Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: ( a ) Determine the net present values ( NPVs ) of the two projects * * * at the companys current cost of

Required:a Determine the net present values NPVs of the two projects at the companys current cost of capital and identify the project the company should opt for.b Recompute the NPV of the SType project at as suggested by the finance director. Comparing the NPVs of the two projects, identify the project the company should opt for.c Comment on the views of the chief executive and the finance director.d Recompute the NPV of the SType project at the rate you deem suitable and comparing the NPVs of the two projects, identify the project the company should opt for.Class Test Asset Beta

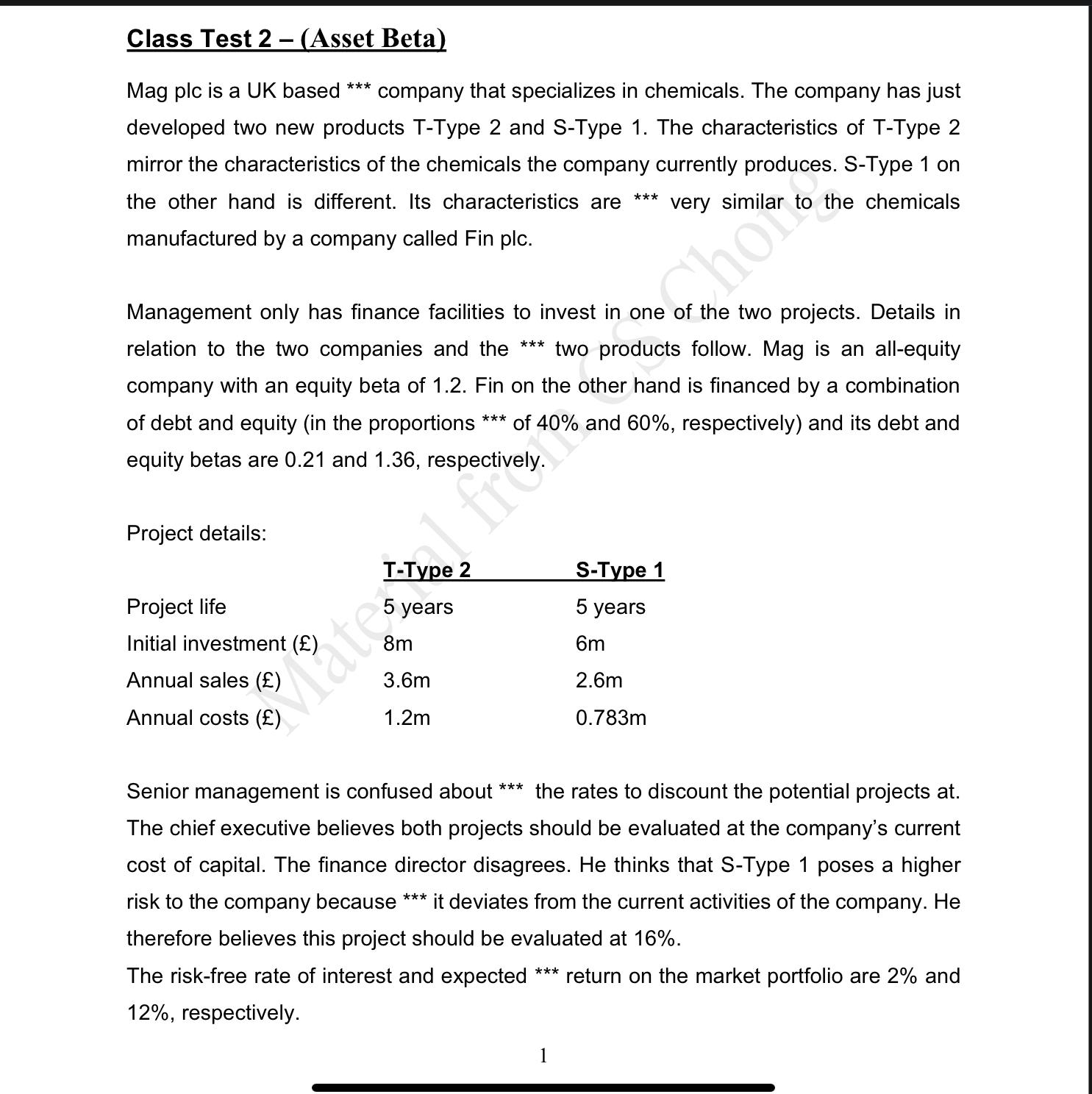

Mag plc is a UK based company that specializes in chemicals. The company has just developed two new products TType and SType The characteristics of TType mirror the characteristics of the chemicals the company currently produces. SType on the other hand is different. Its characteristics are very similar to the chemicals manufactured by a company called Fin plc

Management only has finance facilities to invest in one of the two projects. Details in relation to the two companies and the two products follow. Mag is an allequity company with an equity beta of Fin on the other hand is financed by a combination of debt and equity in the proportions of and respectively and its debt and equity betas are and respectively.

Project details:

tableTType SType Project life, years, yearsInitial investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started