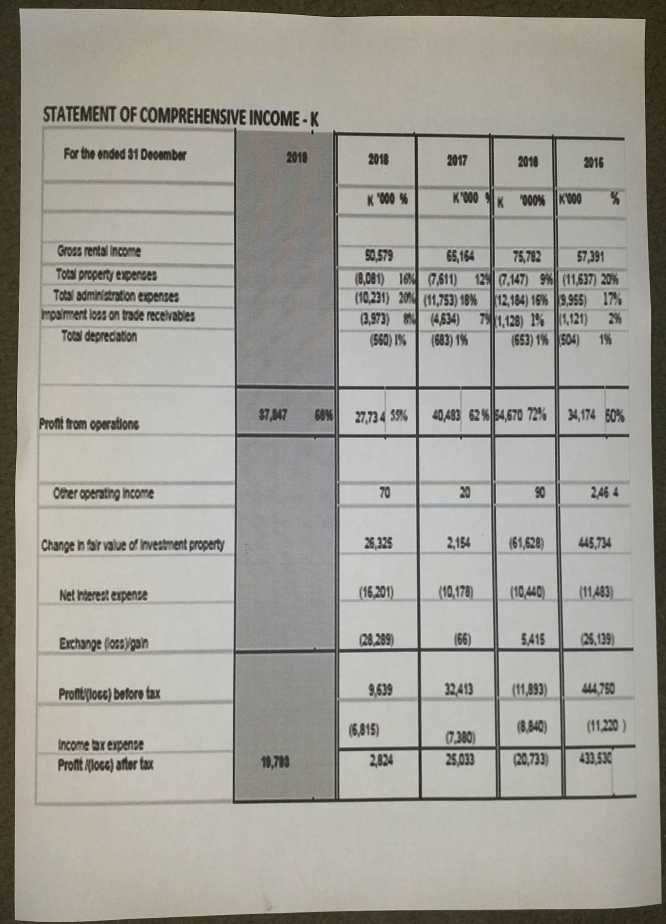

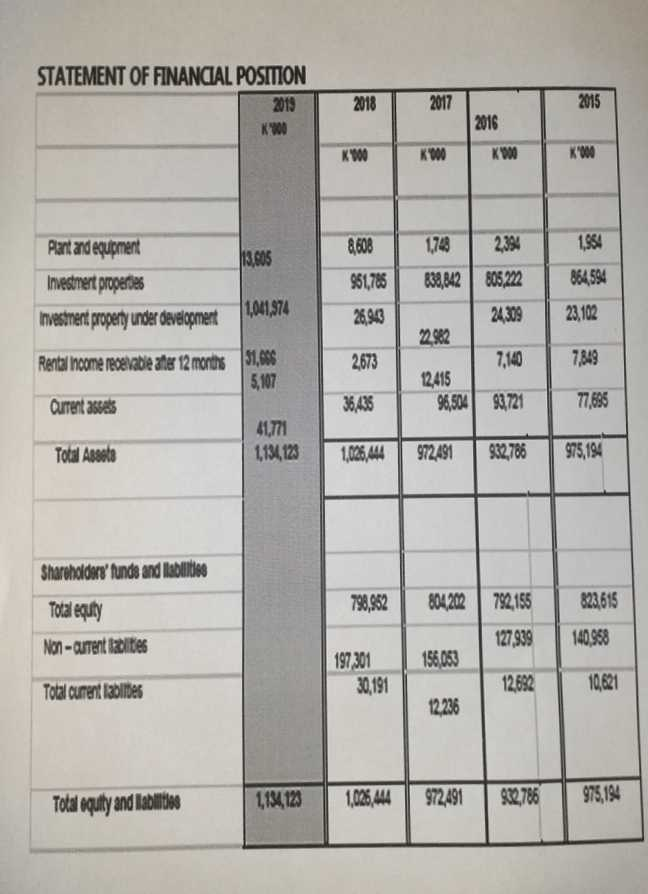

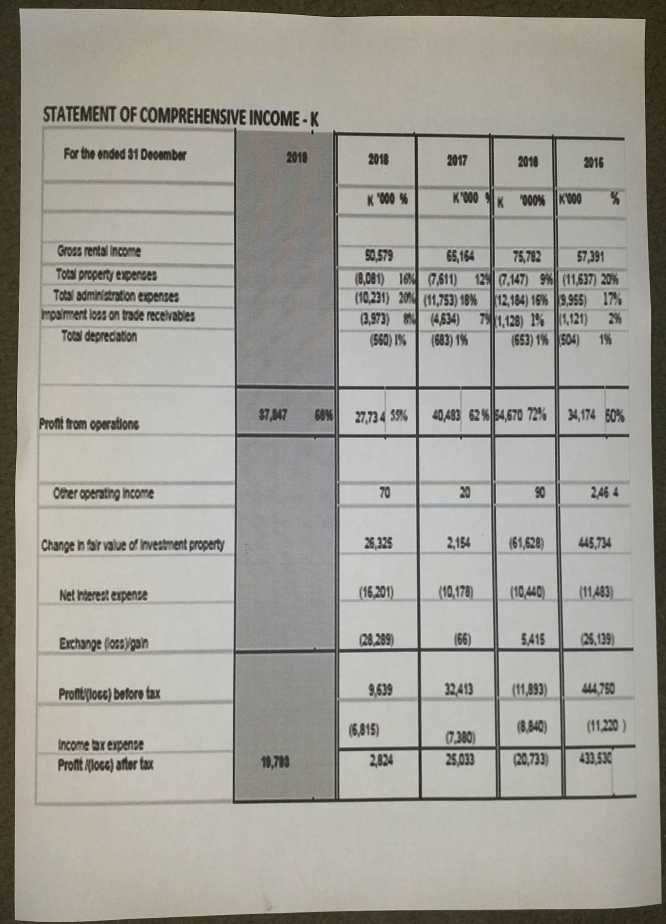

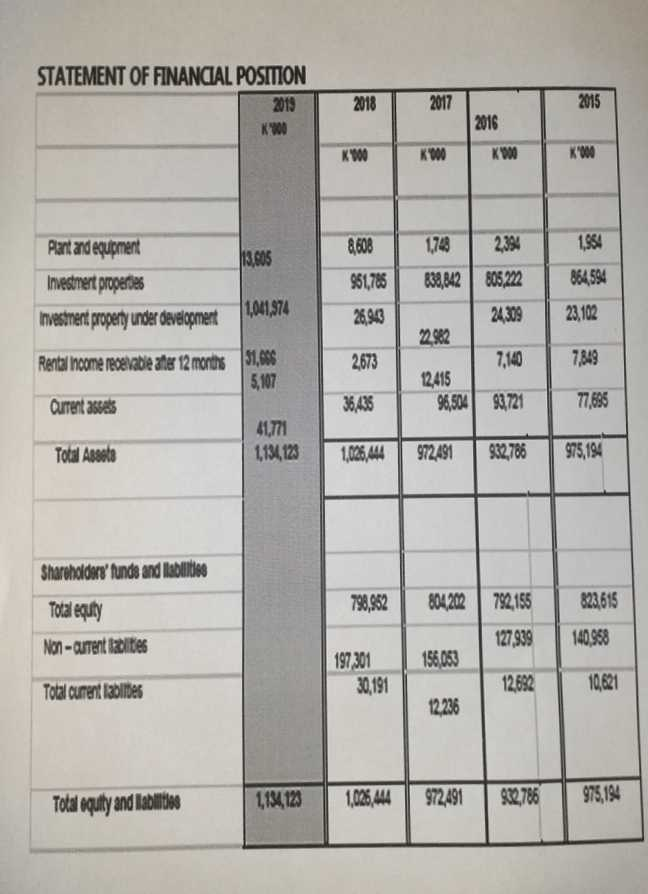

Required a) Citing relevant accounting standards discuss and explain how the interest expense during construction would have been accounted for in the financial statement.. b) Compute the interest that you think has been expensed by the accountants relating to the construction for the years 2017 and 2018. c) Basing on the explanation in (a) above prepare all the necessary Journal entries to correct and update the books relating to the cost of this asset d) Prepare the new Income statement and the statement of financial position for 2017, 2018 and 2019 after recording the adjustments in (c) above e) Explain why it's important for accountants to be up to date with the financial accounting standard by, discussing the effect that the above adjustment on the finance costs have on the profit before tax for in 2017, 2018, 2019 and its impact on the shareholders and potential investors 1 After noticing the above anomaly relating to how the finance cost was recorded, you suspect that may be the issue of the bond on January 1 2017 had some anomaly also, but after checking you discover that it was properly recorded. Prepare all the journal entries that were made by the accountants relating to this bond issue for the year 2017, 2018 and 2019 that have made you to conclude that the bond issue was properly recorded. STATEMENT OF COMPREHENSIVE INCOME-K For the onded 31 December 2018 2018 2017 2018 2016 K 600 % K'000K 1000% K 000 % Gross rental income Total property expenses Total administration expenses mpalment is on trade receivables Tois deprecation 50,579 75,762 57,391 18,081) 168,611) 120.147) 9611,637) 20h (10,231) 20 (11,753) 18% 12,184) 16% 9,955) 17% (3,973) (4634) 791,128) % 1,121) 2% (560) IS (683) 15 1653) 15 504) 15 $7,847 68% 27,734 39% Pront from operations 40,483 62%|54,670 72% 34,174 50% Ofer operating income 70 90 2,464 Change in fair value of Investment property 23,325 2,154 161,628 445,734 Net interest expense (16,201) (10,178) (10,440) Exchange forsygan 28,289 166) 5415 125,139 Prontylocc) boforo tax 9,639 (11,893) 44,750 (8,840) (11.220) Income ax expense Pront Hotel attor tax (6,815) 2834 0.380 25,033 (20,733 433,5% STATEMENT OF FINANCIAL POSITION 2019 K00 2018 2017 2015 2016 KW KW 8608 1984 13,005 Pant and equipment Investment properties Investment property under development 1,748 838,842 2,384 8052 864,594 1,041,974 951,785 26,90 24309 23,102 2673 7,849 Rental income recevable ate 12 months $1,096 5,107 Current 35648 41,771 Total Aseste 1,134,123 7.140 12,415 96,504 93,721 36,438 77.696 1,026,444 972,491 932,786 975,194 Shareholders' funds and abilities Total equity Non-autent les 798,952 804202792,155 823,615 127,939 140,988 158,053 197301 30,191 Total aumentales 12682 10,621 12236 1,134,123 Total equity and Tablete 1,026,444 972,491 82,786 975,194 Required a) Citing relevant accounting standards discuss and explain how the interest expense during construction would have been accounted for in the financial statement.. b) Compute the interest that you think has been expensed by the accountants relating to the construction for the years 2017 and 2018. c) Basing on the explanation in (a) above prepare all the necessary Journal entries to correct and update the books relating to the cost of this asset d) Prepare the new Income statement and the statement of financial position for 2017, 2018 and 2019 after recording the adjustments in (c) above e) Explain why it's important for accountants to be up to date with the financial accounting standard by, discussing the effect that the above adjustment on the finance costs have on the profit before tax for in 2017, 2018, 2019 and its impact on the shareholders and potential investors 1 After noticing the above anomaly relating to how the finance cost was recorded, you suspect that may be the issue of the bond on January 1 2017 had some anomaly also, but after checking you discover that it was properly recorded. Prepare all the journal entries that were made by the accountants relating to this bond issue for the year 2017, 2018 and 2019 that have made you to conclude that the bond issue was properly recorded. STATEMENT OF COMPREHENSIVE INCOME-K For the onded 31 December 2018 2018 2017 2018 2016 K 600 % K'000K 1000% K 000 % Gross rental income Total property expenses Total administration expenses mpalment is on trade receivables Tois deprecation 50,579 75,762 57,391 18,081) 168,611) 120.147) 9611,637) 20h (10,231) 20 (11,753) 18% 12,184) 16% 9,955) 17% (3,973) (4634) 791,128) % 1,121) 2% (560) IS (683) 15 1653) 15 504) 15 $7,847 68% 27,734 39% Pront from operations 40,483 62%|54,670 72% 34,174 50% Ofer operating income 70 90 2,464 Change in fair value of Investment property 23,325 2,154 161,628 445,734 Net interest expense (16,201) (10,178) (10,440) Exchange forsygan 28,289 166) 5415 125,139 Prontylocc) boforo tax 9,639 (11,893) 44,750 (8,840) (11.220) Income ax expense Pront Hotel attor tax (6,815) 2834 0.380 25,033 (20,733 433,5% STATEMENT OF FINANCIAL POSITION 2019 K00 2018 2017 2015 2016 KW KW 8608 1984 13,005 Pant and equipment Investment properties Investment property under development 1,748 838,842 2,384 8052 864,594 1,041,974 951,785 26,90 24309 23,102 2673 7,849 Rental income recevable ate 12 months $1,096 5,107 Current 35648 41,771 Total Aseste 1,134,123 7.140 12,415 96,504 93,721 36,438 77.696 1,026,444 972,491 932,786 975,194 Shareholders' funds and abilities Total equity Non-autent les 798,952 804202792,155 823,615 127,939 140,988 158,053 197301 30,191 Total aumentales 12682 10,621 12236 1,134,123 Total equity and Tablete 1,026,444 972,491 82,786 975,194