Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Advise MedClin regarding the deductibility of the $400,000. MedClin Pty Ltd (MedClin) is a company that owns a number of bulk-billing medical centres

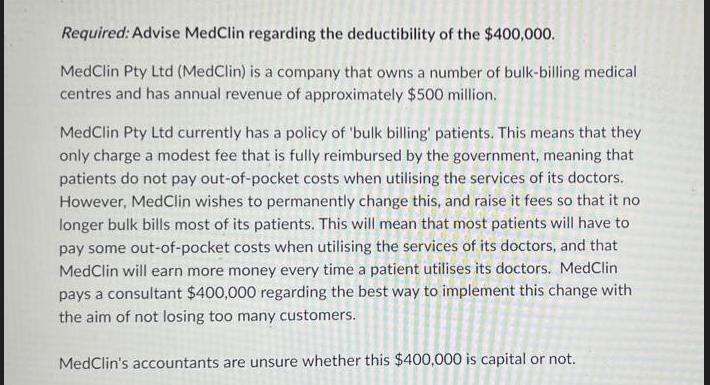

Required: Advise MedClin regarding the deductibility of the $400,000. MedClin Pty Ltd (MedClin) is a company that owns a number of bulk-billing medical centres and has annual revenue of approximately $500 million. MedClin Pty Ltd currently has a policy of 'bulk billing' patients. This means that they only charge a modest fee that is fully reimbursed by the government, meaning that patients do not pay out-of-pocket costs when utilising the services of its doctors. However, MedClin wishes to permanently change this, and raise it fees so that it no longer bulk bills most of its patients. This will mean that most patients will have to pay some out-of-pocket costs when utilising the services of its doctors, and that MedClin will earn more money every time a patient utilises its doctors. MedClin pays a consultant $400,000 regarding the best way to implement this change with the aim of not losing too many customers. MedClin's accountants are unsure whether this $400,000 is capital or not.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The deductibility of the 400000 paid to the consultant by MedClin Pty Ltd depends on whether it is considered a revenue expense or a capital expense R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started