Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: a. Prepare the journal entries: In Dorae Berhads accounts, to correct the investment in Nobi Berhad. In the group accounts, to adjust the fair

Required:

Required:

a. Prepare the journal entries:

- In Dorae Berhad’s accounts, to correct the investment in Nobi Berhad.

- In the group accounts, to adjust the fair value of the freehold land at the acquisition date and to eliminate the cost of investment against the share of net assets.

- In the group accounts, to incorporate the post-acquisition revaluation of the freehold land.

Narratives are not required.

b. Show the movements in the group’s revaluation reserves and retained profits for the 2021 financial year.

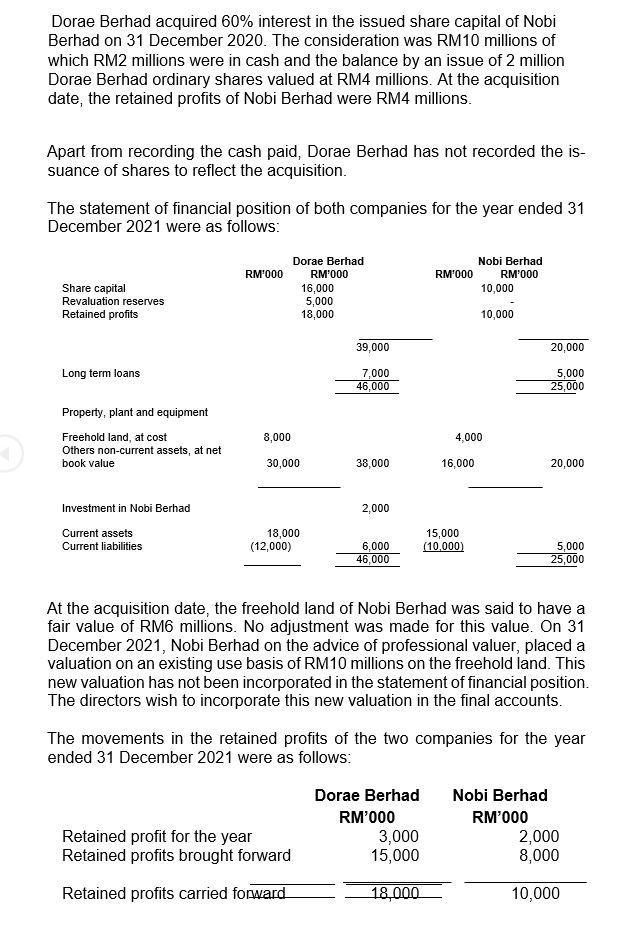

Dorae Berhad acquired 60% interest in the issued share capital of Nobi Berhad on 31 December 2020. The consideration was RM10 millions of which RM2 millions were in cash and the balance by an issue of 2 million Dorae Berhad ordinary shares valued at RM4 millions. At the acquisition date, the retained profits of Nobi Berhad were RM4 millions. Apart from recording the cash paid, Dorae Berhad has not recorded the is- suance of shares to reflect the acquisition. The statement of financial position of both companies for the year ended 31 December 2021 were as follows: Share capital Revaluation reserves Retained profits Long term loans Property, plant and equipment Freehold land, at cost Others non-current assets, at net book value Investment in nobi Berhad Current assets Current liabilities RM000 8,000 30,000 Dorae Berhad RM'000 16,000 5,000 18,000 18,000 (12,000) 39,000 7,000 46,000 Retained profit for the year Retained profits brought forward Retained profits carried forward 38,000 2,000 6,000 46,000 RM'000 16,000 3,000 15,000 18,000 Nobi Berhad RM'000 4,000 15,000 (10,000) 10,000 10,000 20,000 Dorae Berhad Nobi Berhad RM'000 RM'000 5,000 25,000 At the acquisition date, the freehold land of Nobi Berhad was said to have a fair value of RM6 millions. No adjustment was made for this value. On 31 December 2021, Nobi Berhad on the advice of professional valuer, placed a valuation on an existing use basis of RM10 millions on the freehold land. This new valuation has not been incorporated in the statement of financial position. The directors wish to incorporate this new valuation in the final accounts. 20,000 The movements in the retained profits of the two companies for the year ended 31 December 2021 were as follows: 5,000 25,000 2,000 8,000 10,000

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started