Question

Required: 1-a. Prepare a classified consolidated statement of income (with earnings per share) for the current year. The number of shares outstanding used in the

Required:

1-a. Prepare a classified consolidated statement of income (with earnings per share) for the current year. The number of shares outstanding used in the computation of earnings per share was 48,338.

1-b. Prepare a consolidated balance sheet for the current year.

2. Compute gross profit percentage and return on assets. Total assets at the beginning of the year were $737,545.

Prepare a classified consolidated statement of income (with earnings per share) for the current year. The number of shares outstanding used in the computation of earnings per share was 48,338. (Enter your answers in thousands. Round "Basic earnings per share" to 2 decimal places.)

| |||||||||||||||||||||||||||||||||||||||||

Prepare a consolidated balance sheet for the current year. (Amounts to be deducted should be indicated by a minus sign. Enter your answers in thousands.)

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Compute gross profit percentage and return on assets. Total assets at the beginning of the year were $737,545. (Enter your answers in thousands. Round your answers to 1 decimal place.)

| |||||||||||||||||||||||||||||||||||||

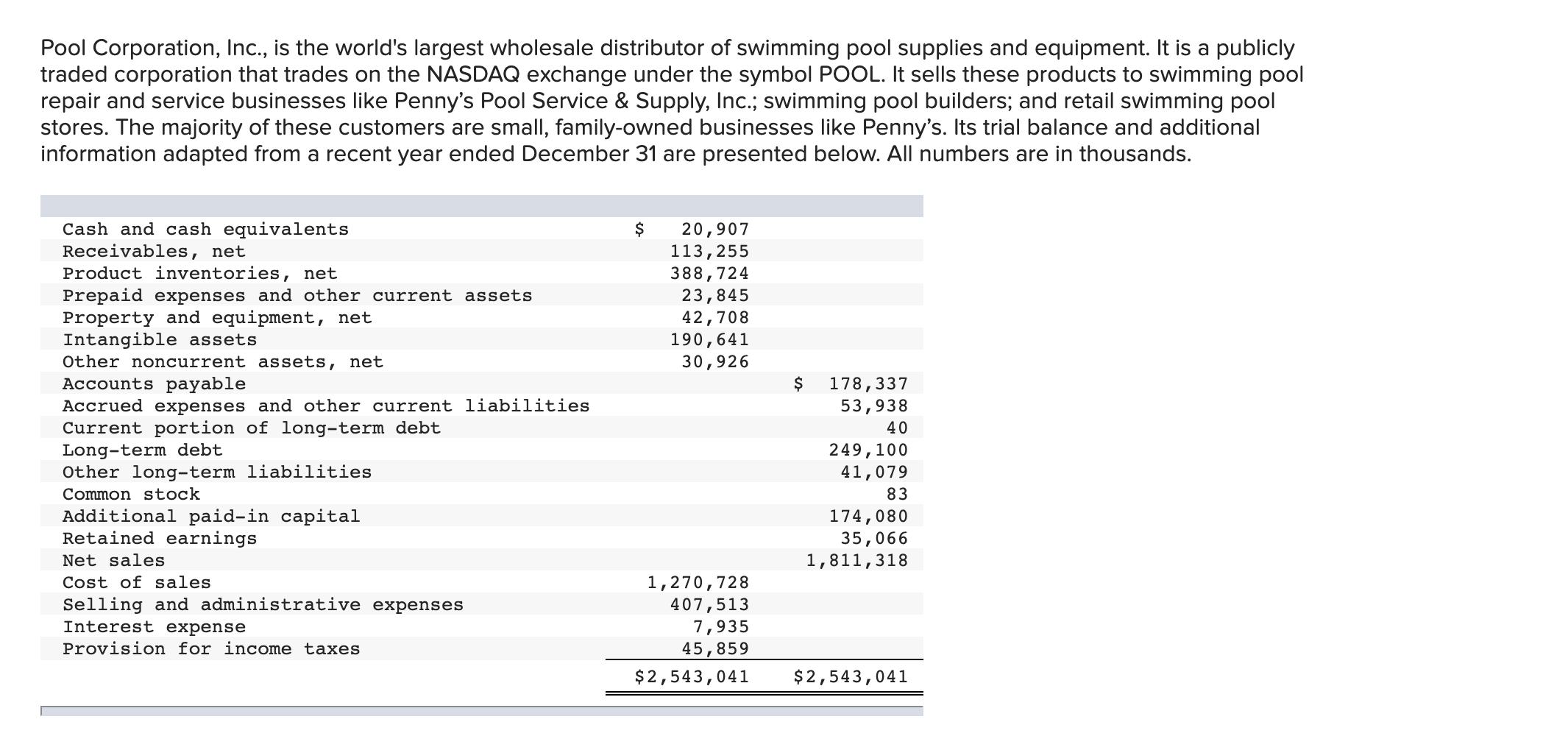

Pool Corporation, Inc., is the world's largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange under the symbol POOL. It sells these products to swimming pool repair and service businesses like Penny's Pool Service & Supply, Inc.; swimming pool builders; and retail swimming pool stores. The majority of these customers are small, family-owned businesses like Penny's. Its trial balance and additional information adapted from a recent year ended December 31 are presented below. All numbers are in thousands. Cash and cash equivalents Receivables, net Product inventories, net Prepaid expenses and other current assets Property and equipment, net Intangible assets Other noncurrent assets, net Accounts payable Accrued expenses and other current liabilities Current portion of long-term debt Long-term debt Other long-term liabilities Common stock Additional paid-in capital Retained earnings Net sales Cost of sales Selling and administrative expenses Interest expense Provision for income taxes $ 20,907 113,255 388,724 23,845 42,708 190,641 30,926 1,270,728 407,513 7,935 45,859 $2,543,041 $ 178,337 53,938 40 249,100 41,079 83 174,080 35,066 1,811,318 $2,543,041

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Net Sales Cost of sales Gross profit POOL CORPORATION INC Consolidated Statement of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started