Answered step by step

Verified Expert Solution

Question

1 Approved Answer

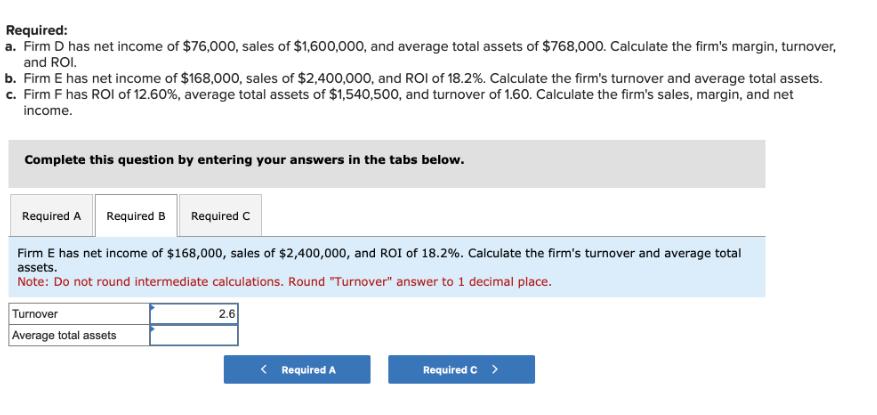

Required: a. Firm D has net income of $76,000, sales of $1,600,000, and average total assets of $768,000. Calculate the firm's margin, turnover, and

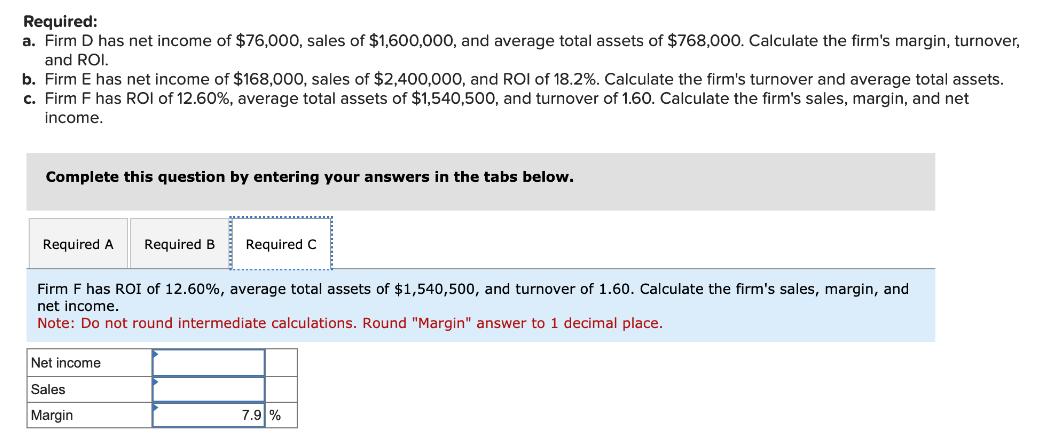

Required: a. Firm D has net income of $76,000, sales of $1,600,000, and average total assets of $768,000. Calculate the firm's margin, turnover, and ROI. b. Firm E has net income of $168,000, sales of $2,400,000, and ROI of 18.2%. Calculate the firm's turnover and average total assets. c. Firm F has ROI of 12.60%, average total assets of $1,540,500, and turnover of 1.60. Calculate the firm's sales, margin, and net income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Firm E has net income of $168,000, sales of $2,400,000, and ROI of 18.2%. Calculate the firm's turnover and average total assets. Note: Do not round intermediate calculations. Round "Turnover" answer to 1 decimal place. Turnover Average total assets 2.6 < Required A Required C > Required: a. Firm D has net income of $76,000, sales of $1,600,000, and average total assets of $768,000. Calculate the firm's margin, turnover, and ROI. b. Firm E has net income of $168,000, sales of $2,400,000, and ROI of 18.2%. Calculate the firm's turnover and average total assets. c. Firm F has ROI of 12.60%, average total assets of $1,540,500, and turnover of 1.60. Calculate the firm's sales, margin, and net income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Firm F has ROI of 12.60%, average total assets of $1,540,500, and turnover of 1.60. Calculate the firm's sales, margin, and net income. Note: Do not round intermediate calculations. Round "Margin" answer to 1 decimal place. Net income Sales Margin 7.9 %

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Firm Ds margin is 48 turnover is 208 and ROI is 99 Required B Step 1 Calculate Firm Es turnover by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started