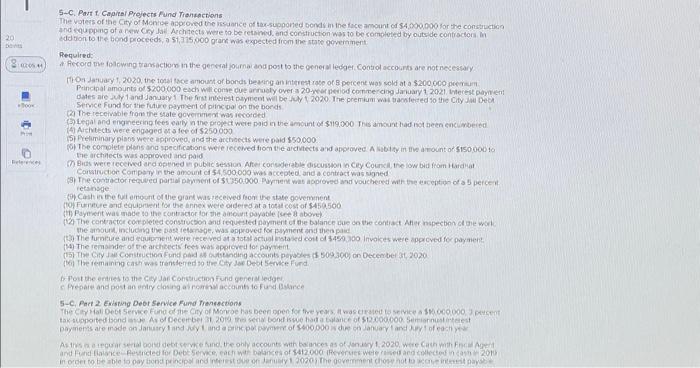

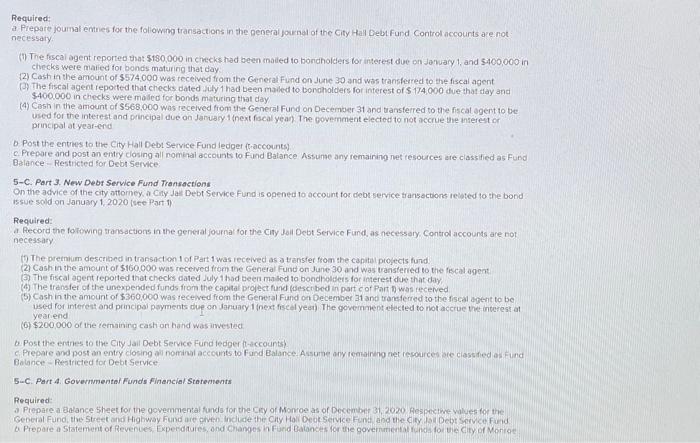

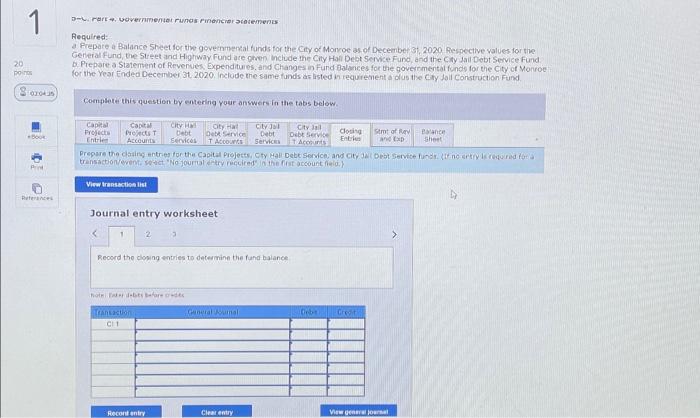

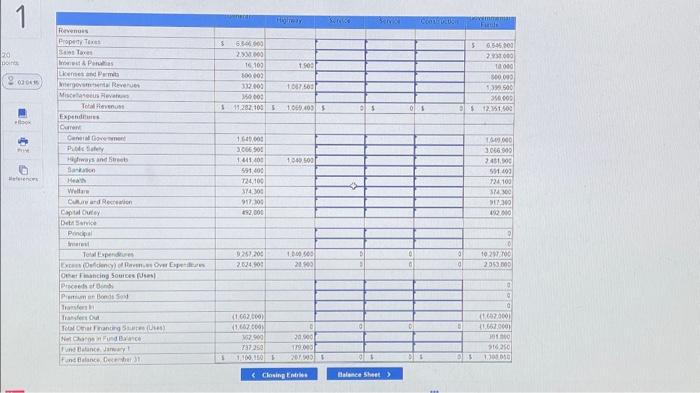

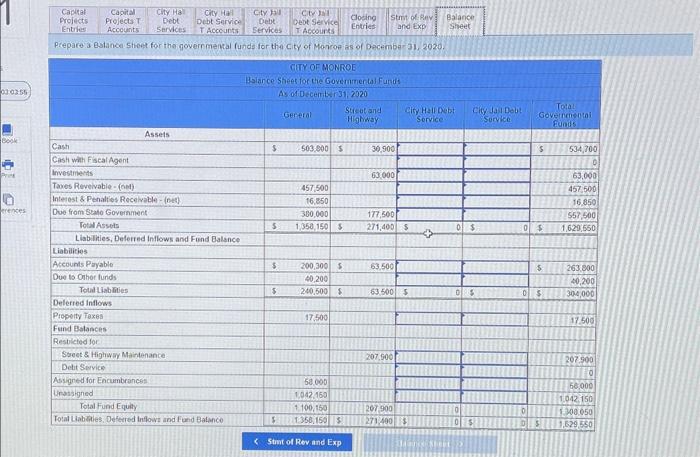

Required: a Prepare joumal entres for the foliowing transactions in the peneral joumal of the City Hall Debu fund Control accounts are not necessary. (1) The fiscal agent reported tha: $180,000 in checks had been cnaded to bondholders for interest due on January 1 , and 5400,000 in checks were maired for bonds maturing that day. (2) Cash in the amount of $574,000 was received from the General Fund on Jutie 30 and was transferred to the fiscal agent (F) The friscal agent reported that checks dated why 1 had been maled to bondholders for interest of $174.000 due that tlay and $400,000 in checks were moled for bonds maturing that day (4) Cash in the amount of $568,000 was recelved from the General Fund on December 34 and transferred to the fiscal ogent to be used for the interest and principal due on Janvary t inext fiscal yean. The govemment elected to not accrie the inserest or principal at year-erd of Post the entres to the City Hall Debi Service Fund ledger (fraccounts) c. Prepare and post an entry dosing all nomizal accounts to Fund Balance Assume any remaining net tesources are ciassified as Fund Balance - Restricted for Debt Service: 5-C. Part 3. New Debr Service Fund Transactions On the advice of the city attorney, a Ciny Jas Debt Service Fund is opened to account for debt service trans octions teipted to the bond issue sold on January 1,2020 (see Port 1) Required: a Record the fortowng transactions in the genetal journal for the City Jeil Debt Service Fund, as necessary, Control accounts are not necessary t9 The premum described in transaction 1 of Part 1 was received as a transfer from the capital piofects fund. (2) Cash bn the amount of $160.000 was recerved feom the General Fund on June 30 and was transteried to the fiscal apent (4) The fransfer of the unexpended funds from the capital project fund fiescr bed in part cof Part to was recerved (5) Cash in the amount of $360,000 was recepved from the General Fund on December 31 and transferred to the fiscal agent to be used for interest and principai payments due on January l (next fised year) The gowernment efected to not acerue the interest at yeariend (6) $200,000 of the temaining cash on haind was invested b. Post the entres to the City jail Debt Service Fund ledper tt-iccountsh. Balance - Pestricted for Debt Service: S-C. Part 4. Governmental Funds Financial Starements Required: 5-C. Part t Capiral Prejects Fund Trankactions edation to the bond proceeds, a 51,375,000 grarn wis expected from the stape geverament Required; Semce Fund for the future payment of pinc val on the bonds (4) Arstiects were engaged of s fee of $250000 (5) Preliminary pians Were approved, and the archoccts were paid $50,000. the archinects watr approved and paid retsingle (19) The remainder of the archeects feet was apoteved for payment. of Preoare and post an entry closing ai rominulaccaints to fund Butarce 5-C. Pact 2 Existing Deot Service Fund Trenesctions Required: a Frepare a Balance sheet for the govemmenal funds for the City of Monvoe as of Decembet 3: 2020 . Respective values for tive Geheral Fund, the Street and Highway Fund are phen inctude the City Hail Dest Serwi. Fund, and the City Jall Debt Service Fund D. Prepare a Statement of Revenves, Expenditures, and Changes in Fund Balances for the goverimental funds for the City of Monroe Complete this question by entering your answers in the tabs below. Journal entry worksheet 3 Reocrd the oloping entries to determine the fund balance Prepace a estance stheet for the governmental funds for the city of Moncop as of Decermber 31, 2020 . \begin{tabular}{|c|c|c|c|c|c|c|} \hline & & & \multirow[t]{2}{*}{ } & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Fingle }} \\ \hline & & & & & & \\ \hline & & & & & 5 & \\ \hline \multirow[b]{2}{*}{ points } & & & & & & 2851000 \\ \hline & +502 & & & & & 10000 \\ \hline \multirow{3}{*}{20000} & & & & & & 6000 \\ \hline & & & & & & \\ \hline & & & & & & 36000 \\ \hline \multirow{3}{*}{ } & 1.05009 & 8 & 3 & 1 & 4 & 1251,500 \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & 10000 \\ \hline & & & & & & 366690 \\ \hline & 1,045500 & & & & & 2451.00 \\ \hline \multirow{19}{*}{ B } & & & & & & \\ \hline & & & & & & n+100 \\ \hline & & & & & & 346 \\ \hline & & & & & & \\ \hline & & & & & & 100.010 \\ \hline & & & & & & \\ \hline & & & & & & 9 \\ \hline & & & & & & \\ \hline & 1000,505 & 5 & 8 & 9 & & 1920100 \\ \hline & 2180 & 8 & 0 & 9 & & 205000 \\ \hline & & & & & & \\ \hline & & & & & & a \\ \hline & & & & & & 9 \\ \hline & & & & & & a \\ \hline & & & & & & (1.02000) \\ \hline & 6 & a & 0 & & & \\ \hline & 21.900 & & & & & 18100 \\ \hline & 10000 & & & & & 36200 \\ \hline & & 1 & 1 & 1 & 13 & 102000 \\ \hline \end{tabular}