Question

Required: (a) Prepare a contribution margin format variable costing income statement for each year, and reconcile the variable costing net operating income figures against those

Required:

(a) Prepare a contribution margin format variable costing income statement for each year, and reconcile the variable costing net operating income figures against those reflected in Table 1.

(b) Refer to the company’ operating results reflected in Table 1. Prepare a brief report (not more than 250 words) to AEC’s senior management to explain the fluctuations in net operating income from 2019 to 2021. (c) (i) Explain how operations would have differed in 2020 and 2021 if the company had been using Lean Production with the results that ending inventory was zero.

(ii) If Lean production has been in use during 2020 and 2021, and the predetermined overhead absorption rate is based on 40,000 units per year, compute the company’s net operating income/(loss) for each year under absorption costing. Explain the reason for any differences between these income figures and those reported using variable costing. Justify your explanation with a brief computation.

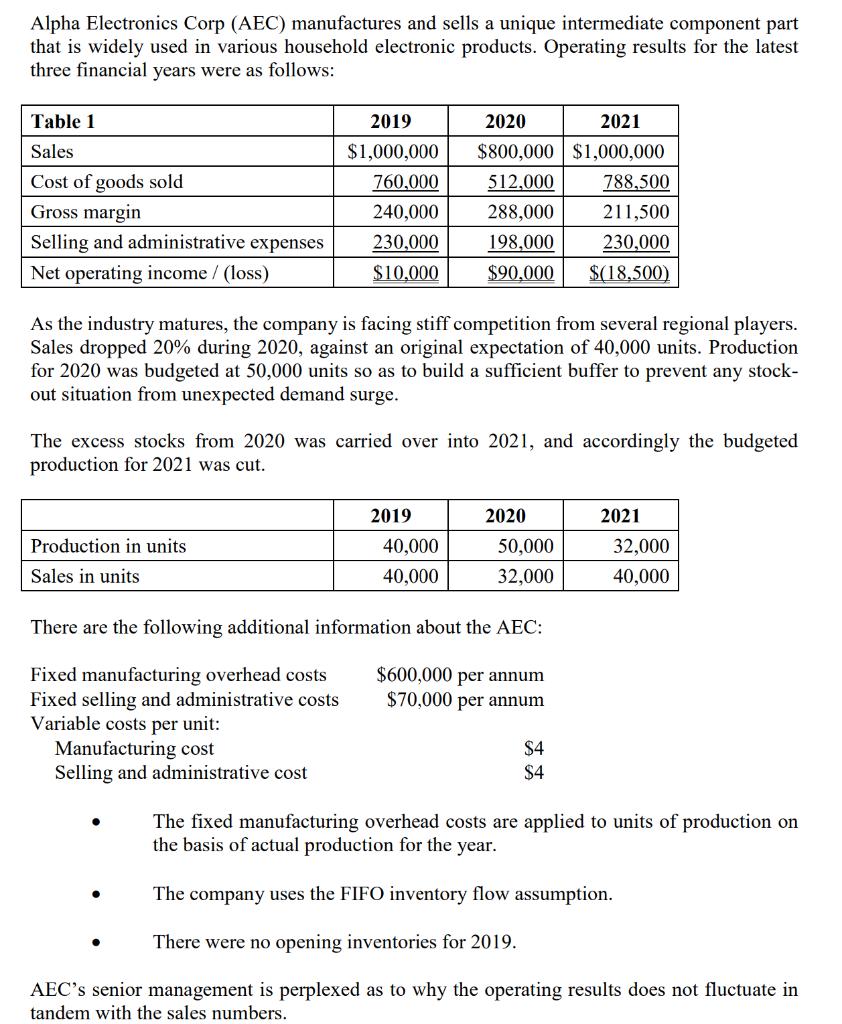

Alpha Electronics Corp (AEC) manufactures and sells a unique intermediate component part that is widely used in various household electronic products. Operating results for the latest three financial years were as follows: Table 1 2019 2020 2021 Sales $1,000,000 $800,000 $1,000,000 Cost of goods sold 760,000 512,000 788.500 Gross margin 240,000 288,000 211,500 Selling and administrative expenses 230,000 198,000 230,000 Net operating income / (loss) $10,000 $90,000 $(18,500) As the industry matures, the company is facing stiff competition from several regional players. Sales dropped 20% during 2020, against an original expectation of 40,000 units. Production for 2020 was budgeted at 50,000 units so as to build a sufficient buffer to prevent any stock- out situation from unexpected demand surge. The excess stocks from 2020 was carried over into 2021, and accordingly the budgeted production for 2021 was cut. 2019 2020 2021 Production in units 40,000 50,000 32,000 Sales in units 40,000 32,000 40,000 There are the following additional information about the AEC: $600,000 per annum Fixed manufacturing overhead costs Fixed selling and administrative costs Variable costs per unit: Manufacturing cost Selling and administrative cost $70,000 per annum $4 $4 The fixed manufacturing overhead costs are applied to units of production on the basis of actual production for the year. The company uses the FIFO inventory flow assumption. There were no opening inventories for 2019. AEC's senior management is perplexed as to why the operating results does not fluctuate in tandem with the sales numbers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Reconciliation of Units 2019 2020 2021 Opening stock Production 18000 50000 32000 18000 32000 40000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started