Answered step by step

Verified Expert Solution

Question

1 Approved Answer

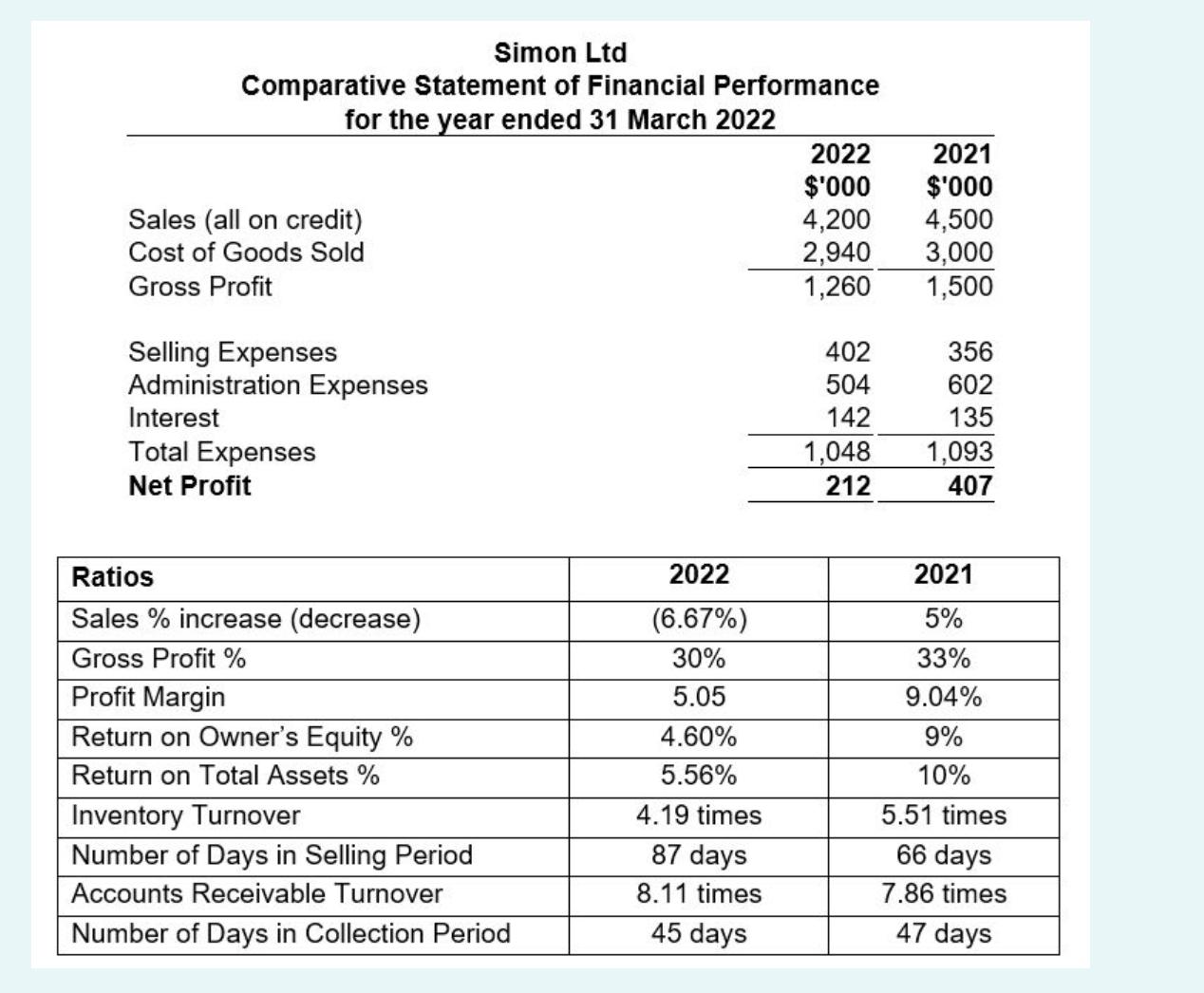

Required: Assess Simon Ltd's profitability in 2022 based on the ratios and financial statements provided. Assess Simon Ltd's efficiency in 2022 based on the ratios

Required:

Assess Simon Ltd's profitability in 2022 based on the ratios and financial statements provided.

Assess Simon Ltd's efficiency in 2022 based on the ratios and financial statements provided.

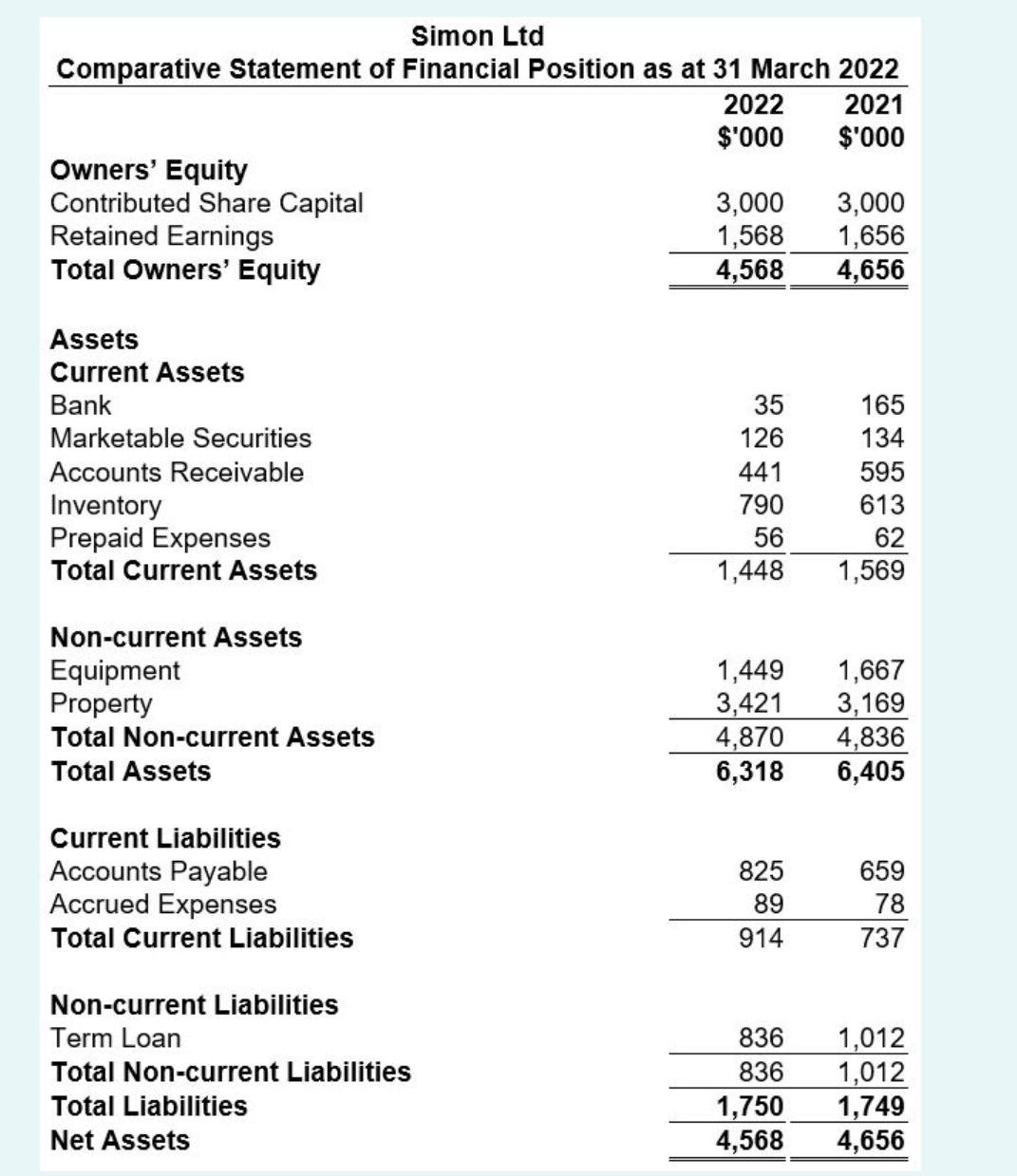

Simon Ltd Comparative Statement of Financial Position as at 31 March 2022 2021 $'000 Owners' Equity Contributed Share Capital Retained Earnings Total Owners' Equity Assets Current Assets Bank Marketable Securities Accounts Receivable Inventory Prepaid Expenses Total Current Assets Non-current Assets Equipment Property Total Non-current Assets Total Assets Current Liabilities Accounts Payable Accrued Expenses Total Current Liabilities Non-current Liabilities Term Loan Total Non-current Liabilities Total Liabilities Net Assets 2022 $'000 3,000 3,000 1,568 1,656 4,568 4,656 35 126 441 790 56 1,448 1,449 3,421 4,870 6,318 825 89 914 836 836 165 134 595 613 62 1,569 1,667 3,169 4,836 6,405 659 78 737 1,012 1,012 1,750 1,749 4,568 4,656

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started