Answered step by step

Verified Expert Solution

Question

1 Approved Answer

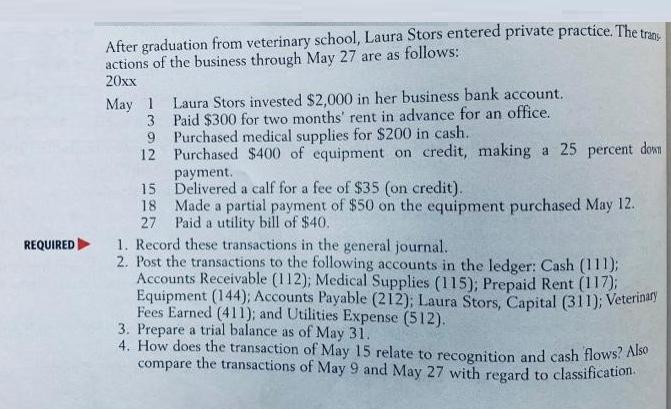

REQUIRED After graduation from veterinary school, Laura Stors entered private practice. The trans actions of the business through May 27 are as follows: 20xx

REQUIRED After graduation from veterinary school, Laura Stors entered private practice. The trans actions of the business through May 27 are as follows: 20xx May 1 Laura Stors invested $2,000 in her business bank account. Paid $300 for two months' rent in advance for an office. Purchased medical supplies for $200 in cash. Purchased $400 of equipment on credit, making a 25 percent down 3 9 12 15 18 27 payment. Delivered a calf for a fee of $35 (on credit). Made a partial payment of $50 on the equipment purchased May 12. Paid a utility bill of $40. 1. Record these transactions in the general journal. 2. Post the transactions to the following accounts in the ledger: Cash (111); Accounts Receivable (112); Medical Supplies (115); Prepaid Rent (117); Equipment (144); Accounts Payable (212); Laura Stors, Capital (311); Veterinary Fees Earned (411); and Utilities Expense (512). 3. Prepare a trial balance as of May 31. 4. How does the transaction of May 15 relate to recognition and cash flows? Also compare the transactions of May 9 and May 27 with regard to classification.

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 IN THE BOOKS OF LAURA STORS JOURNAL ENTRIES DATE PARTICULARS DEBIT AMOUNT CREDIT AMOUNT 01 MAY 20XX CASH AC DR TO LAURA STORS CAPITAL AC 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started