Question

Required: A. Determine the annual financing costs using the following strategy: Determine the permanent funds requirement. Insert the permanent funds amount in Column A. Finance

Required:

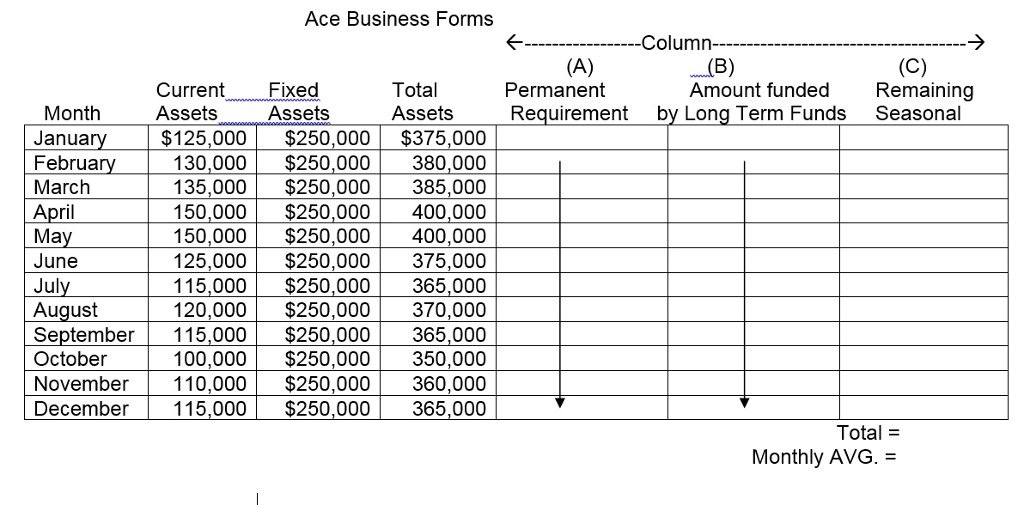

A. Determine the annual financing costs using the following strategy:

Determine the permanent funds requirement. Insert the permanent funds amount in Column A.

Finance all permanent funds plus $25,000 per month of seasonal funds with long term debt. Insert amount funded by long term funds in Column B.

Finance the average monthly seasonal funds (Insert each month amount in Column C, determine average monthly amount) with short term debt.

The cost of long term funds is 10%.

The cost of short term funds is 8%.

The total financing cost is: ____________________

B. Pick one: This is an example of a(n)_____ _____ strategy.

aggressive conservative trade-off

Ace Business Forms Column CurrentFixed Assets Total Assets Permanent Requirement (B) Amount fundedRemaining Assets by Long Ter m Funds Seasonal Month Januar Februa March April $125,000$250,000 $375,000 130,000$250,000380,000 135,000$250,000 385,000 150,000$250,000400,000 150,000$250,000 400,000 125,000 $250,000375,000 115,000$250,000 365,000 120,000$250,000370,000 September 115,000 $250,000 365,000 100,000 $250,000350,000 November 110,000 $250,000 360,000 December 115,000$250,000 365,000 June Jul August October Total = Monthly AVG. =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started