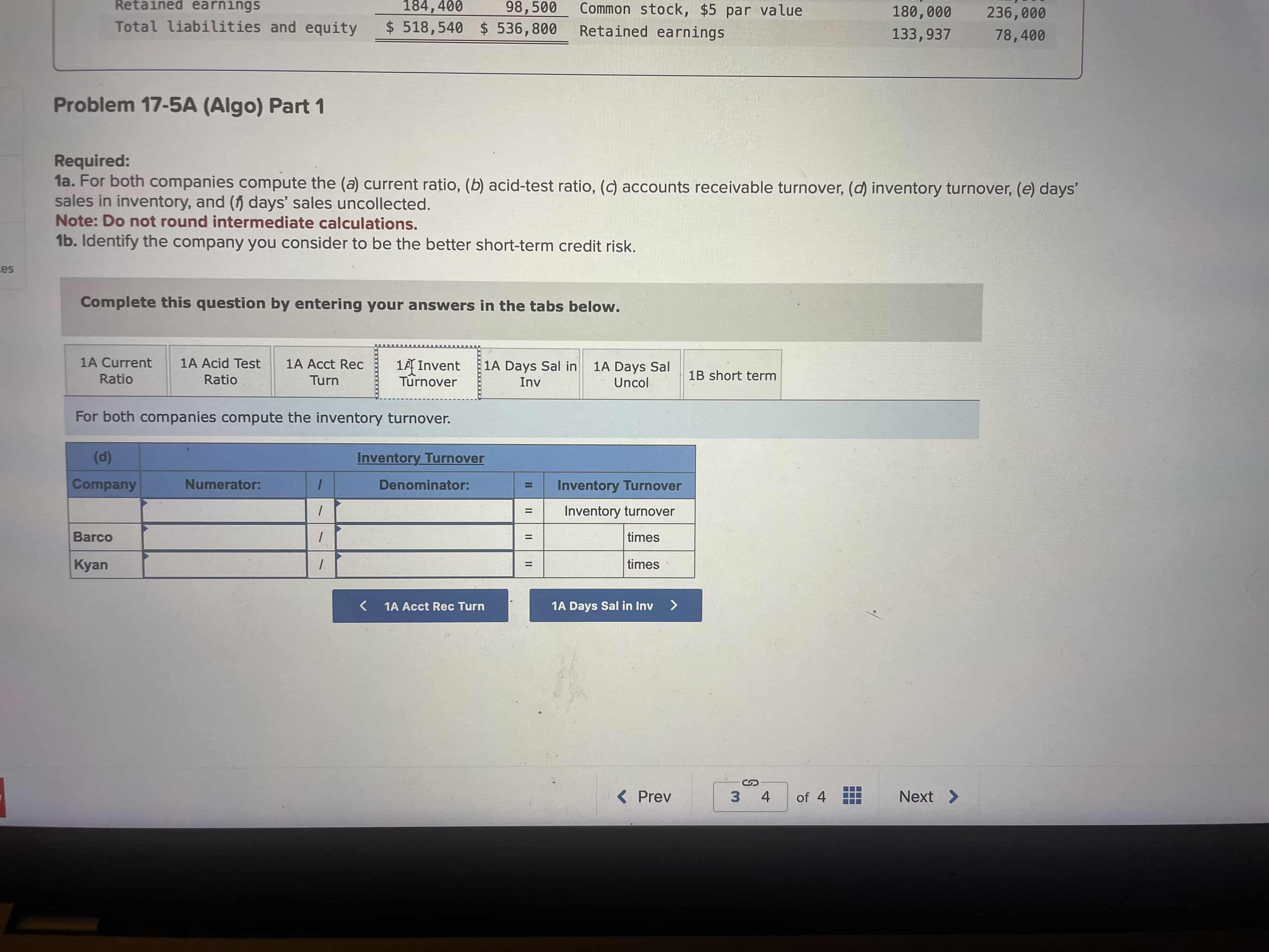

Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, \\( (d) \\) inventory turnover, \\( (e) \\) days' sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, \\( (d) \\) inventory turnover, \\( (e) \\) days' sales in inventory, and \\( (f) \\) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, (c) accounts receivable turnover, ( \\( d \\) ) inventory turnover, \\( (e) \\) days' sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. \\( 1 \\mathrm{~B} \\) short term For both companies compute the days' sales uncollected. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, ( \\( d \\) ) inventory turnover, (e) days sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1B short term For both companies compute the inventory turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days sales in inventory, and \\( (f) \\) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivable turnover. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, \\( (d) \\) inventory turnover, \\( (e) \\) days' sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk. Required information Problem 17-2A (Algo) Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. Problem 17-2A (Algo) Part 2 Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, \\( (d) \\) inventory turnover, \\( (e) \\) days' sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, \\( (d) \\) inventory turnover, \\( (e) \\) days' sales in inventory, and \\( (f) \\) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, (c) accounts receivable turnover, ( \\( d \\) ) inventory turnover, \\( (e) \\) days' sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. \\( 1 \\mathrm{~B} \\) short term For both companies compute the days' sales uncollected. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, ( \\( d \\) ) inventory turnover, (e) days sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1B short term For both companies compute the inventory turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days sales in inventory, and \\( (f) \\) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivable turnover. Required: 1a. For both companies compute the (a) current ratio, \\( (b) \\) acid-test ratio, \\( (c) \\) accounts receivable turnover, \\( (d) \\) inventory turnover, \\( (e) \\) days' sales in inventory, and ( \\( f \\) ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk. Required information Problem 17-2A (Algo) Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. Problem 17-2A (Algo) Part 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started