Answered step by step

Verified Expert Solution

Question

1 Approved Answer

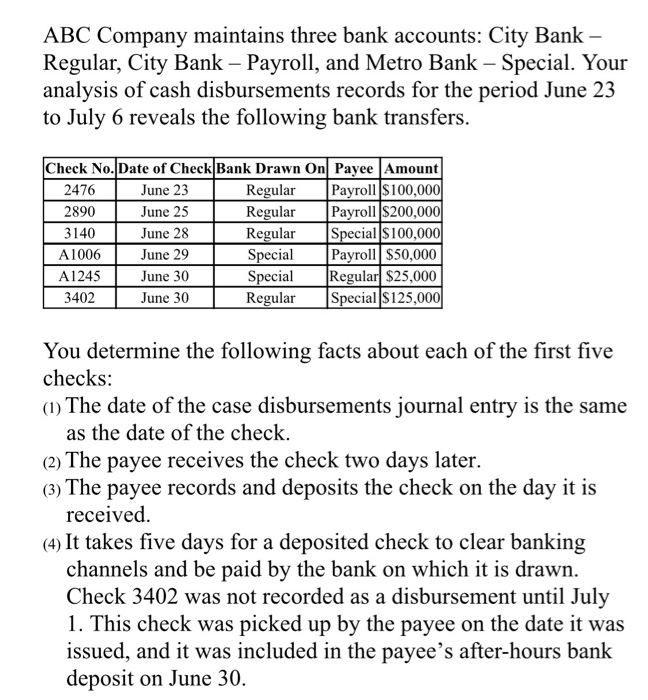

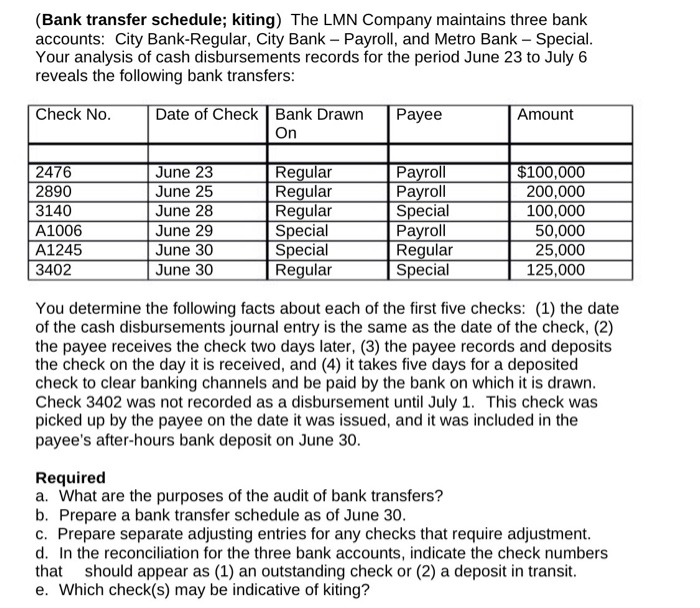

Required : a. Prepare a bank transfer schedule as of June 30 using the following layout. Check No. Bank Accounts Amount of Check Disbursement Date

Required :

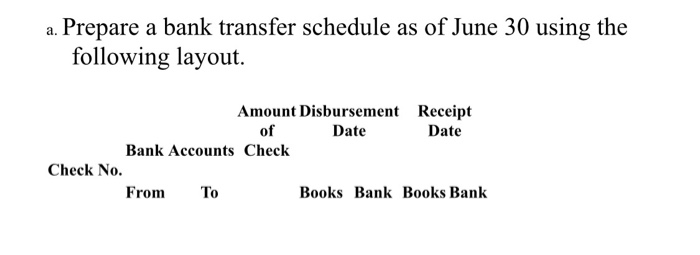

a. Prepare a bank transfer schedule as of June 30 using the following layout.

Check No.

Bank Accounts

Amount

of

Check

Disbursement

Date

Receipt

Date

From

To

Books

Bank

Books

Bank

b. Prepare separate adjusting entries for any checks that require adjustment.

c. In the reconciliation for the three bank accounts, indicate the check numbers that should appear as (1) an outstanding check or (2) a deposit in transit.

d. Which check(s) may be indicative of kiting?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started