Required

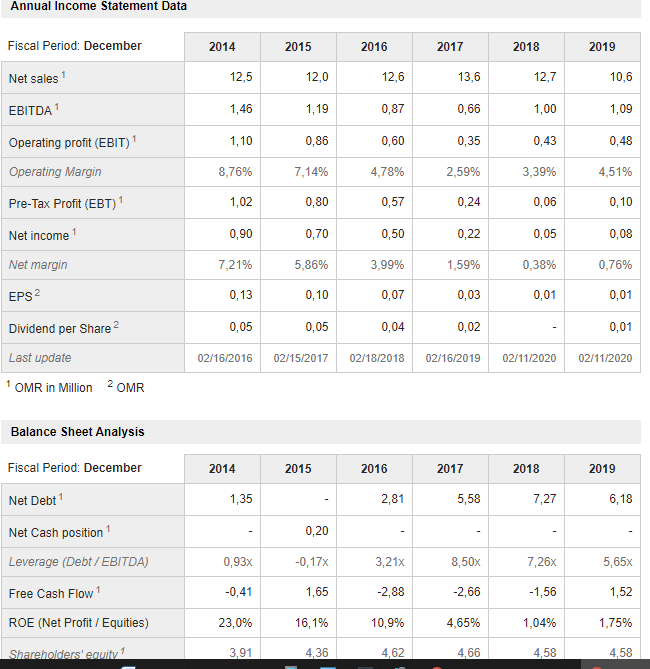

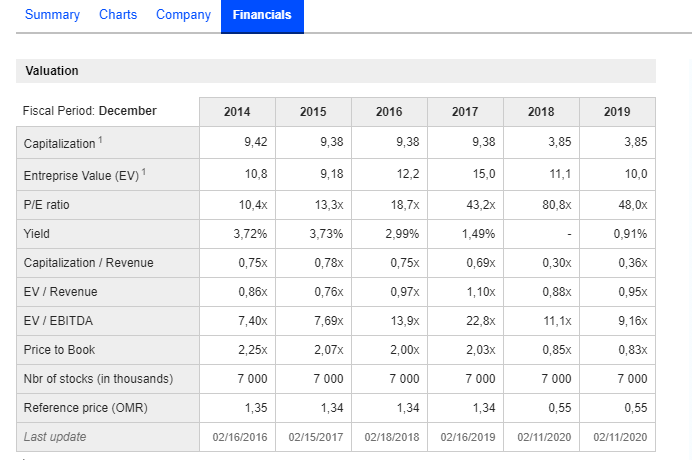

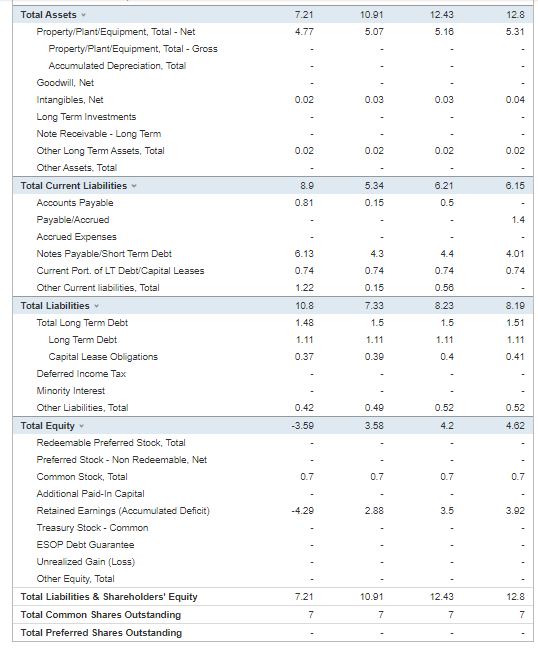

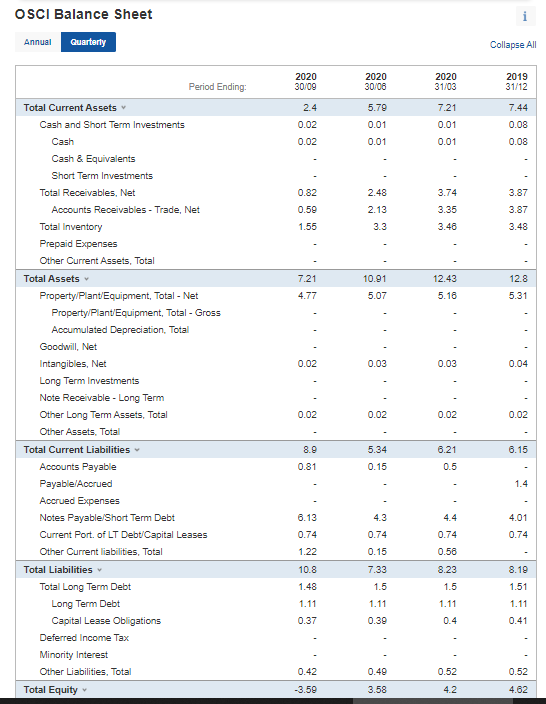

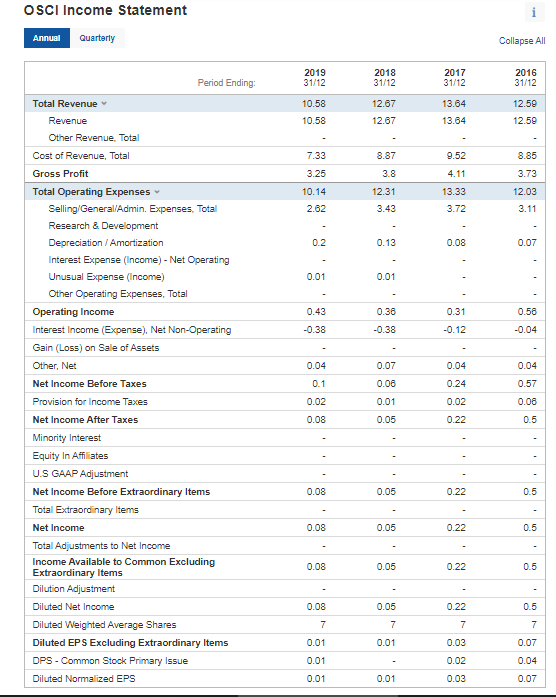

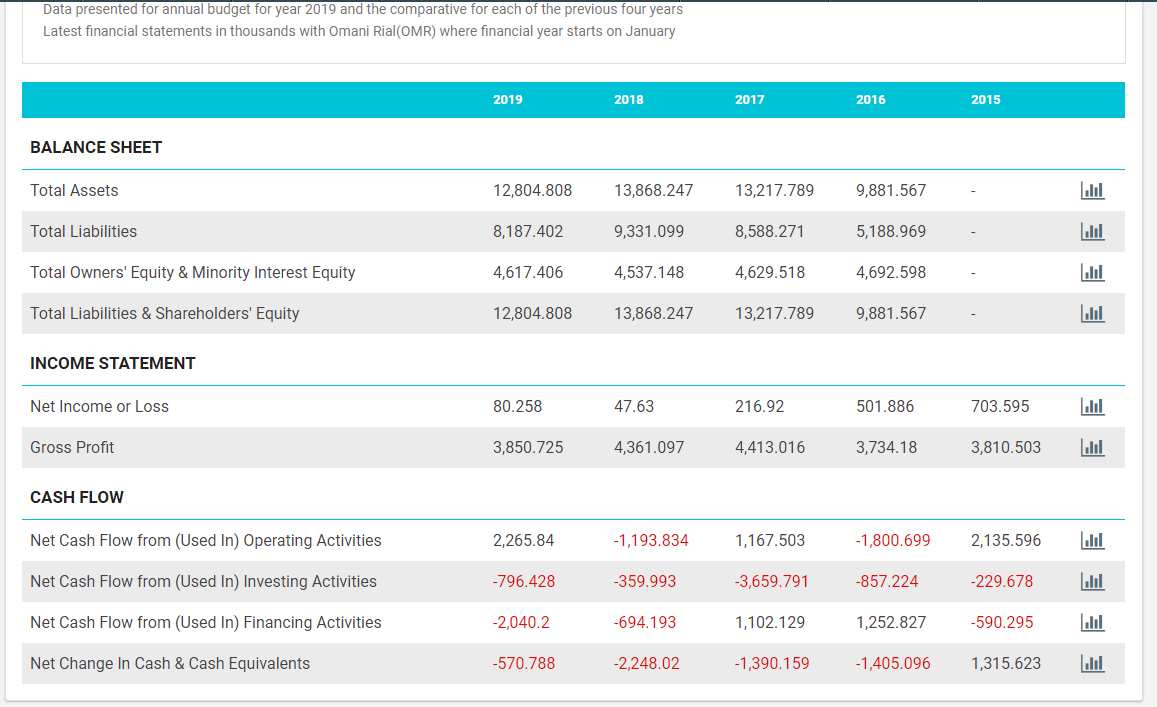

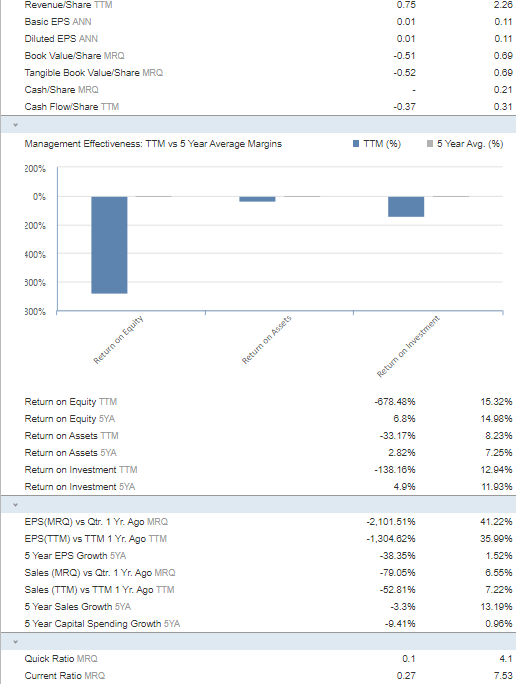

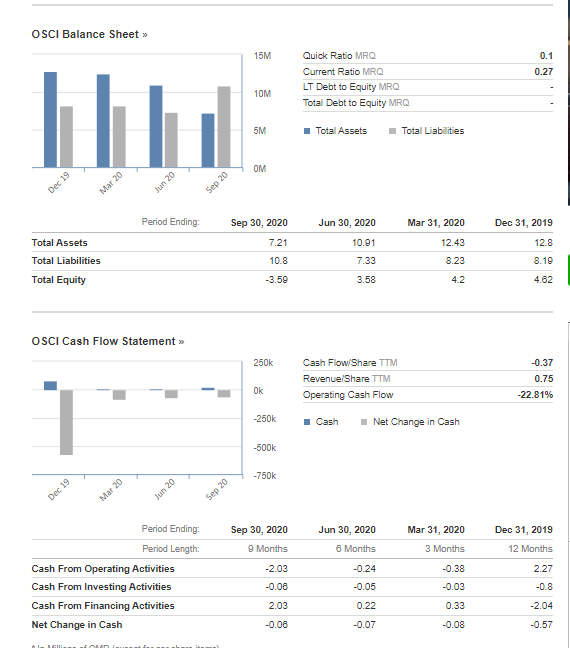

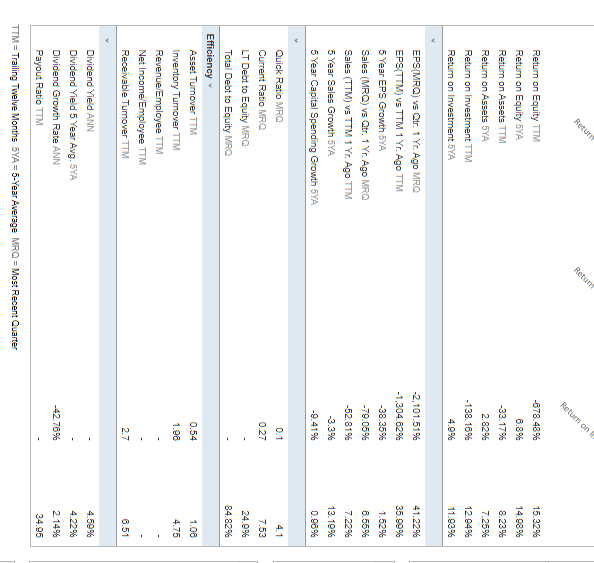

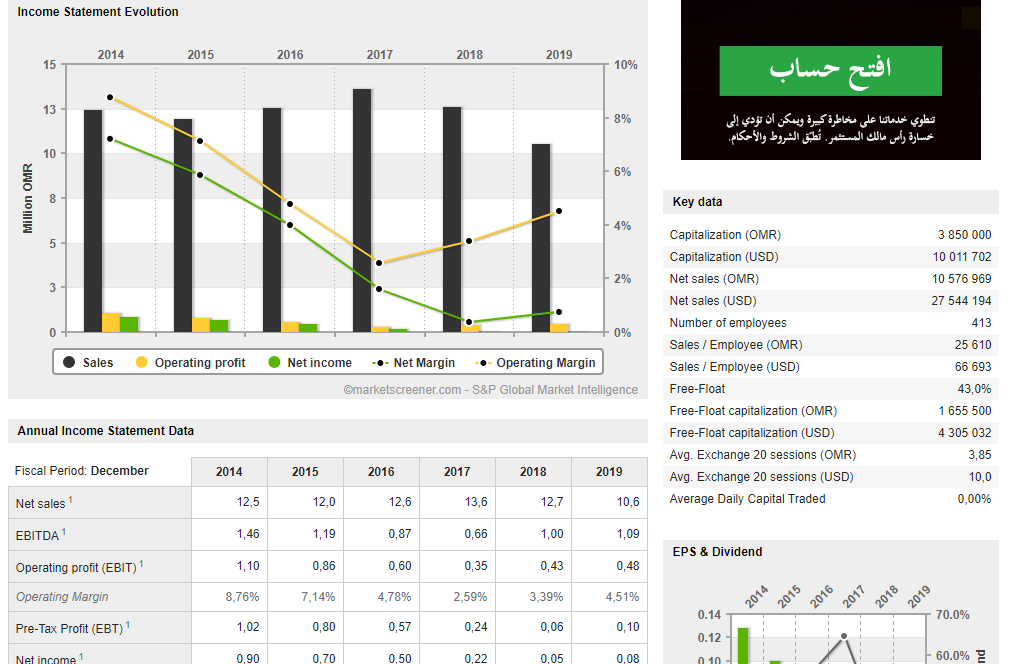

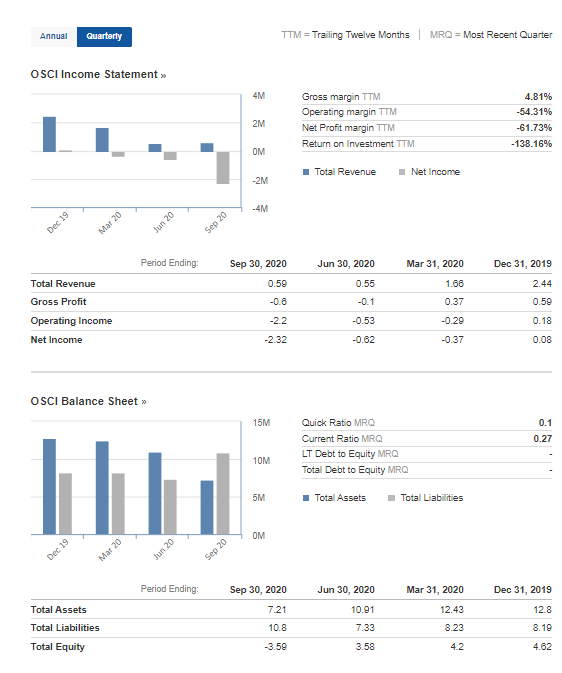

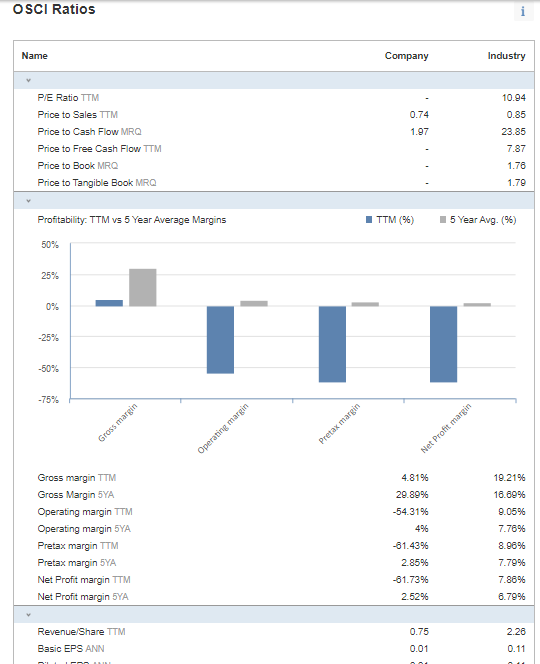

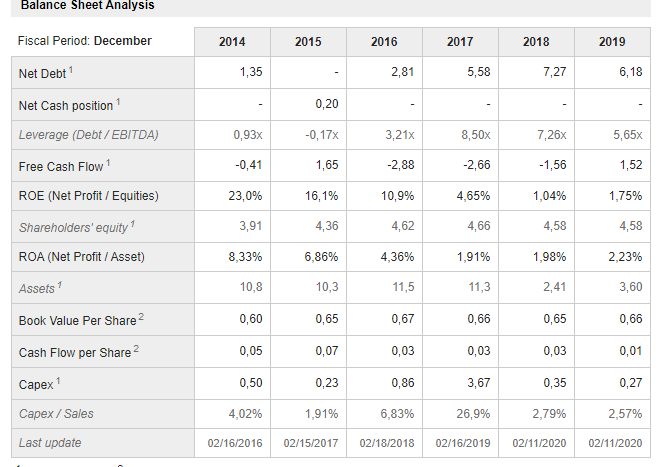

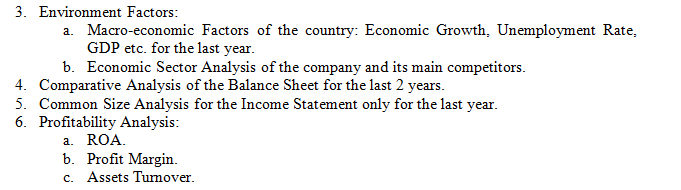

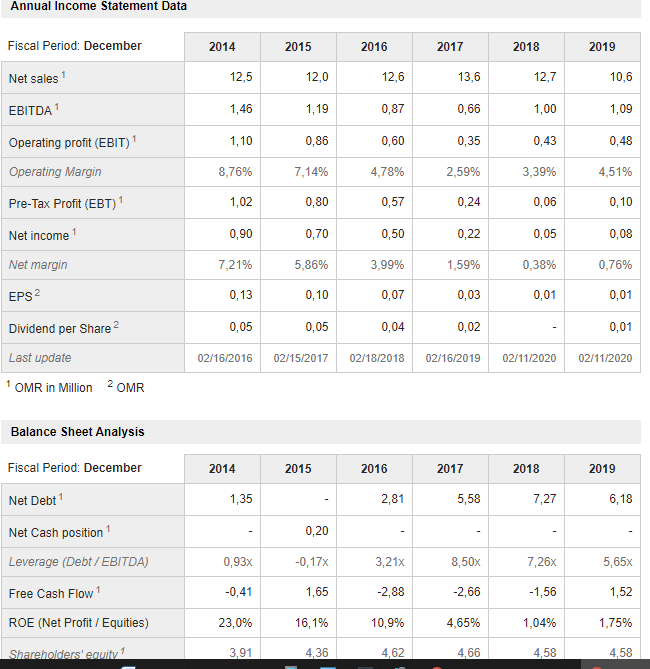

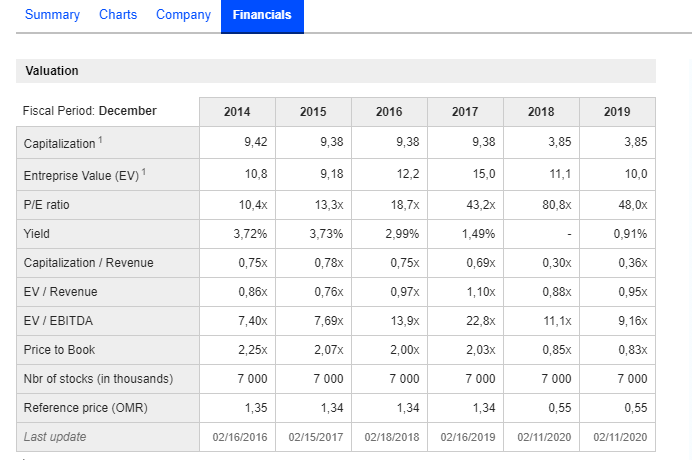

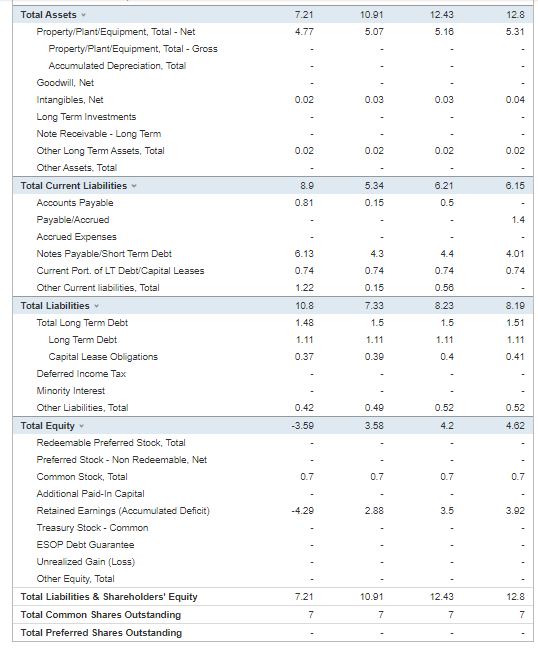

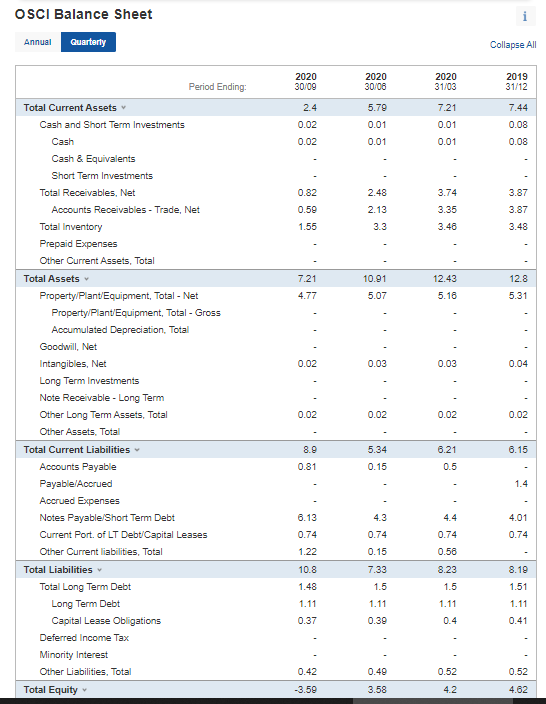

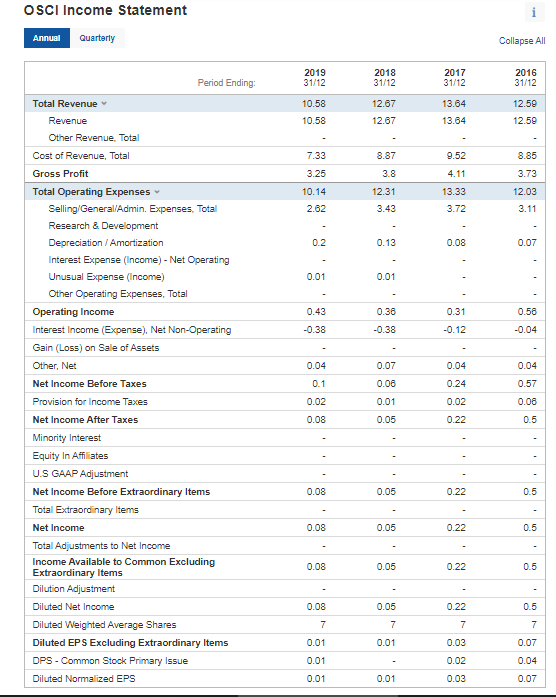

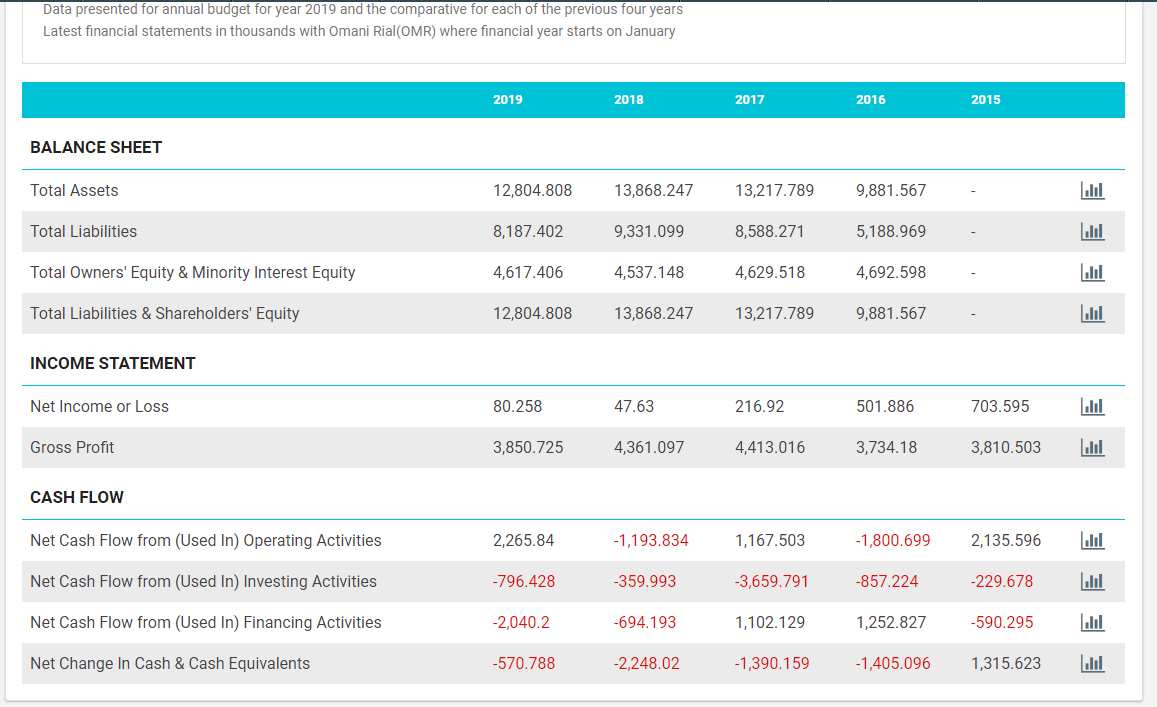

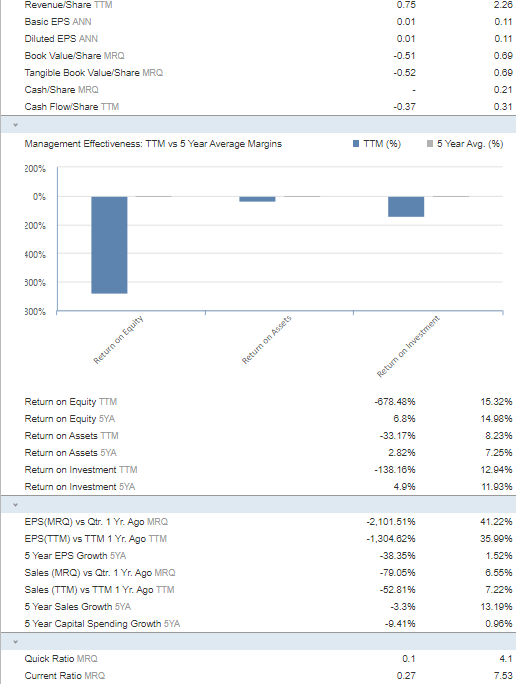

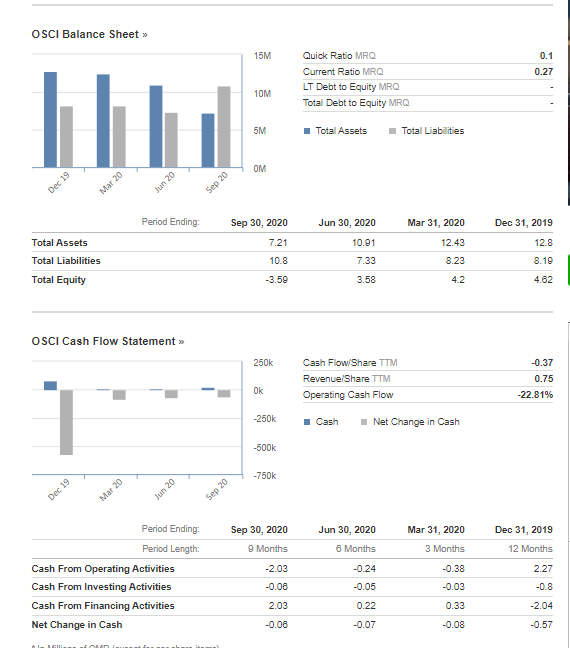

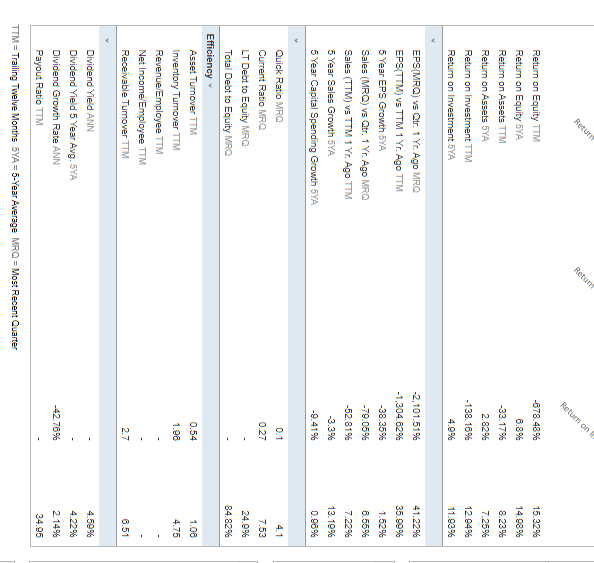

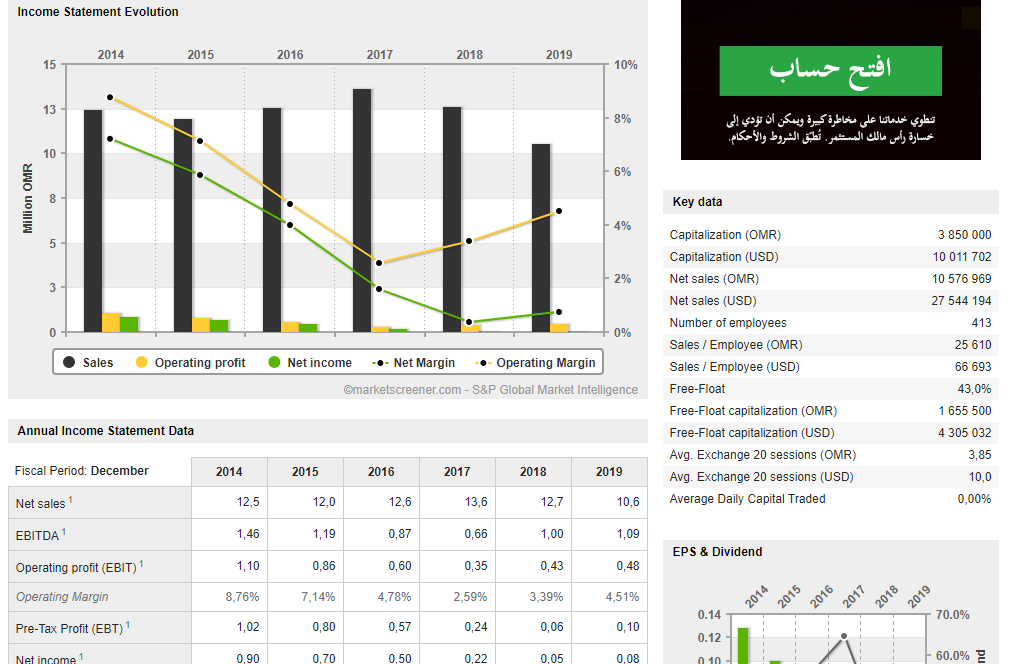

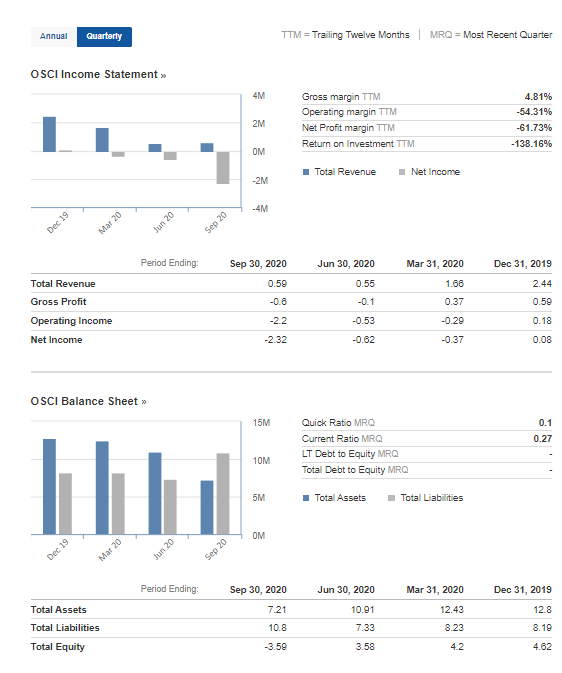

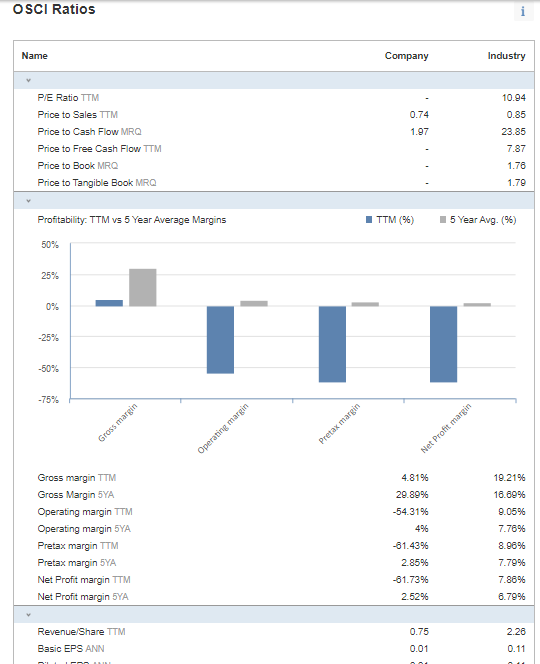

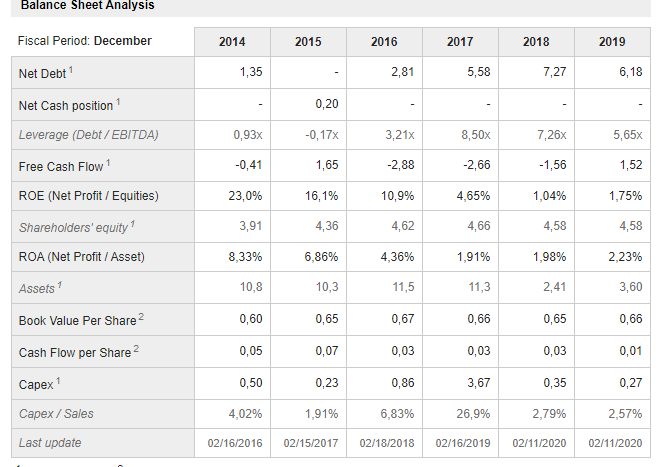

Annual Income Statement Data Fiscal Period: December 2014 2015 2016 2017 2018 2019 12,5 12,0 12,6 13,6 12,7 10.6 Net sales EBITDA1 1,46 1,19 0,87 0,66 1,00 1,09 Operating profit (EBIT) 1 1,10 0,86 0,60 0,35 0,43 0,48 8,76% 7,14% 4,78% 2,59% 3,39% 4,51% Operating Margin Pre-Tax Profit (EBT) 1 1,02 0,80 0,57 0,24 0,06 0,10 Net income 0,90 0,70 0,50 0,22 0,05 0,08 Net margin 7,21% 5,86% 3,99% 1,59% 0,38% 0,76% EPS 2 0,13 0,10 0,07 0,03 0,01 0,01 Dividend per Share 2 0,05 0,05 0,04 0,02 0,01 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 Last update 1 OMR in Million 2 OMR Balance Sheet Analysis Fiscal Period: December 2014 2015 2016 2017 2018 2019 Net Debt 1,35 2,81 5,58 7,27 6,18 Net Cash position 0,20 Leverage (Debt / EBITDA) 0,93x -0,17x 3,21x 8,50x 7,26x 5,65x Free Cash Flow 1 -0,41 1,65 -2,88 -2,66 -1,56 1,52 ROE (Net Profit / Equities) 23,0% 16,1% 10,9% 4,65% 1,04% 1,75% Shareholders' equity 1 3.91 4,36 4,62 4,66 4,58 4,58 Summary Charts Company Financials Valuation Fiscal Period: December 2014 2015 2016 2017 2018 2019 9,42 9,38 9,38 9,38 3,85 3,85 Capitalization Entreprise Value (EV) P/E ratio 10,8 9,18 122 15,0 11,1 10,0 10,4x 13,3x 18,7% 43,2x 80,8x 48,0x Yield 3,72% 3,73% 2,99% 1,49% 0,91% Capitalization / Revenue 0,75x 0,78x 0,75x 0,69% 0,30x 0,36x EV / Revenue 0,86x 0,76x 0,97% 1,10x 0,88 0,95x EV / EBITDA 7,40x 7,69% 13,9% 22,8x 11,1x 9,16x 2,25x 2,07x 2,00x 2,03x 0,85x Price to Book Nbr of stocks (in thousands) Reference price (OMR) 0,83% 7 000 7 000 7000 7 000 7 000 7000 1,35 1,34 1,34 1,34 0,55 0,55 Last update 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 7.21 10.91 12.8 12.43 5.18 4.77 5.07 5.31 0.02 0.03 0.03 0.04 0.02 0.02 0.02 0.02 8.9 5.34 6.21 6.15 0.81 0.15 0.5 1.4 4.3 4.4 4.01 6.13 0.74 1.22 0.74 0.74 0.74 0.15 0.58 10.8 1.48 Total Assets Property/Plant Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation. Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets. Total Total Current Liabilities Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt Capital Leases Other Current liabilities. Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority Interest Other Liabilities. Total Total Equity Redeemable Preferred Stock, Total Preferred Stock - Non Redeemable, Net Common Stock, Total Additional Paid-In Capital Retained Earnings (Accumulated Deficit) Treasury Stock - Common ESOP Debt Guarantee Unrealized Gain (Loss) Other Equity, Total Total Liabilities & Shareholders' Equity Total Common Shares Outstanding Total Preferred Shares Outstanding 7.33 1.5 8.23 1.5 8.19 1.51 1.11 1.11 1.11 1.11 0.39 0.37 0.4 0.41 0.49 0.52 0.52 0.42 -3.59 3.58 4.2 4.62 0.7 0.7 0.7 0.7 -4 29 2.88 3.5 3.92 7.21 10.91 12.43 12.8 7 7 7 7 OSCI Balance Sheet Annual Quarterly Collapse All 2020 30/09 2020 30/06 2020 31/03 2019 31/12 2.4 5.79 7.21 7.44 0.08 0.01 0.02 0.02 0.01 0.01 0.01 0.08 0.82 2.48 2.13 3.74 3.35 3.87 3.87 0.59 1.55 3.3 3.48 3.48 12.8 7.21 4.77 10.91 5.07 12.43 5.18 5.31 0.02 0.03 0.03 0.04 Period Ending: Total Current Assets Cash and Short Term Investments Cash Cash & Equivalents Short Term Investments Total Receivables, Net Accounts Receivables - Trade, Net Total Inventory Prepaid Expenses Other Current Assets, Total Total Assets Property/Plant/Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation. Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets, Total Total Current Liabilities Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt Capital Leases Other Current liabilities, Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority Interest Other Liabilities, Total Total Equity 0.02 0.02 0.02 0.02 8.9 5.34 6.21 6.15 0.81 0.15 0.5 1.4 4.3 4.4 4.01 6.13 0.74 1.22 0.74 0.74 0.74 0.15 0.58 10.8 8.23 8.19 7.33 1.5 1.48 1.5 1.51 1.11 1.11 1.11 1.11 0.39 0.37 0.4 0.41 0.42 0.49 0.52 0.52 -3.50 3.58 4.2 4.62 OSCI Income Statement Annual Quarterly Collapse All 2019 31/12 2018 31/12 2017 31/12 2016 31/12 12.59 10.58 10.58 12.67 12.67 13.64 13.64 12.59 7.33 8.87 9.52 8.85 3.25 3.8 4.11 3.73 10.14 12.31 3.43 13.33 3.72 12.03 3.11 2.62 0.2 0.13 0.08 0.07 0.01 0.01 0.43 0.38 0.31 0.58 -0.38 -0.38 -0.12 -0.04 0.04 0.07 0.04 0.04 Period Ending Total Revenue Revenue Other Revenue, Total Cost of Revenue, Total Gross Profit Total Operating Expenses Selling/General/Admin. Expenses, Total Research & Development Depreciation / Amortization Interest Expense (Income) - Net Operating Unusual Expense (Income) Other Operating Expenses, Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net Net Income Before Taxes Provision for Income Taxes Net Income After Taxes Minority Interest Equity In Affiliates U.S GAAP Adjustment Net Income Before Extraordinary Items Total Extraordinary Items Net Income Total Adjustments to Net Income Income Available to Common Excluding Extraordinary Items Dilution Adjustment Diluted Net Income Diluted Weighted Average Shares Diluted EPS Excluding Extraordinary Items DPS - Common Stock Primary Issue Diluted Normalized EPS 0.1 0.08 0.24 0.57 0.02 0.01 0.02 0.08 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 7 7 7 7 0.07 0.01 0.01 0.03 0.01 0.02 0.04 0.01 0.01 0.03 0.07 Data presented for annual budget for year 2019 and the comparative for each of the previous four years Latest financial statements in thousands with Omani Rial (OMR) where financial year starts on January 2019 2018 2017 2016 2015 BALANCE SHEET Total Assets 12,804.808 13,868.247 13,217.789 9,881.567 Jul Total Liabilities 8,187.402 9,331.099 8,588.271 5,188.969 Total Owners' Equity & Minority Interest Equity 4,617.406 4,537.148 4,629.518 4,692.598 Total Liabilities & Shareholders' Equity 12,804.808 13,868.247 13,217.789 9,881.567 lil INCOME STATEMENT Net Income or Loss 80.258 47.63 216.92 501.886 703.595 Gross Profit 3,850.725 4,361.097 4,413.016 3,734.18 3,810.503 Jul CASH FLOW Net Cash Flow from (Used In) Operating Activities 2,265.84 -1,193.834 1,167.503 -1,800.699 2,135.596 Net Cash Flow from (Used In) Investing Activities -796.428 -359.993 -3,659.791 -857.224 -229.678 E LEE Net Cash Flow from (Used In) Financing Activities -2,040.2 -694.193 1,102.129 1,252.827 -590.295 Net Change In Cash & Cash Equivalents -570.788 -2,248.02 -1,390.159 -1,405.096 1,315.623 2.28 0.11 Revenue/Share TTM Basic EPS ANN Diluted EPS ANN Book Value Share MRQ Tangible Book Value Share MRO Cash/Share MRO Cash FlowShare TTM 0.75 0.01 0.01 -0.51 -0.52 0.11 0.69 0.69 0.21 -0.37 0.31 Management Effectiveness: TTM vs 5 Year Average Margins TTM(%) 15 Year Avg. (%) 200% 0% 200% 400% 300% 300% Return on Equity Return on Assets Return on Investment Return on Equity TTM Return on Equity SYA Return on Assets TTM Return on Assets 5YA Return on Investment TTM Return on Investment 5YA -678.48% 6.8% -33.17% 2.82% 15.32% 14.98% 8.23% 7.25% 12.94% 11.93% -138.16% 4.9% -2,101.51% -1,304.62% -38.35% 41.2296 35.99% EPS(MRQ) vs Qtr. 1 Yr Ago MRQ EPS(TTM) vs TTM 1 Yr. Ago TTM 5 Year EPS Growth SYA Sales (MRQ) vs Qtr. 1 Yr. Ago MRQ Sales (TTM) vs TTM 1 Yr. Ago TTM 5 Year Sales Growth SYA 5 Year Capital Spending Growth 5YA -79.05% -52.81% -3.3% 1.52% 6.55% 7.22% 13. 19% 0.96% -9.41% Quick Ratio MRQ Current Ratio MRQ 0.1 0.27 4.1 7.53 OSCI Balance Sheet 15M 0.1 0.27 Quick Ratio MRQ Current Ratio MRQ LT Debt to Equity MRO Total Debt to Equity MRQ 10M 5M Total Assets Total Liabilities OM Dec 19 Mar 20 Jun 20 Sep 20 Period Ending Jun 30, 2020 Mar 31, 2020 Dec 31, 2019 Total Assets Total Liabilities Total Equity Sep 30, 2020 7.21 10.8 10.91 12.43 8.23 12.8 8.19 7.33 -3.59 3.58 4.2 4.62 OSCI Cash Flow Statement >> 250k Cash Flow/Share TTM Revenue/Share TTM Operating Cash Flow -0.37 0.75 -22.81% Ok -250k Cash Net Change in Cash -500k -750k Dec 19 Mar 20 Jun 20 Sep 20 Sep 30, 2020 Mar 31, 2020 Jun 30, 2020 6 Months -0.24 Dec 31, 2019 12 Months 9 Months 3 Months -0.38 2.27 Period Ending Period Length: Cash From Operating Activities Cash From Investing Activities Cash From Financing Activities Net Change in Cash -2.03 -0.08 -0.05 -0.03 -0.8 2.03 0.22 0.33 -2.04 -0.00 -0.07 -0.08 -0.57 General Chart Financials Technical Forum Financial Summary Income Statement Balance Sheet Cash Flow Ratios Dividends Earnings Yield OSCI Dividends Ex-Dividend Date Mar 15, 2018 Mar 20, 2017 Mar 16, 2016 Mar 16, 2015 Dividend : Type: 0.02 LTTM 0.04 LTTM Payment Date : Mar 20, 2018 Apr 01, 2017 Apr 01, 2016 Apr 01, 2015 3.64% 2.99% 0.05 LTTM 3.73% 0.05 LTTM 3.73% Legend 1 Monthly Si Quarterly GM Semi-Annual 12 Annual LT Trailing Twelve Months Retur Retund Return on -678.48% 15.32% 14.98% 8.23% Return on Equity TTM Return on Equity 5YA Return on Assets TTM Return on Assets 5YA Return on Investment TTM Return on Investment 5YA 6.8% -33.17% 2.82% -138.16% 4.9% 7.2596 12.94% 11.63% 41.22% 35.99% 1.529% EPS(MRO) vs Otr. 1 Yr. Ago MRQ EPS(TTM) vs TTM 1 Yr. Ago TTM 5 Year EPS Growth 5YA Sales (MRQ) vs Qtr. 1 Yr Ago MRQ Sales (TTM) vs TTM 1 Yr. Ago TTM 5 Year Sales Growth 5YA 5 Year Capital Spending Growth SYA -2,101.51% -1,304.629 -38.35% -79.05% -52.81% -3.3% 6.55% 7.2296 13. 19% -9.41 0.96% 4.1 0.1 0.27 7.53 24.9% 84.82% Quick Ratio MRQ Current Ratio MRO LT Debt to Equity MRQ Total Debt to Equity MRO Efficiency Asset Turnover TTM Inventory Tumover TTM Revenue/Employee TTM Net Income/Employee TTM Receivable Turnover TTM 0.54 1.08 4.75 1.96 27 6.51 4.59% 4.22% 2.14% -42.76% Dividend Yield ANN Dividend Yield 5 Year Avg. 5YA Dividend Growth Rate ANN Payout Ratio ITM TTM = Trailing Twelve Months 5YA = 5-Year Average MRQ = Most Recent Quarter 34.95 Income Statement Evolution 2014 2015 2016 2017 2018 2019 15 10% 13 - 8% . 10 - 6% Million OMR 8 Key data LLLL 4% 3 850 000 5 2% 10 011 702 10 576 969 27 544 194 3 413 0 0% Sales Operating profit Net income - Net Margin Operating Margin Capitalization (OMR) Capitalization (USD) Net sales (OMR) Net sales (USD) Number of employees Sales / Employee (OMR) Sales / Employee (USD) Free-Float Free-Float capitalization (OMR) Free-Float capitalization (USD) Avg. Exchange 20 sessions (OMR) Avg. Exchange 20 sessions (USD) Average Daily Capital Traded 25 610 66 693 43,0% marketscreener.com - S&P Global Market Intelligence 1 655 500 Annual Income Statement Data 4 305 032 Fiscal Period: December 2014 2015 2016 2017 2018 2019 3,85 10,0 0,00% Net sales 1 12,5 12,0 12,6 13,6 12,7 10,6 EBITDA 1 1,46 1,19 0.87 0,66 1,00 1,09 EPS & Dividend Operating profit (EBIT) 1,10 0,86 0,60 0,35 0,43 0,48 2018 2017 2016 2015 Operating Margin 8,76% 7,14% 4,78% 2,59% 3,39% 4,51% 2014 2019 70.0% Pre-Tax Profit (EBT) 1 1,02 0,80 0,57 0,24 0,06 0,10 0.14 0.12 Net income 1 0.90 0,70 0,50 0,22 0,05 0,08 60.0% 10- Annual Quarterly TTM = Trailing Twelve Months | MRQ = Most Recent Quarter OSCI Income Statement >> 4M 2M Gross margin TTM Operating margin TTM Net Profit margin TTM Return on Investment TTM 4.81% -54.31% -61.73% -138.16% OM Total Revenue Net Income -2M -4M Mar 20 Jun 20 Sep 20 Dec 19 Period Ending: Sep 30, 2020 Mar 31, 2020 Jun 30, 2020 0.55 0.59 1.66 Dec 31, 2019 2.44 0.59 -0.8 -0.1 0.37 Total Revenue Gross Profit Operating Income Net Income -22 -0.53 -0.29 0.18 -2.32 -0.62 -0.37 0.08 OSCI Balance Sheet 15M 0.1 0.27 Quick Ratio MRQ Current Ratio MRO LT Debt to Equity MRQ Total Debt to Equity MRO 10M 5M Total Assets Total Liabilities OM Dec 19 Mar 20 Jun 20 Sep 20 Period Ending Sep 30, 2020 Jun 30, 2020 Mar 31, 2020 Dec 31, 2019 7.21 10.91 12.8 Total Assets Total Liabilities Total Equity 12.43 8.23 10.8 7.33 8.19 -3.59 3.58 4.2 4.62 OSCI Earnings Latest Release Dec 27, 2020 EPS / Forecast -0.33/- Revenue / Forecast 586.0K/ Revenue EPS Forecast $3.50M $0.30 $3.00M $0.20 $2.50M $0.10 $2.00M $0.00 Revenue EPS $1.50M $-0.10 $1.00M $-0.20 $500.00K $-0.30 Investing.com $0.00 $-0.40 09/2020 06/2019 09/2019 12/2019 03/2020 06/2020 Release Date Period End EPS/ Forecast Revenue / Forecast 09/2020 -0.33 / -- 586.OK / - 08/2020 -0.09 / - 548.1K / - 1.66M/ - 03/2020 -0.05 / - Dec 27, 2020 Jul 29, 2020 Jun 25, 2020 Feb 11, 2020 Oct 22, 2019 Jul 21, 2019 12/2010 0.01 / 2.44M / -- 0.02 / -- 09/2019 08/2019 2.8OMI - 2.99M/ - 0.02 - OSCI Ratios Name Company Industry 10.94 0.85 0.74 1.97 PE Ratio TTM Price to Sales TTM Price to Cash Flow MRQ Price to Free Cash Flow TTM Price to Book MRO Price to Tangible Book MRQ 23.85 7.87 1.78 1.79 Profitability. TTM vs 5 Year Average Margins TTM (96) 15 Year Avg. (%) 50% 25% 0% -25% -50% -75% Gross margin Pretax margin Operating margin Net Profit margin 19.21% 18.09% 9.05% 7.78% Gross margin TTM Gross Margin SYA Operating margin TTM Operating margin 5YA Pretax margin TTM Pretax margin 5YA Net Profit margin TTM Net Profit margin 5YA 4.81% 29.899 -54.31% 4% -81.43% 2.85% -81.73% 2.52% 8.96% 7.79% 7.86% 8.79% 0.75 2.26 Revenue/Share TTM Basic EPS ANN 0.01 0.11 Balance Sheet Analysis Fiscal Period: December 2014 2015 2016 2017 2018 2019 Net Debt 1,35 2.81 5,58 7,27 6,18 Net Cash position 0,20 Leverage (Debt / EBITDA) 0,93x -0,17% 3,21x 8,50x 7,26% 5,65x Free Cash Flow -0,41 1,65 -2,88 -2,66 -1,56 1,52 ROE (Net Profit / Equities) 23,0% 16,1% 10,9% 4,65% 1,04% 1,75% Shareholders' equity 3,91 4,36 4,62 4,66 4,58 4,58 ROA (Net Profit / Asset) 8,33% 6,86% 4,36% 1,91% 1,98% 2.23% Assets 10,8 10,3 11,5 11,3 2,41 3,60 Book Value Per Share 2 0,60 0,65 0,67 0,66 0,65 0,66 Cash Flow per Share 2 0,05 0,07 0,03 0,03 0,03 0,01 Capex 1 0,50 0,23 0,86 3,67 0,35 0,27 Capex / Sales 4,02% 1,91% 6,83% 26,9% 2,79% 2,57% Last update 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 3. Environment Factors: a. Macro-economic Factors of the country: Economic Growth, Unemployment Rate, GDP etc. for the last year. b. Economic Sector Analysis of the company and its main competitors. 4. Comparative Analysis of the Balance Sheet for the last 2 years. 5. Common Size Analysis for the Income Statement only for the last year. 6. Profitability Analysis: a. ROA b. Profit Margin. c. Assets Tumover. Annual Income Statement Data Fiscal Period: December 2014 2015 2016 2017 2018 2019 12,5 12,0 12,6 13,6 12,7 10.6 Net sales EBITDA1 1,46 1,19 0,87 0,66 1,00 1,09 Operating profit (EBIT) 1 1,10 0,86 0,60 0,35 0,43 0,48 8,76% 7,14% 4,78% 2,59% 3,39% 4,51% Operating Margin Pre-Tax Profit (EBT) 1 1,02 0,80 0,57 0,24 0,06 0,10 Net income 0,90 0,70 0,50 0,22 0,05 0,08 Net margin 7,21% 5,86% 3,99% 1,59% 0,38% 0,76% EPS 2 0,13 0,10 0,07 0,03 0,01 0,01 Dividend per Share 2 0,05 0,05 0,04 0,02 0,01 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 Last update 1 OMR in Million 2 OMR Balance Sheet Analysis Fiscal Period: December 2014 2015 2016 2017 2018 2019 Net Debt 1,35 2,81 5,58 7,27 6,18 Net Cash position 0,20 Leverage (Debt / EBITDA) 0,93x -0,17x 3,21x 8,50x 7,26x 5,65x Free Cash Flow 1 -0,41 1,65 -2,88 -2,66 -1,56 1,52 ROE (Net Profit / Equities) 23,0% 16,1% 10,9% 4,65% 1,04% 1,75% Shareholders' equity 1 3.91 4,36 4,62 4,66 4,58 4,58 Summary Charts Company Financials Valuation Fiscal Period: December 2014 2015 2016 2017 2018 2019 9,42 9,38 9,38 9,38 3,85 3,85 Capitalization Entreprise Value (EV) P/E ratio 10,8 9,18 122 15,0 11,1 10,0 10,4x 13,3x 18,7% 43,2x 80,8x 48,0x Yield 3,72% 3,73% 2,99% 1,49% 0,91% Capitalization / Revenue 0,75x 0,78x 0,75x 0,69% 0,30x 0,36x EV / Revenue 0,86x 0,76x 0,97% 1,10x 0,88 0,95x EV / EBITDA 7,40x 7,69% 13,9% 22,8x 11,1x 9,16x 2,25x 2,07x 2,00x 2,03x 0,85x Price to Book Nbr of stocks (in thousands) Reference price (OMR) 0,83% 7 000 7 000 7000 7 000 7 000 7000 1,35 1,34 1,34 1,34 0,55 0,55 Last update 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 7.21 10.91 12.8 12.43 5.18 4.77 5.07 5.31 0.02 0.03 0.03 0.04 0.02 0.02 0.02 0.02 8.9 5.34 6.21 6.15 0.81 0.15 0.5 1.4 4.3 4.4 4.01 6.13 0.74 1.22 0.74 0.74 0.74 0.15 0.58 10.8 1.48 Total Assets Property/Plant Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation. Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets. Total Total Current Liabilities Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt Capital Leases Other Current liabilities. Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority Interest Other Liabilities. Total Total Equity Redeemable Preferred Stock, Total Preferred Stock - Non Redeemable, Net Common Stock, Total Additional Paid-In Capital Retained Earnings (Accumulated Deficit) Treasury Stock - Common ESOP Debt Guarantee Unrealized Gain (Loss) Other Equity, Total Total Liabilities & Shareholders' Equity Total Common Shares Outstanding Total Preferred Shares Outstanding 7.33 1.5 8.23 1.5 8.19 1.51 1.11 1.11 1.11 1.11 0.39 0.37 0.4 0.41 0.49 0.52 0.52 0.42 -3.59 3.58 4.2 4.62 0.7 0.7 0.7 0.7 -4 29 2.88 3.5 3.92 7.21 10.91 12.43 12.8 7 7 7 7 OSCI Balance Sheet Annual Quarterly Collapse All 2020 30/09 2020 30/06 2020 31/03 2019 31/12 2.4 5.79 7.21 7.44 0.08 0.01 0.02 0.02 0.01 0.01 0.01 0.08 0.82 2.48 2.13 3.74 3.35 3.87 3.87 0.59 1.55 3.3 3.48 3.48 12.8 7.21 4.77 10.91 5.07 12.43 5.18 5.31 0.02 0.03 0.03 0.04 Period Ending: Total Current Assets Cash and Short Term Investments Cash Cash & Equivalents Short Term Investments Total Receivables, Net Accounts Receivables - Trade, Net Total Inventory Prepaid Expenses Other Current Assets, Total Total Assets Property/Plant/Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation. Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets, Total Total Current Liabilities Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt Capital Leases Other Current liabilities, Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority Interest Other Liabilities, Total Total Equity 0.02 0.02 0.02 0.02 8.9 5.34 6.21 6.15 0.81 0.15 0.5 1.4 4.3 4.4 4.01 6.13 0.74 1.22 0.74 0.74 0.74 0.15 0.58 10.8 8.23 8.19 7.33 1.5 1.48 1.5 1.51 1.11 1.11 1.11 1.11 0.39 0.37 0.4 0.41 0.42 0.49 0.52 0.52 -3.50 3.58 4.2 4.62 OSCI Income Statement Annual Quarterly Collapse All 2019 31/12 2018 31/12 2017 31/12 2016 31/12 12.59 10.58 10.58 12.67 12.67 13.64 13.64 12.59 7.33 8.87 9.52 8.85 3.25 3.8 4.11 3.73 10.14 12.31 3.43 13.33 3.72 12.03 3.11 2.62 0.2 0.13 0.08 0.07 0.01 0.01 0.43 0.38 0.31 0.58 -0.38 -0.38 -0.12 -0.04 0.04 0.07 0.04 0.04 Period Ending Total Revenue Revenue Other Revenue, Total Cost of Revenue, Total Gross Profit Total Operating Expenses Selling/General/Admin. Expenses, Total Research & Development Depreciation / Amortization Interest Expense (Income) - Net Operating Unusual Expense (Income) Other Operating Expenses, Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net Net Income Before Taxes Provision for Income Taxes Net Income After Taxes Minority Interest Equity In Affiliates U.S GAAP Adjustment Net Income Before Extraordinary Items Total Extraordinary Items Net Income Total Adjustments to Net Income Income Available to Common Excluding Extraordinary Items Dilution Adjustment Diluted Net Income Diluted Weighted Average Shares Diluted EPS Excluding Extraordinary Items DPS - Common Stock Primary Issue Diluted Normalized EPS 0.1 0.08 0.24 0.57 0.02 0.01 0.02 0.08 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 0.08 0.05 0.22 0.5 7 7 7 7 0.07 0.01 0.01 0.03 0.01 0.02 0.04 0.01 0.01 0.03 0.07 Data presented for annual budget for year 2019 and the comparative for each of the previous four years Latest financial statements in thousands with Omani Rial (OMR) where financial year starts on January 2019 2018 2017 2016 2015 BALANCE SHEET Total Assets 12,804.808 13,868.247 13,217.789 9,881.567 Jul Total Liabilities 8,187.402 9,331.099 8,588.271 5,188.969 Total Owners' Equity & Minority Interest Equity 4,617.406 4,537.148 4,629.518 4,692.598 Total Liabilities & Shareholders' Equity 12,804.808 13,868.247 13,217.789 9,881.567 lil INCOME STATEMENT Net Income or Loss 80.258 47.63 216.92 501.886 703.595 Gross Profit 3,850.725 4,361.097 4,413.016 3,734.18 3,810.503 Jul CASH FLOW Net Cash Flow from (Used In) Operating Activities 2,265.84 -1,193.834 1,167.503 -1,800.699 2,135.596 Net Cash Flow from (Used In) Investing Activities -796.428 -359.993 -3,659.791 -857.224 -229.678 E LEE Net Cash Flow from (Used In) Financing Activities -2,040.2 -694.193 1,102.129 1,252.827 -590.295 Net Change In Cash & Cash Equivalents -570.788 -2,248.02 -1,390.159 -1,405.096 1,315.623 2.28 0.11 Revenue/Share TTM Basic EPS ANN Diluted EPS ANN Book Value Share MRQ Tangible Book Value Share MRO Cash/Share MRO Cash FlowShare TTM 0.75 0.01 0.01 -0.51 -0.52 0.11 0.69 0.69 0.21 -0.37 0.31 Management Effectiveness: TTM vs 5 Year Average Margins TTM(%) 15 Year Avg. (%) 200% 0% 200% 400% 300% 300% Return on Equity Return on Assets Return on Investment Return on Equity TTM Return on Equity SYA Return on Assets TTM Return on Assets 5YA Return on Investment TTM Return on Investment 5YA -678.48% 6.8% -33.17% 2.82% 15.32% 14.98% 8.23% 7.25% 12.94% 11.93% -138.16% 4.9% -2,101.51% -1,304.62% -38.35% 41.2296 35.99% EPS(MRQ) vs Qtr. 1 Yr Ago MRQ EPS(TTM) vs TTM 1 Yr. Ago TTM 5 Year EPS Growth SYA Sales (MRQ) vs Qtr. 1 Yr. Ago MRQ Sales (TTM) vs TTM 1 Yr. Ago TTM 5 Year Sales Growth SYA 5 Year Capital Spending Growth 5YA -79.05% -52.81% -3.3% 1.52% 6.55% 7.22% 13. 19% 0.96% -9.41% Quick Ratio MRQ Current Ratio MRQ 0.1 0.27 4.1 7.53 OSCI Balance Sheet 15M 0.1 0.27 Quick Ratio MRQ Current Ratio MRQ LT Debt to Equity MRO Total Debt to Equity MRQ 10M 5M Total Assets Total Liabilities OM Dec 19 Mar 20 Jun 20 Sep 20 Period Ending Jun 30, 2020 Mar 31, 2020 Dec 31, 2019 Total Assets Total Liabilities Total Equity Sep 30, 2020 7.21 10.8 10.91 12.43 8.23 12.8 8.19 7.33 -3.59 3.58 4.2 4.62 OSCI Cash Flow Statement >> 250k Cash Flow/Share TTM Revenue/Share TTM Operating Cash Flow -0.37 0.75 -22.81% Ok -250k Cash Net Change in Cash -500k -750k Dec 19 Mar 20 Jun 20 Sep 20 Sep 30, 2020 Mar 31, 2020 Jun 30, 2020 6 Months -0.24 Dec 31, 2019 12 Months 9 Months 3 Months -0.38 2.27 Period Ending Period Length: Cash From Operating Activities Cash From Investing Activities Cash From Financing Activities Net Change in Cash -2.03 -0.08 -0.05 -0.03 -0.8 2.03 0.22 0.33 -2.04 -0.00 -0.07 -0.08 -0.57 General Chart Financials Technical Forum Financial Summary Income Statement Balance Sheet Cash Flow Ratios Dividends Earnings Yield OSCI Dividends Ex-Dividend Date Mar 15, 2018 Mar 20, 2017 Mar 16, 2016 Mar 16, 2015 Dividend : Type: 0.02 LTTM 0.04 LTTM Payment Date : Mar 20, 2018 Apr 01, 2017 Apr 01, 2016 Apr 01, 2015 3.64% 2.99% 0.05 LTTM 3.73% 0.05 LTTM 3.73% Legend 1 Monthly Si Quarterly GM Semi-Annual 12 Annual LT Trailing Twelve Months Retur Retund Return on -678.48% 15.32% 14.98% 8.23% Return on Equity TTM Return on Equity 5YA Return on Assets TTM Return on Assets 5YA Return on Investment TTM Return on Investment 5YA 6.8% -33.17% 2.82% -138.16% 4.9% 7.2596 12.94% 11.63% 41.22% 35.99% 1.529% EPS(MRO) vs Otr. 1 Yr. Ago MRQ EPS(TTM) vs TTM 1 Yr. Ago TTM 5 Year EPS Growth 5YA Sales (MRQ) vs Qtr. 1 Yr Ago MRQ Sales (TTM) vs TTM 1 Yr. Ago TTM 5 Year Sales Growth 5YA 5 Year Capital Spending Growth SYA -2,101.51% -1,304.629 -38.35% -79.05% -52.81% -3.3% 6.55% 7.2296 13. 19% -9.41 0.96% 4.1 0.1 0.27 7.53 24.9% 84.82% Quick Ratio MRQ Current Ratio MRO LT Debt to Equity MRQ Total Debt to Equity MRO Efficiency Asset Turnover TTM Inventory Tumover TTM Revenue/Employee TTM Net Income/Employee TTM Receivable Turnover TTM 0.54 1.08 4.75 1.96 27 6.51 4.59% 4.22% 2.14% -42.76% Dividend Yield ANN Dividend Yield 5 Year Avg. 5YA Dividend Growth Rate ANN Payout Ratio ITM TTM = Trailing Twelve Months 5YA = 5-Year Average MRQ = Most Recent Quarter 34.95 Income Statement Evolution 2014 2015 2016 2017 2018 2019 15 10% 13 - 8% . 10 - 6% Million OMR 8 Key data LLLL 4% 3 850 000 5 2% 10 011 702 10 576 969 27 544 194 3 413 0 0% Sales Operating profit Net income - Net Margin Operating Margin Capitalization (OMR) Capitalization (USD) Net sales (OMR) Net sales (USD) Number of employees Sales / Employee (OMR) Sales / Employee (USD) Free-Float Free-Float capitalization (OMR) Free-Float capitalization (USD) Avg. Exchange 20 sessions (OMR) Avg. Exchange 20 sessions (USD) Average Daily Capital Traded 25 610 66 693 43,0% marketscreener.com - S&P Global Market Intelligence 1 655 500 Annual Income Statement Data 4 305 032 Fiscal Period: December 2014 2015 2016 2017 2018 2019 3,85 10,0 0,00% Net sales 1 12,5 12,0 12,6 13,6 12,7 10,6 EBITDA 1 1,46 1,19 0.87 0,66 1,00 1,09 EPS & Dividend Operating profit (EBIT) 1,10 0,86 0,60 0,35 0,43 0,48 2018 2017 2016 2015 Operating Margin 8,76% 7,14% 4,78% 2,59% 3,39% 4,51% 2014 2019 70.0% Pre-Tax Profit (EBT) 1 1,02 0,80 0,57 0,24 0,06 0,10 0.14 0.12 Net income 1 0.90 0,70 0,50 0,22 0,05 0,08 60.0% 10- Annual Quarterly TTM = Trailing Twelve Months | MRQ = Most Recent Quarter OSCI Income Statement >> 4M 2M Gross margin TTM Operating margin TTM Net Profit margin TTM Return on Investment TTM 4.81% -54.31% -61.73% -138.16% OM Total Revenue Net Income -2M -4M Mar 20 Jun 20 Sep 20 Dec 19 Period Ending: Sep 30, 2020 Mar 31, 2020 Jun 30, 2020 0.55 0.59 1.66 Dec 31, 2019 2.44 0.59 -0.8 -0.1 0.37 Total Revenue Gross Profit Operating Income Net Income -22 -0.53 -0.29 0.18 -2.32 -0.62 -0.37 0.08 OSCI Balance Sheet 15M 0.1 0.27 Quick Ratio MRQ Current Ratio MRO LT Debt to Equity MRQ Total Debt to Equity MRO 10M 5M Total Assets Total Liabilities OM Dec 19 Mar 20 Jun 20 Sep 20 Period Ending Sep 30, 2020 Jun 30, 2020 Mar 31, 2020 Dec 31, 2019 7.21 10.91 12.8 Total Assets Total Liabilities Total Equity 12.43 8.23 10.8 7.33 8.19 -3.59 3.58 4.2 4.62 OSCI Earnings Latest Release Dec 27, 2020 EPS / Forecast -0.33/- Revenue / Forecast 586.0K/ Revenue EPS Forecast $3.50M $0.30 $3.00M $0.20 $2.50M $0.10 $2.00M $0.00 Revenue EPS $1.50M $-0.10 $1.00M $-0.20 $500.00K $-0.30 Investing.com $0.00 $-0.40 09/2020 06/2019 09/2019 12/2019 03/2020 06/2020 Release Date Period End EPS/ Forecast Revenue / Forecast 09/2020 -0.33 / -- 586.OK / - 08/2020 -0.09 / - 548.1K / - 1.66M/ - 03/2020 -0.05 / - Dec 27, 2020 Jul 29, 2020 Jun 25, 2020 Feb 11, 2020 Oct 22, 2019 Jul 21, 2019 12/2010 0.01 / 2.44M / -- 0.02 / -- 09/2019 08/2019 2.8OMI - 2.99M/ - 0.02 - OSCI Ratios Name Company Industry 10.94 0.85 0.74 1.97 PE Ratio TTM Price to Sales TTM Price to Cash Flow MRQ Price to Free Cash Flow TTM Price to Book MRO Price to Tangible Book MRQ 23.85 7.87 1.78 1.79 Profitability. TTM vs 5 Year Average Margins TTM (96) 15 Year Avg. (%) 50% 25% 0% -25% -50% -75% Gross margin Pretax margin Operating margin Net Profit margin 19.21% 18.09% 9.05% 7.78% Gross margin TTM Gross Margin SYA Operating margin TTM Operating margin 5YA Pretax margin TTM Pretax margin 5YA Net Profit margin TTM Net Profit margin 5YA 4.81% 29.899 -54.31% 4% -81.43% 2.85% -81.73% 2.52% 8.96% 7.79% 7.86% 8.79% 0.75 2.26 Revenue/Share TTM Basic EPS ANN 0.01 0.11 Balance Sheet Analysis Fiscal Period: December 2014 2015 2016 2017 2018 2019 Net Debt 1,35 2.81 5,58 7,27 6,18 Net Cash position 0,20 Leverage (Debt / EBITDA) 0,93x -0,17% 3,21x 8,50x 7,26% 5,65x Free Cash Flow -0,41 1,65 -2,88 -2,66 -1,56 1,52 ROE (Net Profit / Equities) 23,0% 16,1% 10,9% 4,65% 1,04% 1,75% Shareholders' equity 3,91 4,36 4,62 4,66 4,58 4,58 ROA (Net Profit / Asset) 8,33% 6,86% 4,36% 1,91% 1,98% 2.23% Assets 10,8 10,3 11,5 11,3 2,41 3,60 Book Value Per Share 2 0,60 0,65 0,67 0,66 0,65 0,66 Cash Flow per Share 2 0,05 0,07 0,03 0,03 0,03 0,01 Capex 1 0,50 0,23 0,86 3,67 0,35 0,27 Capex / Sales 4,02% 1,91% 6,83% 26,9% 2,79% 2,57% Last update 02/16/2016 02/15/2017 02/18/2018 02/16/2019 02/11/2020 02/11/2020 3. Environment Factors: a. Macro-economic Factors of the country: Economic Growth, Unemployment Rate, GDP etc. for the last year. b. Economic Sector Analysis of the company and its main competitors. 4. Comparative Analysis of the Balance Sheet for the last 2 years. 5. Common Size Analysis for the Income Statement only for the last year. 6. Profitability Analysis: a. ROA b. Profit Margin. c. Assets Tumover