Answered step by step

Verified Expert Solution

Question

1 Approved Answer

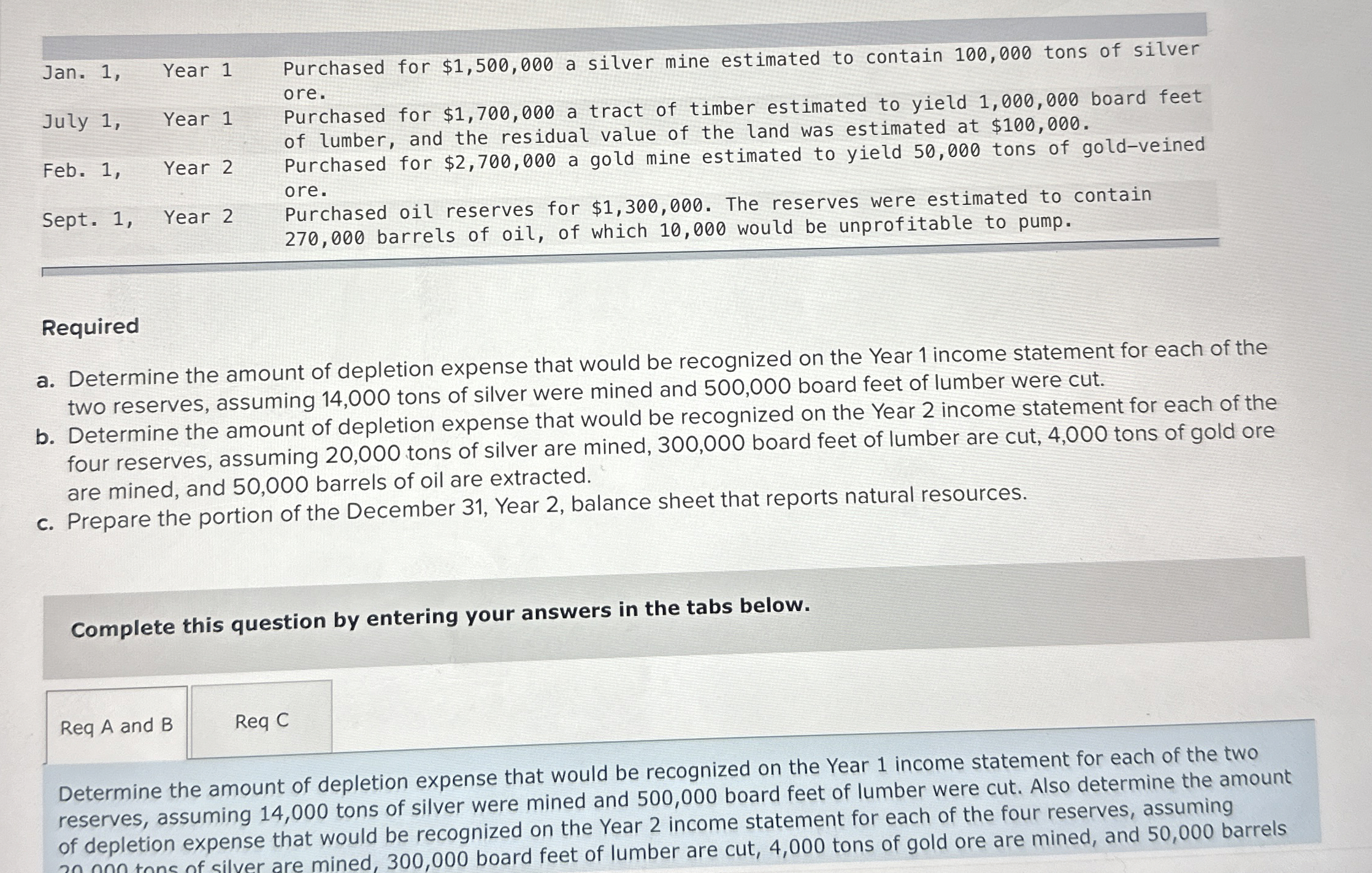

Required a . Determine the amount of depletion expense that would be recognized on the Year 1 income statement for each of the two reserves,

Required

a Determine the amount of depletion expense that would be recognized on the Year income statement for each of the

two reserves, assuming tons of silver were mined and board feet of lumber were cut.

b Determine the amount of depletion expense that would be recognized on the Year income statement for each of the

four reserves, assuming tons of silver are mined, board feet of lumber are cut, tons of gold ore

are mined, and barrels of oil are extracted.

c Prepare the portion of the December Year balance sheet that reports natural resources.

Complete this question by entering your answers in the tabs below.

Req A and

Determine the amount of depletion expense that would be recognized on the Year income statement for each of the two

reserves, assuming tons of silver were mined and board feet of lumber were cut. Also determine the amount

of depletion expense that would be recognized on the Year income statement for each of the four reserves, assuming

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started