Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: a. Determine the cash consideration arising from the acquisition of Tunggak Bhd on 1 January 2021. b. Prepare the Consolidated Statement of Cash Flows

Required: a. Determine the cash consideration arising from the acquisition of Tunggak Bhd on 1 January 2021.

b. Prepare the Consolidated Statement of Cash Flows of Sonic Bhd Group for the year ended 31 December 2021, using the INDIRECT METHOD.

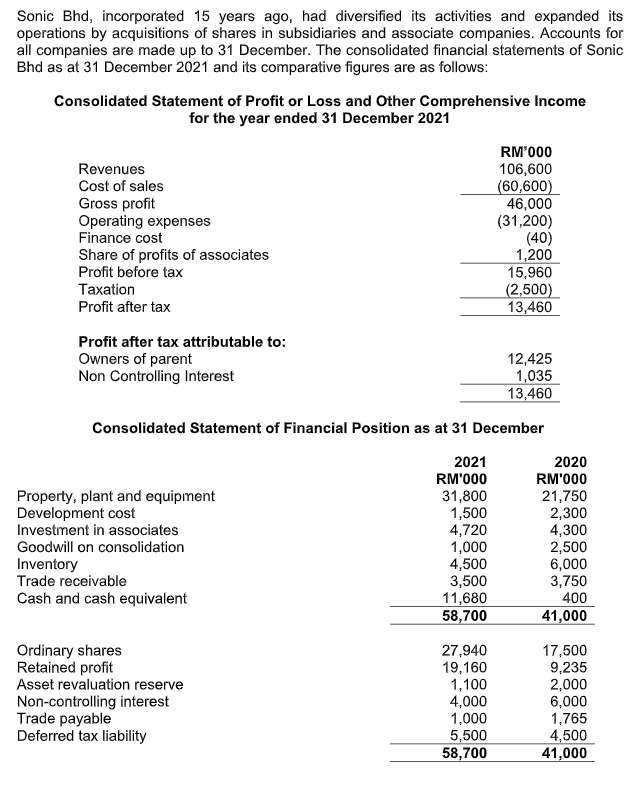

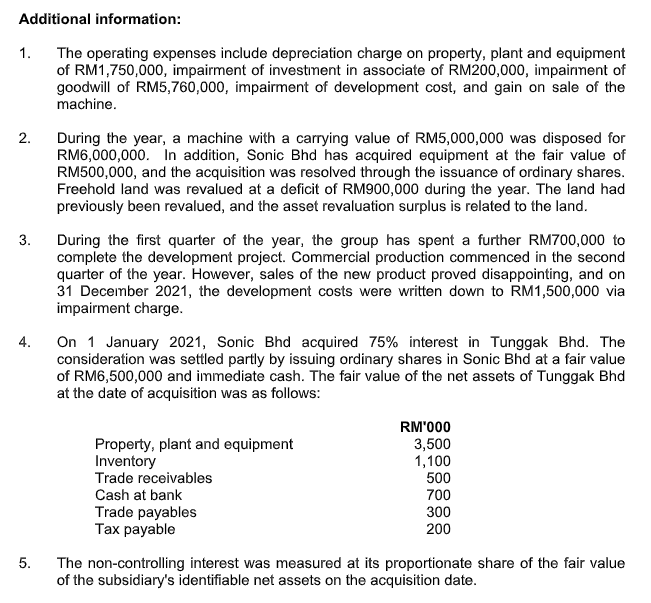

Sonic Bhd, incorporated 15 years ago, had diversified its activities and expanded its operations by acquisitions of shares in subsidiaries and associate companies. Accounts for all companies are made up to 31 December. The consolidated financial statements of Sonic Bhd as at 31 December 2021 and its comparative figures are as follows: Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 Revenues Cost of sales Gross profit Operating expenses Finance cost Share of profits of associates Profit before tax Taxation Profit after tax RM'000 106,600 (60,600) 46,000 (31,200) (40) 1,200 15,960 (2,500) 13,460 Profit after tax attributable to: Owners of parent Non Controlling Interest 12,425 1,035 13,460 Consolidated Statement of Financial Position as at 31 December Property, plant and equipment Development cost Investment in associates Goodwill on consolidation Inventory Trade receivable Cash and cash equivalent 2021 RM'000 31,800 1,500 4,720 1,000 4,500 3,500 11,680 58,700 2020 RM'000 21,750 2,300 4,300 2,500 6,000 3,750 400 41,000 Ordinary shares Retained profit Asset revaluation reserve Non-controlling interest Trade payable Deferred tax liability 27,940 19,160 1,100 4,000 1,000 5,500 58,700 17,500 9,235 2,000 6,000 1,765 4,500 41,000 Additional information: 1. The operating expenses include depreciation charge on property, plant and equipment of RM1,750,000, impairment of investment in associate of RM200,000, impairment of goodwill of RM5,760,000, impairment of development cost, and gain on sale of the machine. 2. 3. 4. During the year, a machine with a carrying value of RM5,000,000 was disposed for RM6,000,000. In addition, Sonic Bhd has acquired equipment at the fair value of RM500,000, and the acquisition was resolved through the issuance of ordinary shares. Freehold land was revalued at a deficit of RM900,000 during the year. The land had previously been revalued, and the asset revaluation surplus is related to the land. During the first quarter of the year, the group has spent a further RM700,000 to complete the development project. Commercial production commenced in the second quarter of the year. However, sales of the new product proved disappointing, and on 31 December 2021, the development costs were written down to RM1,500,000 via impairment charge. On 1 January 2021, Sonic Bhd acquired 75% interest in Tunggak Bhd. The consideration was settled partly by issuing ordinary shares in Sonic Bhd at a fair value of RM6,500,000 and immediate cash. The fair value of the net assets of Tunggak Bhd at the date of acquisition was as follows: RM'000 Property, plant and equipment 3,500 Inventory 1,100 Trade receivables 500 Cash at bank 700 Trade payables 300 Tax payable 200 The non-controlling interest was measured at its proportionate share of the fair value of the subsidiary's identifiable net assets on the acquisition date. 5. Sonic Bhd, incorporated 15 years ago, had diversified its activities and expanded its operations by acquisitions of shares in subsidiaries and associate companies. Accounts for all companies are made up to 31 December. The consolidated financial statements of Sonic Bhd as at 31 December 2021 and its comparative figures are as follows: Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 Revenues Cost of sales Gross profit Operating expenses Finance cost Share of profits of associates Profit before tax Taxation Profit after tax RM'000 106,600 (60,600) 46,000 (31,200) (40) 1,200 15,960 (2,500) 13,460 Profit after tax attributable to: Owners of parent Non Controlling Interest 12,425 1,035 13,460 Consolidated Statement of Financial Position as at 31 December Property, plant and equipment Development cost Investment in associates Goodwill on consolidation Inventory Trade receivable Cash and cash equivalent 2021 RM'000 31,800 1,500 4,720 1,000 4,500 3,500 11,680 58,700 2020 RM'000 21,750 2,300 4,300 2,500 6,000 3,750 400 41,000 Ordinary shares Retained profit Asset revaluation reserve Non-controlling interest Trade payable Deferred tax liability 27,940 19,160 1,100 4,000 1,000 5,500 58,700 17,500 9,235 2,000 6,000 1,765 4,500 41,000 Additional information: 1. The operating expenses include depreciation charge on property, plant and equipment of RM1,750,000, impairment of investment in associate of RM200,000, impairment of goodwill of RM5,760,000, impairment of development cost, and gain on sale of the machine. 2. 3. 4. During the year, a machine with a carrying value of RM5,000,000 was disposed for RM6,000,000. In addition, Sonic Bhd has acquired equipment at the fair value of RM500,000, and the acquisition was resolved through the issuance of ordinary shares. Freehold land was revalued at a deficit of RM900,000 during the year. The land had previously been revalued, and the asset revaluation surplus is related to the land. During the first quarter of the year, the group has spent a further RM700,000 to complete the development project. Commercial production commenced in the second quarter of the year. However, sales of the new product proved disappointing, and on 31 December 2021, the development costs were written down to RM1,500,000 via impairment charge. On 1 January 2021, Sonic Bhd acquired 75% interest in Tunggak Bhd. The consideration was settled partly by issuing ordinary shares in Sonic Bhd at a fair value of RM6,500,000 and immediate cash. The fair value of the net assets of Tunggak Bhd at the date of acquisition was as follows: RM'000 Property, plant and equipment 3,500 Inventory 1,100 Trade receivables 500 Cash at bank 700 Trade payables 300 Tax payable 200 The non-controlling interest was measured at its proportionate share of the fair value of the subsidiary's identifiable net assets on the acquisition date. 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started