Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required- A) compute risk adjusted net present value for each model. B) which investment should Mr. John accept if the two investment are mutually exclusive

required- A) compute risk adjusted net present value for each model. B) which investment should Mr. John accept if the two investment are mutually exclusive C) should Mr. John accept both investment if there was no capital rationing.

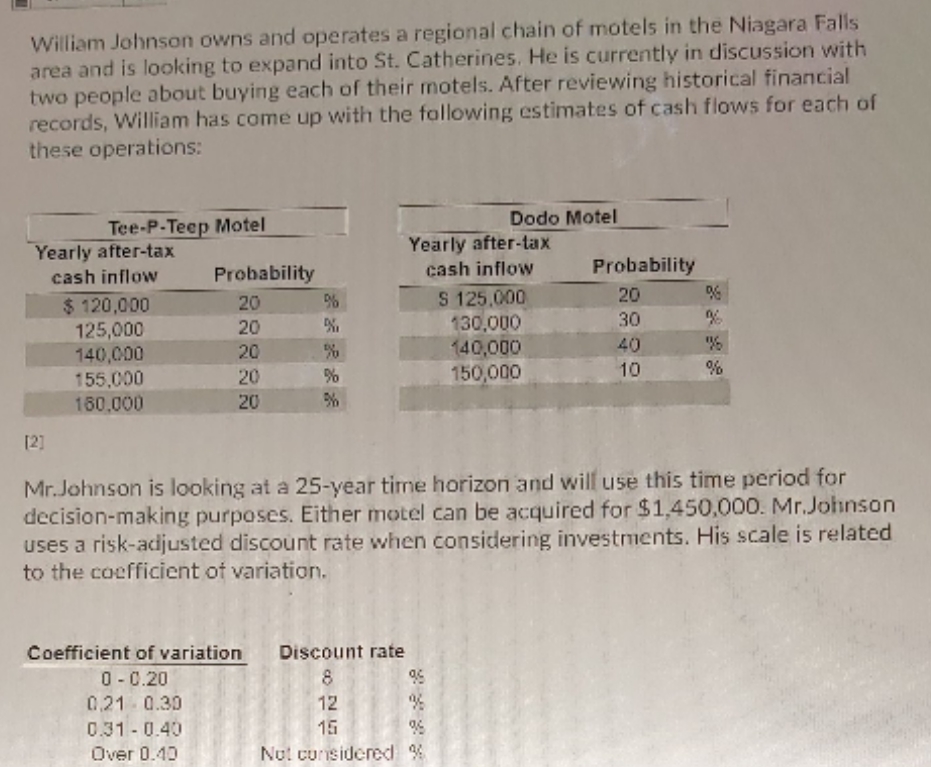

William Johnson owns and operates a regional chain of motels in the Niagara Falls area and is looking to expand into St. Catherines. He is currently in discussion with two people about buying each of their motels. After reviewing historical financial records, William has come up with the following estimates of cash flows for each of these operations: Tee-P-Teep Motel Dodo Motel Yearly after-tax Yearly after-tax cash inflow Probability cash inflow Probability $ 120,000 20 % S 125,000 20 % 125,000 20 % 130,000 30 % 140,000 20 % 140,000 40 6 155,000 20 % 150,000 10 % 180,000 20 % [2] Mr.Johnson is looking at a 25-year time horizon and will use this time period for decision-making purposes. Either motel can be acquired for $1,450,000. Mr.Johnson uses a risk-adjusted discount rate when considering investments. His scale is related to the coefficient of variation. Coefficient of variation Discount rate 0-0.20 0.21 0.30 826 12 % 15 % Over 0.40 Not considered % 0.31-0.40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

For the TeePTeep Motel Expected cash inflow 120000 020 125000 020 140000 020 156000 020 18000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started