Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: ( a ) Prepare a consolidated balance sheet at January 1 , Year 5 . table [ [ Green Inc. ] , [

Required:

a Prepare a consolidated balance sheet at January Year

tableGreen Inc.Consolidated Balance Sheet,Assets

b Calculate goodwill and noncontrolling interest under the identifiable net assets method.

Goodwill

$

Noncontrolling interest

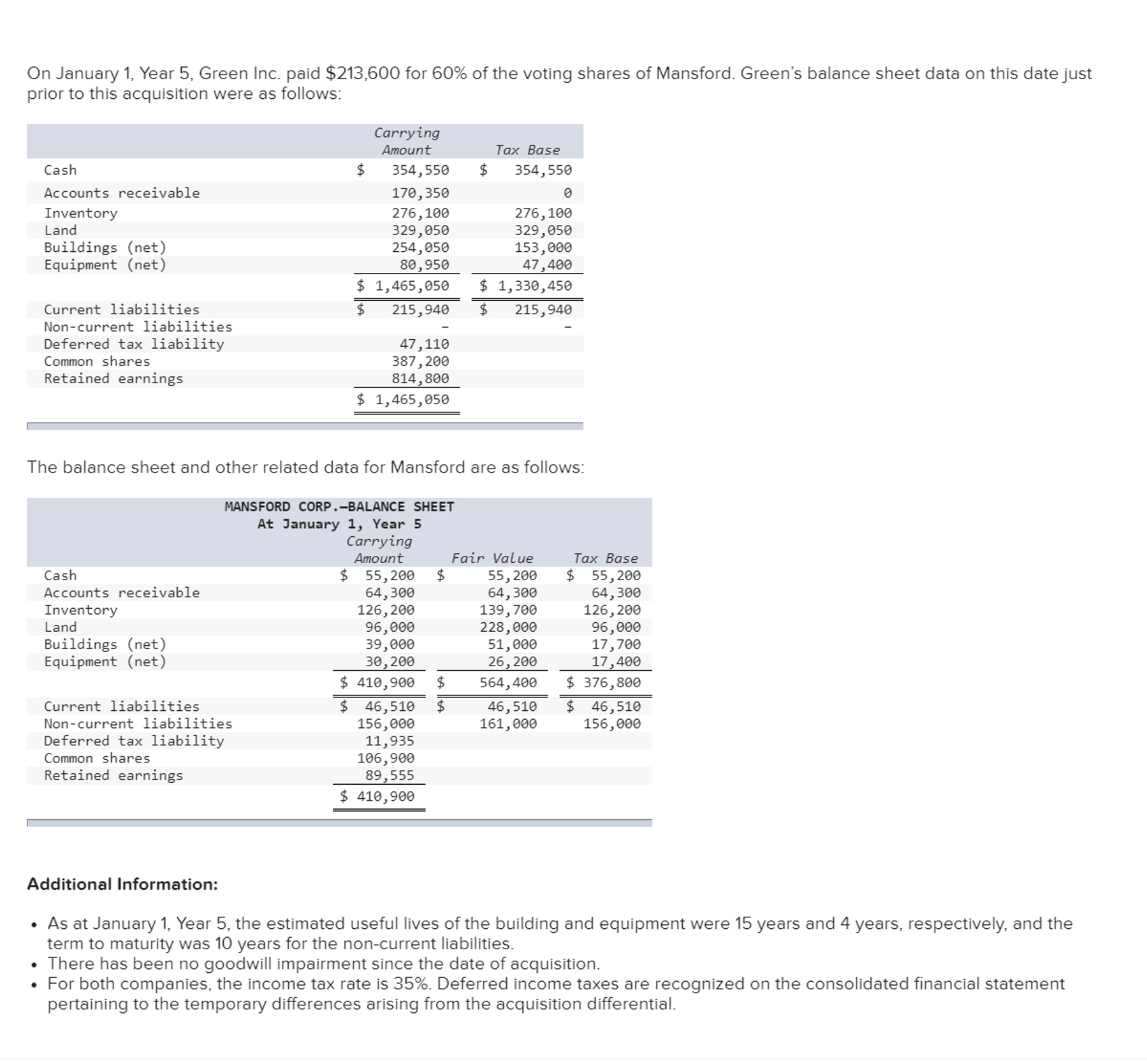

$On January Year Green Inc. paid $ for of the voting shares of Mansford. Green's balance sheet data on this date just

prior to this acquisition were as follows:

The balance sheet and other related data for Mansford are as follows:

Additional Information:

As at January Year the estimated useful lives of the building and equipment were years and years, respectively, and the

term to maturity was years for the noncurrent liabilities.

There has been no goodwill impairment since the date of acquisition.

For both companies, the income tax rate is Deferred income taxes are recognized on the consolidated financial statement

pertaining to the temporary differences arising from the acquisition differential.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started